OHRP

... Before December 15! The open enrollment period for coverage effective January 1, 2015, is scheduled to begin on November 15, 2014 and end on December 15, 2014. If you enroll after December 15, 2014, you will have a gap in coverage. ...

... Before December 15! The open enrollment period for coverage effective January 1, 2015, is scheduled to begin on November 15, 2014 and end on December 15, 2014. If you enroll after December 15, 2014, you will have a gap in coverage. ...

the powerpoint presentation regarding Monetary Policy.

... • An increase in the bank rate tells the chartered banks that the B of C wants a decrease in loans and an increase in interest rates to create a decrease in the money supply • A decrease in the bank rate tells the chartered banks the opposite. ...

... • An increase in the bank rate tells the chartered banks that the B of C wants a decrease in loans and an increase in interest rates to create a decrease in the money supply • A decrease in the bank rate tells the chartered banks the opposite. ...

Financial Planning and Risk Management Seminar

... non-essential spending, insured properly via health or medical insurance, life insurance, general insurance (motor, personal accidents, etc.); 5. Investing your money and constructing an investment portfolio – invest in short term (saving account, fixed deposits) or long term (stocks, bonds, mutual ...

... non-essential spending, insured properly via health or medical insurance, life insurance, general insurance (motor, personal accidents, etc.); 5. Investing your money and constructing an investment portfolio – invest in short term (saving account, fixed deposits) or long term (stocks, bonds, mutual ...

Financial Institutions

... For example, a customer wants to buy a computer but doesn't have the cash. The computer store can offer a loan. The computer store isn’t really issuing the loan, the business finance company issues the loan. Some large manufacturers form their own finance company called captive finance companies ...

... For example, a customer wants to buy a computer but doesn't have the cash. The computer store can offer a loan. The computer store isn’t really issuing the loan, the business finance company issues the loan. Some large manufacturers form their own finance company called captive finance companies ...

Types of Term Life Insurance

... • In a universal life insurance, the protection and savings components are separated – Most policies have a target premium, but the policyholder is not obligated to pay it – A monthly mortality charge is deducted from the cash-value account for the cost of the insurance protection – Insurers typical ...

... • In a universal life insurance, the protection and savings components are separated – Most policies have a target premium, but the policyholder is not obligated to pay it – A monthly mortality charge is deducted from the cash-value account for the cost of the insurance protection – Insurers typical ...

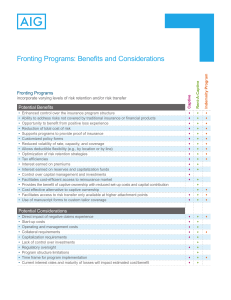

Fronting Programs: Benefits and Considerations

... or provided by subsidiaries or affiliates of American International Group, Inc. Products or services may not be available in all countries, and coverage is subject to actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty c ...

... or provided by subsidiaries or affiliates of American International Group, Inc. Products or services may not be available in all countries, and coverage is subject to actual policy language. Non-insurance products and services may be provided by independent third parties. Certain property-casualty c ...

Inside the Black Box: The Credit Channel of Monetary Policy

... Based on the theoretical prediction that the external finance premium facing a borrower should depend on borrower’s financial position. The greater is the borrower’s net worth, the lower the external finance premium should be. Since borrower’s financial position affect the external finance premium, ...

... Based on the theoretical prediction that the external finance premium facing a borrower should depend on borrower’s financial position. The greater is the borrower’s net worth, the lower the external finance premium should be. Since borrower’s financial position affect the external finance premium, ...

IASB Update Note No. 6 – Peter Wright and Nick Dexter This is the

... The FASB is somewhat behind the IASB in the due-process for the production of a standard, having only issued a discussion paper in 2010 rather than an exposure draft. However, the FASB is aiming to finalise its standard by the end of 2012. The two boards will then consider how best to address any di ...

... The FASB is somewhat behind the IASB in the due-process for the production of a standard, having only issued a discussion paper in 2010 rather than an exposure draft. However, the FASB is aiming to finalise its standard by the end of 2012. The two boards will then consider how best to address any di ...

Specialized Insurance Solutions - Great American Insurance Group

... Specialty Human Services Strategic Comp Summit Trucking Unemployment Risk Solutions ...

... Specialty Human Services Strategic Comp Summit Trucking Unemployment Risk Solutions ...

Challenges of the Actuarial Profession in Indonesia

... Several local players are owned by shareholders who are not naturally in the business of providing life insurance or longterm savings solutions ...

... Several local players are owned by shareholders who are not naturally in the business of providing life insurance or longterm savings solutions ...

1 TCSS ECONOMICS: Unit 5 PERSONAL FINANCE Unit Essential

... D. collateral, how much the person's assets are worth Bill is choosing between two different savings accounts. One has simple interest and the other has compound interest. If Bill is planning on saving money for a long period of time and he wants the most return on his savings he should choose the a ...

... D. collateral, how much the person's assets are worth Bill is choosing between two different savings accounts. One has simple interest and the other has compound interest. If Bill is planning on saving money for a long period of time and he wants the most return on his savings he should choose the a ...

Great Eastern Concludes Financial Year 2016 with Strong New

... The Group’s operating profit from insurance business for FY-16 decreased by 13%. The decrease is attributed to new business strain from higher sales growth and medical claims in the Singapore operations. On a full year basis, group profit attributable to shareholders decreased by 25%, largely attri ...

... The Group’s operating profit from insurance business for FY-16 decreased by 13%. The decrease is attributed to new business strain from higher sales growth and medical claims in the Singapore operations. On a full year basis, group profit attributable to shareholders decreased by 25%, largely attri ...

Live now, pay later – but how much?

... even after some divesting, an IHT bill may be inevitable and it makes sense to plan for this. Bear in mind that any IHT due must be paid before probate can be granted, which could be inconvenient for beneficiaries if the estate is tied up in property and other illiquid assets, perhaps necessitating ...

... even after some divesting, an IHT bill may be inevitable and it makes sense to plan for this. Bear in mind that any IHT due must be paid before probate can be granted, which could be inconvenient for beneficiaries if the estate is tied up in property and other illiquid assets, perhaps necessitating ...

macroprudential cap on debt-to-income ratio and

... therefore mitigate the risk of financial instability. In the paper, I study the effects of this macroprudential policy in a New Keynesian DSGE model, which is estimated over the period of the build-up of household debt occurred in US before the financial crisis. Following some prominent literature, ...

... therefore mitigate the risk of financial instability. In the paper, I study the effects of this macroprudential policy in a New Keynesian DSGE model, which is estimated over the period of the build-up of household debt occurred in US before the financial crisis. Following some prominent literature, ...

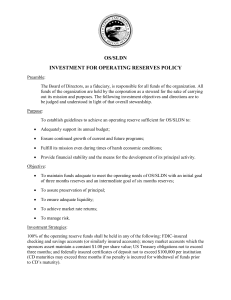

Investment Policy - OutServe-SLDN

... three months; and federally insured certificates of deposit not to exceed $100,000 per institution (CD maturities may exceed three months if no penalty is incurred for withdrawal of funds prior to CD’s maturity). ...

... three months; and federally insured certificates of deposit not to exceed $100,000 per institution (CD maturities may exceed three months if no penalty is incurred for withdrawal of funds prior to CD’s maturity). ...

EB-Connect, the smart link to your group insurance

... processing can be guaranteed to take no more than one day. ...

... processing can be guaranteed to take no more than one day. ...

Death of a Spouse - North Florida Wealth Advisors

... £Checking and Savings: Retitle jointly held accounts into the surviving owner’s name. Accounts that are not passed via title or Pay on Death designations will pass through the estate and be awarded via probate. £Retirement Plans and IRAs: Identify designated beneficiaries. Discuss with your Financia ...

... £Checking and Savings: Retitle jointly held accounts into the surviving owner’s name. Accounts that are not passed via title or Pay on Death designations will pass through the estate and be awarded via probate. £Retirement Plans and IRAs: Identify designated beneficiaries. Discuss with your Financia ...

----------------------------- THE NEW DEAL -----------------------------

... ----------------------------- THE NEW DEAL ----------------------------The New Deal was a series of economic programs passed by Congress during the first term of Franklin Delano Roosevelt, 32nd President of the United States, from 1933 to his reelection in 1937. The programs were responses to the Gr ...

... ----------------------------- THE NEW DEAL ----------------------------The New Deal was a series of economic programs passed by Congress during the first term of Franklin Delano Roosevelt, 32nd President of the United States, from 1933 to his reelection in 1937. The programs were responses to the Gr ...

THE NEW DEAL - Westerville City Schools

... ----------------------------- THE NEW DEAL ----------------------------The New Deal was a series of economic programs passed by Congress during the first term of Franklin Delano Roosevelt, 32nd President of the United States, from 1933 to his reelection in 1937. The programs were responses to the Gr ...

... ----------------------------- THE NEW DEAL ----------------------------The New Deal was a series of economic programs passed by Congress during the first term of Franklin Delano Roosevelt, 32nd President of the United States, from 1933 to his reelection in 1937. The programs were responses to the Gr ...

In the Literature

... importance of the Affordable Care Act’s emphasis on insurance expansion, benefit standards, and limits on costs for those with lower incomes. They note that the U.S. has the opportunity to learn from insurance innovations in other countries, including value-based benefit design. ...

... importance of the Affordable Care Act’s emphasis on insurance expansion, benefit standards, and limits on costs for those with lower incomes. They note that the U.S. has the opportunity to learn from insurance innovations in other countries, including value-based benefit design. ...

Chairman`s Speech to Lloyd`s European

... Source: Insurance Information Institute, quoting Tillinghast Towers Perrin in website presentation, ...

... Source: Insurance Information Institute, quoting Tillinghast Towers Perrin in website presentation, ...

4 February 2004 - Productivity Commission

... provide informed views on how particular conservation measures might best be implemented and, in many cases, to undertake necessary work most effectively and efficiently. On the other hand, it is not necessarily the case that land owners and the “local community” will agree on appropriate policy and ...

... provide informed views on how particular conservation measures might best be implemented and, in many cases, to undertake necessary work most effectively and efficiently. On the other hand, it is not necessarily the case that land owners and the “local community” will agree on appropriate policy and ...

Ann Nealon CEO

... • State whether business will be: 1)General (Minimum Capital US$120,000 ), 2) Long Term (US$240,000) or 3) Both (US$360,000) ...

... • State whether business will be: 1)General (Minimum Capital US$120,000 ), 2) Long Term (US$240,000) or 3) Both (US$360,000) ...

11 Lesson 18.4 Types of Business Insurance Goals

... Describe several types of property and vehicle insurance that businesses need. Identify the types of insurance businesses should consider carrying on the people associated with the business. Describe additional insurance businesses may need to cover special types of risks. ...

... Describe several types of property and vehicle insurance that businesses need. Identify the types of insurance businesses should consider carrying on the people associated with the business. Describe additional insurance businesses may need to cover special types of risks. ...

here - AXA Corporate Solutions

... fronting is forbidden in respect of: fire insurance and reinsurance business, motor insurance and reinsurance business, liability insurance and reinsurance business, life insurance and reinsurance business, accident insurance and reinsurance business, such other insurance and reinsurance and busines ...

... fronting is forbidden in respect of: fire insurance and reinsurance business, motor insurance and reinsurance business, liability insurance and reinsurance business, life insurance and reinsurance business, accident insurance and reinsurance business, such other insurance and reinsurance and busines ...