Changes to Result in Better Framework and Incentive Structure for

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

... The new MM model is designed to simplify and improve the quality of market making services. It focuses on registration and responsibility of Exchange Participants (EPs) for MM activities and will discontinue registration of third parties known as Registered Traders (see chart on next page). The main ...

Focus on Risk Adjusted Returns

... make RIHFs more accessible through a minimum investment amount of R50 000. Consequently we expect more demand from the retail space and pension funds, and for the industry to grow going forward.” ...

... make RIHFs more accessible through a minimum investment amount of R50 000. Consequently we expect more demand from the retail space and pension funds, and for the industry to grow going forward.” ...

Operating Instruction nº 54/2017 INITIAL

... 1.- Take as a reference price the closing price of the session of July 13 , the expected last trading day in the segment of Growing Companies belonging to Mercado Alternativo Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the refer ...

... 1.- Take as a reference price the closing price of the session of July 13 , the expected last trading day in the segment of Growing Companies belonging to Mercado Alternativo Bursátil (MAB). During the opening auction, orders shall be allowed that entail prices within a 50% static range of the refer ...

Ch. 15: Financial Markets

... maturity value will be paid to the bond holder. Bond maturity dates when issued generally range from 3 months up to 30 years. Coupon rate • Between the date of issuance and the maturity date, the bond-holder receives an annual interest payment equal to the coupon rate times the maturity value. Yield ...

... maturity value will be paid to the bond holder. Bond maturity dates when issued generally range from 3 months up to 30 years. Coupon rate • Between the date of issuance and the maturity date, the bond-holder receives an annual interest payment equal to the coupon rate times the maturity value. Yield ...

Chapter 259 South African Rand/US Dollar (ZAR/USD)

... This chapter is limited in application to South African rand/U.S. dollar futures. In addition to this chapter, South African rand/U.S. dollar futures shall be subject to the general rules and regulations of the Exchange insofar as applicable. For purposes of this chapter, unless otherwise specified, ...

... This chapter is limited in application to South African rand/U.S. dollar futures. In addition to this chapter, South African rand/U.S. dollar futures shall be subject to the general rules and regulations of the Exchange insofar as applicable. For purposes of this chapter, unless otherwise specified, ...

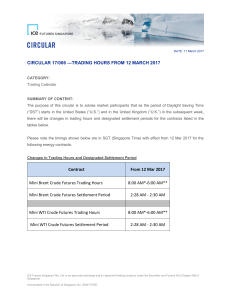

Trading hours from 12 March 2017

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

... CIRCULAR 17/006 —TRADING HOURS FROM 12 MARCH 2017 CATEGORY: Trading Calendar ...

Chapter 9 Behavioral Finance and Technical Analysis

... investor utility depends on the change in wealth from the start of the investment rather than on the starting level of wealth. ...

... investor utility depends on the change in wealth from the start of the investment rather than on the starting level of wealth. ...

Waiting can be a winning strategy

... one of the secrets behind his success. Of course, one must have a reason for waiting, and not wait just for the sake of it. Mr Buffett is a long-term value investor. He spots companies whose share prices do not reflect their true value, as they might be unloved by mainstream investors or they could ...

... one of the secrets behind his success. Of course, one must have a reason for waiting, and not wait just for the sake of it. Mr Buffett is a long-term value investor. He spots companies whose share prices do not reflect their true value, as they might be unloved by mainstream investors or they could ...

20 Dec 15 AGNC stock price appreciation in 2016

... $(859) million of net losses on interest rate swaps (excludes $24 million of net unrealized gains recognized in OCI); $(107) million of interest rate swap periodic interest costs; $(25) million of net losses on interest rate swaptions; $(19) million of net losses on U.S. Treasury positions; $73 mil ...

... $(859) million of net losses on interest rate swaps (excludes $24 million of net unrealized gains recognized in OCI); $(107) million of interest rate swap periodic interest costs; $(25) million of net losses on interest rate swaptions; $(19) million of net losses on U.S. Treasury positions; $73 mil ...

November 2013 - Dana Investment Advisors

... unemployment, disability and/or food stamps. That is why job creation is so important. Improving job numbers would encourage more people to look for work and make our economy more productive. The Affordable Care Act enters into the employment number also. Employers are wrestling with the consequence ...

... unemployment, disability and/or food stamps. That is why job creation is so important. Improving job numbers would encourage more people to look for work and make our economy more productive. The Affordable Care Act enters into the employment number also. Employers are wrestling with the consequence ...

31. On December 1, you borrow $210,000 to buy a house. The

... 33. Interest rates or rates of return on investments that have not been adjusted for the effects of inflation are called _____ rates. nominal 34. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current mar ...

... 33. Interest rates or rates of return on investments that have not been adjusted for the effects of inflation are called _____ rates. nominal 34. You own a bond that has a 7 percent coupon and matures in 12 years. You purchased this bond at par value when it was originally issued. If the current mar ...

Public/Old_Stocks_Studied/Zimmer(ZMH)

... AG. In April 2004, ZMH acquired Implex Corp. Implex gives ZMH flexibility in the development of reconstructive joint and spinal devices. Zimmer is a spun off (August 6, 2001) of Bristol-Myers Squibb Co. Zimmer is under investigation by the U.S. Department of Justice (regarding consulting contracts b ...

... AG. In April 2004, ZMH acquired Implex Corp. Implex gives ZMH flexibility in the development of reconstructive joint and spinal devices. Zimmer is a spun off (August 6, 2001) of Bristol-Myers Squibb Co. Zimmer is under investigation by the U.S. Department of Justice (regarding consulting contracts b ...

Slide 1 - Mad Hedge Fund Trader

... bushels to high 11 million bushels range, down 20% *Corn up 50% *No amount of rain can save the corn crop now because much of it is dead *Farmers are now plowing under dead corn crops and planting wheat *Number of people who believe in global warming has risen from 50% to 70% this year ...

... bushels to high 11 million bushels range, down 20% *Corn up 50% *No amount of rain can save the corn crop now because much of it is dead *Farmers are now plowing under dead corn crops and planting wheat *Number of people who believe in global warming has risen from 50% to 70% this year ...