File

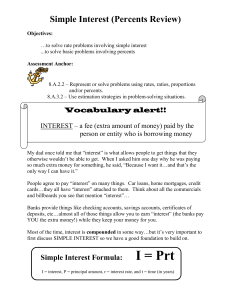

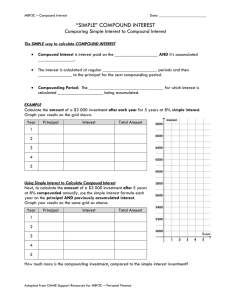

... Simple Interest When banks use simple interest, they consider the principal, the interest rate, and the length of time of the loan. ...

... Simple Interest When banks use simple interest, they consider the principal, the interest rate, and the length of time of the loan. ...

CONSIDERATION DOCTRINE AND REGULATORY ARBITRAGE IN

... entitling the transferor to a subset of the cash generated by what it was transferring. Because the Uniform Commercial Code defines “value” expansively, to include any “consideration sufficient to support a simple contract,” the U.C.C. apparently directs us to determine whether $10 would support a ...

... entitling the transferor to a subset of the cash generated by what it was transferring. Because the Uniform Commercial Code defines “value” expansively, to include any “consideration sufficient to support a simple contract,” the U.C.C. apparently directs us to determine whether $10 would support a ...

Secured Transactions Summary: Fall 2001

... B. Types of Security 1. Personal security Creditor asks the debtor to find another person or persons who will fulfil the obligation in the debtor’s place in the event of default Creditor remains an unsecured creditor but has two separate funds to draw upon K of suretyship – ex. parent agrees t ...

... B. Types of Security 1. Personal security Creditor asks the debtor to find another person or persons who will fulfil the obligation in the debtor’s place in the event of default Creditor remains an unsecured creditor but has two separate funds to draw upon K of suretyship – ex. parent agrees t ...

Diapositive 1

... and minimum amount). Should he wish to exit before the maturity date, the investor may thus be unable to sell part or all of his financial asset, or may have to sell at a considerably unfavourable price. Finally, certain securities becoming relatively illiquid may face high volatility and a decline ...

... and minimum amount). Should he wish to exit before the maturity date, the investor may thus be unable to sell part or all of his financial asset, or may have to sell at a considerably unfavourable price. Finally, certain securities becoming relatively illiquid may face high volatility and a decline ...

Mortgage Lending Rules - American Bankers Association

... systems to manage compliance risks, and often results in unpredictable (and unfair) liabilities for the lender based on other parties’ actions, such as those of the title insurance company, that are extremely difficult to control. Under the current tolerance rules, estimated credits offered by lende ...

... systems to manage compliance risks, and often results in unpredictable (and unfair) liabilities for the lender based on other parties’ actions, such as those of the title insurance company, that are extremely difficult to control. Under the current tolerance rules, estimated credits offered by lende ...

Sample letter from CAI volunteers to Member of Congress

... and 20 other states and Washington, DC, that provide a limited lien priority over a first mortgage to collect the borrower’s delinquent assessments. The amount in question is modest, typically six months’ delinquent assessments. Yet, the limited lien priority is an effective tool in fostering financ ...

... and 20 other states and Washington, DC, that provide a limited lien priority over a first mortgage to collect the borrower’s delinquent assessments. The amount in question is modest, typically six months’ delinquent assessments. Yet, the limited lien priority is an effective tool in fostering financ ...

Adequate explanations

... • How are lenders addressing these changes? • What does this mean for intermediaries? ...

... • How are lenders addressing these changes? • What does this mean for intermediaries? ...

here - Reverse Market Insight

... Negative subsidy means NPV of expected revenues exceeds NPV of expected costs HECM subsidy rate projected for FY2008 is negative 1.68 ...

... Negative subsidy means NPV of expected revenues exceeds NPV of expected costs HECM subsidy rate projected for FY2008 is negative 1.68 ...

Norwegian Covered Bonds Market

... hit the hardest, which is reflected in the development in key figures such as unemployment, house prices etc. Although the petroleum industry will continue to be an important part of the economy in many years to come, the Norwegian economy is now in a transition period to become less dependent of it ...

... hit the hardest, which is reflected in the development in key figures such as unemployment, house prices etc. Although the petroleum industry will continue to be an important part of the economy in many years to come, the Norwegian economy is now in a transition period to become less dependent of it ...

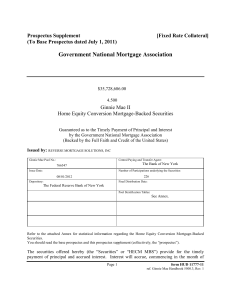

Government National Mortgage Association

... Each Security will accrue interest at the HECM MBS Rate set forth on the cover of this prospectus supplement for the initial Distribution Date, but will adjust as described herein. The HECM MBS Rate is generally equal to the weighted average of the interest rates on the underlying Participations (ea ...

... Each Security will accrue interest at the HECM MBS Rate set forth on the cover of this prospectus supplement for the initial Distribution Date, but will adjust as described herein. The HECM MBS Rate is generally equal to the weighted average of the interest rates on the underlying Participations (ea ...

2005 Survey - Freddie Mac Home

... – More likely to be married or living with someone as if married (72% vs. 66%). – More likely to be employed either full-time, part-time or self-employed (73% vs. 54%). – Less affluent than other homeowners (median income of $52,400 vs. $56,700). – Less likely to have prior experience with home owne ...

... – More likely to be married or living with someone as if married (72% vs. 66%). – More likely to be employed either full-time, part-time or self-employed (73% vs. 54%). – Less affluent than other homeowners (median income of $52,400 vs. $56,700). – Less likely to have prior experience with home owne ...

Nonagency MBS, CMBS, ABS

... When this is done, the excess interest can be set up similar to a notional interest-only (IO) class, with the proceeds going to a reserve account and paid out to IO holders at some future date if there is an excess. ...

... When this is done, the excess interest can be set up similar to a notional interest-only (IO) class, with the proceeds going to a reserve account and paid out to IO holders at some future date if there is an excess. ...

simple interest - percents review

... 8.A.3.2 – Use estimation strategies in problem-solving situations. ...

... 8.A.3.2 – Use estimation strategies in problem-solving situations. ...

Residential mortgage lending for underserved communities: recent

... offering for traditionally underserved communities and first-time home buyers, allowing them to potentially reach new markets or expand existing ones while earning CRA credit by serving an unmet need. The WBHL℠ program also faces challenges, including barriers to scaling, a unique repayment structur ...

... offering for traditionally underserved communities and first-time home buyers, allowing them to potentially reach new markets or expand existing ones while earning CRA credit by serving an unmet need. The WBHL℠ program also faces challenges, including barriers to scaling, a unique repayment structur ...

DOC - Investor Relations

... institutions or entities from time to time parties to the Loan Agreement (collectively, referred to as the “Lender”) and Hercules Technology Growth Capital, Inc., a Maryland corporation, in its capacity as administrative agent for itself and the Lender (the “Agent”). Under the Loan Agreement, the Le ...

... institutions or entities from time to time parties to the Loan Agreement (collectively, referred to as the “Lender”) and Hercules Technology Growth Capital, Inc., a Maryland corporation, in its capacity as administrative agent for itself and the Lender (the “Agent”). Under the Loan Agreement, the Le ...

What Happens to Bondholders When a Company Files for Bankruptcy

... laws when their liabilities or debts exceed the value of their assets, or they are unable to pay their bills. A bankruptcy filing gives a company an opportunity to reorganize its business in hopes of returning to profitability or completely closing down operations and selling off assets, then using ...

... laws when their liabilities or debts exceed the value of their assets, or they are unable to pay their bills. A bankruptcy filing gives a company an opportunity to reorganize its business in hopes of returning to profitability or completely closing down operations and selling off assets, then using ...

Why Restrain Alienation? - Chicago Unbound

... under conditions of radical uncertainty as to the causes of social disorder and as to the consequences of public intervention? A few illustrations show the nature of the problem. 1. Gun Control. - Gun control affords a useful initial example. Guns are an instrument of aggression, just as they are in ...

... under conditions of radical uncertainty as to the causes of social disorder and as to the consequences of public intervention? A few illustrations show the nature of the problem. 1. Gun Control. - Gun control affords a useful initial example. Guns are an instrument of aggression, just as they are in ...

4 ccr 725-3 mortgage loan originators and mortgage companies 1

... a mortgage loan often severely restrict the ability of the borrower to refinance or sell their property. Additionally, in higher rate environments, borrowers often have only two viable options: to absorb a much higher monthly payment or lose their home through foreclosure proceedings. The Board upda ...

... a mortgage loan often severely restrict the ability of the borrower to refinance or sell their property. Additionally, in higher rate environments, borrowers often have only two viable options: to absorb a much higher monthly payment or lose their home through foreclosure proceedings. The Board upda ...

Concept of Accounting And Review Of Balance Sheet

... Accounting bases are the methods which have been deployed for applying fundamental accounting concepts to financial transactions and items. Eg. Depreciation and Inventory. Accounting policies are the specific accounting bases selected and consistently followed by a business ...

... Accounting bases are the methods which have been deployed for applying fundamental accounting concepts to financial transactions and items. Eg. Depreciation and Inventory. Accounting policies are the specific accounting bases selected and consistently followed by a business ...

Cyber Security - what does it mean for the board?

... • Are our competitors ahead of us? If so, does this give them an advantage? • Who in our organization is responsible for cyber security issues and can they and the management team answer the following questions? ...

... • Are our competitors ahead of us? If so, does this give them an advantage? • Who in our organization is responsible for cyber security issues and can they and the management team answer the following questions? ...

SIMPLE INTEREST VS COMPOUND INTEREST

... a) Carlene wants to borrow $7 000 for five years. Compare the growth of this loan at 7% per year, simple interest, to the same loan at 7% per year, compounded annually. ...

... a) Carlene wants to borrow $7 000 for five years. Compare the growth of this loan at 7% per year, simple interest, to the same loan at 7% per year, compounded annually. ...

FRBSF L CONOMIC

... communication initiatives by providing forward guidance about future policy. In August 2011, it started to explicitly lay out its expectations for the future path of the federal funds rate. The Fed’s unconventional balance sheet policies began in 2009 with a program of large-scale asset purchases (L ...

... communication initiatives by providing forward guidance about future policy. In August 2011, it started to explicitly lay out its expectations for the future path of the federal funds rate. The Fed’s unconventional balance sheet policies began in 2009 with a program of large-scale asset purchases (L ...

Securitization

... In a sequential, principal cashflows from the underlying collateral are allocated to one tranche at a time. When one tranche is paid off, the next tranche receives all the principal and so on. In other words, the tranches are ...

... In a sequential, principal cashflows from the underlying collateral are allocated to one tranche at a time. When one tranche is paid off, the next tranche receives all the principal and so on. In other words, the tranches are ...

Guideline B-21 Residential Mortgage Insurance - OSFI-BSIF

... insurance underwriting process. OSFI and the industry would primarily rely on existing OSFI guidance. While this would appear to avoid potential regulatory burden, this option would overlook strengthened international principles and recommendations with respect to mortgage insurance in an area that ...

... insurance underwriting process. OSFI and the industry would primarily rely on existing OSFI guidance. While this would appear to avoid potential regulatory burden, this option would overlook strengthened international principles and recommendations with respect to mortgage insurance in an area that ...

1 ITEM 8 UNDERSTANDING FINANCIAL STATEMENTS It is

... The balance sheet is a statement of the financial condition of a company at a particular point in time. It is a picture in words and dollars of the financial strength of the business at a certain date. The balance sheet is divided into two parts, which are usually shown side by side. The totals of t ...

... The balance sheet is a statement of the financial condition of a company at a particular point in time. It is a picture in words and dollars of the financial strength of the business at a certain date. The balance sheet is divided into two parts, which are usually shown side by side. The totals of t ...