Corporate Diversification and the Cost of Capital

... Our work is also related to Ortiz-Molina and Phillips (2009), who find that firms with more liquid real assets have a lower cost of capital using the implied cost of equity developed by Gebhardt et al. (2001). To the extent their measure of real asset liquidity is inversely related to deadweight cos ...

... Our work is also related to Ortiz-Molina and Phillips (2009), who find that firms with more liquid real assets have a lower cost of capital using the implied cost of equity developed by Gebhardt et al. (2001). To the extent their measure of real asset liquidity is inversely related to deadweight cos ...

RTF - Vornado Realty Trust

... Accounting Principles (“GAAP”), excluding extraordinary items as defined under GAAP and gains or losses from sales of previously depreciated operating real estate assets, plus specified non-cash items, such as real estate asset depreciation and amortization, and after adjustments for unconsolidated ...

... Accounting Principles (“GAAP”), excluding extraordinary items as defined under GAAP and gains or losses from sales of previously depreciated operating real estate assets, plus specified non-cash items, such as real estate asset depreciation and amortization, and after adjustments for unconsolidated ...

Intermediary Balance Sheets - Federal Reserve Bank of New York

... financial institutions which screen, select, monitor and diversify across investment projects on households’ behalf. This delegation of capital allocation decisions gives rise to principal-agent problems between households and intermediaries, which are solved by imposing constraints on financial ins ...

... financial institutions which screen, select, monitor and diversify across investment projects on households’ behalf. This delegation of capital allocation decisions gives rise to principal-agent problems between households and intermediaries, which are solved by imposing constraints on financial ins ...

Momentum, Acceleration, and Reversal

... accelerated price increases can occur. One possibility is the well-known positive feedback process or herding, which can lead to an accelerated price increase. An example of the positive feedback process is that investors who bought stock and made money today cause more investors to buy stock tomorr ...

... accelerated price increases can occur. One possibility is the well-known positive feedback process or herding, which can lead to an accelerated price increase. An example of the positive feedback process is that investors who bought stock and made money today cause more investors to buy stock tomorr ...

Capital Structure Decision

... shares for future financing on unfavorable term due to heavy debt. Hence the firm should all ways return some unused debt capacity for future needs. Flexibility also implies the firm’s ability to refund money when not required for which purpose it may have to incorporate a provision to refund the am ...

... shares for future financing on unfavorable term due to heavy debt. Hence the firm should all ways return some unused debt capacity for future needs. Flexibility also implies the firm’s ability to refund money when not required for which purpose it may have to incorporate a provision to refund the am ...

2015-2016 - Plymouth Marine Laboratory

... The Trustees, who are also Directors of Plymouth Marine Laboratory (PML) for the purposes of the Companies Act, submit their annual report (incorporating the strategic report), together with the audited consolidated financial statements of the charity and its trading subsidiary for the period ended ...

... The Trustees, who are also Directors of Plymouth Marine Laboratory (PML) for the purposes of the Companies Act, submit their annual report (incorporating the strategic report), together with the audited consolidated financial statements of the charity and its trading subsidiary for the period ended ...

On the interplay between speculative bubbles and productive

... are of course whether speculative investments are good or rather bad for capital accumulation and production, whether bubbles are compatible with dynamic e¢ ciency, and what is the role played by speculative assets. To address these issues, the literature mainly focuses on the polar case where one m ...

... are of course whether speculative investments are good or rather bad for capital accumulation and production, whether bubbles are compatible with dynamic e¢ ciency, and what is the role played by speculative assets. To address these issues, the literature mainly focuses on the polar case where one m ...

Smart Beta - A referential guide for institutional investors

... Over the past decade, “smart beta,” a new suite of indexation strategies touting advantages over both active investment managers and traditional market-capitalizationweighted indexes, has erupted onto the financial scene and increasingly won the favor of institutional investors. However, the rise of ...

... Over the past decade, “smart beta,” a new suite of indexation strategies touting advantages over both active investment managers and traditional market-capitalizationweighted indexes, has erupted onto the financial scene and increasingly won the favor of institutional investors. However, the rise of ...

The Development of a European Capital Market

... In addition, the underlying purpose of the Group's work differs from what was aimed at in most of these other studies, which set out to reveal certain deficiencies in the structure or functioning of the capital markets and to seek remedies exclusively at national level. The OECD study, too, although ...

... In addition, the underlying purpose of the Group's work differs from what was aimed at in most of these other studies, which set out to reveal certain deficiencies in the structure or functioning of the capital markets and to seek remedies exclusively at national level. The OECD study, too, although ...

EIB - EESC European Economic and Social Committee

... achieved through: .. Involvement of the EIB or / and of national promotional banks or agencies from member states. .. Involvement of the EIB could be in a substantial part of the monetary expansion or in a limited amount. ...

... achieved through: .. Involvement of the EIB or / and of national promotional banks or agencies from member states. .. Involvement of the EIB could be in a substantial part of the monetary expansion or in a limited amount. ...

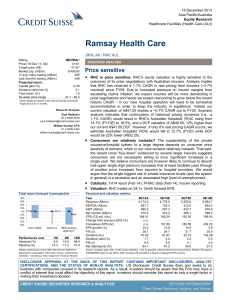

Ramsay Health Care 2013 12 18 - Price sensitive

... outcomes of its price negotiations with Australian insurers. Analysis implies that RHC has received a 1.1% CAGR in real pricing from insurers (~3.7% nominal) since FY09. Due to increased pressure on insurer margins from escalating claims inflation, we expect insurers will be more demanding in price ...

... outcomes of its price negotiations with Australian insurers. Analysis implies that RHC has received a 1.1% CAGR in real pricing from insurers (~3.7% nominal) since FY09. Due to increased pressure on insurer margins from escalating claims inflation, we expect insurers will be more demanding in price ...

RMB Budapest

... Bank and China Import & Export Bank, totaled more than 150 billion yuan by the end of 2014; ...

... Bank and China Import & Export Bank, totaled more than 150 billion yuan by the end of 2014; ...

Serial Dependence and Portfolio Performance in the Swedish Stock

... transformed into daily, weekly and monthly returns. First the significance of the models is tested and it is found that for the daily and weekly data all of the models are significant. For monthly data 77 % of the estimated models are significant. After this the performance of a VAR arbitrage portfo ...

... transformed into daily, weekly and monthly returns. First the significance of the models is tested and it is found that for the daily and weekly data all of the models are significant. For monthly data 77 % of the estimated models are significant. After this the performance of a VAR arbitrage portfo ...

Inflation Risk and Real Return

... so over sufficiently long time periods the relatively high expected returns of equities mean investors can expect to grow assets after inflation. Over short time horizons, though, equities may suffer from inflation shocks. Over long horizons, we expect that most, but not all, of an inflation increas ...

... so over sufficiently long time periods the relatively high expected returns of equities mean investors can expect to grow assets after inflation. Over short time horizons, though, equities may suffer from inflation shocks. Over long horizons, we expect that most, but not all, of an inflation increas ...

Overconfidence and Firm Decision Making: Evidence from

... light on how other investors react to and value a firm’s investment, but studying real estate investments can reveal information on how (overconfident) managers themselves value their own investments. Real estate also provides a far more precise measurement of over- or underpricing than takeovers. E ...

... light on how other investors react to and value a firm’s investment, but studying real estate investments can reveal information on how (overconfident) managers themselves value their own investments. Real estate also provides a far more precise measurement of over- or underpricing than takeovers. E ...

printmgr file - Morgan Stanley

... Debt valuation adjustments (“DVA”) represent the change in the fair value resulting from fluctuations in the Firm’s credit spreads and other credit factors related to liabilities carried at fair value, primarily certain Long-term and Short-term borrowings. Amounts include Provision for (benefit from ...

... Debt valuation adjustments (“DVA”) represent the change in the fair value resulting from fluctuations in the Firm’s credit spreads and other credit factors related to liabilities carried at fair value, primarily certain Long-term and Short-term borrowings. Amounts include Provision for (benefit from ...

EAST WEST BANCORP INC (Form: 10-Q, Received

... Certain matters discussed in this Quarterly Report on Form 10-Q (this “Form 10-Q”) contain or incorporate statements that East West Bancorp, Inc. (referred to herein on an unconsolidated basis as “East West” and on a consolidated basis as the “Company” or “EWBC”) believes are “forward-looking statem ...

... Certain matters discussed in this Quarterly Report on Form 10-Q (this “Form 10-Q”) contain or incorporate statements that East West Bancorp, Inc. (referred to herein on an unconsolidated basis as “East West” and on a consolidated basis as the “Company” or “EWBC”) believes are “forward-looking statem ...

Farewell to cheap capital? The implications of long‑term shifts in

... Farewell to cheap capital? The implications of long-term shifts in global investment and saving is the latest research by the McKinsey Global Institute (MGI) on the outlook for global capital markets in the wake of the 2008 financial crisis and subsequent recession. Among the lingering effects of th ...

... Farewell to cheap capital? The implications of long-term shifts in global investment and saving is the latest research by the McKinsey Global Institute (MGI) on the outlook for global capital markets in the wake of the 2008 financial crisis and subsequent recession. Among the lingering effects of th ...

Collateral Shortages, Asset Price and Investment

... are the net present discounted values of the dividend processes, with appropriate discount factors. As a result, asset price volatility is proportional to the volatility of dividends if the aggregate endowment, or equivalently the equilibrium stochastic discount factor, only varies by a limited amou ...

... are the net present discounted values of the dividend processes, with appropriate discount factors. As a result, asset price volatility is proportional to the volatility of dividends if the aggregate endowment, or equivalently the equilibrium stochastic discount factor, only varies by a limited amou ...

A Model of Competitive Stock Trading Volume Jiang Wang

... It provides no additional information about prices given characterizations of the aggregate risk. The weak empirical performance of the representative agent models has led researchers to develop models with heterogeneous investors and an incomplete asset market (see, e.g., Mankiw 1986; Scheinkman an ...

... It provides no additional information about prices given characterizations of the aggregate risk. The weak empirical performance of the representative agent models has led researchers to develop models with heterogeneous investors and an incomplete asset market (see, e.g., Mankiw 1986; Scheinkman an ...

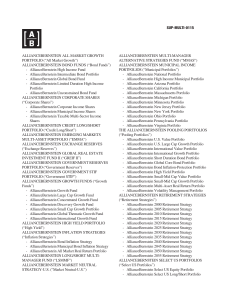

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.