27four Asset Select Fund of Funds

... Bank target band by year end. Reserve Bank activity is therefore likely to remain muted given the added complication of subdued economic growth. Offshore equities continue to offer the best relative opportunity within financial markets given current valuations as well as historically significant cor ...

... Bank target band by year end. Reserve Bank activity is therefore likely to remain muted given the added complication of subdued economic growth. Offshore equities continue to offer the best relative opportunity within financial markets given current valuations as well as historically significant cor ...

investment grade infrastructure bond fund

... Disclosure: This fact sheet shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale or any acceptance of an offer to buy these securities in any province or territory of Canada. This offering is only made by prospectus. The prospectus contains import ...

... Disclosure: This fact sheet shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale or any acceptance of an offer to buy these securities in any province or territory of Canada. This offering is only made by prospectus. The prospectus contains import ...

amundi index jp morgan gbi global govies - ie

... of the fund (FCP), collective employee fund (FCPE), SICAV, SICAV sub-fund or SICAV investing primarily in real estate (SPPICAV) (collectively, “the Funds”) described herein and should in no case be interpreted as such. This document is not a contract or commitment of any form. Information contained ...

... of the fund (FCP), collective employee fund (FCPE), SICAV, SICAV sub-fund or SICAV investing primarily in real estate (SPPICAV) (collectively, “the Funds”) described herein and should in no case be interpreted as such. This document is not a contract or commitment of any form. Information contained ...

Pension fund equity investment

... Application to pension funds Pension fund liabilities comprise a sequence of payments extending many years into the future. Such liabilities are not at call. Auto-correlation of share investment returns over such long periods invalidates the assumptions underlying the simple financial economics appr ...

... Application to pension funds Pension fund liabilities comprise a sequence of payments extending many years into the future. Such liabilities are not at call. Auto-correlation of share investment returns over such long periods invalidates the assumptions underlying the simple financial economics appr ...

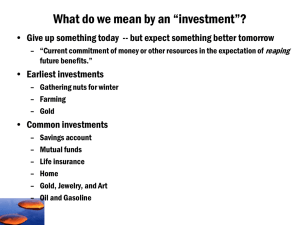

Chap001_overview

... A stock portfolio can be expected to lose money about 1 out of every 4 years. o Bonds have a much lower average rate of return (under 6%) and have not lost more than 13% of their value in any one year. ...

... A stock portfolio can be expected to lose money about 1 out of every 4 years. o Bonds have a much lower average rate of return (under 6%) and have not lost more than 13% of their value in any one year. ...

Fact Sheet:SSgA Enhanced Emerging Markets Equity Fund, May2017

... Companies with large market capitalizations go in and out of favor based on market and economic conditions. Larger companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the value of the security may not rise as much as com ...

... Companies with large market capitalizations go in and out of favor based on market and economic conditions. Larger companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the value of the security may not rise as much as com ...

KIID LU1335425580 en LU

... The entry and exit charges shown are maximum figures. In some cases you might pay less. Actual entry and exit charges can be obtained from your financial adviser or distributor. The ongoing charges figure is an estimate based on expected total of charges. This figure may vary from year to year. Perf ...

... The entry and exit charges shown are maximum figures. In some cases you might pay less. Actual entry and exit charges can be obtained from your financial adviser or distributor. The ongoing charges figure is an estimate based on expected total of charges. This figure may vary from year to year. Perf ...

Focus on Risk Adjusted Returns

... make RIHFs more accessible through a minimum investment amount of R50 000. Consequently we expect more demand from the retail space and pension funds, and for the industry to grow going forward.” ...

... make RIHFs more accessible through a minimum investment amount of R50 000. Consequently we expect more demand from the retail space and pension funds, and for the industry to grow going forward.” ...

Satrix Balanced Index Fund

... provide any guarantee either with respect to the capital or the return of a portfolio. The performance of the portfolio depends on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-div date. Lump sum investment ...

... provide any guarantee either with respect to the capital or the return of a portfolio. The performance of the portfolio depends on the underlying assets and variable market factors. Performance is based on NAV to NAV calculations with income reinvestments done on the ex-div date. Lump sum investment ...

Global Macro Investment For Presentation at Yale U. October 22

... be infinite. Certain factors, which were useful for predicting the past, may become irrelevant for the future. There could be structural changes in the market that requires considering new factors; • Are better than gut feelings for most professionals. Out of greed and fear, most people trade emotio ...

... be infinite. Certain factors, which were useful for predicting the past, may become irrelevant for the future. There could be structural changes in the market that requires considering new factors; • Are better than gut feelings for most professionals. Out of greed and fear, most people trade emotio ...

WF/BlackRock US Aggregate Bond Index CIT

... The WF/BlackRock U.S. Aggregate Bond Index CIT (the "Fund") invests in an underlying collective investment fund (the "Master Fund") that is managed by BlackRock Institutional Trust Company, N.A., which in turn invests in the securities mentioned in this fact sheet, or invests in another collective f ...

... The WF/BlackRock U.S. Aggregate Bond Index CIT (the "Fund") invests in an underlying collective investment fund (the "Master Fund") that is managed by BlackRock Institutional Trust Company, N.A., which in turn invests in the securities mentioned in this fact sheet, or invests in another collective f ...

Document

... trading ideas, as well as any other information contained in this announcement is only for the purposes of information. It is non-binding and it represents the view of Raiffeisenbank. This announcement is not an offer or solicitation to purchase or sale of any financial assets or other financial ins ...

... trading ideas, as well as any other information contained in this announcement is only for the purposes of information. It is non-binding and it represents the view of Raiffeisenbank. This announcement is not an offer or solicitation to purchase or sale of any financial assets or other financial ins ...

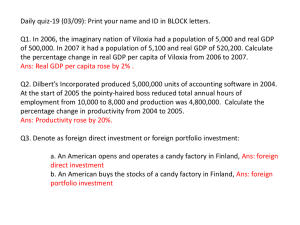

03/09

... Daily quiz-19 (03/09): Print your name and ID in BLOCK letters. Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to ...

... Daily quiz-19 (03/09): Print your name and ID in BLOCK letters. Q1. In 2006, the imaginary nation of Viloxia had a population of 5,000 and real GDP of 500,000. In 2007 it had a population of 5,100 and real GDP of 520,200. Calculate the percentage change in real GDP per capita of Viloxia from 2006 to ...

Investing During a Non-Normal Market Environment

... than is suitable for some investors. For that reason, investors overall thinking should be geared toward either allocating less of their portfolio to different types and asset styles of equities, or toward allocating less to higher risk stocks in order to maintain the same equity allocation. Absent ...

... than is suitable for some investors. For that reason, investors overall thinking should be geared toward either allocating less of their portfolio to different types and asset styles of equities, or toward allocating less to higher risk stocks in order to maintain the same equity allocation. Absent ...

Discussion of “Coordinating Business Cycles” Christophe Chamley May 14, 2015

... and all firms investing) ...

... and all firms investing) ...

FUND FACTSHEET – JULY 2016 RHB DANA HAZEEM (formerly

... We continue to expect sluggish but fairly stable growth, low inflation and moderately supportive macroeconomic policies in 2H2016. Financial conditions have mostly returned to the levels before the UK’s European Union referendum but uncertainties continue to rise. Those uncertainties – mainly coming ...

... We continue to expect sluggish but fairly stable growth, low inflation and moderately supportive macroeconomic policies in 2H2016. Financial conditions have mostly returned to the levels before the UK’s European Union referendum but uncertainties continue to rise. Those uncertainties – mainly coming ...

What Sets Us Apart - Asia Pacific Fund

... performance will not necessarily be repeated. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. There are additional risks associated with investments (made directly or through investment vehicles which invest) in emerging or developing markets. ...

... performance will not necessarily be repeated. Changes in rates of exchange may have an adverse effect on the value, price or income of an investment. There are additional risks associated with investments (made directly or through investment vehicles which invest) in emerging or developing markets. ...

Newsletter

... always was, ‘garbage in garbage out.’ Hundreds of billions in losses await those that took the AAA Kool-Aid, and a frozen ‘deer in the headlights’ investment community stands by in hopes of central bank salvation. The rate cuts will come but salvation will dangle tantalizingly out of reach.” Harry L ...

... always was, ‘garbage in garbage out.’ Hundreds of billions in losses await those that took the AAA Kool-Aid, and a frozen ‘deer in the headlights’ investment community stands by in hopes of central bank salvation. The rate cuts will come but salvation will dangle tantalizingly out of reach.” Harry L ...

statement of investment policy

... individual financial instruments. F. Prudence: The Corning Healthcare District adheres to the guidance provided by the “Prudent Man Rule” (Civil Code Section #2261), which obligates a fiduciary to ensure that: “…investment shall be made with the exercise of that degree of judgment and care, under ci ...

... individual financial instruments. F. Prudence: The Corning Healthcare District adheres to the guidance provided by the “Prudent Man Rule” (Civil Code Section #2261), which obligates a fiduciary to ensure that: “…investment shall be made with the exercise of that degree of judgment and care, under ci ...

Stock Market -Trading

... – The front-end fee is 4% and the expense ratio is 1.2% – The securities in which the fund invests increase in value by 12% during the year – What is your rate of return on the fund if you sell your shares at the end of the year? ...

... – The front-end fee is 4% and the expense ratio is 1.2% – The securities in which the fund invests increase in value by 12% during the year – What is your rate of return on the fund if you sell your shares at the end of the year? ...

Super fund mergers could cross sectors

... Not-for-profit funds are often controlled by a trustee corporation and the shares of the trustee corporation are typically held by the sponsoring organisations, including unions and employer organisations. In theory, an industry fund could merge with a retail fund if these organisations sold their i ...

... Not-for-profit funds are often controlled by a trustee corporation and the shares of the trustee corporation are typically held by the sponsoring organisations, including unions and employer organisations. In theory, an industry fund could merge with a retail fund if these organisations sold their i ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.