capital theory, inflation and deflation: the austrians and monetary

... what Leijonhufvud (1981a, p. 103) calls an "effective demand failure." The process by which this deflation works is that attempts to buy and sell are frustrated by the lack of money. For example, suppose a firm desires to hire some additional labor. It may be true that the value of each worker's mar ...

... what Leijonhufvud (1981a, p. 103) calls an "effective demand failure." The process by which this deflation works is that attempts to buy and sell are frustrated by the lack of money. For example, suppose a firm desires to hire some additional labor. It may be true that the value of each worker's mar ...

Chapters 13 14 15

... would revert to either specie metals or barter once inflation reached a certain level. The widespread use of fiat money created the possibility of hyperinflation as governments often tended to print larger amounts of money to finance their expenses. Inflation results where such an increase in money ...

... would revert to either specie metals or barter once inflation reached a certain level. The widespread use of fiat money created the possibility of hyperinflation as governments often tended to print larger amounts of money to finance their expenses. Inflation results where such an increase in money ...

“Fiscal Sustainability” Handout CEPR-RIETI Workshop Presenter: Prof. Wouter DEN HAAN

... More likely if debt is long-term and issued during tranquil times ...

... More likely if debt is long-term and issued during tranquil times ...

Helicopter money ING International Survey special report

... to do with as they please. We asked people what they would do with this “helicopter money” if it were given to them. ...

... to do with as they please. We asked people what they would do with this “helicopter money” if it were given to them. ...

This PDF is a selec on from a published volume... Bureau of Economic Research

... Christopher Sims was annoyed that the discussion still revolved around fighting the battles of the 1960s and 1970s by redefining the various orthodoxies of the time. Sims thought that monetarism to Nelson was monetarism without money, and the emphasis on the ability of monetary policy to ultimately ...

... Christopher Sims was annoyed that the discussion still revolved around fighting the battles of the 1960s and 1970s by redefining the various orthodoxies of the time. Sims thought that monetarism to Nelson was monetarism without money, and the emphasis on the ability of monetary policy to ultimately ...

AP Macroeconomics - Wyoming City Schools

... 26. Define the M1 and M2 money supply and list their components. 27. Distinguish between money and near money. 28. Explain the basis of fractional reserve banking and the historical basis of the Federal Reserve System. 29. Explain the process of multiple deposit expansion or contraction and given ap ...

... 26. Define the M1 and M2 money supply and list their components. 27. Distinguish between money and near money. 28. Explain the basis of fractional reserve banking and the historical basis of the Federal Reserve System. 29. Explain the process of multiple deposit expansion or contraction and given ap ...

Monetary Misperceptions: Optimal Monetary Policy

... forgotten over time – then optimal policy approaches nominal income (NGDP) targeting as information approaches completeness. Nominal income targeting is also exactly optimal if agents have log preferences over consumption. In the more general case where technology shocks follow a first-order Markov ...

... forgotten over time – then optimal policy approaches nominal income (NGDP) targeting as information approaches completeness. Nominal income targeting is also exactly optimal if agents have log preferences over consumption. In the more general case where technology shocks follow a first-order Markov ...

DETERMINANTS OF HIGH INFLATION IN AN LDC:

... and the subsequent transitory and civilian regimes showed a higher level of monetary discipline. The effect of that was a declining inflation rate. The other results again show a similar pattern to those previously obtained. Nominal money, output and the rest of the structural factors were significa ...

... and the subsequent transitory and civilian regimes showed a higher level of monetary discipline. The effect of that was a declining inflation rate. The other results again show a similar pattern to those previously obtained. Nominal money, output and the rest of the structural factors were significa ...

McCallum rule and Chinese monetary policy

... Compared to advanced economies, various studies note the role of interest rates in the Chinese economy to being minor (see e.g. Laurens and Maino, 2007; Mehrotra, 2007; Koivu, 2008). Even if authorities define a number of interest rates (the central bank lending rate, rediscount rate and benchmark ...

... Compared to advanced economies, various studies note the role of interest rates in the Chinese economy to being minor (see e.g. Laurens and Maino, 2007; Mehrotra, 2007; Koivu, 2008). Even if authorities define a number of interest rates (the central bank lending rate, rediscount rate and benchmark ...

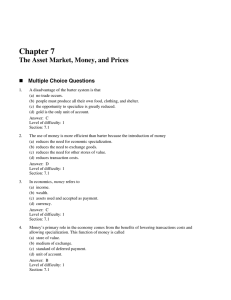

Chapter 7 The Asset Market, Money, and Prices

... Why is per-capita U.S. currency demand so large? Who is holding large amounts of U.S. currency and why are they doing so? Should U.S. policymakers be concerned about this? Why? Answer: Currency demand is large mostly because foreigners hold many dollars. They do so because of inflation or political ...

... Why is per-capita U.S. currency demand so large? Who is holding large amounts of U.S. currency and why are they doing so? Should U.S. policymakers be concerned about this? Why? Answer: Currency demand is large mostly because foreigners hold many dollars. They do so because of inflation or political ...

Macroeconomic Theories of Inflation

... inflationary gap arises. The larger the gap between aggregate demand and aggregate supply, the more rapid is the inflation. Keynesian (Keynes and his followers)do not deny this fact that even before reaching full employment production factors and various appearing constraint can cause increase in pu ...

... inflationary gap arises. The larger the gap between aggregate demand and aggregate supply, the more rapid is the inflation. Keynesian (Keynes and his followers)do not deny this fact that even before reaching full employment production factors and various appearing constraint can cause increase in pu ...

NBER WORKING PAPER SERIES IS-LM AND MONETARISM Michael D. Bordo Anna J. Schwartz

... A third issue is that Keynes asserts that under conditions of underemployment, when interest rates are positive but low, a liquidity trap exists such that the demand for money becomes infinitely elastic. Changes in the real supply of money then have no effect at all. Of all the commentators on Fried ...

... A third issue is that Keynes asserts that under conditions of underemployment, when interest rates are positive but low, a liquidity trap exists such that the demand for money becomes infinitely elastic. Changes in the real supply of money then have no effect at all. Of all the commentators on Fried ...

Questioning the U.S. Dollar`s Status as a Reserve Currency

... analysis of historical data and capital markets theory. These estimates have certain inherent limitations, and unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees or other costs. References to future net returns are not promises or even estimates of a ...

... analysis of historical data and capital markets theory. These estimates have certain inherent limitations, and unlike an actual performance record, they do not reflect actual trading, liquidity constraints, fees or other costs. References to future net returns are not promises or even estimates of a ...