This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... of changes in tax rates on tax collections. Among his other findings, Lindsey highlights the fact that the amount of wage and salary income showing up on the returns of high-bracket taxpayers rose sharply following the implementation of ERTA. Partially as a result of this change, tax collections fro ...

... of changes in tax rates on tax collections. Among his other findings, Lindsey highlights the fact that the amount of wage and salary income showing up on the returns of high-bracket taxpayers rose sharply following the implementation of ERTA. Partially as a result of this change, tax collections fro ...

Union Budget 2017-18: Spotlight on Affordable Housing

... buildings are stock-in-trade, the rule will be applicable only after one year of receiving the completion certificate. The law will provide some breathing time for developers to liquidate their inventory. ...

... buildings are stock-in-trade, the rule will be applicable only after one year of receiving the completion certificate. The law will provide some breathing time for developers to liquidate their inventory. ...

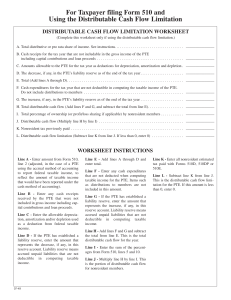

For Taxpayer filing Form 510 and Using the Distributable Cash Flow

... B. Cash receipts for the tax year that are not includable in the gross income of the PTE including capital contributions and loan proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________ C. Amounts allowable to the PTE for the tax year as d ...

... B. Cash receipts for the tax year that are not includable in the gross income of the PTE including capital contributions and loan proceeds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . _______________ C. Amounts allowable to the PTE for the tax year as d ...

Weighted Average Cost of Capital

... REIT market capitalization decreased by 56.3% The growth of the industry declined since ‘07 but the revenues have been stable due to long-term lease contracts ...

... REIT market capitalization decreased by 56.3% The growth of the industry declined since ‘07 but the revenues have been stable due to long-term lease contracts ...

Chapter 8

... IF NET LOSS => add to ordinary gains and losses. Can also offset salary, interest, dividends, etc. Result is ordinary rate benefit of 1231 net losses. ...

... IF NET LOSS => add to ordinary gains and losses. Can also offset salary, interest, dividends, etc. Result is ordinary rate benefit of 1231 net losses. ...

Guidance on Revenue opinions on classification of activities as trading

... Ms. Marie Hurley, Corporate Business and International Division, Financial Services I, 2nd Floor, New Stamping Building, Dublin Castle, Dublin 2. ...

... Ms. Marie Hurley, Corporate Business and International Division, Financial Services I, 2nd Floor, New Stamping Building, Dublin Castle, Dublin 2. ...

Vietnam NewsBrief New regional investment and tax guide for South

... been a magnet increasingly attracting investment from multinational corporations. ASEAN countries themselves are also seeking investment opportunities in the region in advance of ASEAN Economic Community (AEC), which is the goal of regional economic integration by 2015. This connectivity will increa ...

... been a magnet increasingly attracting investment from multinational corporations. ASEAN countries themselves are also seeking investment opportunities in the region in advance of ASEAN Economic Community (AEC), which is the goal of regional economic integration by 2015. This connectivity will increa ...

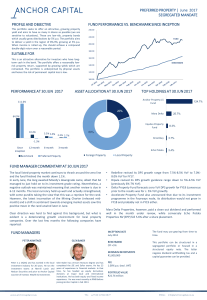

fund performance vs. benchmark since inception

... and the fund finished the month down 1.1%. In early June, the long awaited Moody’s downgrade came, albeit that SA managed to just hold on to its investment grade rating. Nevertheless, a negative outlook was maintained meaning that another review is due in 6-12 months. The local currency held up well ...

... and the fund finished the month down 1.1%. In early June, the long awaited Moody’s downgrade came, albeit that SA managed to just hold on to its investment grade rating. Nevertheless, a negative outlook was maintained meaning that another review is due in 6-12 months. The local currency held up well ...

Dominican Republic

... estimation methodology; an overestimation of the Inflation rate requires an underestimation of the real per capita income of the country. If we are right the inflation rate and the decline in real GDP were not as bad as the data shows. Another implication is that the gains made during the early 1990 ...

... estimation methodology; an overestimation of the Inflation rate requires an underestimation of the real per capita income of the country. If we are right the inflation rate and the decline in real GDP were not as bad as the data shows. Another implication is that the gains made during the early 1990 ...

(wealth accumulator established).

... Invest for the future With Tom finishing school in the near future, additional funds will be available to invest; around $12,000 on an ongoing basis. This will increase as the other children gradually finish school. With the long term objective in mind, an installment gearing strategy is applied, wh ...

... Invest for the future With Tom finishing school in the near future, additional funds will be available to invest; around $12,000 on an ongoing basis. This will increase as the other children gradually finish school. With the long term objective in mind, an installment gearing strategy is applied, wh ...

Will shares produce highest returns long-term?

... because of the interconnections and uncertainty. It will however, always “try” to be in “balance”. From time to time, the allocation of economic activity will get out of balance; interest rates will rise too high, or wages will go up too fast. In each case, the immediate result is lower residual pro ...

... because of the interconnections and uncertainty. It will however, always “try” to be in “balance”. From time to time, the allocation of economic activity will get out of balance; interest rates will rise too high, or wages will go up too fast. In each case, the immediate result is lower residual pro ...

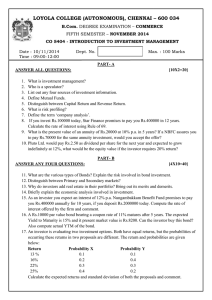

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... you Rs.400000 annually for 10 years, if you deposit Rs.2000000 today. Compute the rate of interest offered by the firm and comment. 16. A Rs.10000 par value bond bearing a coupon rate of 11% matures after 5 years. The expected Yield to Maturity is 15% and it present market value is Rs.8200. Can the ...

... you Rs.400000 annually for 10 years, if you deposit Rs.2000000 today. Compute the rate of interest offered by the firm and comment. 16. A Rs.10000 par value bond bearing a coupon rate of 11% matures after 5 years. The expected Yield to Maturity is 15% and it present market value is Rs.8200. Can the ...

ThE USE oF rETUrN oF CApITAl For INvESTMENTS INSIDE A

... ROC. Second, if Jeremie requires life insurance for any reason, the policy might be purchased by the corporation holding his investments with his life as the insured. The premiums on the policy could be paid using ROC within the corporation which essentially results in these premiums being financed ...

... ROC. Second, if Jeremie requires life insurance for any reason, the policy might be purchased by the corporation holding his investments with his life as the insured. The premiums on the policy could be paid using ROC within the corporation which essentially results in these premiums being financed ...

Paul Wilcox: Use it or lose it - every seven years

... Still, do not forget that ISA investments are CGTexempt and so can be realised for gifting purposes. Furthermore, if they remain in the estate at death, their value may incur a crippling 40% rate of IHT. Even where realising assets could involve a minor CGT liability, there is always the attractive ...

... Still, do not forget that ISA investments are CGTexempt and so can be realised for gifting purposes. Furthermore, if they remain in the estate at death, their value may incur a crippling 40% rate of IHT. Even where realising assets could involve a minor CGT liability, there is always the attractive ...

1 SECURITIES AND EXCHANGE COMMISSION WASHINGTON

... (a) Includes an after-tax benefit of $2.3 million, or $.02 per share, from the favorable tax treatment, net of expense, of the charitable contribution of the remaining shares of a stock investment in an insurance company. (b) The company adopted Statement of Financial Accounting Standard (SFAS) No. ...

... (a) Includes an after-tax benefit of $2.3 million, or $.02 per share, from the favorable tax treatment, net of expense, of the charitable contribution of the remaining shares of a stock investment in an insurance company. (b) The company adopted Statement of Financial Accounting Standard (SFAS) No. ...

interest - Dublin City Schools

... development, and careers. People with few skills are more likely to be poor. There are two methods for classifying how income is distributed in a nation—the personal distribution of income and the functional distribution of income. ...

... development, and careers. People with few skills are more likely to be poor. There are two methods for classifying how income is distributed in a nation—the personal distribution of income and the functional distribution of income. ...