CI Investment Grade Bond Fund

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

... Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. The indicated rates of return are the historical annual compounded total including changes in unit value and reinvestment of all distributi ...

Chapter 4 - A simple stock-flow consistent model with porfolio choice

... The impact of a rise in interest rates is still positive in the long run even when higher interest rates have a short-run negative impact on income, Because they are assumed to induce lower propensities to consume ...

... The impact of a rise in interest rates is still positive in the long run even when higher interest rates have a short-run negative impact on income, Because they are assumed to induce lower propensities to consume ...

mshdamml lh - Michigan Municipal League

... the infrastructure projects in the U.S. built by state and local governments, and with over $3.7 trillion in outstanding tax exempt bonds, issued by 30,000 separate government units. Local governments save an average of 25 percent to 30 percent on interest costs with tax-exempt municipal bonds as co ...

... the infrastructure projects in the U.S. built by state and local governments, and with over $3.7 trillion in outstanding tax exempt bonds, issued by 30,000 separate government units. Local governments save an average of 25 percent to 30 percent on interest costs with tax-exempt municipal bonds as co ...

Matching the risk profile of your funds with the risk characteristics of

... The other main message is that bonds do not have a significantly lower volatility of returns compared to shares over very long periods. We have now been in a secular bull market for bonds lasting over 30 years, with only small relatively short reversals in that long term trend. Investors who have no ...

... The other main message is that bonds do not have a significantly lower volatility of returns compared to shares over very long periods. We have now been in a secular bull market for bonds lasting over 30 years, with only small relatively short reversals in that long term trend. Investors who have no ...

The share that taps into high yields from North America, at a 13pc

... British dividend pool as a whole is dominated by a small number of very large companies. In fact, just 10 firms account for half of the dividends paid by FTSE 100 constituent companies. If any of these groups is forced to cut or suspend its dividend, the effect will be significant. By contrast, the ...

... British dividend pool as a whole is dominated by a small number of very large companies. In fact, just 10 firms account for half of the dividends paid by FTSE 100 constituent companies. If any of these groups is forced to cut or suspend its dividend, the effect will be significant. By contrast, the ...

ECON 593: Workshop on Economic Education

... Maryland Council on Economic Education and Towson University College of Business and Economics. ...

... Maryland Council on Economic Education and Towson University College of Business and Economics. ...

教育基金Education Fund - Michigan Chinese School

... • Penalty free early distributions can be made to pay for qualified expenses in relation to higher education fees, applicable not only to the IRA owner but also certain family members • Income limits and contribution limits • Possible of $6000/yr. ...

... • Penalty free early distributions can be made to pay for qualified expenses in relation to higher education fees, applicable not only to the IRA owner but also certain family members • Income limits and contribution limits • Possible of $6000/yr. ...

181108 Overall revenue monitoring 2008/09

... The underspend on Community Committee has been partly offset by a lower level of income from car park charges and significant increases in vehicle fuel costs on services such as refuse collection. ...

... The underspend on Community Committee has been partly offset by a lower level of income from car park charges and significant increases in vehicle fuel costs on services such as refuse collection. ...

Don`t confuse numbers with measurements

... is strong and healthy. But wait, what am I saying? When we look at the American experience in the last 41 years, we find that during 11 of those years American lenders also faced negative real rates of interest. However, only once did these real rates go lower than minus 3.3 percent, which is relati ...

... is strong and healthy. But wait, what am I saying? When we look at the American experience in the last 41 years, we find that during 11 of those years American lenders also faced negative real rates of interest. However, only once did these real rates go lower than minus 3.3 percent, which is relati ...

Teachers Pension Plan Deductions

... will only receive a percentage of your salary, but your contribution to Teachers Pension Plan will be calculated on 100% of your salary. The same will apply in your year of Leave. Participation in the DSL Plan will have no impact on your Pensionable Earnings. Investment Options The Board will open a ...

... will only receive a percentage of your salary, but your contribution to Teachers Pension Plan will be calculated on 100% of your salary. The same will apply in your year of Leave. Participation in the DSL Plan will have no impact on your Pensionable Earnings. Investment Options The Board will open a ...

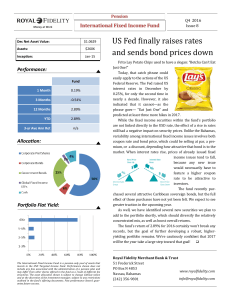

US Fed finally raises rates and sends bond prices down

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

... Federal Reserve. The Fed raised US interest rates in December by 0.25%, for only the second time in nearly a decade. However, it also indicated that it cannot—as the phrase goes— “Eat Just One” and predicted at least three more hikes in 2017. While the fixed income securities within the fund’s portf ...

Life Insurance Retirement Plan (LIRP)

... Tax Efficiency Before, During, and After Retirement A Life Insurance Retirement Plan (LIRP) can be an ideal solution for highly compensated/high-net-worth clients seeking to drive additional retirement income on a tax favored basis. The LIRP provides many of the same tax-free characteristics of a Ro ...

... Tax Efficiency Before, During, and After Retirement A Life Insurance Retirement Plan (LIRP) can be an ideal solution for highly compensated/high-net-worth clients seeking to drive additional retirement income on a tax favored basis. The LIRP provides many of the same tax-free characteristics of a Ro ...

Saving and Investing on a Shoestring: Finding Money to Save

... Debra Pankow, Ph.D., family economics specialist, and Marina Serdiouk, graduate student ...

... Debra Pankow, Ph.D., family economics specialist, and Marina Serdiouk, graduate student ...

Pension Fund Management Private Client Investment Portfolios

... investments, fixed income investments and equity based investments. We are targeted at individuals and institutions who intend to have their own portfolios were they can track the fixed income investments placed on their behalf, property structures done for them, equity counters held and the transac ...

... investments, fixed income investments and equity based investments. We are targeted at individuals and institutions who intend to have their own portfolios were they can track the fixed income investments placed on their behalf, property structures done for them, equity counters held and the transac ...

TFSA - Retire First

... eligibility for federal Income-tested Benefits and Credits. Your Old Age Security (OAS) benefits, Guaranteed Income Supplement (GIS) or Employment Insurance (EI) benefits will not be reduced. Income and withdrawals will not affect your Canada Child Tax Benefit (CCTB), the Goods and Services Tax Cred ...

... eligibility for federal Income-tested Benefits and Credits. Your Old Age Security (OAS) benefits, Guaranteed Income Supplement (GIS) or Employment Insurance (EI) benefits will not be reduced. Income and withdrawals will not affect your Canada Child Tax Benefit (CCTB), the Goods and Services Tax Cred ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... the long-standing questions in analyzing voluntary transfer programs, such as the earned income tax credit, is why some eligible households fail to take advantage of these programs. In "The EITC and Transfer Programs: A Study of Labor Market and Program Participation," the authors develop a new hous ...

... the long-standing questions in analyzing voluntary transfer programs, such as the earned income tax credit, is why some eligible households fail to take advantage of these programs. In "The EITC and Transfer Programs: A Study of Labor Market and Program Participation," the authors develop a new hous ...

No Slide Title

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...

... Slovenia, Spain, Sweden, the Netherlands, United Kingdom Population: 460.1 million Total GDP: $11.7 trillion ...