Lecture 3b Ch 11 Mortgage Markets

... Mortgage loan contracts contain many legal terms that need to be understood. Most protect the lender from financial loss. • PMI: insurance against default by the borrower • Qualifications: includes credit history, employment history, etc., to determine the borrowers ability to repay the mortgage as ...

... Mortgage loan contracts contain many legal terms that need to be understood. Most protect the lender from financial loss. • PMI: insurance against default by the borrower • Qualifications: includes credit history, employment history, etc., to determine the borrowers ability to repay the mortgage as ...

shares as security in modern times: problems and prospects

... between the company and the lender; the agreements struck between creditor and company can be quite varied. One form of borrowing by a company is by issuing debentures. When the term ‘debenture’ is used in its familiar commercial sense, it means a series of bonds which evidence the fact that the com ...

... between the company and the lender; the agreements struck between creditor and company can be quite varied. One form of borrowing by a company is by issuing debentures. When the term ‘debenture’ is used in its familiar commercial sense, it means a series of bonds which evidence the fact that the com ...

What is FINSA? - International trade

... from US-allied countries bid against companies from countries viewed as higher security risks. Offering the highest bid now will be no guarantee of winning a deal. In fact, financial analysts may apply a price premium if they perceive a political risk or the potential for significant transactional d ...

... from US-allied countries bid against companies from countries viewed as higher security risks. Offering the highest bid now will be no guarantee of winning a deal. In fact, financial analysts may apply a price premium if they perceive a political risk or the potential for significant transactional d ...

The Renewable Heat Incentive: a reformed and refocused scheme

... We would not favour option 1 – third party ownership. Any agreement of this type is likely to include rights to enter the property and recover the heating technology if the homeowner breached the contract. Lenders would not want to give such rights of entry to third parties over a security property ...

... We would not favour option 1 – third party ownership. Any agreement of this type is likely to include rights to enter the property and recover the heating technology if the homeowner breached the contract. Lenders would not want to give such rights of entry to third parties over a security property ...

Overview of law relating to charges

... Going concern – charge not filed In State Bank of India v. Viswaniryat (P) Limited [1989] 65 Com Cas 795 (Ker-DB), it was held that an equitable mortgage created by a going concern is not void even if the particulars of the same have not been filed as per Section 125 of the Act. Unsecured creditors ...

... Going concern – charge not filed In State Bank of India v. Viswaniryat (P) Limited [1989] 65 Com Cas 795 (Ker-DB), it was held that an equitable mortgage created by a going concern is not void even if the particulars of the same have not been filed as per Section 125 of the Act. Unsecured creditors ...

Some international trends in the regulation of mortgage markets

... The option to repay part of the mortgage early without incurring in a high cost is usually highly appreciated by borrowers. However, it can have an important effect on lenders, increasing the cost in cases of fixed rate funding, as the collateral provided for mortgage backed securities have to be su ...

... The option to repay part of the mortgage early without incurring in a high cost is usually highly appreciated by borrowers. However, it can have an important effect on lenders, increasing the cost in cases of fixed rate funding, as the collateral provided for mortgage backed securities have to be su ...

Powerpoint

... Third Circuit Court of Appeals held that “where ‘an otherwise unavoidable transfer’ is made after the filing of a bankruptcy petition, it does not affect the new value defense.” If a vendor receives payment of its pre-petition invoices after the petition date, the vendor is not precluded from later ...

... Third Circuit Court of Appeals held that “where ‘an otherwise unavoidable transfer’ is made after the filing of a bankruptcy petition, it does not affect the new value defense.” If a vendor receives payment of its pre-petition invoices after the petition date, the vendor is not precluded from later ...

Intangible assets

... Comparison of IRFS and GAAP Long-Lived Asset Accounting Tangible Long-Lived Assets IAS 16 allows two different models Cost Method – same as U.S. GAAP Revaluation Method – asset is carried at a revalued amount reflecting fair market value at the revaluation date. Subsequent depreciation is based on f ...

... Comparison of IRFS and GAAP Long-Lived Asset Accounting Tangible Long-Lived Assets IAS 16 allows two different models Cost Method – same as U.S. GAAP Revaluation Method – asset is carried at a revalued amount reflecting fair market value at the revaluation date. Subsequent depreciation is based on f ...

Carrying Mortgage Debt Into Retirement

... insurance (and all the upkeep that goes with owning a home), but if you can swing the cost, living mortgage free is a nice place to be. To see how much faster you can pay off your mortgage by making extra payments, check out AARP’s Mortgage Payoff Calculator at www.aarp.org/money. If you still have ...

... insurance (and all the upkeep that goes with owning a home), but if you can swing the cost, living mortgage free is a nice place to be. To see how much faster you can pay off your mortgage by making extra payments, check out AARP’s Mortgage Payoff Calculator at www.aarp.org/money. If you still have ...

CAPSTEAD MORTGAGE CORP (Form: 8-K, Received: 01

... increasing 85 basis points to end the year at 2.45%. As a consequence, longer duration mortgage-backed securities lost considerable value. For instance, Fannie Mae 30-year fixed 3.0% mortgage securities declined in price by approximately 4.75% during this period. In contrast, Capstead’s ARM securiti ...

... increasing 85 basis points to end the year at 2.45%. As a consequence, longer duration mortgage-backed securities lost considerable value. For instance, Fannie Mae 30-year fixed 3.0% mortgage securities declined in price by approximately 4.75% during this period. In contrast, Capstead’s ARM securiti ...

English

... After 6 months, the student owes $18 in interest. Therefore to completely pay off the loan, the student must pay $618. ...

... After 6 months, the student owes $18 in interest. Therefore to completely pay off the loan, the student must pay $618. ...

fraud overview

... Lending Market and whilst no statistical data is available on the outlay of fraud, anecdotal evidence suggests it has cost the Australian banking and finance industry millions of dollars per year. Mortgage Fraud doesn’t just impact lenders; it is costly for all stakeholders involved in mortgage lend ...

... Lending Market and whilst no statistical data is available on the outlay of fraud, anecdotal evidence suggests it has cost the Australian banking and finance industry millions of dollars per year. Mortgage Fraud doesn’t just impact lenders; it is costly for all stakeholders involved in mortgage lend ...

Corporate Securities Law Prospectus Exemption

... issue a news release disclosing the proposed offering, including that the issuer is relying on the Exemption, details of the use of proceeds, the number and pricing of the securities to be issued (including minimum and maximum amounts, if applicable), and how the issuer intends to deal with any over ...

... issue a news release disclosing the proposed offering, including that the issuer is relying on the Exemption, details of the use of proceeds, the number and pricing of the securities to be issued (including minimum and maximum amounts, if applicable), and how the issuer intends to deal with any over ...

DOC - Europa EU

... efficient price determination and the resulting reduction in market volatility will enable both large and small investors to buy or sell securities more easily and at a fairer price. Integrated European financial markets will mean that consumers will be better able to purchase financial services and ...

... efficient price determination and the resulting reduction in market volatility will enable both large and small investors to buy or sell securities more easily and at a fairer price. Integrated European financial markets will mean that consumers will be better able to purchase financial services and ...

New Mortgage Rules to Reinforce Soft Landing in

... The first policy measure, effective on October 17th, adjusts the way high loan-to-value borrowers requiring mortgage insurance are income tested. The test ensures that the borrower’s gross debt service ratio (GDS ) and total debt service ratio (TDS ) do not exceed 39% and 44%, respectively. The prio ...

... The first policy measure, effective on October 17th, adjusts the way high loan-to-value borrowers requiring mortgage insurance are income tested. The test ensures that the borrower’s gross debt service ratio (GDS ) and total debt service ratio (TDS ) do not exceed 39% and 44%, respectively. The prio ...

Slide 1

... Commercial Mortgages: add diversification into an asset class challenging for clients to achieve on their own, by a team of experienced mortgage specialists. Private Placement Loans: provide corporate bond type returns with reduced risk and/or higher yields. Real Estate: adds equity-like returns wit ...

... Commercial Mortgages: add diversification into an asset class challenging for clients to achieve on their own, by a team of experienced mortgage specialists. Private Placement Loans: provide corporate bond type returns with reduced risk and/or higher yields. Real Estate: adds equity-like returns wit ...

reorganizing with Value but Without Profit (or Equity)

... Code section 501(a), the court added that “an ‘interest’ is that which is held by an ‘equity security holder’” and distinguished “equity security,” defined in section 101(16) as a share in a corporation or “similar security,” from nonprofit membership.20 In overruling the objection, the court conclu ...

... Code section 501(a), the court added that “an ‘interest’ is that which is held by an ‘equity security holder’” and distinguished “equity security,” defined in section 101(16) as a share in a corporation or “similar security,” from nonprofit membership.20 In overruling the objection, the court conclu ...

maximizing the financial value of ip assets

... IP strategies and portfolios. • Conduct periodic searches of the competitive IP landscape to gain detailed legal and business information relating to competitor products and IP assets. This information can be used to assess the expected value of your IP portfolio and to determine whether new techno ...

... IP strategies and portfolios. • Conduct periodic searches of the competitive IP landscape to gain detailed legal and business information relating to competitor products and IP assets. This information can be used to assess the expected value of your IP portfolio and to determine whether new techno ...

286.5-451 Loans on direct reduction plan -

... unsecured, which is insured or guaranteed in any manner and in any amount by the United States or any instrumentality thereof. (7) In the case of loans made under subsections (4), (5), and (6) of this section, in the event the ownership of the real estate security or any part thereof becomes vested ...

... unsecured, which is insured or guaranteed in any manner and in any amount by the United States or any instrumentality thereof. (7) In the case of loans made under subsections (4), (5), and (6) of this section, in the event the ownership of the real estate security or any part thereof becomes vested ...

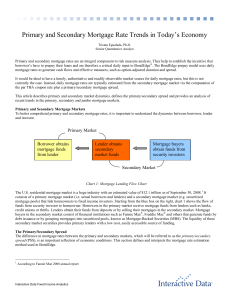

Primary and Secondary Mortgage Rate Trends in Today`s Economy

... mortgage pools) that link homeowners to fixed income investors. Starting from the blue box on the right, chart 1 shows the flow of funds from security investor to homeowner. Borrowers in the primary market receive mortgage funds from lenders such as banks, credit unions or thrifts. Lenders obtain th ...

... mortgage pools) that link homeowners to fixed income investors. Starting from the blue box on the right, chart 1 shows the flow of funds from security investor to homeowner. Borrowers in the primary market receive mortgage funds from lenders such as banks, credit unions or thrifts. Lenders obtain th ...

Loans Classified by Special Provision

... homeowner has invested in the property given as security for the loan. To be eligible, the participant must be at least 62 years old and the reverse mortgage must be the only loan allowed on the property. A reverse loan allows senior citizens on fixed incomes to realize the equity build-up in their ...

... homeowner has invested in the property given as security for the loan. To be eligible, the participant must be at least 62 years old and the reverse mortgage must be the only loan allowed on the property. A reverse loan allows senior citizens on fixed incomes to realize the equity build-up in their ...

THE SUB-PRIME MORTGAGE MESS Kevin M. Bahr, Ph.D

... The Community Reinvestment Act of 1977 encouraged lenders to make loans to low and moderate-income borrowers, markets which may include borrowers with a weak credit history. The 1980 Depository Institutions Deregulation and Monetary Control Act (DIDMCA) effectively eliminated states' interest rate ...

... The Community Reinvestment Act of 1977 encouraged lenders to make loans to low and moderate-income borrowers, markets which may include borrowers with a weak credit history. The 1980 Depository Institutions Deregulation and Monetary Control Act (DIDMCA) effectively eliminated states' interest rate ...

1. Let`s start with the basics- what exactly is a Section 1031

... 6. Can I select multiple properties as potential replacement properties? What are the identification rules? Yes, an investor can identify multiple properties. There are two main rules and one exception. The first rule is the 3 property rule, which allows the investor to identify any three (3) proper ...

... 6. Can I select multiple properties as potential replacement properties? What are the identification rules? Yes, an investor can identify multiple properties. There are two main rules and one exception. The first rule is the 3 property rule, which allows the investor to identify any three (3) proper ...

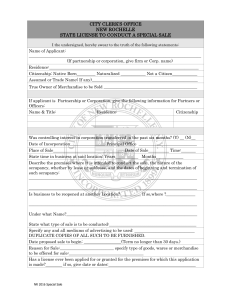

city clerk`s office - City of New Rochelle

... Is business to be reopened at another Location? _________ If so,where ?______________ _________________________________________________________________________________ Under what Name?_______________________________________________________________ State what type of sale is to be conducted:_________ ...

... Is business to be reopened at another Location? _________ If so,where ?______________ _________________________________________________________________________________ Under what Name?_______________________________________________________________ State what type of sale is to be conducted:_________ ...

Chapter 4 Capital resources

... (1) The requirements about monitoring of property values referred to in ■ MIPRU 4.2F.11R (3)(b) are as follows: (a) the value of the property must be monitored on a frequent basis and, at a minimum, once every three years; (b) more frequent monitoring must be carried out where the market is subject ...

... (1) The requirements about monitoring of property values referred to in ■ MIPRU 4.2F.11R (3)(b) are as follows: (a) the value of the property must be monitored on a frequent basis and, at a minimum, once every three years; (b) more frequent monitoring must be carried out where the market is subject ...