Ch 29 notes - Solon City Schools

... • If a traveler has any foreign currency left over on their return home, may want to sell it, which they may do at their local bank or money changer. • The exchange rate as well as fees and charges can vary significantly on each of these transactions, and the exchange rate can vary from one day to ...

... • If a traveler has any foreign currency left over on their return home, may want to sell it, which they may do at their local bank or money changer. • The exchange rate as well as fees and charges can vary significantly on each of these transactions, and the exchange rate can vary from one day to ...

Foreign Exchange

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

... 2. Mexico buys tractors from Canada 3. Canada sells syrup to the U.S. 4. Japan buys Fireworks from Mexico For all these transactions, there are different national currencies. Each country must be paid in their own currency The buyer (importer) must exchange their currency for that of the sellers (ex ...

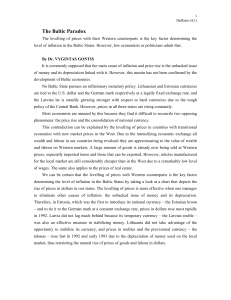

The Baltic Paradox

... drop in the "actual" rather than the officially established value of the litas against the dollar because inflation in the United States was only 2.6 per cent. Those who think like that ignore the fact that in Lithuania there are no restrictions to the exchange of litas into dollars and vice versa a ...

... drop in the "actual" rather than the officially established value of the litas against the dollar because inflation in the United States was only 2.6 per cent. Those who think like that ignore the fact that in Lithuania there are no restrictions to the exchange of litas into dollars and vice versa a ...

Peter Bernholz INSTITUTIONAL REQUIREMENTS FOR STABLE MONEY INTEGRATED WORLD ECONOMY

... its stability in terms of other currencies (Table 1). The gold content of the form was 3.54 g in 1252, when it was first issued. It amounted to 3.53 g in 1500 and never fell below 3.33 g between these dates. Thus, in 250 years the gold content changed maximally by 6 percent. ...

... its stability in terms of other currencies (Table 1). The gold content of the form was 3.54 g in 1252, when it was first issued. It amounted to 3.53 g in 1500 and never fell below 3.33 g between these dates. Thus, in 250 years the gold content changed maximally by 6 percent. ...

The success of the euro has shown the world the value of modern

... Prior to and during most of the 1800s international trade was denominated in terms of currencies that represented weights of gold. Most national currencies at the time were in essence merely different ways of measuring gold weights (much as the yard and the metre both measure length and are related ...

... Prior to and during most of the 1800s international trade was denominated in terms of currencies that represented weights of gold. Most national currencies at the time were in essence merely different ways of measuring gold weights (much as the yard and the metre both measure length and are related ...

Diagnostic Tables - Description

... currency converted to the numéraire currency with the PPPs. PPP-Ratio: Standardized price ratios based on the PPP converted prices. The PPP-Prices expressed as a percentage of their geometric mean. ...

... currency converted to the numéraire currency with the PPPs. PPP-Ratio: Standardized price ratios based on the PPP converted prices. The PPP-Prices expressed as a percentage of their geometric mean. ...

IPEII File - CSUN Moodle

... international monetary system. The pressure to maintain par values in a fixed exchange rate regime was a major burden. Flexibility was limited. Disequilibria that was short-term could remedied reasonably smoothly. Structural or long-term disequlibria could force devalue and revaluations of currency, ...

... international monetary system. The pressure to maintain par values in a fixed exchange rate regime was a major burden. Flexibility was limited. Disequilibria that was short-term could remedied reasonably smoothly. Structural or long-term disequlibria could force devalue and revaluations of currency, ...

Can the trading system survive without multilateral disciplines in

... extraordinarily difficult to frame any proposals about tariffs if countries are free to alter the value of their currencies without agreement at short notice. Tariffs and currency depreciations are in many cases alternatives. Without currency agreements you have no firm ground on which to discuss ta ...

... extraordinarily difficult to frame any proposals about tariffs if countries are free to alter the value of their currencies without agreement at short notice. Tariffs and currency depreciations are in many cases alternatives. Without currency agreements you have no firm ground on which to discuss ta ...

Chapter 10 File

... 1. The International Monetary Fund (IMF) to maintain order in the international monetary system 2. The World Bank to promote general economic ...

... 1. The International Monetary Fund (IMF) to maintain order in the international monetary system 2. The World Bank to promote general economic ...

dpam l bonds emerging markets sustainable - f

... In Central Europe, we increased Poland and Czech Republic at the expense of Romania and Croatia. In Africa, we increased Mozambique, Ivory Coast and Senegal and extended duration in South Africa. In Latin America, we increased Argentina, Colombia, Chile and Uruguay. In Asia, we increased exposure to ...

... In Central Europe, we increased Poland and Czech Republic at the expense of Romania and Croatia. In Africa, we increased Mozambique, Ivory Coast and Senegal and extended duration in South Africa. In Latin America, we increased Argentina, Colombia, Chile and Uruguay. In Asia, we increased exposure to ...

may 2013 treasury management 2 solutions

... rates and the Official exchange rates thereby limiting foreign currency circulation on the Black market. Most forex will be channeled through the Banks and therefore used for importation of strategic commodities. IMF programme on track which means more future aid from both bilateral and multilater ...

... rates and the Official exchange rates thereby limiting foreign currency circulation on the Black market. Most forex will be channeled through the Banks and therefore used for importation of strategic commodities. IMF programme on track which means more future aid from both bilateral and multilater ...

chapter 2 international monetary system

... Answer: Gresham’s law refers to the phenomenon that bad (abundant) money drives good (scarce) money out of circulation. This kind of phenomenon was often observed under the bimetallic standard under which both gold and silver were used as means of payments, with the exchange rate between the two met ...

... Answer: Gresham’s law refers to the phenomenon that bad (abundant) money drives good (scarce) money out of circulation. This kind of phenomenon was often observed under the bimetallic standard under which both gold and silver were used as means of payments, with the exchange rate between the two met ...

Currency

A currency (from Middle English: curraunt, ""in circulation"", from Latin: currens, -entis) in the most specific use of the word refers to money in any form when in actual use or circulation as a medium of exchange, especially circulating banknotes and coins. A more general definition is that a currency is a system of money (monetary units) in common use, especially in a nation. Under this definition, British pounds, U.S. dollars, and European euros are examples of currency. These various currencies are stores of value, and are traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are defined by governments, and each type has limited boundaries of acceptance.Other definitions of the term ""currency"" are discussed in their respective synonymous articles banknote, coin, and money. The latter definition, pertaining to the currency systems of nations, is the topic of this article. Currencies can be classified into two monetary systems: fiat money and commodity money, depending on what guarantees the value (the economy at large vs. the government's physical metal reserves). Some currencies are legal tender in certain jurisdictions, which means they cannot be refused as payment for debt. Others are simply traded for their economic value. Digital currency arose with the popularity of computers and the Internet.