Balance of Payments - McGraw Hill Higher Education

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

Balance of Payments - McGraw Hill Higher Education

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

US$ Depreciation

... B. How Do Americans Purchase German Goods? 1. Foreign Currency Demand: • derived from the demand for foreign country’s goods, services, and financial assets. ...

... B. How Do Americans Purchase German Goods? 1. Foreign Currency Demand: • derived from the demand for foreign country’s goods, services, and financial assets. ...

Balance of Payments

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

Chapter 36

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

... • Buy/sell current goods or services • Imports and exports • International asset transactions • Buy/sell real or financial assets • Buy stock • Sell your house to a foreigner • Requires currency exchange LO1 ...

Macro_5.2-_Foreign_Exchange_FOREX

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

CHAPTER 14 FIGURES

... Source: U.S. Bureau of Economic Analysis, U.S. International Transactions Accounts Data, table 1, with rearrangements and simplifications by authors. *Also includes the net value of financial derivatives (financial instruments whose values are linkedto an underlying asset, interest rate, or index, s ...

... Source: U.S. Bureau of Economic Analysis, U.S. International Transactions Accounts Data, table 1, with rearrangements and simplifications by authors. *Also includes the net value of financial derivatives (financial instruments whose values are linkedto an underlying asset, interest rate, or index, s ...

SECTION 8: Open Economy: International Trade & Finance Need to Know The , consists of international transactions that don’t create liabilities.

... An Exchange Rate Regime Is A Rule Governing Policy Toward The Exchange Rate. ...

... An Exchange Rate Regime Is A Rule Governing Policy Toward The Exchange Rate. ...

forwards

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

... 1. Currencies: The currencies that have forward contracts available are the Canadian dollar (C$), Japanese yen (¥), Swiss franc (SF), and the UK pound (£). Within each of these currencies, there are 1 month, 3 month, and 6 month forwards available. That is, the currency delivery date is one month (o ...

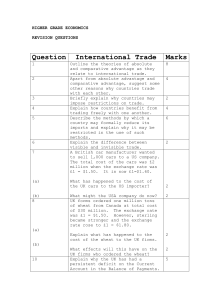

higher grade economics - Bannerman High School

... possible measures which used to reduce UK imports. possible measures that used to increase UK ...

... possible measures which used to reduce UK imports. possible measures that used to increase UK ...

Vocabulary, Economic terms, page 99

... The study was supported by a $70 000 grant from a research group. They were awarded grants to develop new methods of crop production. currency ...

... The study was supported by a $70 000 grant from a research group. They were awarded grants to develop new methods of crop production. currency ...

MS34B-Week 5

... Inflation erodes purchasing power. As a result, governments try to control by managing the supply and demand of their currency. Factors affecting money supply change include: Public Sector Credit, Private Sector Credit, Changes in Monetary Base (currency issue, cash reserves, current accounts), ...

... Inflation erodes purchasing power. As a result, governments try to control by managing the supply and demand of their currency. Factors affecting money supply change include: Public Sector Credit, Private Sector Credit, Changes in Monetary Base (currency issue, cash reserves, current accounts), ...

chapte r 4

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

... How exchange rates reach equilibrium? 1. Demand for a Currency a. derived from the local buyers who are willing and able to purchase foreign goods but who must convert their local currencies. b. An indirect relationship exists between the cost of foreign currency and amount demanded. c. Graphically, ...

Lecture 3

... Some currency pairs are only inactively traded, so their exchange rate is determined through their relationship to a widely traded third currency (cross rate). ...

... Some currency pairs are only inactively traded, so their exchange rate is determined through their relationship to a widely traded third currency (cross rate). ...

Chapter 18

... • The four largest export partners for the U.S.: – Canada – Mexico – China – Japan ...

... • The four largest export partners for the U.S.: – Canada – Mexico – China – Japan ...

Slides on Currencies in International Trade (Session 3)

... ◦ ‘Hot’ investments in ‘emerging’ currencies have often caused problems when foreigners changed their minds ...

... ◦ ‘Hot’ investments in ‘emerging’ currencies have often caused problems when foreigners changed their minds ...

Business in the Global Economy

... Sudden changes in government may create an unfriendly setting for foreign business Risk of losing buildings, equipment or money in foreign banks Laws that impact foreign businesses in a country reduces confidence in that country’s currency ...

... Sudden changes in government may create an unfriendly setting for foreign business Risk of losing buildings, equipment or money in foreign banks Laws that impact foreign businesses in a country reduces confidence in that country’s currency ...

International Finance

... sold in different countries must be sold for the same price when their prices are expressed in terms of the same currency, for example, if $ 1 = FFr 5, then, a jacket sold for $ 50 in NY should be sold for FFr 250 in Paris. If the law of one price were true for all goods and services, the PPP exchan ...

... sold in different countries must be sold for the same price when their prices are expressed in terms of the same currency, for example, if $ 1 = FFr 5, then, a jacket sold for $ 50 in NY should be sold for FFr 250 in Paris. If the law of one price were true for all goods and services, the PPP exchan ...

File

... _________________ their own currency and _________________ another country’s currency. A country that is buying bonds ________________ their own currency and _______________ another country’s currency. When a country’s currency appreciates, their imports _________ and their exports fall. Now note th ...

... _________________ their own currency and _________________ another country’s currency. A country that is buying bonds ________________ their own currency and _______________ another country’s currency. When a country’s currency appreciates, their imports _________ and their exports fall. Now note th ...

PDF

... social and political costs escalate. Nevertheless, eventually, the country’s international credibility is restored and the crisis is transformed into a severe and prolonged recession. Why are financial crises frequent now while absent before 1973? Largely because, in 1973, when the supply of dollars ...

... social and political costs escalate. Nevertheless, eventually, the country’s international credibility is restored and the crisis is transformed into a severe and prolonged recession. Why are financial crises frequent now while absent before 1973? Largely because, in 1973, when the supply of dollars ...

Naira opens at N374 at new investor window Source

... slide in oil revenues and lukewarm portfolio inflows. The supply of FX at the new window will come from portfolio investors, exporters and authorized dealers (Deposit Money Banks), while transactions eligible to access the window will include loan repayments, interest payments, dividend/income remit ...

... slide in oil revenues and lukewarm portfolio inflows. The supply of FX at the new window will come from portfolio investors, exporters and authorized dealers (Deposit Money Banks), while transactions eligible to access the window will include loan repayments, interest payments, dividend/income remit ...

2/18 - David Youngberg

... will converge, assuming transportation costs are low. b. The intuition works much like basic economics. If two firms produce the same good, but one’s twice as expensive, market forces will pull the two prices together. c. The only difference here is that since we are looking at both different prices ...

... will converge, assuming transportation costs are low. b. The intuition works much like basic economics. If two firms produce the same good, but one’s twice as expensive, market forces will pull the two prices together. c. The only difference here is that since we are looking at both different prices ...

A Foreign Exchange and Policy Perspective

... new currency to Iraq from printing facilities in England, Spain, Germany, and Sri Lanka. I have a few specimens here if you want to see them. As this story illustrates, currency markets are an even larger part of our job at the U.S. Treasury than commonly appreciated. And there are other interesting ...

... new currency to Iraq from printing facilities in England, Spain, Germany, and Sri Lanka. I have a few specimens here if you want to see them. As this story illustrates, currency markets are an even larger part of our job at the U.S. Treasury than commonly appreciated. And there are other interesting ...