World Vision Australia - Social Impact Investing Submission

... Small and medium enterprises (SMEs) in developing countries are hindered by a range of factors such as inadequate infrastructure, restrictive taxes and regulations, and discriminatory social barriers. 9 Despite these barriers, overall they contribute 67 percent to their national GDPs and employ 80 p ...

... Small and medium enterprises (SMEs) in developing countries are hindered by a range of factors such as inadequate infrastructure, restrictive taxes and regulations, and discriminatory social barriers. 9 Despite these barriers, overall they contribute 67 percent to their national GDPs and employ 80 p ...

Chapter 21 Glossary

... bargain-purchase option An option that allows a lessee to purchase the leased property for a price that is significantly lower than the property’s expected fair value at the date the option becomes exercisable. At the inception of the lease, the difference between the option price and the expected f ...

... bargain-purchase option An option that allows a lessee to purchase the leased property for a price that is significantly lower than the property’s expected fair value at the date the option becomes exercisable. At the inception of the lease, the difference between the option price and the expected f ...

american capital agency corp. - corporate

... other comprehensive income (loss), a component of stockholders’ equity. We evaluate securities for other-than-temporary impairment at least on a quarterly basis, and more frequently when economic or market conditions warrant such evaluation. The determination of whether a security is other-than-temp ...

... other comprehensive income (loss), a component of stockholders’ equity. We evaluate securities for other-than-temporary impairment at least on a quarterly basis, and more frequently when economic or market conditions warrant such evaluation. The determination of whether a security is other-than-temp ...

Leverage Cycles and the Anxious Economy

... most optimistic investors who are buying. To explain our data on emerging market closures, we tell a story that places liquidity and leverage on center stage, but that does not have the extreme behavior of the sell-off. In order to understand the role of leverage in the anxious economy, in Section I ...

... most optimistic investors who are buying. To explain our data on emerging market closures, we tell a story that places liquidity and leverage on center stage, but that does not have the extreme behavior of the sell-off. In order to understand the role of leverage in the anxious economy, in Section I ...

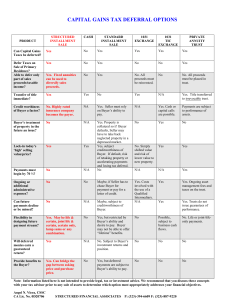

CAPITAL GAINS TAX DEFERRAL OPTIONS

... with your tax advisor prior to any sale of assets to determine which option most appropriately addresses your financial objectives. Angel N. Viera, CSSC CA Lic. No. 0D20706 ...

... with your tax advisor prior to any sale of assets to determine which option most appropriately addresses your financial objectives. Angel N. Viera, CSSC CA Lic. No. 0D20706 ...

Not All Benchmarks Are Created Equal

... Performance benchmarks for actively managed portfolios Index-linked vehicles to capture the market beta (equity risk premium) The broad acceptance of market cap weighted indices does not rely on (potentially flawed) academic theories, such as the CAPM; it stems from practical considerations li ...

... Performance benchmarks for actively managed portfolios Index-linked vehicles to capture the market beta (equity risk premium) The broad acceptance of market cap weighted indices does not rely on (potentially flawed) academic theories, such as the CAPM; it stems from practical considerations li ...

Chapter 12 Segment Reporting, Decentralization, and the Balanced Scorecard

... 1. MPC’s previous manufacturing strategy was focused on high-volume production of a limited range of paper grades. The goal of this strategy was to keep the machines running constantly to maximize the number of tons produced. Changeovers were avoided because they lowered equipment utilization. Maxim ...

... 1. MPC’s previous manufacturing strategy was focused on high-volume production of a limited range of paper grades. The goal of this strategy was to keep the machines running constantly to maximize the number of tons produced. Changeovers were avoided because they lowered equipment utilization. Maxim ...

BIG REPORT - Big Lottery Fund

... – 75%; and 76% - 100%. Findings from the survey are often cross referenced by these bands in order to identify any differences between more conventional trading models for social enterprises i.e. where the majority of the income is through trading, and models which are less enterprise-focused. 2.1.2 ...

... – 75%; and 76% - 100%. Findings from the survey are often cross referenced by these bands in order to identify any differences between more conventional trading models for social enterprises i.e. where the majority of the income is through trading, and models which are less enterprise-focused. 2.1.2 ...

Policy Dialogue on Corporate Governance in China

... the State Council or even the NPC (the government or the local People’s Congress in local levels), charged with the exclusive authority to act as the owner of state owned assets. Ownership function is thus separated from other functions of the state as all other party and government organs are suppo ...

... the State Council or even the NPC (the government or the local People’s Congress in local levels), charged with the exclusive authority to act as the owner of state owned assets. Ownership function is thus separated from other functions of the state as all other party and government organs are suppo ...

What Difference Do Dividends Make?

... reduce the realized return. Once the sample was segmented by investment style, we formed four dividend yield portfolios within each style category: no dividend, low dividend, high dividend, and extreme dividend. We divided the dividend payers, roughly in half, into low- and high-dividend portfolios; ...

... reduce the realized return. Once the sample was segmented by investment style, we formed four dividend yield portfolios within each style category: no dividend, low dividend, high dividend, and extreme dividend. We divided the dividend payers, roughly in half, into low- and high-dividend portfolios; ...

Why doesn’t Capital Flow from Rich to Poor Countries? An

... The neoclassical theory predicts that capital should flow from rich to poor countries. Under the standard assumptions such as countries produce the same goods with the same constant returns to scale production function and the same factors of production—capital and labor—differences in income per ca ...

... The neoclassical theory predicts that capital should flow from rich to poor countries. Under the standard assumptions such as countries produce the same goods with the same constant returns to scale production function and the same factors of production—capital and labor—differences in income per ca ...

Download attachment

... recognized asset or liability or of an unrecognized firm commitment. *30. The accounting for bonds payable will deviate from amortized cost in the case where the bonds are designated as a hedged item in a qualifying fair value hedge. If the hedge meets the special hedge accounting criteria (designat ...

... recognized asset or liability or of an unrecognized firm commitment. *30. The accounting for bonds payable will deviate from amortized cost in the case where the bonds are designated as a hedged item in a qualifying fair value hedge. If the hedge meets the special hedge accounting criteria (designat ...

1/N and Long Run Optimal Portfolios

... call here “1 ”). Recently, DeMiguel, Garlappi, and Uppal (2009a, henceforth DGU) have reported that the 1 strategy consistently outperforms almost every optimizing model they scrutinize for problems limited to the selection of stock portfolios. However, their analysis cannot be brought to bear o ...

... call here “1 ”). Recently, DeMiguel, Garlappi, and Uppal (2009a, henceforth DGU) have reported that the 1 strategy consistently outperforms almost every optimizing model they scrutinize for problems limited to the selection of stock portfolios. However, their analysis cannot be brought to bear o ...

The effect of capital market characteristics on the value

... rising valuations.’’ (Ceteris paribus, a higher valuation implies a smaller ownership share for venture capitalists). Another tenet of our model is the link between ownership shares and incentives. ...

... rising valuations.’’ (Ceteris paribus, a higher valuation implies a smaller ownership share for venture capitalists). Another tenet of our model is the link between ownership shares and incentives. ...

The Equity Premium: Why Is It a Puzzle? Rajnish Mehra

... average bond return of 1.1 percent. Similar statistical differences have been documented for France, Germany, and Japan. And together, the United States, the United Kingdom, Japan, Germany, and France account for more than 85 percent of capitalized global equity value. The dramatic investment implic ...

... average bond return of 1.1 percent. Similar statistical differences have been documented for France, Germany, and Japan. And together, the United States, the United Kingdom, Japan, Germany, and France account for more than 85 percent of capitalized global equity value. The dramatic investment implic ...

Sample

... 35) A life insurance company purchases $1 billion of corporate bonds from premiums collected on its life insurance policies. Therefore A) the corporate bonds are indirect securities and the life insurance policies are direct securities. B) the corporate bonds are indirect securities and the life ins ...

... 35) A life insurance company purchases $1 billion of corporate bonds from premiums collected on its life insurance policies. Therefore A) the corporate bonds are indirect securities and the life insurance policies are direct securities. B) the corporate bonds are indirect securities and the life ins ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.