This information is provided to help students understand financial obligations...

... responsibility. If your insurance provider is an HMO, you are responsible for obtaining any preauthorizations or referrals from your primary care provider. The Health Center is not a contracting Medicaid/Medicare provider, therefore if you are a beneficiary of this program, you will be personally re ...

... responsibility. If your insurance provider is an HMO, you are responsible for obtaining any preauthorizations or referrals from your primary care provider. The Health Center is not a contracting Medicaid/Medicare provider, therefore if you are a beneficiary of this program, you will be personally re ...

I`m HIV positive, can I still purchase life insurance

... Selling your life insurance policy, typically called a “viatical settlement”, is the process of selling your existing policy for cash. In order to sell your life insurance policy, you must be considered terminally ill. Improvements in the overall health and treatment options for people with HIV and ...

... Selling your life insurance policy, typically called a “viatical settlement”, is the process of selling your existing policy for cash. In order to sell your life insurance policy, you must be considered terminally ill. Improvements in the overall health and treatment options for people with HIV and ...

Assignment #1 File

... Question1.a. Tom, age 32, is a bookkeeper. Tom believes that he will have average annual earnings of $80,000 per year up until he retires in 30 years. Roughly 50 percent of Tom’s average annual earnings are used to pay taxes, insurance premiums, and for self-maintenance; with the balance available f ...

... Question1.a. Tom, age 32, is a bookkeeper. Tom believes that he will have average annual earnings of $80,000 per year up until he retires in 30 years. Roughly 50 percent of Tom’s average annual earnings are used to pay taxes, insurance premiums, and for self-maintenance; with the balance available f ...

Title Insurance

... could have been discovered in the public records, and those so-called "non-record" defects that could not be discovered in the record, even with the most complete search. • Not only protects the insured owner, but also their heirs for as long as they hold title to the property, and even after they s ...

... could have been discovered in the public records, and those so-called "non-record" defects that could not be discovered in the record, even with the most complete search. • Not only protects the insured owner, but also their heirs for as long as they hold title to the property, and even after they s ...

Life insurance: Ownership and investment considerations

... ‘universal life’ policies (for simplicity, we have included ‘whole life’ policies under the rubric of universal life). Term insurance Term insurance is what comes to mind when most people contemplate an insurance policy. In this situation, the insured pays a premium to the insurance company on a mon ...

... ‘universal life’ policies (for simplicity, we have included ‘whole life’ policies under the rubric of universal life). Term insurance Term insurance is what comes to mind when most people contemplate an insurance policy. In this situation, the insured pays a premium to the insurance company on a mon ...

Permanent Life Insurance

... Why should I purchase permanent insurance? A permanent life policy provides lifelong insurance protection. The policy pays a death benefit if you die tomorrow or if you live to be a hundred. There is also a savings element that will grow on a tax-deferred basis and may become substantial over time. ...

... Why should I purchase permanent insurance? A permanent life policy provides lifelong insurance protection. The policy pays a death benefit if you die tomorrow or if you live to be a hundred. There is also a savings element that will grow on a tax-deferred basis and may become substantial over time. ...

Law for Business

... Insurance companies share risk and charge a premium which represents their estimate of average losses plus a competitive profit The contract outlining payments between you and the insurance company is known as a policy ...

... Insurance companies share risk and charge a premium which represents their estimate of average losses plus a competitive profit The contract outlining payments between you and the insurance company is known as a policy ...

FINANCIAL POLICY • CO-PAYS ARE DUE AT THE TIME OF

... For patients with no insurance, no insurance card with them, the incorrect PCP listed on the insurance card, or no prior authorization (if necessary), please understand that your insurance may not pay for the services provided to them by Kent Pediatrics. You will be responsible for the full amount o ...

... For patients with no insurance, no insurance card with them, the incorrect PCP listed on the insurance card, or no prior authorization (if necessary), please understand that your insurance may not pay for the services provided to them by Kent Pediatrics. You will be responsible for the full amount o ...

Office_Policies_

... Financial Agreement – I understand that I am responsible for all charges regardless of insurance coverage. I agree to pay my account in accordance with the regular rates and terms of this office. If my account is referred for collection, I agree to reimburse the fees of any collection agency, which ...

... Financial Agreement – I understand that I am responsible for all charges regardless of insurance coverage. I agree to pay my account in accordance with the regular rates and terms of this office. If my account is referred for collection, I agree to reimburse the fees of any collection agency, which ...

BUSINESS SUCCESSION PLANNING * Measuring the Opportunities

... PRIVILEGE RIDER (QPEP) HOW IT WORKS • Participant surrenders policy for its cash surrender value and retains the proceeds under the plan or rollover to an IRA. • New policy issued outside of plan for Net Amount at Risk (Face Amount – CV) without any medical evidence, regardless of health, at current ...

... PRIVILEGE RIDER (QPEP) HOW IT WORKS • Participant surrenders policy for its cash surrender value and retains the proceeds under the plan or rollover to an IRA. • New policy issued outside of plan for Net Amount at Risk (Face Amount – CV) without any medical evidence, regardless of health, at current ...

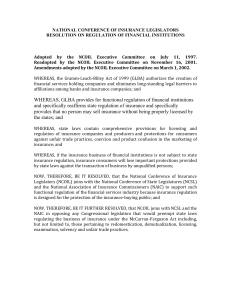

On Regulation of Financial Institutions – 07/11/97

... WHEREAS, GLBA provides for functional regulation of financial institutions and specifically reaffirms state regulation of insurance and specifically provides that no person may sell insurance without being properly licensed by the states; and WHEREAS, state laws contain comprehensive provisions for ...

... WHEREAS, GLBA provides for functional regulation of financial institutions and specifically reaffirms state regulation of insurance and specifically provides that no person may sell insurance without being properly licensed by the states; and WHEREAS, state laws contain comprehensive provisions for ...

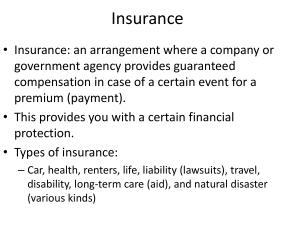

Insurance

... Insurance • Insurance: an arrangement where a company or government agency provides guaranteed compensation in case of a certain event for a premium (payment). • This provides you with a certain financial protection. • Types of insurance: – Car, health, renters, life, liability (lawsuits), travel, d ...

... Insurance • Insurance: an arrangement where a company or government agency provides guaranteed compensation in case of a certain event for a premium (payment). • This provides you with a certain financial protection. • Types of insurance: – Car, health, renters, life, liability (lawsuits), travel, d ...

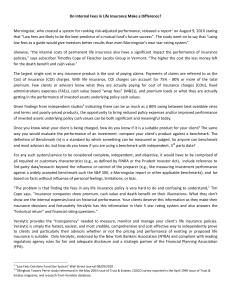

Do Internal Fees in Life Insurance Make a Difference?

... Once you know what your client is being charged, how do you know if it is a suitable product for your client? The same way you would evaluate the performance of an investment -compare your client’s product against a benchmark. The definition of Benchmark (n) is a standard by which something can be m ...

... Once you know what your client is being charged, how do you know if it is a suitable product for your client? The same way you would evaluate the performance of an investment -compare your client’s product against a benchmark. The definition of Benchmark (n) is a standard by which something can be m ...

Why You Need Title Insurance

... • An expired or forged power of attorney used during a property transfer • An incorrect public record © 2015 Stewart. All rights reserved. Trademarks are the property of their respective owners. (800) STEWART | stewart.com | AS-1513-183-10 | 11/15 ...

... • An expired or forged power of attorney used during a property transfer • An incorrect public record © 2015 Stewart. All rights reserved. Trademarks are the property of their respective owners. (800) STEWART | stewart.com | AS-1513-183-10 | 11/15 ...

COMMERCIAL AUTO PLUS ENDORSEMENT CA 81 68 HIGHLIGHTS

... This coverage enhancement endorsement offers broadened coverages under your client company’s commercial auto policy. Cancellation Condition broadened to 60 days notice (except for non-payment of premium) Broadened definition of “Insured”: - any legally incorporated subsidiary the client company has ...

... This coverage enhancement endorsement offers broadened coverages under your client company’s commercial auto policy. Cancellation Condition broadened to 60 days notice (except for non-payment of premium) Broadened definition of “Insured”: - any legally incorporated subsidiary the client company has ...

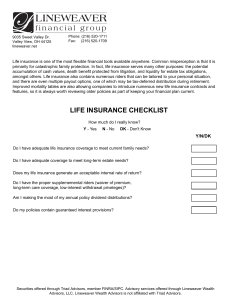

life insurance checklist - Lineweaver Financial Group

... primarily for catastrophic family protection. In fact, life insurance serves many other purposes: the potential accumulation of cash values, death benefit protected from litigation, and liquidity for estate tax obligations, amongst others. Life insurance also contains numerous riders that can be tai ...

... primarily for catastrophic family protection. In fact, life insurance serves many other purposes: the potential accumulation of cash values, death benefit protected from litigation, and liquidity for estate tax obligations, amongst others. Life insurance also contains numerous riders that can be tai ...

Life Settlements as an Asset Class

... clients’ portfolios? If not, you might want to take a second look at this investment class. Life settlements have unique advantages as an asset of which most investors either ignore or are not aware. Let’s clarify what a life settlement is. An investor purchases the ownership and beneficiary rights ...

... clients’ portfolios? If not, you might want to take a second look at this investment class. Life settlements have unique advantages as an asset of which most investors either ignore or are not aware. Let’s clarify what a life settlement is. An investor purchases the ownership and beneficiary rights ...