Prudential Jennison 20/20 Focus Fund Fact Sheet

... return to the investor after net operating expenses but before any sales charges are imposed. SEC standardized return describes the return to the investor after net operating expenses and maximum sales charges are imposed. All returns assume share price changes as well as the compounding effect of r ...

... return to the investor after net operating expenses but before any sales charges are imposed. SEC standardized return describes the return to the investor after net operating expenses and maximum sales charges are imposed. All returns assume share price changes as well as the compounding effect of r ...

Reading Ch 2 A Tycoon Of The MUTUAL FUNDS

... especially those for municipal bonds, can provide tax- free interest. However, be sure to read all of the fine print to see if you qualify. Growth. These search out stocks that are most likely to experience a rapid price increase. The basic philosophy here is to buy low and sell high. Of course, thi ...

... especially those for municipal bonds, can provide tax- free interest. However, be sure to read all of the fine print to see if you qualify. Growth. These search out stocks that are most likely to experience a rapid price increase. The basic philosophy here is to buy low and sell high. Of course, thi ...

Deutsche Invest I Top Asia - Deutsche Asset Management

... willingness to repay) may have an adverse affect on the value of the bond. • Due to its composition/the techniques used by the Fund management, the investment fund has elevated volatility, i.e. the share price may be subject to significant fluctuations up or down within short periods of time. The sh ...

... willingness to repay) may have an adverse affect on the value of the bond. • Due to its composition/the techniques used by the Fund management, the investment fund has elevated volatility, i.e. the share price may be subject to significant fluctuations up or down within short periods of time. The sh ...

Essay Plan Appreciation of the $A

... Investment, investment is reduced as there is less attraction. There is a reduction of capital inflow and investment (direct, portfolio). It can be witnessed that an appreciation o the $A offers short term gain yet long term loss to the Australian economy. Australia has sustained a rising exchange r ...

... Investment, investment is reduced as there is less attraction. There is a reduction of capital inflow and investment (direct, portfolio). It can be witnessed that an appreciation o the $A offers short term gain yet long term loss to the Australian economy. Australia has sustained a rising exchange r ...

The art of strategic thinking

... I have mentioned above some of the advantages you have as pension fund investors, and it would be unfair if I didn’t mention at least one disadvantage. As trustees, managers and advisors to pension funds you are exposed to a major structural bias, that of limited upside and almost unlimited downside ...

... I have mentioned above some of the advantages you have as pension fund investors, and it would be unfair if I didn’t mention at least one disadvantage. As trustees, managers and advisors to pension funds you are exposed to a major structural bias, that of limited upside and almost unlimited downside ...

4.32kWp on Student let in Huddersfield : World Of Renewables

... Average annual return on investment expected -17.9% Mr Clifton asked us to review his portfolio of his student let investment properties to ascertain which would be suitable for solar PV. Mr Clifton selected the property that was capable of accommodating the largest system. The reasons behind Mr Cli ...

... Average annual return on investment expected -17.9% Mr Clifton asked us to review his portfolio of his student let investment properties to ascertain which would be suitable for solar PV. Mr Clifton selected the property that was capable of accommodating the largest system. The reasons behind Mr Cli ...

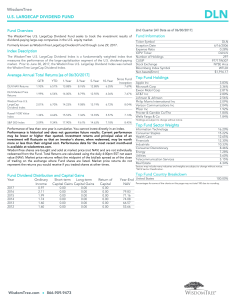

WisdomTree LargeCap Dividend Fund

... There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for ...

... There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read the Fund’s prospectus for ...

Royce Opportunity Fund

... calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters. The Price-Earnings, or P/E, Ratio is calculated by dividing a company's share price by its trailing 12-month earnings-per-share (EPS). The Price-to-Boo ...

... calculated by measuring the Fund’s performance in quarters when the benchmark goes down and dividing it by the benchmark’s return in those quarters. The Price-Earnings, or P/E, Ratio is calculated by dividing a company's share price by its trailing 12-month earnings-per-share (EPS). The Price-to-Boo ...

Outlook 2017 Highlights: Passing the Baton

... Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past. RiverFront’s Price Matters® discipline compares inflation-adjusted current ...

... Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past. RiverFront’s Price Matters® discipline compares inflation-adjusted current ...

The Point - Fieldpoint Private

... judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of the date provided as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Asset allocation models are based on ...

... judgments of such sources or represent reasonable estimates. Any pricing or valuation of securities or other assets contained in this material is as of the date provided as prices fluctuate on a daily basis. Past performance is not a guarantee of future results. Asset allocation models are based on ...

The land of the rising sun

... Stronger domestic demand is key but there is a limit to how much new government spending Japan can afford Rolling the investment dice For a mature, highly industrialised nation with an ageing population, growth challenges and extreme longterm debt, these measures are bold. Investors who got into the ...

... Stronger domestic demand is key but there is a limit to how much new government spending Japan can afford Rolling the investment dice For a mature, highly industrialised nation with an ageing population, growth challenges and extreme longterm debt, these measures are bold. Investors who got into the ...

November 13, 2013, The Citizen`s Share Idea for Europe, Saving EU

... Q3 Will wage trade-off reduce worker spending? In principle, trade-off of wages for equity/profit-sharing can maintain worker lifetime income by transferring lower wage today for higher income tomorrow, adjusted for risk-> no reduction in consumer spending. Wage concession lowers price of goods, wh ...

... Q3 Will wage trade-off reduce worker spending? In principle, trade-off of wages for equity/profit-sharing can maintain worker lifetime income by transferring lower wage today for higher income tomorrow, adjusted for risk-> no reduction in consumer spending. Wage concession lowers price of goods, wh ...

Interest Rate Parity

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

... two members from amongst the officials of the ministers of central government dealing with Finance and Law. Two members who are professional and have experience or special knowledge relating to securities market. One member from RBI. ...

Title of presentation located in this space

... “Supply will never catch up with demand… What investors are paying for is not just square feet of built up space, but a quality of life that is rarely found elsewhere in the world.” Hashim Al Dabal, Chairman, Dubai Properties ...

... “Supply will never catch up with demand… What investors are paying for is not just square feet of built up space, but a quality of life that is rarely found elsewhere in the world.” Hashim Al Dabal, Chairman, Dubai Properties ...

end of the golden age? - Virtus Investment Partners

... a world where meeting a specific investor outcome forms the bedrock of investment decisions, rather than one where allocating among equities, bonds, and other asset classes does. This shift should apply to all investors, be they pension plans, companies, or individuals, regardless of whether they ar ...

... a world where meeting a specific investor outcome forms the bedrock of investment decisions, rather than one where allocating among equities, bonds, and other asset classes does. This shift should apply to all investors, be they pension plans, companies, or individuals, regardless of whether they ar ...

Investing Against the Grain

... obert Frost chose the road less traveled and claims it made all the difference. The same can be said for the portfolio management strategy at Dubots Capital Management. While many investment counselors encourage clients to invest for the long term, stay the course, and ride the down markets waiting ...

... obert Frost chose the road less traveled and claims it made all the difference. The same can be said for the portfolio management strategy at Dubots Capital Management. While many investment counselors encourage clients to invest for the long term, stay the course, and ride the down markets waiting ...

October 2011 - Roof Advisory Group

... Within this strategic investment management context, the firm makes tactical shifts to address changing market conditions and optimize client portfolio performance. Each client situation is unique but a few of the tactics presently being used across most portfolios managed are outlined below: ...

... Within this strategic investment management context, the firm makes tactical shifts to address changing market conditions and optimize client portfolio performance. Each client situation is unique but a few of the tactics presently being used across most portfolios managed are outlined below: ...

High street banks make way for Paxton fund

... specialising in short-term loans secured on UK property. The first closing was oversubscribed and declared successful on the first day of the new financial year. Fundraising will continue until the scheme's loan book reaches £10m. Traditional bankers’ current lack of appetite for property, with cons ...

... specialising in short-term loans secured on UK property. The first closing was oversubscribed and declared successful on the first day of the new financial year. Fundraising will continue until the scheme's loan book reaches £10m. Traditional bankers’ current lack of appetite for property, with cons ...

Focused Dynamic Growth - American Century Investments

... A Note About Risk Investment return and principal value will fluctuate, and it is possible to lose money by investing. Because this fund may, at times, concentrate its investments in a specific area, during such times it may be subject to greater risks and market fluctuations than when the portfolio ...

... A Note About Risk Investment return and principal value will fluctuate, and it is possible to lose money by investing. Because this fund may, at times, concentrate its investments in a specific area, during such times it may be subject to greater risks and market fluctuations than when the portfolio ...

Dreyfus Emerging Markets Debt U.S. Dollar Fund

... The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor's shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. ...

... The performance data quoted represents past performance, which is no guarantee of future results. Share price and investment return fluctuate and an investor's shares may be worth more or less than original cost upon redemption. Current performance may be lower or higher than the performance quoted. ...

4th Quarter 2012 - Jupiter Capital Partners

... Sri Lankan GDP grew by 7.9%, 6.4% and 4.8% for the first three quarters of this year compared to 7.9%, 8.2% and 8.4% growth during corresponding periods last year. The Central Bank predicts GDP growth for 2012 will come down to 6.8% from 8.3% seen last year. This is in par with the ADB’s forecast of ...

... Sri Lankan GDP grew by 7.9%, 6.4% and 4.8% for the first three quarters of this year compared to 7.9%, 8.2% and 8.4% growth during corresponding periods last year. The Central Bank predicts GDP growth for 2012 will come down to 6.8% from 8.3% seen last year. This is in par with the ADB’s forecast of ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.