Ch 29 notes - Solon City Schools

... appreciated because ….. the dollar can now buy more yen • When exchange rate changes from 90 yen per dollar to 80 yen per dollar: the dollar has….. depreciated because …… the dollar can now buy less yen ...

... appreciated because ….. the dollar can now buy more yen • When exchange rate changes from 90 yen per dollar to 80 yen per dollar: the dollar has….. depreciated because …… the dollar can now buy less yen ...

Speaking at a press conference following the European

... devalue the peg, the U.S. ultimately abandoned it. Without an anchor to gold, the U.S. dollar's exchange rate was free to float on the open market -- and, conversely, world currencies were left to float as well. ...

... devalue the peg, the U.S. ultimately abandoned it. Without an anchor to gold, the U.S. dollar's exchange rate was free to float on the open market -- and, conversely, world currencies were left to float as well. ...

LMAX EXCHANGE Wall Street 30 (Mini) Contract Terms

... LMAX will (i) consult Members on any proposed amendment to the Contract Terms; and (ii) give Members a minimum period of 10 Business Days to comment on the proposed amendment. LMAX will notify Members of any amendment as Amendments to soon as practicable by email and/or by posting a notice on its we ...

... LMAX will (i) consult Members on any proposed amendment to the Contract Terms; and (ii) give Members a minimum period of 10 Business Days to comment on the proposed amendment. LMAX will notify Members of any amendment as Amendments to soon as practicable by email and/or by posting a notice on its we ...

Measuring Trade

... Extra dollars end up in the hands of foreigners Foreigners use these dollars to purchase land, stocks and bonds • This is a form of export and balances our trade accounts ...

... Extra dollars end up in the hands of foreigners Foreigners use these dollars to purchase land, stocks and bonds • This is a form of export and balances our trade accounts ...

Monetary & Fiscal Policy in a Global Economy

... What does this have to do with international trade & finance? ...

... What does this have to do with international trade & finance? ...

Chapter 7 Power Point Presentation

... direction of exchange rate movement. A high interest rate will increase the demand for the home currency, thus enhancing its exchange value. A high level of inflation is too much money chasing too few goods and would cause currency to depreciate. The exchange rate is very sensitive to changes in ...

... direction of exchange rate movement. A high interest rate will increase the demand for the home currency, thus enhancing its exchange value. A high level of inflation is too much money chasing too few goods and would cause currency to depreciate. The exchange rate is very sensitive to changes in ...

Real Exchange Rate

... • Law of One Price: LOOP-if two countries produce an identical good, if the good is tradable, if there is free trade and there are no transactions /transportation costs, then the price should be the same in both countries. In the shirt example, U.S consumers would buy Indian shirts, buy more rupees, ...

... • Law of One Price: LOOP-if two countries produce an identical good, if the good is tradable, if there is free trade and there are no transactions /transportation costs, then the price should be the same in both countries. In the shirt example, U.S consumers would buy Indian shirts, buy more rupees, ...

Exchange Rate Systems - Mays Business School

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

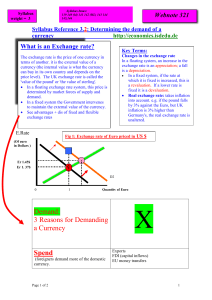

Demand for a currency - yELLOWSUBMARINER.COM

... Real exchange rate: takes inflation into account. e.g. if the pound falls by 3% against the Euro, but UK inflation is 3% higher than Germany's, the real exchange rate is unaltered. ...

... Real exchange rate: takes inflation into account. e.g. if the pound falls by 3% against the Euro, but UK inflation is 3% higher than Germany's, the real exchange rate is unaltered. ...

Chapter 17 International Finance Name

... 2. If the exchange rate between the Dollar and the British pound were $2 equals one pound, a good prices at 150 pounds in England would cost a U.S. buyer ( ) dollars, and a U.S. good priced at $20 would cost someone in England ( ) pounds. 3. Until 1971, the exchange between the US dollar and many ot ...

... 2. If the exchange rate between the Dollar and the British pound were $2 equals one pound, a good prices at 150 pounds in England would cost a U.S. buyer ( ) dollars, and a U.S. good priced at $20 would cost someone in England ( ) pounds. 3. Until 1971, the exchange between the US dollar and many ot ...

Government Influence on Exchange Rates

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

... • Some speculators attempt to determine when the central bank is intervening directly, and the extent of the intervention, in order to capitalize on the anticipated results of the intervention effort. ...

International Trade

... Why is there a balance in the balance of payments? The value of a country’s currency fluctuates as the supply fluctuates on the world market ...

... Why is there a balance in the balance of payments? The value of a country’s currency fluctuates as the supply fluctuates on the world market ...

Exchange Rates Theories

... When there is not much international capital flows, TB>0 Currency appreciation TB<0 Currency depreciation These exchange rate movements eliminate trade imbalances. The ex rate adjusts to equilibrate transaction of goods and services ...

... When there is not much international capital flows, TB>0 Currency appreciation TB<0 Currency depreciation These exchange rate movements eliminate trade imbalances. The ex rate adjusts to equilibrate transaction of goods and services ...

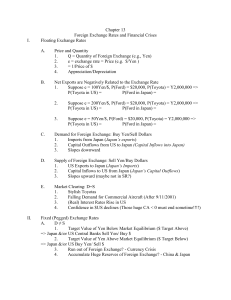

Chapter 13 - Montana State University

... May conflict with attempts to stimulate the Domestic Economy a. England: 1992 b. Countries hit with currency/financial crisis (Asia, 1997): IMF c. Generally, if a country uses monetary policy to defend exchange rate, it can’t use it for domestic stabilization Market rates rise with risk of default ...

... May conflict with attempts to stimulate the Domestic Economy a. England: 1992 b. Countries hit with currency/financial crisis (Asia, 1997): IMF c. Generally, if a country uses monetary policy to defend exchange rate, it can’t use it for domestic stabilization Market rates rise with risk of default ...

Foreign Exchange and the International Monetary System

... Example: Suppose your nation’s economy is very prosperous Your people will have money to buy imports Their demand for foreign currencies will put upward pressure on their exchange rates Government has to slow the domestic economy to prevent change in exchange rate Higher taxes, higher inte ...

... Example: Suppose your nation’s economy is very prosperous Your people will have money to buy imports Their demand for foreign currencies will put upward pressure on their exchange rates Government has to slow the domestic economy to prevent change in exchange rate Higher taxes, higher inte ...

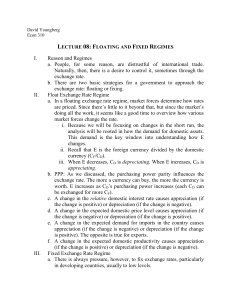

2/25 - David Youngberg

... d. It is with this reserve of foreign currency that fixed exchange rate regimes manipulate the market. e. Suppose China as a major manufacturer suddenly looks less appealing to the world at large, putting downward pressure on the yuan. i. At eight to the dollar, the yuan is currently overvalued. ii. ...

... d. It is with this reserve of foreign currency that fixed exchange rate regimes manipulate the market. e. Suppose China as a major manufacturer suddenly looks less appealing to the world at large, putting downward pressure on the yuan. i. At eight to the dollar, the yuan is currently overvalued. ii. ...

chapter 29

... and expectations of future exchanges rates since these forces drive hot money. In the short run, business cycles account for most of the change in exchange rates. Countries with higher relative GDPs demand more foreign currency, causing their own currencies to depreciate. 6. Purchasing power parity ...

... and expectations of future exchanges rates since these forces drive hot money. In the short run, business cycles account for most of the change in exchange rates. Countries with higher relative GDPs demand more foreign currency, causing their own currencies to depreciate. 6. Purchasing power parity ...

Lecture Slides Chapter 15

... known as adjustable pegged exchange rates 3) currencies values tied to each other 4) nations to use fiscal and monetary policies first to address balance of payments disequilibria 5) last resort was to re-peg currencies; greater than 10% change required IMF permission ...

... known as adjustable pegged exchange rates 3) currencies values tied to each other 4) nations to use fiscal and monetary policies first to address balance of payments disequilibria 5) last resort was to re-peg currencies; greater than 10% change required IMF permission ...

lecture 5.slides - Lancaster University

... • world’s economies increasingly inter-dependent • steadily increasing world trade - dependent on each other’s demand for exports • vast increase in financial flows due to liberalisation of financial markets - abolition of controls on currency movements - financial markets affect each other (instant ...

... • world’s economies increasingly inter-dependent • steadily increasing world trade - dependent on each other’s demand for exports • vast increase in financial flows due to liberalisation of financial markets - abolition of controls on currency movements - financial markets affect each other (instant ...

TEST BANK

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

... Calculate the variance of the monthly rate of return in dollar terms, if the variance of the foreign market’s return (in terms of its own currency) is 1.14, the variance between the U.S. dollar and the foreign currency is 17.64, the covariance is 2.34, and the contribution of the cross-product term ...

Exchange Rate Policy and Open

... Fixed Exchange Rate How governments keep exchange rates at a fixed rate When equilibrium value is below target: 1. Governments can buy up excess currency (exchange market intervention) with foreign exchange reserves 2. Governments can implement policy to raise interest rates 3. Governments can use ...

... Fixed Exchange Rate How governments keep exchange rates at a fixed rate When equilibrium value is below target: 1. Governments can buy up excess currency (exchange market intervention) with foreign exchange reserves 2. Governments can implement policy to raise interest rates 3. Governments can use ...