7.1 rise in investment demand when saving depends on interest rate

... economy over a period of time. The term "inflation" is also defined as the increases in the money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange wh ...

... economy over a period of time. The term "inflation" is also defined as the increases in the money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange wh ...

The Money Market Notes

... • The market where the Fed and the users of money interact thus determining the nominal interest rate (i%). • Money Demand (MD) comes from households, firms, government and the foreign sector. • The Money Supply (MS) is determined only by the Federal Reserve. ...

... • The market where the Fed and the users of money interact thus determining the nominal interest rate (i%). • Money Demand (MD) comes from households, firms, government and the foreign sector. • The Money Supply (MS) is determined only by the Federal Reserve. ...

Monetarism Revisited - Research Showcase @ CMU

... Britain, the Radcliffe Committee did the same. Prominent economists like Nicholas Kaldor and Joan Robinson denied any role for money in inflation well into the 1980s. In the simple Keynesian models of the time, the government used fiscal policy to control aggregate output. The central bank's role, i ...

... Britain, the Radcliffe Committee did the same. Prominent economists like Nicholas Kaldor and Joan Robinson denied any role for money in inflation well into the 1980s. In the simple Keynesian models of the time, the government used fiscal policy to control aggregate output. The central bank's role, i ...

Monetary Policy

... • The more money there is out there being spent, the less the money is worth. The supply is high, thus the value is comparatively lower. • What this also means is that people are spending, and this is good. • Proper balance between a healthy amount of spending and money in circulation & an acceptabl ...

... • The more money there is out there being spent, the less the money is worth. The supply is high, thus the value is comparatively lower. • What this also means is that people are spending, and this is good. • Proper balance between a healthy amount of spending and money in circulation & an acceptabl ...

F Biggest danger is bank bashing

... is produced by commercial banks through deposit creation. Keynes spends many pages in The Treatise dealing with bank money. This isn’t surprising because, as Keynes makes clear, ...

... is produced by commercial banks through deposit creation. Keynes spends many pages in The Treatise dealing with bank money. This isn’t surprising because, as Keynes makes clear, ...

File

... total deposits in cash reserves in their vaults or with the Federal Reserve bank. • This enables the bank to provide funds for customers who might suddenly want to withdraw large amounts of cash from their accounts. • Currently most financial institutions are required to reserve 10 percent of their ...

... total deposits in cash reserves in their vaults or with the Federal Reserve bank. • This enables the bank to provide funds for customers who might suddenly want to withdraw large amounts of cash from their accounts. • Currently most financial institutions are required to reserve 10 percent of their ...

Business Economics Final Exam Study Guide Vocabulary words

... reducing unemployment unemployment in the United States fiscal policy aimed at slowing the growth of the U.S. economy a monetary policy tool used to influence the money supply actions that would most likely slow the economy during a period of rapid growth & inflation fiscal policies that would be im ...

... reducing unemployment unemployment in the United States fiscal policy aimed at slowing the growth of the U.S. economy a monetary policy tool used to influence the money supply actions that would most likely slow the economy during a period of rapid growth & inflation fiscal policies that would be im ...

creation of money

... of increasing prices in the real economy, which tend to influence inflation in the short run. ...

... of increasing prices in the real economy, which tend to influence inflation in the short run. ...

Monetary Policy

... expanding or contracting their loans, sort of like it was the “moral” and responsible thing to do; “Selective credit controls” means that the Fed manages the distribution of credit as opposed to the total volume of credit; and “Margin Credit” requirements on the stock market are also picked by the F ...

... expanding or contracting their loans, sort of like it was the “moral” and responsible thing to do; “Selective credit controls” means that the Fed manages the distribution of credit as opposed to the total volume of credit; and “Margin Credit” requirements on the stock market are also picked by the F ...

4.04 KEY TERMS Advertising: A non-personal promotional message

... 4. Nonprofit corporation: Legal entities that make money for reasons other than the owner’s profit 5. Policy: Guiding principle, rules or strategy 6. Portfolio: A collection of documents, photographs, and work samples which is used to demonstrate to potential employers an individual’s skills, knowle ...

... 4. Nonprofit corporation: Legal entities that make money for reasons other than the owner’s profit 5. Policy: Guiding principle, rules or strategy 6. Portfolio: A collection of documents, photographs, and work samples which is used to demonstrate to potential employers an individual’s skills, knowle ...

Just Say No to Rate Cuts - Lawrence Capital Management

... "money x velocity = price x quantity." Money is defined as the money supply, while velocity is the number of times that money circulates. The right side of the equation defines nominal GDP -- the price of all goods (P), times the quantity of all goods (Q). Typically, economists use the equation to ...

... "money x velocity = price x quantity." Money is defined as the money supply, while velocity is the number of times that money circulates. The right side of the equation defines nominal GDP -- the price of all goods (P), times the quantity of all goods (Q). Typically, economists use the equation to ...

Document

... Expansionary monetary policy, which reduces the interest rate and increases aggregate demand by increasing the money supply, is used to close recessionary gaps. Contractionary monetary policy, which increases the interest rate and reduces aggregate demand by decreasing the money supply, is used to c ...

... Expansionary monetary policy, which reduces the interest rate and increases aggregate demand by increasing the money supply, is used to close recessionary gaps. Contractionary monetary policy, which increases the interest rate and reduces aggregate demand by decreasing the money supply, is used to c ...

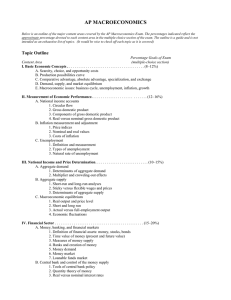

APMACROECONOMICSTopicOutline

... 3. Actual versus full-employment output 4. Economic fluctuations IV. Financial Sector . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15–20%) A. Money, banking, and financial markets 1. Definition of financial assets: money, stocks, bonds 2. Time value ...

... 3. Actual versus full-employment output 4. Economic fluctuations IV. Financial Sector . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15–20%) A. Money, banking, and financial markets 1. Definition of financial assets: money, stocks, bonds 2. Time value ...

FreeResponseAnalysis Money Unit-5

... bonds money flows into the banking system from Fed’s vault & bonds flow into Fed. This “new” money causes MS to rise in the money market & nominal interest rates fall. Lower interest rates will make it less expensive to borrow money and therefore directly impact investment spending & AD. In this way ...

... bonds money flows into the banking system from Fed’s vault & bonds flow into Fed. This “new” money causes MS to rise in the money market & nominal interest rates fall. Lower interest rates will make it less expensive to borrow money and therefore directly impact investment spending & AD. In this way ...