29.3 aggregate demand

... For example, if the price level rises and other things remain the same, a given quantity of money will less goods and services, so people cut their spending. So the quantity of real GDP demanded decreases. ...

... For example, if the price level rises and other things remain the same, a given quantity of money will less goods and services, so people cut their spending. So the quantity of real GDP demanded decreases. ...

UNDERLYING FACTORS OF PERSISTENT INFLATION IN ROMANIA

... rightward. If in the initial situation the economy was at its natural level, now the output will outrun its natural level; thus the unemployment will a experience a decline below the natural level generating higher wages and as a consequence the aggregate supply curve will quickly begin to shift lef ...

... rightward. If in the initial situation the economy was at its natural level, now the output will outrun its natural level; thus the unemployment will a experience a decline below the natural level generating higher wages and as a consequence the aggregate supply curve will quickly begin to shift lef ...

Targeting Constant Money Growth at the Zero

... conversely, when it wished to ease, it lowered its funds rate target. After the target was reduced to a range of 0 to 0.25 percent in December 2008, however, the zero lower bound on the federal funds rate forced the Fed to look for other ways of providing additional monetary stimulus to help output ...

... conversely, when it wished to ease, it lowered its funds rate target. After the target was reduced to a range of 0 to 0.25 percent in December 2008, however, the zero lower bound on the federal funds rate forced the Fed to look for other ways of providing additional monetary stimulus to help output ...

Inflation and deflation

... However, as noted in Chapter 16, monetary policy is carried out by central banks, and in most industrialised countries the central bank is an independent body whose main goal is the maintenance of a low and stable rate of inflation. In some countries, including Poland, South Korea, Canada, England, ...

... However, as noted in Chapter 16, monetary policy is carried out by central banks, and in most industrialised countries the central bank is an independent body whose main goal is the maintenance of a low and stable rate of inflation. In some countries, including Poland, South Korea, Canada, England, ...

CHAPTER– 5 THE NEGATIVE EFFECTS OF MONEY LAUNDERING

... transfers, suddenly and without notification, causing liquidity problems and possible bank runs. Generally, this is done due to non-market forces such as investigations or inquiries by the authorities. Further, cases have been documented where criminal activity was the main cause for bank failure. T ...

... transfers, suddenly and without notification, causing liquidity problems and possible bank runs. Generally, this is done due to non-market forces such as investigations or inquiries by the authorities. Further, cases have been documented where criminal activity was the main cause for bank failure. T ...

Is Numérairology the Future of Monetary Economics?

... sufficient speed and flexibility to set the own rate of interest on bread. If in addition money wages or prices were sticky in terms of the bread numéraire, the bakers’ guild would have a non-trivial monetary stabilisation policy role. The welfare significance of the numéraire when there are nominal ...

... sufficient speed and flexibility to set the own rate of interest on bread. If in addition money wages or prices were sticky in terms of the bread numéraire, the bakers’ guild would have a non-trivial monetary stabilisation policy role. The welfare significance of the numéraire when there are nominal ...

Paraguay’s Fiscal and Monetary History Carlos Javier Charotti Felipe Gonzalez Soley

... 1982 1992. The Stabilization Plan was not effective for several domestic reasons and external shocks. This period chracterized by an increase of inflation due to State-Owned Enterprises (SOE) deficits financed by the Central Bank, low real GDP growth, sustained current account deficits, reduction of ...

... 1982 1992. The Stabilization Plan was not effective for several domestic reasons and external shocks. This period chracterized by an increase of inflation due to State-Owned Enterprises (SOE) deficits financed by the Central Bank, low real GDP growth, sustained current account deficits, reduction of ...

Chapter 25 060413-1 檔案

... Output gaps can cause inflation to increase (if expansionary gap) or decrease (if recessionary gap). The aggregate demand - aggregate supply (AD-AS) model studies both inflation and output. AD-AS 模型討論產出和物價 Effective for analyzing and tracing the effects of fiscal and monetary policies on the ...

... Output gaps can cause inflation to increase (if expansionary gap) or decrease (if recessionary gap). The aggregate demand - aggregate supply (AD-AS) model studies both inflation and output. AD-AS 模型討論產出和物價 Effective for analyzing and tracing the effects of fiscal and monetary policies on the ...

Principles of Macroeconomics, Case/Fair/Oster, 10e

... big part in economic behavior. The problem is that traditional models assume that expectations are formed in naïve ways, which is inconsistent with the assumptions of microeconomics. If, as microeconomic theory assumes, people are out to maximize their satisfaction and firms are out to maximize thei ...

... big part in economic behavior. The problem is that traditional models assume that expectations are formed in naïve ways, which is inconsistent with the assumptions of microeconomics. If, as microeconomic theory assumes, people are out to maximize their satisfaction and firms are out to maximize thei ...

Exam Name___________________________________ 1

... A) actual rate of inflation is less than 5 percent. B) inflation is fully anticipated and no one changes their behaviour. C) whole private sector is unaware that it is happening. D) anticipated rate of inflation is less than the actual rate of inflation. E) anticipated rate of inflation is more than ...

... A) actual rate of inflation is less than 5 percent. B) inflation is fully anticipated and no one changes their behaviour. C) whole private sector is unaware that it is happening. D) anticipated rate of inflation is less than the actual rate of inflation. E) anticipated rate of inflation is more than ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... exchange value vis-h-vis the U.S. dollar depreciated continuously through 1986. Second, the strong performance of the Japanese yen against the U.S. currency since 1985 accelerated the effective depreciation of the Korean won. As Korea’s current account registered sizable surpluses (largely with the ...

... exchange value vis-h-vis the U.S. dollar depreciated continuously through 1986. Second, the strong performance of the Japanese yen against the U.S. currency since 1985 accelerated the effective depreciation of the Korean won. As Korea’s current account registered sizable surpluses (largely with the ...

CHAPTER IX THEORIES OP INFLATION There are seven important

... There are seven important theories of inflations 1, The cost-push theory of inflation 2« The demand-pull theory of inflation 3. Keynesian theory of inflation 4. Bent Hansen's dynamic'model of demand inflation 5. Schultze's sectoral demand-shift theory of inflation 6. The markup theory of inflation 7 ...

... There are seven important theories of inflations 1, The cost-push theory of inflation 2« The demand-pull theory of inflation 3. Keynesian theory of inflation 4. Bent Hansen's dynamic'model of demand inflation 5. Schultze's sectoral demand-shift theory of inflation 6. The markup theory of inflation 7 ...

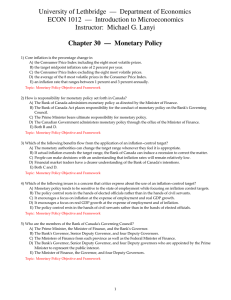

University of Lethbridge — Department of Economics

... 9) The objective of the Bank of Canada's monetary policy is A) to control the quantity of money and interest rates to avoid inflation and when possible prevent excessive swings in real GDP growth and unemployment. B) to keep the unemployment rate below 5 percent, the inflation rate between 1 and 3 p ...

... 9) The objective of the Bank of Canada's monetary policy is A) to control the quantity of money and interest rates to avoid inflation and when possible prevent excessive swings in real GDP growth and unemployment. B) to keep the unemployment rate below 5 percent, the inflation rate between 1 and 3 p ...

PLEASE DO NOT QUOTE A Small Estimated Model (SEM) for New Zealand

... must be reversed in so far as they do not impact on the long-run level of consumer prices as determined by the level of import prices and unit labour costs. As a result, although monetary policy can impact consumer price inflation via the output gap in the short-run, this impact will be reversed ove ...

... must be reversed in so far as they do not impact on the long-run level of consumer prices as determined by the level of import prices and unit labour costs. As a result, although monetary policy can impact consumer price inflation via the output gap in the short-run, this impact will be reversed ove ...

The IS*LM/AD*AS Model: A General Framework for Macroeconomic

... • After the increase in M, wealth holders have too much money compared with what they want to hold (an excess supply) and they start to buy non-monetary assets, bidding up their prices and lowering the real interest rate. • So far we are holding the price level constant because we are in a short per ...

... • After the increase in M, wealth holders have too much money compared with what they want to hold (an excess supply) and they start to buy non-monetary assets, bidding up their prices and lowering the real interest rate. • So far we are holding the price level constant because we are in a short per ...

Ch7

... Suppose you have a student loan of $80,000. Suppose that the CPI rises by 3 percent a year each year from now (2008) through 2028. Also suppose that the nominal interest rate on your loan is fixed at 5 percent a year. How much will a $100 repayment cost you in 2008 dollars, when you start to pay off ...

... Suppose you have a student loan of $80,000. Suppose that the CPI rises by 3 percent a year each year from now (2008) through 2028. Also suppose that the nominal interest rate on your loan is fixed at 5 percent a year. How much will a $100 repayment cost you in 2008 dollars, when you start to pay off ...

Chapter 22

... – C = consumption expenditure, the total demand for consumer goods and services – I = planned investment spending, the total planned spending by business firms on new machines, factories, and other capital goods, plus planned spending on new ...

... – C = consumption expenditure, the total demand for consumer goods and services – I = planned investment spending, the total planned spending by business firms on new machines, factories, and other capital goods, plus planned spending on new ...

Chapter X - mcdonald - University of Illinois at Chicago

... namely quantities of money-value and quantities of employment.” Economists are often guilty of this sort of thing – beginning a discussion with a confusing definition that puts the reader off. He chose not to measure output as the money-value of output (i.e., nominal gross domestic product) divided ...

... namely quantities of money-value and quantities of employment.” Economists are often guilty of this sort of thing – beginning a discussion with a confusing definition that puts the reader off. He chose not to measure output as the money-value of output (i.e., nominal gross domestic product) divided ...

Inflation Tutorial

... Creditors lose and debtors gain if the lender does not anticipate inflation correctly. For those who borrow, this is similar to getting an interest-free loan. Uncertainty about what will happen next makes corporations and consumers less likely to spend. This hurts economic output in the long run. Pe ...

... Creditors lose and debtors gain if the lender does not anticipate inflation correctly. For those who borrow, this is similar to getting an interest-free loan. Uncertainty about what will happen next makes corporations and consumers less likely to spend. This hurts economic output in the long run. Pe ...

Chapter 4: Inflation in the Twentieth Century

... form. When you have a checking account, you are a creditor. When you have a savings account, you are a creditor. The same is true if you hold Treasury securities, money market funds, corporate bonds, or any of the other financial instruments that we will ...

... form. When you have a checking account, you are a creditor. When you have a savings account, you are a creditor. The same is true if you hold Treasury securities, money market funds, corporate bonds, or any of the other financial instruments that we will ...