Martin Feldstein Avoiding Currency Crises

... capital inflows, as Chile has done. This is a strategy advocated earlier by Eichengreen and one that Eichengreen and Haussman note is gaining favor in Washington. I think such a policy is not generally appropriate. It unambiguously raises the cost of capital to businesses in the country and may have ...

... capital inflows, as Chile has done. This is a strategy advocated earlier by Eichengreen and one that Eichengreen and Haussman note is gaining favor in Washington. I think such a policy is not generally appropriate. It unambiguously raises the cost of capital to businesses in the country and may have ...

Lecture 21: Exchange Rates and International Trade

... b. PPP: As we discussed, the purchasing power parity influences the exchange rate. The more a currency can buy, the more the currency is worth. E increases as CD’s purchasing power increases (each CD can be exchanged for more CF). c. A change in the relative domestic interest rate causes appreciatio ...

... b. PPP: As we discussed, the purchasing power parity influences the exchange rate. The more a currency can buy, the more the currency is worth. E increases as CD’s purchasing power increases (each CD can be exchanged for more CF). c. A change in the relative domestic interest rate causes appreciatio ...

Exchange Rate Policy Macro_Module_43

... 1. Buy up the surplus of Landers in the FOREX. This is called Exchange Market Intervention. 2. The Central Bank of Highlander can increase interest rates. 1. Attract foreign capital investment 2. Increasing D Lander 3. Reduce capital outflow from Highlander 4. Reduce S Lander 5. P of Lander will ris ...

... 1. Buy up the surplus of Landers in the FOREX. This is called Exchange Market Intervention. 2. The Central Bank of Highlander can increase interest rates. 1. Attract foreign capital investment 2. Increasing D Lander 3. Reduce capital outflow from Highlander 4. Reduce S Lander 5. P of Lander will ris ...

Chapter1

... What is Foreign Exchange and Where is the Market? *foreign exchange refers to bank deposits denominated in foreign currency and banknotes *global market with 24-hour trading *no physical location, telephone and electronic trading World’s largest financial market *estimated daily turnover = $1.88 tri ...

... What is Foreign Exchange and Where is the Market? *foreign exchange refers to bank deposits denominated in foreign currency and banknotes *global market with 24-hour trading *no physical location, telephone and electronic trading World’s largest financial market *estimated daily turnover = $1.88 tri ...

INTERNATIONAL FINANCIAL CRISES:

... confidence in the economy deteriorated. Moreover, if the capital that was attracted from abroad was not used productively, the inflow became the basis for nonperforming loans by domestic banks, some of which might be state owned. Because local lenders harbored doubts about the future value of the do ...

... confidence in the economy deteriorated. Moreover, if the capital that was attracted from abroad was not used productively, the inflow became the basis for nonperforming loans by domestic banks, some of which might be state owned. Because local lenders harbored doubts about the future value of the do ...

This PDF is a selection from a published volume from the... Bureau of Economic Research Volume Title: NBER International Seminar on Macroeconomics

... economy. Thus, central banks are closest to commercial banks and other financial intermediaries, yet the European Central Bank does not have information on EZ systemically important financial institutions! This is particularly serious because, even before the tensions arose in the EZ’s most indebted ...

... economy. Thus, central banks are closest to commercial banks and other financial intermediaries, yet the European Central Bank does not have information on EZ systemically important financial institutions! This is particularly serious because, even before the tensions arose in the EZ’s most indebted ...

An Attack on a Currency

... Poor lending/investment decisions by Thai institutions. Investment in speculative activities (especially in the Thai property markets) ...

... Poor lending/investment decisions by Thai institutions. Investment in speculative activities (especially in the Thai property markets) ...

The Dollar : Medium and Long Term Prospects - Inter

... China is their assembly center for now Letting go their exchange rates prices them out vs. competitors. China’s exchange rate policy is theirs also. China’s surplus with the US is adds to Asia’s as well. ...

... China is their assembly center for now Letting go their exchange rates prices them out vs. competitors. China’s exchange rate policy is theirs also. China’s surplus with the US is adds to Asia’s as well. ...

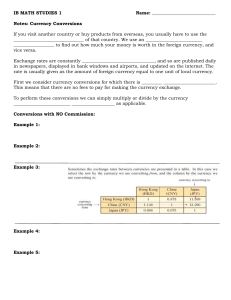

Commission on Currency Exchange

... Potential Test Questions involving Currency: 1) A currency exchange service exchanges 1 Mexican peso for Thai baht using a buy rate of 2.584 and a sell rate of 2.4807. Sergio wishes to exchange 400 peso for Thai baht. a) How many baht will he receive? b) If he immediately exchanges the baht back to ...

... Potential Test Questions involving Currency: 1) A currency exchange service exchanges 1 Mexican peso for Thai baht using a buy rate of 2.584 and a sell rate of 2.4807. Sergio wishes to exchange 400 peso for Thai baht. a) How many baht will he receive? b) If he immediately exchanges the baht back to ...

The Foreign Exchange Market

... High-speed computer linkages between trading centers mean there is no significant difference between exchange rates in the differing trading centers If exchange rates quoted in different markets were not essentially the same, there would be an opportunity for arbitrage the process of buying a cur ...

... High-speed computer linkages between trading centers mean there is no significant difference between exchange rates in the differing trading centers If exchange rates quoted in different markets were not essentially the same, there would be an opportunity for arbitrage the process of buying a cur ...

optimum currency areas - YSU

... – European Commission: executive body – Court of Justice: interprets EU law – European Central Bank, which conducts monetary policy through a system of member country banks called the European System of Central Banks ...

... – European Commission: executive body – Court of Justice: interprets EU law – European Central Bank, which conducts monetary policy through a system of member country banks called the European System of Central Banks ...

Course Outline School of Business and Economics BUSN 6030/1

... 4. Explain the important implications that international trade theory holds for business practice. 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries ...

... 4. Explain the important implications that international trade theory holds for business practice. 5. Explain why some governments intervene in international trade to restrict imports and promote exports. 6. Assess the costs and benefits of foreign direct investment to receiving and source countries ...

GI Research Market Commentary Second CNY depreciation

... method. We do not regard this as the beginning of a currency war. Over the short run, they may be strong volatility until markets have fully digested the new fixing method. While the currency may suffer a bit more near-term, we see a strong depreciation of the yuan as less likely. ...

... method. We do not regard this as the beginning of a currency war. Over the short run, they may be strong volatility until markets have fully digested the new fixing method. While the currency may suffer a bit more near-term, we see a strong depreciation of the yuan as less likely. ...

ANSWER: c

... is affected primarily by a nation's long-run economic prospects both a and b should be strongly affected by a nation's balance of trade c: Expectations and the Asset Market Model of Exchange Rates ...

... is affected primarily by a nation's long-run economic prospects both a and b should be strongly affected by a nation's balance of trade c: Expectations and the Asset Market Model of Exchange Rates ...

J. Anna Schwartz

... confidence in the economy deteriorated. Moreover, if the capital that was attracted from abroad was not used productively, the inflow became the basis for nonperforming loans by domestic banks, some of which might be state owned. Because local lenders harbored doubts about the future value ofthe dom ...

... confidence in the economy deteriorated. Moreover, if the capital that was attracted from abroad was not used productively, the inflow became the basis for nonperforming loans by domestic banks, some of which might be state owned. Because local lenders harbored doubts about the future value ofthe dom ...

Dr. Eran Yashiv EC303: Economic Analysis of the EU The European

... Prize in Economic Sciences in Memory of Alfred Nobel • As already indicated, fixed exchange rates predominated in the early 1960s. A few researchers did in fact discuss the advantages and disadvantages of a floating exchange rate. But a national currency was considered a must. The question Mundell p ...

... Prize in Economic Sciences in Memory of Alfred Nobel • As already indicated, fixed exchange rates predominated in the early 1960s. A few researchers did in fact discuss the advantages and disadvantages of a floating exchange rate. But a national currency was considered a must. The question Mundell p ...

fixed exchange rate - McGraw Hill Higher Education

... • Flexible exchange rates strengthen the effectiveness of monetary policy for stabilization • Fixed rates require the central bank to choose between defending the currency and stabilizing the economy • Fixed rates can be beneficial for small economies – Argentina fought hyperinflation by valuing its ...

... • Flexible exchange rates strengthen the effectiveness of monetary policy for stabilization • Fixed rates require the central bank to choose between defending the currency and stabilizing the economy • Fixed rates can be beneficial for small economies – Argentina fought hyperinflation by valuing its ...

On Market Makers` Contribution to Trading Efficiency in Options

... decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates ...

... decided to encourage market making in shekel-euro options by offering direct remuneration to market makers in exchange for obligations they would assume. These obligations include the obligation to enter quotes for sell and buy orders. Market makers began to operate in March 2004. This event creates ...

global supply chain

... – Close to production (as cycles get shorter) – Close to expertise (Indian programmers?) ...

... – Close to production (as cycles get shorter) – Close to expertise (Indian programmers?) ...

ch 20 end of chapter answers

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

... 9. a. This is an enormous change. In order to bring it about, the Never-Never government would have to run an enormously expansionary monetary policy, reducing the real interest rate possibly to negative amounts and probably generating significant inflation. As far as trade policies are concerned, t ...

Document

... Appreciation of the dollar causes American goods to be relatively more expensive and foreign goods to be relatively cheaper thus reducing exports and increasing imports Depreciation of the dollar causes American goods to be relatively cheaper and foreign goods to be relatively more expensive thu ...

... Appreciation of the dollar causes American goods to be relatively more expensive and foreign goods to be relatively cheaper thus reducing exports and increasing imports Depreciation of the dollar causes American goods to be relatively cheaper and foreign goods to be relatively more expensive thu ...

The International Monetary System

... The international monetary system refers to the institutional arrangements that countries adopt to govern exchange rates A floating exchange rate system exists when a country allows the foreign exchange market to determine the relative value of a currency the U.S. dollar, the EU euro, the Japa ...

... The international monetary system refers to the institutional arrangements that countries adopt to govern exchange rates A floating exchange rate system exists when a country allows the foreign exchange market to determine the relative value of a currency the U.S. dollar, the EU euro, the Japa ...

companies step up fx hedging after big moves in

... In October 2013, Reuters ran the following report: “After months of volatility in emerging market currencies and deep uncertainty over the outlook for the dollar, bruised companies have stepped up hedging of their foreign exchange exposure. Providers of protection against big moves in currencies, wh ...

... In October 2013, Reuters ran the following report: “After months of volatility in emerging market currencies and deep uncertainty over the outlook for the dollar, bruised companies have stepped up hedging of their foreign exchange exposure. Providers of protection against big moves in currencies, wh ...