What`s the Point of Credit Scoring?

... Mac) and the Federal National Mortgage Corporation (Fannie Mae) have encouraged mortgage lenders to use credit scoring, which should encourage consistency across underwriters. Freddie Mac sent a letter to its lenders in July 1995 encouraging the use of credit scoring in loans submitted for sale to t ...

... Mac) and the Federal National Mortgage Corporation (Fannie Mae) have encouraged mortgage lenders to use credit scoring, which should encourage consistency across underwriters. Freddie Mac sent a letter to its lenders in July 1995 encouraging the use of credit scoring in loans submitted for sale to t ...

Introducing Expected Returns into Risk Parity

... long-only portfolio. This framework is particularly appealing because the objective function has a concrete financial interpretation in terms of utility functions, with the investor facing a trade-off between risk and performance. To obtain a better expected return, the investor must then choose a r ...

... long-only portfolio. This framework is particularly appealing because the objective function has a concrete financial interpretation in terms of utility functions, with the investor facing a trade-off between risk and performance. To obtain a better expected return, the investor must then choose a r ...

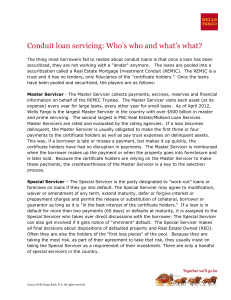

Conduit loan servicing: Who`s who and what`s what?

... guarantor as long as it is "in the best interest of the certificate holders." If a loan is in default for more than two payments (60 days) or defaults at maturity, it is assigned to the Special Servicer who takes over direct discussions with the borrower. The Special Servicer can also get involved i ...

... guarantor as long as it is "in the best interest of the certificate holders." If a loan is in default for more than two payments (60 days) or defaults at maturity, it is assigned to the Special Servicer who takes over direct discussions with the borrower. The Special Servicer can also get involved i ...

PDP-Working Paper

... create the tendency for the whole system to act in a certain way. Our focus is on identifying the key causes of herd behavior and exploring possible good practices that address herd behavior. In particular, we try to develop a framework that could help long-term institutional investors set up their ...

... create the tendency for the whole system to act in a certain way. Our focus is on identifying the key causes of herd behavior and exploring possible good practices that address herd behavior. In particular, we try to develop a framework that could help long-term institutional investors set up their ...

Derivative Risk Management Statement Part A

... Market risk is the risk of adverse movements in markets (including asset prices, volatility, changes in the yield curve or other market variables) for the derivatives or the underlying assets, reference rate or index to which the derivative relates. Such risk is created by holding any security, phys ...

... Market risk is the risk of adverse movements in markets (including asset prices, volatility, changes in the yield curve or other market variables) for the derivatives or the underlying assets, reference rate or index to which the derivative relates. Such risk is created by holding any security, phys ...

2010 - About KLP

... The total costs of the fire damage for KLP Skadeforsikring amount to almost NOK 300 million. In comparison, the average for the last five years has been NOK 20 million! It is expected that these figures will vary substantially, but this is a dramatic deviation for one single accounting year. Looking ...

... The total costs of the fire damage for KLP Skadeforsikring amount to almost NOK 300 million. In comparison, the average for the last five years has been NOK 20 million! It is expected that these figures will vary substantially, but this is a dramatic deviation for one single accounting year. Looking ...

TITEL - VBA beleggingsprofessionals

... • Loss given default – The fraction of the outstanding loan that will not be recovered once default occurred. – Influenced by: • Collateral • Guarantees ...

... • Loss given default – The fraction of the outstanding loan that will not be recovered once default occurred. – Influenced by: • Collateral • Guarantees ...

THE OUTSOURCING OF FINANCIAL REGULATION TO RISK

... the financial risk that borrowers will not make payment on the underlying mortgages when due; securitization thus carves up the risk associated with mortgages and other securitized assets into slices, which are then spread among investors.3 Those investors could then use credit derivatives and other ...

... the financial risk that borrowers will not make payment on the underlying mortgages when due; securitization thus carves up the risk associated with mortgages and other securitized assets into slices, which are then spread among investors.3 Those investors could then use credit derivatives and other ...

Risk premia in general equilibrium

... non-normalities in explaining the business cycle fluctuations for the US economy (FernándezVillaverde and Rubio-Ramı́rez 2007, Justiniano and Primiceri 2008). However, the problem with discrete-time models is that they are hard to solve, and the literature uses approximation schemes to circumvent t ...

... non-normalities in explaining the business cycle fluctuations for the US economy (FernándezVillaverde and Rubio-Ramı́rez 2007, Justiniano and Primiceri 2008). However, the problem with discrete-time models is that they are hard to solve, and the literature uses approximation schemes to circumvent t ...

Working Paper 135/13 THE PSYCHOLOGY AND ECONOMICS OF

... financial planning instrument, but rather as a last resort choice in case of emergency. In the Netherlands, there is currently one type of reverse mortgage loan with a no negative equity guarantee: the ; Florius Verzilver Hypotheek introduced in 2008 by ABN Amro (www.florius.nl/consument/hypotheken/ ...

... financial planning instrument, but rather as a last resort choice in case of emergency. In the Netherlands, there is currently one type of reverse mortgage loan with a no negative equity guarantee: the ; Florius Verzilver Hypotheek introduced in 2008 by ABN Amro (www.florius.nl/consument/hypotheken/ ...

workers compensation - Casualty Actuarial Society

... Workers Compensation Lost-Time Claim Frequency Continues to Fall Frequency per 100 Workers (Lost–Time Claims) ...

... Workers Compensation Lost-Time Claim Frequency Continues to Fall Frequency per 100 Workers (Lost–Time Claims) ...

Basel III Pillar 3 Regulatory Capital Disclosures

... requirements. The SLR rule, which becomes effective on January 1, 2018, will require a covered bank holding company to maintain a minimum SLR of at least 5.0% to avoid restrictions on capital distributions and discretionary bonus payments. The rule will also require that all of our insured depositor ...

... requirements. The SLR rule, which becomes effective on January 1, 2018, will require a covered bank holding company to maintain a minimum SLR of at least 5.0% to avoid restrictions on capital distributions and discretionary bonus payments. The rule will also require that all of our insured depositor ...

Stochastic dominance and behavior towards risk: The market for

... As mentioned, expected utility is the predominant approach used in asset ...

... As mentioned, expected utility is the predominant approach used in asset ...

Title of presentation

... • …Suggests we can conservatively backtest the performance of P2P based on historical bank loan performance data ...

... • …Suggests we can conservatively backtest the performance of P2P based on historical bank loan performance data ...

8. Financial statements - Australian Reinsurance Pool Corporation

... ARPC classifies its financial assets into the following categories: financial assets at fair value through profit or loss; and creditors as other financial instruments. ARPC determines which classification applies to each class of financial assets on the basis of how it manages the assets and assess ...

... ARPC classifies its financial assets into the following categories: financial assets at fair value through profit or loss; and creditors as other financial instruments. ARPC determines which classification applies to each class of financial assets on the basis of how it manages the assets and assess ...

Analyzing Yield, Duration and Convexity of Mortgage Loans under

... Recent literature using mortgage market data demonstrates that individual characteristics are related to prepayment and default risks. Some studies use empirical analyses to express relationships between the mortgage risk premium and various observable variables specific to the borrower, such as loa ...

... Recent literature using mortgage market data demonstrates that individual characteristics are related to prepayment and default risks. Some studies use empirical analyses to express relationships between the mortgage risk premium and various observable variables specific to the borrower, such as loa ...

Shaping change in insurance

... 1 Subject to approval of AGM. 2 Annualised total shareholder return defined as price performance plus dividend yield over the period from 1.1.2005 until 28.2.2017; based on Datastream total return indices in local currency; volatility calculation with 250 trading days per year. Peers: Allianz, Axa, ...

... 1 Subject to approval of AGM. 2 Annualised total shareholder return defined as price performance plus dividend yield over the period from 1.1.2005 until 28.2.2017; based on Datastream total return indices in local currency; volatility calculation with 250 trading days per year. Peers: Allianz, Axa, ...

PDF

... firm could be 95% confident that returns would not drop below a given level. Recent research has shown that VaR does not have the properties of a coherent risk measure (Artzner, Delbaen et al., 1999; Acerbi, 2007). To overcome the shortfalls of VaR, alternatives have been developed and are shown to ...

... firm could be 95% confident that returns would not drop below a given level. Recent research has shown that VaR does not have the properties of a coherent risk measure (Artzner, Delbaen et al., 1999; Acerbi, 2007). To overcome the shortfalls of VaR, alternatives have been developed and are shown to ...

A Causal Framework for Credit Default Theory

... involves both delinquency and the notion of expected loss to the lender. This definition of default comes closest to why one is interested18 in credit defaults in the first place: it is to estimate expected losses from lending. Even the delinquency definition of default with a specified time lag suc ...

... involves both delinquency and the notion of expected loss to the lender. This definition of default comes closest to why one is interested18 in credit defaults in the first place: it is to estimate expected losses from lending. Even the delinquency definition of default with a specified time lag suc ...

The 1/N investment strategy is optimal under high

... include the classical Markowitz portfolio selection rule as well as its most prominent extensions like Bayesian-Shrinkage type estimators, aimed at dampening the effects of estimation error, and more recent approaches based on the investors beliefs about several competing asset pricing models. Furth ...

... include the classical Markowitz portfolio selection rule as well as its most prominent extensions like Bayesian-Shrinkage type estimators, aimed at dampening the effects of estimation error, and more recent approaches based on the investors beliefs about several competing asset pricing models. Furth ...

Credit standards and financial institutions’ leverage ∗ Gilles Dufr´enot

... respectively. In good times, institutions are more optimistic about the future prospects of the economy, they increase their leverage and potentially invest in riskier projects, whose risk-return profile has improved. On average, this behavior can result in bigger losses in the future, a correction ...

... respectively. In good times, institutions are more optimistic about the future prospects of the economy, they increase their leverage and potentially invest in riskier projects, whose risk-return profile has improved. On average, this behavior can result in bigger losses in the future, a correction ...

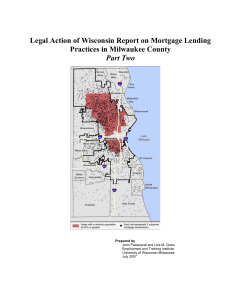

Legal Action of Wisconsin Report on Mortgage Lending

... More than 30 subprime lenders have stopped operations or been sold because of increasing delinquencies from subprime loans (Boston Globe, April 20, 2007). In January 2006 Ameriquest Mortgage Company agreed to pay a $325 million settlement to 49 states and to reform its lending practices. (Wis. Depar ...

... More than 30 subprime lenders have stopped operations or been sold because of increasing delinquencies from subprime loans (Boston Globe, April 20, 2007). In January 2006 Ameriquest Mortgage Company agreed to pay a $325 million settlement to 49 states and to reform its lending practices. (Wis. Depar ...

Capital Adequacy in Insurance / Reinsurance

... 3. Many insurers in the U.S. and abroad issue debt, primarily at the holding company level. That debt is effectively subordinated to policyholder claims. It creates an additional category of stakeholders that press for efficient risk management, which in turn allows insurers to lower their cost of c ...

... 3. Many insurers in the U.S. and abroad issue debt, primarily at the holding company level. That debt is effectively subordinated to policyholder claims. It creates an additional category of stakeholders that press for efficient risk management, which in turn allows insurers to lower their cost of c ...

Securitisation-Markets

... Ginnie Maes are securities issued by private lenders mainly mortgage bankers, under the auspices of the Government National Mortgage Association, a US government corporation. The GNMA (hence the name Ginnie Mae) was split off from Fannie Mae in 1968, and is intended to promote home ownership among f ...

... Ginnie Maes are securities issued by private lenders mainly mortgage bankers, under the auspices of the Government National Mortgage Association, a US government corporation. The GNMA (hence the name Ginnie Mae) was split off from Fannie Mae in 1968, and is intended to promote home ownership among f ...

NBER WORKING PAPER SERIES OF BELIEFS. Pierre Collin-Dufresne

... (1999), and the “Cox-process” framework described in Lando (1998). The tractability of these frameworks stemmed directly from their assumption that no contagion risk was present. One contribution of this paper is to identify a simple and economically intuitive framework that tractably captures cont ...

... (1999), and the “Cox-process” framework described in Lando (1998). The tractability of these frameworks stemmed directly from their assumption that no contagion risk was present. One contribution of this paper is to identify a simple and economically intuitive framework that tractably captures cont ...