Taming your dollar exposure: What Canadian

... drives its short term volatility as well? Macroeconomists have a number of frameworks to explain exchange rate trends in general, but in practice conclusively explaining the reason for a specific shift is very difficult, and predicting the timing and magnitude of future changes is impossible. At any ...

... drives its short term volatility as well? Macroeconomists have a number of frameworks to explain exchange rate trends in general, but in practice conclusively explaining the reason for a specific shift is very difficult, and predicting the timing and magnitude of future changes is impossible. At any ...

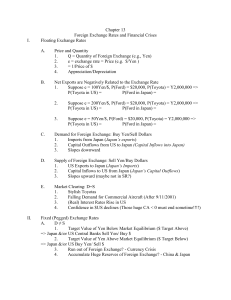

Chapter 13 - Montana State University

... saving) => capital inflows, and thus high value of $US is fault of US: NX = S-I ...

... saving) => capital inflows, and thus high value of $US is fault of US: NX = S-I ...

INTERNATIONAL FINANCIAL CRISES:

... confidence in the economy deteriorated. Moreover, if the capital that was attracted from abroad was not used productively, the inflow became the basis for nonperforming loans by domestic banks, some of which might be state owned. Because local lenders harbored doubts about the future value of the do ...

... confidence in the economy deteriorated. Moreover, if the capital that was attracted from abroad was not used productively, the inflow became the basis for nonperforming loans by domestic banks, some of which might be state owned. Because local lenders harbored doubts about the future value of the do ...

28. Exchange Rates.#F1545B

... Economics U$A Logo RICHARD GILL: Forever, as they say, is a very long time, and the experience under Bretton Woods, as in the 1930s, suggests that when supply and demand pressures get too great, a fixed exchange rate system, even if it has some flexibility, has a tendency to buckle. Actually, the ke ...

... Economics U$A Logo RICHARD GILL: Forever, as they say, is a very long time, and the experience under Bretton Woods, as in the 1930s, suggests that when supply and demand pressures get too great, a fixed exchange rate system, even if it has some flexibility, has a tendency to buckle. Actually, the ke ...

Euroisation - Advantages and Disadvantages of Albanian Economy

... Also the use of foreign currency deposits are widespread in developing countries such as Albania because it is still the only means and usable. The case of Albania is analyzed by several other researchers, who have been taken with this phenomenon, but the results obtained show that the replacement o ...

... Also the use of foreign currency deposits are widespread in developing countries such as Albania because it is still the only means and usable. The case of Albania is analyzed by several other researchers, who have been taken with this phenomenon, but the results obtained show that the replacement o ...

“Silver risk”, currency speculation and bank failures in

... The last quarter of the 19th century was one of the most exciting in American economic history, seeing as it did a dramatic conflict between supporters of two rival economic policies. After the Civil War, the American government decided to adhere to the gold standard, which meant a fixed exchange ra ...

... The last quarter of the 19th century was one of the most exciting in American economic history, seeing as it did a dramatic conflict between supporters of two rival economic policies. After the Civil War, the American government decided to adhere to the gold standard, which meant a fixed exchange ra ...

International Monetary System

... Central banks were allowed to intervene in the exchange rate markets to iron out unwarranted volatilities. ...

... Central banks were allowed to intervene in the exchange rate markets to iron out unwarranted volatilities. ...

The Costs and Benefits of the Euro In European Monetary Union

... manufacturer could end up getting far less for his product then he should have, or the importer could pay much more than was originally agreed upon (Eudey, pp. 14-15). The elimination of this risk will help international trade, therefore, giving advantages to all EMU countries. Two other major benef ...

... manufacturer could end up getting far less for his product then he should have, or the importer could pay much more than was originally agreed upon (Eudey, pp. 14-15). The elimination of this risk will help international trade, therefore, giving advantages to all EMU countries. Two other major benef ...

Currency

A currency (from Middle English: curraunt, ""in circulation"", from Latin: currens, -entis) in the most specific use of the word refers to money in any form when in actual use or circulation as a medium of exchange, especially circulating banknotes and coins. A more general definition is that a currency is a system of money (monetary units) in common use, especially in a nation. Under this definition, British pounds, U.S. dollars, and European euros are examples of currency. These various currencies are stores of value, and are traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are defined by governments, and each type has limited boundaries of acceptance.Other definitions of the term ""currency"" are discussed in their respective synonymous articles banknote, coin, and money. The latter definition, pertaining to the currency systems of nations, is the topic of this article. Currencies can be classified into two monetary systems: fiat money and commodity money, depending on what guarantees the value (the economy at large vs. the government's physical metal reserves). Some currencies are legal tender in certain jurisdictions, which means they cannot be refused as payment for debt. Others are simply traded for their economic value. Digital currency arose with the popularity of computers and the Internet.