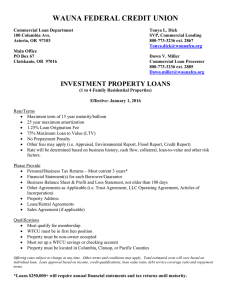

Investment - Wauna Federal Credit Union

... • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreement (if applicable) Qualifications • Must qualify for membership • WFCU must be in first lien position • Property must be non-owner o ...

... • Other Agreements as Applicable (i.e. Trust Agreement, LLC Operating Agreement, Articles of Incorporation) • Property Address • Lease/Rental Agreements • Sales Agreement (if applicable) Qualifications • Must qualify for membership • WFCU must be in first lien position • Property must be non-owner o ...

Document

... High capital inflows prompted by high real interest rates and Turkey’s EU candidacy Inflows of FDI led by privatization The current account deficit/GDP had reached historically high levels of 6.0% in 2006 and 5.8% in 2007. Turkey became one of the most vulnerable- exchange rate overvaluation, high e ...

... High capital inflows prompted by high real interest rates and Turkey’s EU candidacy Inflows of FDI led by privatization The current account deficit/GDP had reached historically high levels of 6.0% in 2006 and 5.8% in 2007. Turkey became one of the most vulnerable- exchange rate overvaluation, high e ...

Presentation - The Cambridge Trust for New Thinking in Economics

... capital supply (saving) to net return; and low elastricity of labour to real wages (except at top of course!) • Argument strengthened in 1990s by globalisation: OECD policy shift from mobile (capital income, corporations and top earnings) towards immobile (consumption and real estate) tax bases. ...

... capital supply (saving) to net return; and low elastricity of labour to real wages (except at top of course!) • Argument strengthened in 1990s by globalisation: OECD policy shift from mobile (capital income, corporations and top earnings) towards immobile (consumption and real estate) tax bases. ...

Making your nest egg last. Strategies for sustainable income in

... Traditional asset classes are defined as those included in traditional balanced portfolios, such as stocks, bonds, and cash, and that have been widely owned by individual investors since the post-war emergence of modern portfolio ...

... Traditional asset classes are defined as those included in traditional balanced portfolios, such as stocks, bonds, and cash, and that have been widely owned by individual investors since the post-war emergence of modern portfolio ...

Lecture 3 - CSUN.edu

... accounting, most small businesses can instead use the cash method for tax purposes. The cash method can offer more flexibility in tax planning because you can sometimes time your receipt of revenue or payments of expenses to shift these items from one tax year to another. However, some businesses mu ...

... accounting, most small businesses can instead use the cash method for tax purposes. The cash method can offer more flexibility in tax planning because you can sometimes time your receipt of revenue or payments of expenses to shift these items from one tax year to another. However, some businesses mu ...

What Does Welfare Reform Mean for East Sussex? (Nick Hopkins)

... • East Sussex ‘Squeezed’: – High employment, low wage economy, jobs may be insecure. – Stagnant wages. – High and differential inflation. – High house prices. ...

... • East Sussex ‘Squeezed’: – High employment, low wage economy, jobs may be insecure. – Stagnant wages. – High and differential inflation. – High house prices. ...

Some Thoughts on Australian House Prices March 2017

... The state of the housing market remains a key consideration for any Australian equity investor. There is a constant flow of speculation as to the outlook for residential property ranging from predictions of a catastrophic collapse through to justifications for ever increasing house prices. In additi ...

... The state of the housing market remains a key consideration for any Australian equity investor. There is a constant flow of speculation as to the outlook for residential property ranging from predictions of a catastrophic collapse through to justifications for ever increasing house prices. In additi ...

SM_C02_Reilly1ce

... invested in instruments that can easily be converted to cash with little chance of loss in value (e.g., money market mutual funds, etc.). Most experts recommend that an individual should carry life insurance equal to 7-10 times an individual’s annual salary but final determination needs to include t ...

... invested in instruments that can easily be converted to cash with little chance of loss in value (e.g., money market mutual funds, etc.). Most experts recommend that an individual should carry life insurance equal to 7-10 times an individual’s annual salary but final determination needs to include t ...

Energy

... First investment category (above Euro 50 mln.) Universal measures; Institutional support; State aid for developing the necessary elements of technical ...

... First investment category (above Euro 50 mln.) Universal measures; Institutional support; State aid for developing the necessary elements of technical ...

Salary V Dividends

... methods available for the extraction of cash from the company. The company may pay a Salary to all employees of the company including its directors, it may pay a Dividend to each of its shareholders in their capacity as such, or it may opt to pay a combination of Salary and Dividend. Whichever form ...

... methods available for the extraction of cash from the company. The company may pay a Salary to all employees of the company including its directors, it may pay a Dividend to each of its shareholders in their capacity as such, or it may opt to pay a combination of Salary and Dividend. Whichever form ...

Over But Not Over Pay + Excess amount over

... needed services that would otherwise be performed by an unrelated party and limited to the amount that would have been paid to a third party. ...

... needed services that would otherwise be performed by an unrelated party and limited to the amount that would have been paid to a third party. ...

capital dividend account and refundable dividend tax on hand

... The proceeds of a life insurance policy received by the corporation in excess of the Adjusted Cost Basis (ACB) of the policy ...

... The proceeds of a life insurance policy received by the corporation in excess of the Adjusted Cost Basis (ACB) of the policy ...

Financial Advisors

... event of a lapse or policy surrender and will reduce both the cash value and death benefit. Please keep in mind that the primary reason to purchase a life insurance policy is the death benefit. Life insurance products contain fees, such as mortality and expense charges, and may contain restrictions, ...

... event of a lapse or policy surrender and will reduce both the cash value and death benefit. Please keep in mind that the primary reason to purchase a life insurance policy is the death benefit. Life insurance products contain fees, such as mortality and expense charges, and may contain restrictions, ...

The effect of stock price changes on budgetary balances

... The sharpness of recent declines in stock prices has sparked investigations into the effects of financial asset prices on public finances. In principle, stock price changes affect public finances via direct and indirect channels. Direct effects stem mainly from the taxation of capital gains or tax-d ...

... The sharpness of recent declines in stock prices has sparked investigations into the effects of financial asset prices on public finances. In principle, stock price changes affect public finances via direct and indirect channels. Direct effects stem mainly from the taxation of capital gains or tax-d ...

Inclusionary Housing Program

... If the lease or rental agreement doesn’t include language indicating that the unit is deed restricted and annual certification is required, then an Affordable Housing Addendum needs to accompany the lease or rental agreement. ...

... If the lease or rental agreement doesn’t include language indicating that the unit is deed restricted and annual certification is required, then an Affordable Housing Addendum needs to accompany the lease or rental agreement. ...

Where Do My Tax Dollars Go?

... The graphs demonstrate total tax‐supported departmental expenditures per tax dollar paid to the Town of Arnprior. Grants and Subsidies include grants provided to various grant recipients such as the Library, Archives and Airport. Contribution to pay‐as‐you‐go expenditures and reserves is based on ...

... The graphs demonstrate total tax‐supported departmental expenditures per tax dollar paid to the Town of Arnprior. Grants and Subsidies include grants provided to various grant recipients such as the Library, Archives and Airport. Contribution to pay‐as‐you‐go expenditures and reserves is based on ...