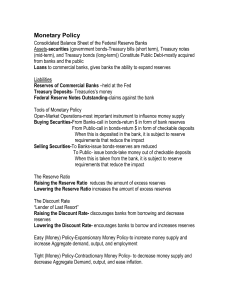

Monetary Policy

... The Federal Funds Rate is the interest rate which banks charge one another on overnight loans. The FOMC has recently used this rate to effect changes in monetary policy. But…the FED does not set the Federal Funds rate or prime rate. Each is established by the interaction of lenders and borrowers. Th ...

... The Federal Funds Rate is the interest rate which banks charge one another on overnight loans. The FOMC has recently used this rate to effect changes in monetary policy. But…the FED does not set the Federal Funds rate or prime rate. Each is established by the interaction of lenders and borrowers. Th ...

CP World History (Unit 7, #2)

... Who controls how much money is in circulation, meaning, how it is made and how it is spent, and explain how they got that power? I. The Federal Reserve and Monetary Policy A. KEY CONCEPTS 1. ______________________________ includes all the Federal Reserve actions that change the money supply in order ...

... Who controls how much money is in circulation, meaning, how it is made and how it is spent, and explain how they got that power? I. The Federal Reserve and Monetary Policy A. KEY CONCEPTS 1. ______________________________ includes all the Federal Reserve actions that change the money supply in order ...

Every Breath You Take

... Four Tools of Monetary Policy Changing the Reserve Requirement ! The amount of money a bank must keep on hand. • Lower reserve requirement = Increase in money supply. • Higher reserve requirement = Decrease in money supply. ...

... Four Tools of Monetary Policy Changing the Reserve Requirement ! The amount of money a bank must keep on hand. • Lower reserve requirement = Increase in money supply. • Higher reserve requirement = Decrease in money supply. ...

When to Shift

... Quantity of money demanded decreases as interest rates increase, which explains the downward slope of MD curve. Money Demand shifts to the right when: ...

... Quantity of money demanded decreases as interest rates increase, which explains the downward slope of MD curve. Money Demand shifts to the right when: ...

week_5_assignment

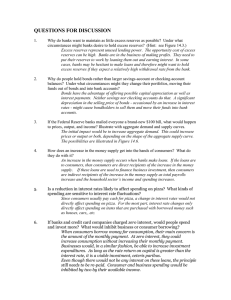

... 15. Why can’t the public debt result in the bankruptcy or the Federal government? What two actions can the government take to prevent bankruptcy? Chapter 14: Money and Banking ...

... 15. Why can’t the public debt result in the bankruptcy or the Federal government? What two actions can the government take to prevent bankruptcy? Chapter 14: Money and Banking ...

Sample Exam Questions

... closest to an efficient level. Why? Macroeconomics 6. What are the three types of policy lags? Is the combined lag likely to be longer for fiscal or montetary policy? 7. Which will cause a larger short-run increase in prices, an anticipated or ...

... closest to an efficient level. Why? Macroeconomics 6. What are the three types of policy lags? Is the combined lag likely to be longer for fiscal or montetary policy? 7. Which will cause a larger short-run increase in prices, an anticipated or ...

AP Macro: The Very Basics to Know The Production Possibilities

... • A point inside the frontier is an inefficient/recessionary economy • A point on the frontier is an efficient economy • A point outside the frontier is unattainable, for now • The frontier will move outward with new factors of production in the future Supply and demand problems • If price changes f ...

... • A point inside the frontier is an inefficient/recessionary economy • A point on the frontier is an efficient economy • A point outside the frontier is unattainable, for now • The frontier will move outward with new factors of production in the future Supply and demand problems • If price changes f ...

Historical Monetary Overview

... This decreases the money supply, increases interest rates, and attracts investments to match a current account deficit. This reverses gold outflows 13. Problem was that countries with gold inflows did not do the opposite Their only incentive was the interest earned on domestic assets The Inter ...

... This decreases the money supply, increases interest rates, and attracts investments to match a current account deficit. This reverses gold outflows 13. Problem was that countries with gold inflows did not do the opposite Their only incentive was the interest earned on domestic assets The Inter ...

Parallel Market Exchange Rate in Oil Exporting

... concluded that, as many other countries, real income and expected inflation were significant determinants of the demand for money in Bangladesh and he also found that foreign interest rates and currency depreciation do not play any major role in explaining the demand for money ...

... concluded that, as many other countries, real income and expected inflation were significant determinants of the demand for money in Bangladesh and he also found that foreign interest rates and currency depreciation do not play any major role in explaining the demand for money ...

Money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a particular country or socio-economic context, or is easily converted to such a form. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, sometimes, a standard of deferred payment. Any item or verifiable record that fulfills these functions can be considered money.Money is historically an emergent market phenomenon establishing a commodity money, but nearly all contemporary money systems are based on fiat money. Fiat money, like any check or note of debt, is without intrinsic use value as a physical commodity. It derives its value by being declared by a government to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for ""all debts, public and private"". Such laws in practice cause fiat money to acquire the value of any of the goods and services that it may be traded for within the nation that issues it.The money supply of a country consists of currency (banknotes and coins) and, depending on the particular definition used, one or more types of bank money (the balances held in checking accounts, savings accounts, and other types of bank accounts). Bank money, which consists only of records (mostly computerized in modern banking), forms by far the largest part of broad money in developed countries.