Lecture 2 (POWER POINT)

... official “par value”. • Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only country responsible for maintaining the gold parity, which they did at $35 per ounce. • Under Bretton Woo ...

... official “par value”. • Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only country responsible for maintaining the gold parity, which they did at $35 per ounce. • Under Bretton Woo ...

operating_exposure

... an exporter’s profit. This is true in both dollar and foreigncurrency units. This is because costs are still susceptible to exchange rate effects. If some of the inputs are internationally traded, costs will rise while revenues will not be helped. Similarly, competition among producers, as well as ...

... an exporter’s profit. This is true in both dollar and foreigncurrency units. This is because costs are still susceptible to exchange rate effects. If some of the inputs are internationally traded, costs will rise while revenues will not be helped. Similarly, competition among producers, as well as ...

Bank of Slovenia`s Operational Monetary Policy

... Slovenia as EU Candidate Country • Preparation for the adoption of the euro (obligatory after joining the EU) • Main task: to bring the rates of price growth in line with the level of Maastricht criterion before the accession to the EU and formation of a long-term and sustainable exchange rate of t ...

... Slovenia as EU Candidate Country • Preparation for the adoption of the euro (obligatory after joining the EU) • Main task: to bring the rates of price growth in line with the level of Maastricht criterion before the accession to the EU and formation of a long-term and sustainable exchange rate of t ...

Lecture 9

... Foreign trade • In the next two lectures we will develop versions of the IS-LM and AD-AS models for an open ...

... Foreign trade • In the next two lectures we will develop versions of the IS-LM and AD-AS models for an open ...

exchange rate

... Effect of “undervalued dollar” and subsequent intervention on 1. U.S. money supply? 2. U.S. Inflation? ...

... Effect of “undervalued dollar” and subsequent intervention on 1. U.S. money supply? 2. U.S. Inflation? ...

Contents of the course - Solvay Brussels School

... should undertake a deflationary policy. Problem : prices and wages are sticky. A surplus country (too many exports - too high domestic currency) : should reflate. Problem : less pressure for adjustment. Tempted to build up their reserve of foreign currencies (selling domestic currencies) and steril ...

... should undertake a deflationary policy. Problem : prices and wages are sticky. A surplus country (too many exports - too high domestic currency) : should reflate. Problem : less pressure for adjustment. Tempted to build up their reserve of foreign currencies (selling domestic currencies) and steril ...

United States

... official “par value”. • Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only country responsible for maintaining the gold parity, which they did at $35 per ounce. • Under Bretton Woo ...

... official “par value”. • Each country was responsible for maintaining its exchange rate within ±1% of the adopted par value by buying or selling foreign reserves as necessary. • The U.S. was only country responsible for maintaining the gold parity, which they did at $35 per ounce. • Under Bretton Woo ...

Low consumption

... The exchange rate is a relative price But relative price of what? Domestic and foreign moneys? Yes, the nominal exchange rate is a monetary phenomenon, but exchange rate regimes are not, they are “real” Exchange rate regimes have real effects ...

... The exchange rate is a relative price But relative price of what? Domestic and foreign moneys? Yes, the nominal exchange rate is a monetary phenomenon, but exchange rate regimes are not, they are “real” Exchange rate regimes have real effects ...

Problem 12

... central banks would have to sell marks and buy dollars, a procedure known as intervention. But the pool of currencies in the marketplace is vastly larger than all the governments’ holdings. Billions of dollars worth of currencies are traded each day. Without the support of the US and Japan, it is un ...

... central banks would have to sell marks and buy dollars, a procedure known as intervention. But the pool of currencies in the marketplace is vastly larger than all the governments’ holdings. Billions of dollars worth of currencies are traded each day. Without the support of the US and Japan, it is un ...

Economy: Undo Jonathan`s Sealed Failure (2)

... accounts and foreign exchange sales by oil companies). Although the inflow more than offset the entire import cost of $57.66 billion (C&F unadjusted for balance of payments), there was unexpected drop in foreign reserves from their end-year 2009 level. Expenditure on imported invisibles was dispropo ...

... accounts and foreign exchange sales by oil companies). Although the inflow more than offset the entire import cost of $57.66 billion (C&F unadjusted for balance of payments), there was unexpected drop in foreign reserves from their end-year 2009 level. Expenditure on imported invisibles was dispropo ...

Lecture 1

... External Wealth A country’s net credit position with the rest of the world is called external wealth. The time series charts show levels of external wealth from 1980 to 2007 for the United States in panel (a) and Argentina in panel (b). All else equal, deficits cause external wealth to fall; surplus ...

... External Wealth A country’s net credit position with the rest of the world is called external wealth. The time series charts show levels of external wealth from 1980 to 2007 for the United States in panel (a) and Argentina in panel (b). All else equal, deficits cause external wealth to fall; surplus ...

Trade and the Exchange Rate

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

Trade and the Exchange Rate

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

... Our goods are now relatively more expensive therefore we lose our international competitiveness. Australia will demand less of our goods and more of another countries. ...

Global Business FBLA Study Guide Competency: Basic International

... Push promotional strategies work well for lower cost items, or items where customers may make a decision on the spot. New businesses use push strategies to develop retail markets for their products and to generate exposure. Once a product is already in stores, a pull strategy creates additional dema ...

... Push promotional strategies work well for lower cost items, or items where customers may make a decision on the spot. New businesses use push strategies to develop retail markets for their products and to generate exposure. Once a product is already in stores, a pull strategy creates additional dema ...

Practice e answers for final

... 2. During the 1997-1998 Asian financial crisis, Indonesia, Korea, Malaysia, Korea suffered from speculative attacks on their currencies. Before the crisis, Korea had its currency (the won) pegged to the U.S. dollar. Except for Malaysia, these countries have since moved to floating exchange rates, an ...

... 2. During the 1997-1998 Asian financial crisis, Indonesia, Korea, Malaysia, Korea suffered from speculative attacks on their currencies. Before the crisis, Korea had its currency (the won) pegged to the U.S. dollar. Except for Malaysia, these countries have since moved to floating exchange rates, an ...

LECTURE 9: THE OPEN ECONOMY IN THE SHORT RUN 1

... Figure 9.3: Real depreciation : impact on output and the trade balance ...

... Figure 9.3: Real depreciation : impact on output and the trade balance ...

LECTURE 9: THE OPEN ECONOMY IN THE SHORT RUN 1

... Figure 9.3: Real depreciation : impact on output and the trade balance ...

... Figure 9.3: Real depreciation : impact on output and the trade balance ...

3.1.4 Loss of competitiveness arising from exchange rate policies

... 3.1.4 Loss of competitiveness arising from exchange rate policies In addition to the factors above, the exchange rate regime adopted by most of the afflicted countries was seen by some as having played a crucial role in the emergence of the crisis in East Asia. Many countries in the region appear to ...

... 3.1.4 Loss of competitiveness arising from exchange rate policies In addition to the factors above, the exchange rate regime adopted by most of the afflicted countries was seen by some as having played a crucial role in the emergence of the crisis in East Asia. Many countries in the region appear to ...

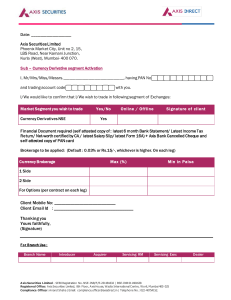

Do You Know - Bank of India

... You can buy foreign exchange from any bank branch dealing in foreign exchange or full-fledged money changers provided they are also permitted to release exchange for business and private visits. If the rupee equivalent exceeds Rs.50,000/-, the entire payment has to be made by way of a crossed ...

... You can buy foreign exchange from any bank branch dealing in foreign exchange or full-fledged money changers provided they are also permitted to release exchange for business and private visits. If the rupee equivalent exceeds Rs.50,000/-, the entire payment has to be made by way of a crossed ...

Chapter 5

... economic and monetary union is important for determining how members respond to aggregate demand shocks. – The economies of EU members are similar in the sense that there is a high volume of intra-industry trade relative to the total volume. – They are different in the sense that Northern European c ...

... economic and monetary union is important for determining how members respond to aggregate demand shocks. – The economies of EU members are similar in the sense that there is a high volume of intra-industry trade relative to the total volume. – They are different in the sense that Northern European c ...

Is Europe an Optimum Currency Area?

... Prize in Economic Sciences in Memory of Alfred Nobel • As already indicated, fixed exchange rates predominated in the early 1960s. A few researchers did in fact discuss the advantages and disadvantages of a floating exchange rate. But a national currency was considered a must. The question Mundell p ...

... Prize in Economic Sciences in Memory of Alfred Nobel • As already indicated, fixed exchange rates predominated in the early 1960s. A few researchers did in fact discuss the advantages and disadvantages of a floating exchange rate. But a national currency was considered a must. The question Mundell p ...

Problem_Set8 - Homework Minutes

... in the RDGP primarily affects imports whereas a change in PI mostly affects exports. A change in R influences foreign capital flow into or out of the nation’s economy. The foreign exchange effects can be analyzed graphically as in Marthinsen; however, both the supply and demand curves usually shift ...

... in the RDGP primarily affects imports whereas a change in PI mostly affects exports. A change in R influences foreign capital flow into or out of the nation’s economy. The foreign exchange effects can be analyzed graphically as in Marthinsen; however, both the supply and demand curves usually shift ...