Using Financial Derivatives to Hedge Against Market

... cover the service provider’s financial damage due to budget cuts, project cancellations, or loss of trust between the two partners. The client and the service provider might therefore use financial derivatives that pay off if the counterpart’s stocks drop under specified thresholds. To cover agains ...

... cover the service provider’s financial damage due to budget cuts, project cancellations, or loss of trust between the two partners. The client and the service provider might therefore use financial derivatives that pay off if the counterpart’s stocks drop under specified thresholds. To cover agains ...

bank balance sheet optimization

... crisis since the Great Depression in the 1930s and has had large repercussions on the real economy since. In the aftermath of this crisis, bank regulators presented two sets of new rules, Basel 2.5 and Basel III, in order to strengthen the resilience of the banking sector. The objective of the refor ...

... crisis since the Great Depression in the 1930s and has had large repercussions on the real economy since. In the aftermath of this crisis, bank regulators presented two sets of new rules, Basel 2.5 and Basel III, in order to strengthen the resilience of the banking sector. The objective of the refor ...

The Relationship Between The Use Of The C`S Of Credit And The

... to MSEs because the clients from this sector are largely poor, lacking in normal securities that can be used as collateral in conventional lending. Commercial banks have therefore for a long time perceived such businesses as highly risky and undeserving o f any credit, even though the business perso ...

... to MSEs because the clients from this sector are largely poor, lacking in normal securities that can be used as collateral in conventional lending. Commercial banks have therefore for a long time perceived such businesses as highly risky and undeserving o f any credit, even though the business perso ...

NBER WORKING PAPER SERIES Paul Beaudry Amartya Lahiri

... examine how an economy may adjust to good profit/productivity shocks in the absence of abundant investment opportunities. However before using the model to interpret recent observations, we use it to better understand what macro-risk allocation implies. For example, we show how and why the efficien ...

... examine how an economy may adjust to good profit/productivity shocks in the absence of abundant investment opportunities. However before using the model to interpret recent observations, we use it to better understand what macro-risk allocation implies. For example, we show how and why the efficien ...

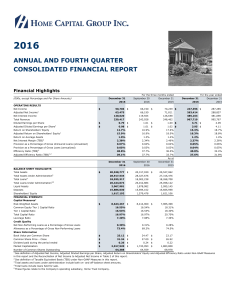

2016 Q4 Report - Home Capital Group

... forward-looking statements. The Company presents forward-looking statements to assist shareholders in understanding the Company’s assumptions and expectations about the future that are relevant in management’s setting of performance goals, strategic priorities and outlook. The Company presents its o ...

... forward-looking statements. The Company presents forward-looking statements to assist shareholders in understanding the Company’s assumptions and expectations about the future that are relevant in management’s setting of performance goals, strategic priorities and outlook. The Company presents its o ...

MLAR definitions - Bank of England

... NOTES FOR COMPLETION OF THE MORTGAGE LENDERS & ADMINISTRATORS RETURN (‘MLAR’) ...

... NOTES FOR COMPLETION OF THE MORTGAGE LENDERS & ADMINISTRATORS RETURN (‘MLAR’) ...

Download attachment

... implement the first best. This is no longer true when efforts are non observable. The consultant effort is less efficient than her proper effort. Thus, she prefers asking for the VC fund's advice. In order to solve the double moral hazard problem, all agents must participate financially in the proje ...

... implement the first best. This is no longer true when efforts are non observable. The consultant effort is less efficient than her proper effort. Thus, she prefers asking for the VC fund's advice. In order to solve the double moral hazard problem, all agents must participate financially in the proje ...

Treasury Bill Yields: Overlooked Information

... increase in risk premium and the decrease in riskfree rate almost, but not completely, offset. Thus, the hidden factor might appear to be hidden due to its extremely short halflife in risk-neutral probability measure. One can also expect, however, that Treasury bill yields might have unique risk pre ...

... increase in risk premium and the decrease in riskfree rate almost, but not completely, offset. Thus, the hidden factor might appear to be hidden due to its extremely short halflife in risk-neutral probability measure. One can also expect, however, that Treasury bill yields might have unique risk pre ...

Market and Public Liquidity

... that satisfies these inequalities. For θ = .35 the immediate and delayed trading equilibrium are such that (Mi∗ , m∗i ) = (.0169, .9358) and (Md∗ , m∗d ) = (.0540, .4860), respectively. Moreover, although both equilibria are interim efficient, it can be shown that the delayed trading equilibrium (we ...

... that satisfies these inequalities. For θ = .35 the immediate and delayed trading equilibrium are such that (Mi∗ , m∗i ) = (.0169, .9358) and (Md∗ , m∗d ) = (.0540, .4860), respectively. Moreover, although both equilibria are interim efficient, it can be shown that the delayed trading equilibrium (we ...

Annual Financial Statements and Combined

... Fundamental Information about the Group Our Strategy The ProCredit group is made up of banks that have specialised in small and medium-sized enterprises (SMEs) in transition economies. Our business model consists of the core activities of traditional banking business. We are active in South Eastern ...

... Fundamental Information about the Group Our Strategy The ProCredit group is made up of banks that have specialised in small and medium-sized enterprises (SMEs) in transition economies. Our business model consists of the core activities of traditional banking business. We are active in South Eastern ...

New Zealand: Financial Sector Assessment Program

... by four major banks with similar business models in which the majority of assets are associated with housing loans. Direct exposures among them are relatively limited, but the potential for spillovers is elevated. Credit has resumed strong growth during the last few years, putting pressure on fundin ...

... by four major banks with similar business models in which the majority of assets are associated with housing loans. Direct exposures among them are relatively limited, but the potential for spillovers is elevated. Credit has resumed strong growth during the last few years, putting pressure on fundin ...

Aggregation of risks and Allocation of capital

... The current focus is on calculating economic capital. However, business decisions need to be made based on risk budget and risk/return optimization. Economic capital plays a central role in prudential supervision, product pricing, risk assessment, risk management and hedging, capital allocation / pr ...

... The current focus is on calculating economic capital. However, business decisions need to be made based on risk budget and risk/return optimization. Economic capital plays a central role in prudential supervision, product pricing, risk assessment, risk management and hedging, capital allocation / pr ...

A Financial Crisis Manual

... the lessons to be gleaned from the lingering crisis. What provoked the largest financial and economic collapse in decades? While the housing bubble and subprime mortgage lending boom provide clear proximate causes, skewed financial sector incentives, errant economic assumptions, and inequitable soci ...

... the lessons to be gleaned from the lingering crisis. What provoked the largest financial and economic collapse in decades? While the housing bubble and subprime mortgage lending boom provide clear proximate causes, skewed financial sector incentives, errant economic assumptions, and inequitable soci ...

ditc_commb_EneFin_00001

... They will, for example, build clauses into financings which are meant to reduce the risks that these charters are cancelled. E.g., ratios for the shipping company (minimum account of cash balance to be held; ratio of current assets to current liabilities; ratio of net debt(gross earnings), to ensure ...

... They will, for example, build clauses into financings which are meant to reduce the risks that these charters are cancelled. E.g., ratios for the shipping company (minimum account of cash balance to be held; ratio of current assets to current liabilities; ratio of net debt(gross earnings), to ensure ...

supplementary regulatory capital disclosure

... To enable banks to meet the new standards, Basel III contains transitional arrangements commencing January 1, 2013, through January 1, 2019. Transitional requirements result in a phase-in of new deductions to common equity over 5 years. Under the transitional rules, all CET1 deductions are multiplie ...

... To enable banks to meet the new standards, Basel III contains transitional arrangements commencing January 1, 2013, through January 1, 2019. Transitional requirements result in a phase-in of new deductions to common equity over 5 years. Under the transitional rules, all CET1 deductions are multiplie ...

Joint Dynamics of Bond and Stock Returns - Wisconsin-School

... comovement, or a “common factor” in returns on assets with independent cash flows in general equilibrium. Martin (2012) generalized this setup to multiple “trees”. My paper differs from these by endogenizing the size of “trees” and modeling technologies with different amounts of cash-flow risk. The ...

... comovement, or a “common factor” in returns on assets with independent cash flows in general equilibrium. Martin (2012) generalized this setup to multiple “trees”. My paper differs from these by endogenizing the size of “trees” and modeling technologies with different amounts of cash-flow risk. The ...

Impact Assessment (IA)

... In 2013/14 in the UK, 17.2 million households were owner occupiers. Of these 8.9 million owned their property outright and 8.3 million were paying off a mortgage. Mortgagors are typically a middle-aged group, with two thirds aged between 35 and 55 years. The large majority (83%) of mortgagors are in ...

... In 2013/14 in the UK, 17.2 million households were owner occupiers. Of these 8.9 million owned their property outright and 8.3 million were paying off a mortgage. Mortgagors are typically a middle-aged group, with two thirds aged between 35 and 55 years. The large majority (83%) of mortgagors are in ...

GCD Discount Rate - Global Credit Data

... discount rates in Section 4.2). The objective of the Working Group is the computation of observed LGDs based on the time value of money – here specific ( ...

... discount rates in Section 4.2). The objective of the Working Group is the computation of observed LGDs based on the time value of money – here specific ( ...

Risk Allocation, Debt Fueled Expansion and Financial Crisis ∗ Paul Beaudry

... price of risk in the economy which, in turn, is affected by the allocation of risk. In the model employment decisions affect agents’ willingness to hold financial assets which, in turn, affects the price of risk which feeds back to employment and output. It is worth stressing that the interaction hi ...

... price of risk in the economy which, in turn, is affected by the allocation of risk. In the model employment decisions affect agents’ willingness to hold financial assets which, in turn, affects the price of risk which feeds back to employment and output. It is worth stressing that the interaction hi ...

New Trends in Mortgage Fraud - National Crime Prevention Council

... educate Victim Service Providers, attorneys, and other allied organizations about the many types of crimes, frauds and schemes associated with mortgage fraud today and how to best serve its victims. ...

... educate Victim Service Providers, attorneys, and other allied organizations about the many types of crimes, frauds and schemes associated with mortgage fraud today and how to best serve its victims. ...

DETERMINANTS OF THE DEMAND FOR LIFE INSURANCE

... unique state insurance company) and the rapid devaluation of people’s life insurance savings, ...

... unique state insurance company) and the rapid devaluation of people’s life insurance savings, ...

Financial Supply Chain Dynamics Risk Operational

... strategies are not necessarily same for all banks. ...

... strategies are not necessarily same for all banks. ...

Table of contents

... Companies listed on the JSE have to comply with the JSE’s regulations. This gives the investor the added confidence that the company has to comply with the minimum requirements of the JSE, whose terms of listing are strict and require total transparency as to the financial activities of the company ...

... Companies listed on the JSE have to comply with the JSE’s regulations. This gives the investor the added confidence that the company has to comply with the minimum requirements of the JSE, whose terms of listing are strict and require total transparency as to the financial activities of the company ...

Backtesting Value-at-Risk based on Tail Losses Woon K. Wong

... for the market risk at 99% whereas for the credit and operational risks, VaR is calculated at 99.9% level. Moreover, due to diversification, VaR at the level of the whole bank is often found to be adequate for regulatory capital determination. As long as there is no single position that dominates t ...

... for the market risk at 99% whereas for the credit and operational risks, VaR is calculated at 99.9% level. Moreover, due to diversification, VaR at the level of the whole bank is often found to be adequate for regulatory capital determination. As long as there is no single position that dominates t ...

PDF

... provide coverage for a broad range of crops produced under widely varying conditions across the United States now? This question arose from the Federal Crop Insurance Act of 1980, which authorized the Federal Crop Insurance Corporation (FCIC) to provide multiple-peril crop insurance for more crops i ...

... provide coverage for a broad range of crops produced under widely varying conditions across the United States now? This question arose from the Federal Crop Insurance Act of 1980, which authorized the Federal Crop Insurance Corporation (FCIC) to provide multiple-peril crop insurance for more crops i ...