Market vs. Residence Principle

... transactions and 0.01% on derivatives transactions. The EU commission, expecting that stock transactions will fall by 15% and derivative transactions by 75%, still forecasts to raise 30 to 35 bn. euros in tax income per year. ...

... transactions and 0.01% on derivatives transactions. The EU commission, expecting that stock transactions will fall by 15% and derivative transactions by 75%, still forecasts to raise 30 to 35 bn. euros in tax income per year. ...

CEO Turnover, Earnings Management, and Big Bath [PDF File

... in earnings. Furthermore, we show that if the earnings report issued by the outgoing CEO is sufficiently low, the incoming CEO will adopt reporting strategy that features a big bath. There are direct and indirect effects. The direct effect is that a lower report adversely affects the incoming CEO p ...

... in earnings. Furthermore, we show that if the earnings report issued by the outgoing CEO is sufficiently low, the incoming CEO will adopt reporting strategy that features a big bath. There are direct and indirect effects. The direct effect is that a lower report adversely affects the incoming CEO p ...

to Official Notice - The Stock Exchange of Mauritius

... (ii) the listing of up to 425,342,317 ordinary shares of BLL on the Official Market of the Stock Exchange of Mauritius Ltd following the above amalgamation, which will involve the migration of BLL from the DEM to the Official Market and consequently, the withdrawal of BLL from the DEM. 2. Suspension ...

... (ii) the listing of up to 425,342,317 ordinary shares of BLL on the Official Market of the Stock Exchange of Mauritius Ltd following the above amalgamation, which will involve the migration of BLL from the DEM to the Official Market and consequently, the withdrawal of BLL from the DEM. 2. Suspension ...

SunAmerica Dynamic Allocation Portfolio Summary

... Component will primarily consist of stock index futures and stock index options, but may also include options on stock index futures and stock index swaps. The aforementioned derivative instruments may be traded on an exchange or over the counter. The Portfolio’s net equity exposure will be primaril ...

... Component will primarily consist of stock index futures and stock index options, but may also include options on stock index futures and stock index swaps. The aforementioned derivative instruments may be traded on an exchange or over the counter. The Portfolio’s net equity exposure will be primaril ...

Eighths, sixteenths, and market depth: changes in tick

... as they could be forced to eat into the limit order book to "nd su$cient liquidity. The question remains, therefore, whether the change in tick size will cause su$cient changes in the cumulative depth to increase costs for larger orders while still reducing costs for smaller ones. As Lee et al. (199 ...

... as they could be forced to eat into the limit order book to "nd su$cient liquidity. The question remains, therefore, whether the change in tick size will cause su$cient changes in the cumulative depth to increase costs for larger orders while still reducing costs for smaller ones. As Lee et al. (199 ...

Heterogeneous Beliefs, Speculation, and the Equity Premium ∗

... The representative agent paradigm with identical agents fails to take into account speculative behavior among different agents in the economy. Under this paradigm, aggregate measures of fundamentals are sufficient to measure the risks faced by agents. Given the smoothness of these aggregate variabl ...

... The representative agent paradigm with identical agents fails to take into account speculative behavior among different agents in the economy. Under this paradigm, aggregate measures of fundamentals are sufficient to measure the risks faced by agents. Given the smoothness of these aggregate variabl ...

The Trinomial Asset Pricing Model

... One of the most central topics in financial mathematics is option pricing theory. In the early 1970s, Fisher Black and Myron Scholes derived a closed formula to calculate the price of European options on a non-dividend-paying stock [1]. Although they could not derive a corresponding formula for Amer ...

... One of the most central topics in financial mathematics is option pricing theory. In the early 1970s, Fisher Black and Myron Scholes derived a closed formula to calculate the price of European options on a non-dividend-paying stock [1]. Although they could not derive a corresponding formula for Amer ...

NBER WORKING PAPER SERIES A MARKET BASED SOLUTION TO PRICE EXTERNALITIES:

... incentive comparability constraints. More generally, an agent’s required rights to trade can be defined by excess demand functions for relevant commodities, which are again functions of his endowments, his choice of trades, and the specific target price. A key take away from our approach is that we ...

... incentive comparability constraints. More generally, an agent’s required rights to trade can be defined by excess demand functions for relevant commodities, which are again functions of his endowments, his choice of trades, and the specific target price. A key take away from our approach is that we ...

FORM 10-Q - Vanguard Natural Resources LLC

... and our representatives may from time to time make other oral or written statements that are also forward-looking statements. These statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, which could cause future outcomes to differ ma ...

... and our representatives may from time to time make other oral or written statements that are also forward-looking statements. These statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, which could cause future outcomes to differ ma ...

The impact of senior political representation on government

... survey done by the same commission reveals that voters primarily expect from House representatives to represent the district according to the wishes of the majority (by working on improving the economy, lowering prices and creating more jobs in addition to other ways), to solve problems in the dist ...

... survey done by the same commission reveals that voters primarily expect from House representatives to represent the district according to the wishes of the majority (by working on improving the economy, lowering prices and creating more jobs in addition to other ways), to solve problems in the dist ...

Correlated Trading and Returns

... Why do individual investors move together? Answering this question requires understanding why individuals actively trade stocks and voluntarily take on idiosyncratic risk and high transaction costs. Knowing the investor’s identity, characteristics of his trades, and his stock, bond, fund, and option ...

... Why do individual investors move together? Answering this question requires understanding why individuals actively trade stocks and voluntarily take on idiosyncratic risk and high transaction costs. Knowing the investor’s identity, characteristics of his trades, and his stock, bond, fund, and option ...

Locals, foreigners, and multi-market trading of equities: Intraday

... but cannot register them once the foreign ownership limit is hit and, therefore, forgo all distributions on any Main Board holdings. 3 Furthermore, a foreigner can only sell Main Board holdings back into the Main Board market. The trading system on both boards is electronic and order-driven. Broker ...

... but cannot register them once the foreign ownership limit is hit and, therefore, forgo all distributions on any Main Board holdings. 3 Furthermore, a foreigner can only sell Main Board holdings back into the Main Board market. The trading system on both boards is electronic and order-driven. Broker ...

Open Research Online How Might We Create a Secondary Annuity

... The essence of competition is having multiple firms compete to buy annuities. While the secondary annuities market will be unusual in that sellers will be individuals and buyers will be firms, because firms will act as price setters by bidding for annuities it is the existence of multiple competing ...

... The essence of competition is having multiple firms compete to buy annuities. While the secondary annuities market will be unusual in that sellers will be individuals and buyers will be firms, because firms will act as price setters by bidding for annuities it is the existence of multiple competing ...

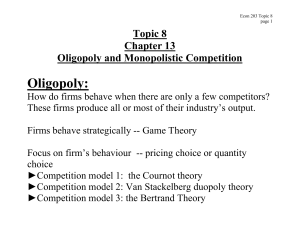

Oligopoly and Monopolistic Competition

... The payoff, expressed in terms of profits for each firm, is shown above for each combination of strategies. In this game, there is a dominant strategy for each player. Regardless of whether Firm B chooses strategy 1 or 2, Firm A will make more profit if it chooses strategy 4 rather than 3. Strategy ...

... The payoff, expressed in terms of profits for each firm, is shown above for each combination of strategies. In this game, there is a dominant strategy for each player. Regardless of whether Firm B chooses strategy 1 or 2, Firm A will make more profit if it chooses strategy 4 rather than 3. Strategy ...

The performance of hedge funds and mutual funds in

... an investment focus in emerging markets. Most studies only consider either hedge funds or mutual funds; we analyze both investment vehicles active in this growing market.6 Our analysis builds upon the Center for International Securities and Derivatives Markets (CISDM) database, which is one of the l ...

... an investment focus in emerging markets. Most studies only consider either hedge funds or mutual funds; we analyze both investment vehicles active in this growing market.6 Our analysis builds upon the Center for International Securities and Derivatives Markets (CISDM) database, which is one of the l ...

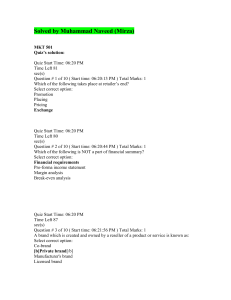

Question # 1 of 10 ( Start time: 06:20:13 PM ) Total Marks: 1

... Second Degree Price Discrimination This type of price discrimination occurs when a firm is trying to sell off any excess capacity it has remaining at a lower price than the normal published price. Examples of second degree price discrimination can be seen in any market where excess capacity needs to ...

... Second Degree Price Discrimination This type of price discrimination occurs when a firm is trying to sell off any excess capacity it has remaining at a lower price than the normal published price. Examples of second degree price discrimination can be seen in any market where excess capacity needs to ...

Responsible Asset Management

... security, industry or market sector. Another risk is that the ratio of securities, fixed income, and cash will change over time due to stock and market movements and, if not corrected, will no longer be appropriate for the client’s goals. Mutual Fund and/or ETF Analysis: RAM looks at the experience ...

... security, industry or market sector. Another risk is that the ratio of securities, fixed income, and cash will change over time due to stock and market movements and, if not corrected, will no longer be appropriate for the client’s goals. Mutual Fund and/or ETF Analysis: RAM looks at the experience ...

1 INVESTMENT: UNIT - 1 Investment involves making of a sacrifice

... potential to become growth stocks, have very good fundamentals and good future, but somehow the market is yet to price the shares correctly. Turn Around Stocks: Turn around stocks are those that are not really doing well in the sense that the market price is well below the intrinsic value mainly bec ...

... potential to become growth stocks, have very good fundamentals and good future, but somehow the market is yet to price the shares correctly. Turn Around Stocks: Turn around stocks are those that are not really doing well in the sense that the market price is well below the intrinsic value mainly bec ...

The Impact of Auctions on Residential Sales Prices in

... through December 1992. Library research was done to discover every house that was advertised to be auctioned during this time period. In addition, five local brokers who are active in the auction business were interviewed; and they supplied lists of all the properties that they had recently sold by ...

... through December 1992. Library research was done to discover every house that was advertised to be auctioned during this time period. In addition, five local brokers who are active in the auction business were interviewed; and they supplied lists of all the properties that they had recently sold by ...