as PDF

... the last week. Believe it or not, this started in Australian shares on Tuesday as buyers saw value around the 5000 mark on the ASX 200 and then continued as China eased monetary policy, Fed officials indicated that a September interest rate hike was looking less likely if global growth worries persi ...

... the last week. Believe it or not, this started in Australian shares on Tuesday as buyers saw value around the 5000 mark on the ASX 200 and then continued as China eased monetary policy, Fed officials indicated that a September interest rate hike was looking less likely if global growth worries persi ...

Joint Investment Activities Are Often Lawful, But

... sell their business. Thus, the antitrust laws consider this type of joint conduct to be lawful and beneficial to competition. The antitrust laws, however, are also designed to protect all forms of competition, including competition in the market for corporate control. Accordingly, agreements among i ...

... sell their business. Thus, the antitrust laws consider this type of joint conduct to be lawful and beneficial to competition. The antitrust laws, however, are also designed to protect all forms of competition, including competition in the market for corporate control. Accordingly, agreements among i ...

Word - 399 Kb - Productivity Commission

... certainty in these two areas, there are several other investment barriers, which contribute investment risk and therefore dissuade investment in adaptation, they include: a. b. c. d. e. ...

... certainty in these two areas, there are several other investment barriers, which contribute investment risk and therefore dissuade investment in adaptation, they include: a. b. c. d. e. ...

Marathon Monthly Commentary - JP Morgan Asset Management

... help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions. The views contained herein are not to be taken as an advice or a recommendation to buy or sell any investment in any jurisdiction ...

... help clients understand the markets and support investment decision-making, the program explores the implications of current economic data and changing market conditions. The views contained herein are not to be taken as an advice or a recommendation to buy or sell any investment in any jurisdiction ...

Emerging Research on Climate Change Risk and Fossil

... • Cost of carbon emissions could grow to as much as $8 trillion by 2030; the longer policymaking continues to be delayed and uncoordinated, the higher the cost of emissions will be. This high cost will pose a risk to companies and the portfolios that invest in them, and certain sectors of the econo ...

... • Cost of carbon emissions could grow to as much as $8 trillion by 2030; the longer policymaking continues to be delayed and uncoordinated, the higher the cost of emissions will be. This high cost will pose a risk to companies and the portfolios that invest in them, and certain sectors of the econo ...

here [PDF 930KB]

... sterling-denominated assets, while still maintaining a diversified portfolio. Where possible, we might also hedge against moves in exchange rates. This can be done by using hedged share classes of funds investing in overseas equities, thus maintaining exposure to non-UK markets while hedging out the ...

... sterling-denominated assets, while still maintaining a diversified portfolio. Where possible, we might also hedge against moves in exchange rates. This can be done by using hedged share classes of funds investing in overseas equities, thus maintaining exposure to non-UK markets while hedging out the ...

CF Prudential Managed Defensive Fund

... returns. Investor sentiment was subdued partly because of geopolitical tension in Ukraine and the Middle East and worries about the Ebola crisis in West Africa. In addition, a slowdown in China’s economic growth and weaker economic activity in some emerging markets and the eurozone resulted in fears ...

... returns. Investor sentiment was subdued partly because of geopolitical tension in Ukraine and the Middle East and worries about the Ebola crisis in West Africa. In addition, a slowdown in China’s economic growth and weaker economic activity in some emerging markets and the eurozone resulted in fears ...

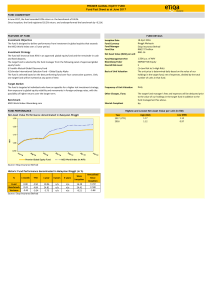

Etiqa Insurance Berhad Overall Risk Level Basis of Unit Valuation

... one target fund will be invested at any point of time. Target Market The fund is targeted at individuals who have an appetite for a higher risk investment strategy, from exposure to global equity volatility and movements in foreign exchange rates, with the possibility of higher returns over the long ...

... one target fund will be invested at any point of time. Target Market The fund is targeted at individuals who have an appetite for a higher risk investment strategy, from exposure to global equity volatility and movements in foreign exchange rates, with the possibility of higher returns over the long ...

Asset ALLOCAtION FUNDs - PGIM Investments

... Generally, stock returns are due to capital appreciation and the reinvestment of gains. Bond returns are due mainly to reinvesting interest. Also, stock prices are usually more volatile than bond prices over the long term. Small company stock returns for 1926–1980 are those of stocks comprising the ...

... Generally, stock returns are due to capital appreciation and the reinvestment of gains. Bond returns are due mainly to reinvesting interest. Also, stock prices are usually more volatile than bond prices over the long term. Small company stock returns for 1926–1980 are those of stocks comprising the ...

Europe`s bank loan funds – where now?

... performance has continued into 2012 as investors have made an aggressive push for yield. ...

... performance has continued into 2012 as investors have made an aggressive push for yield. ...

Risk transfer mechanisms

... Protection buyers: – Capacity/Premiums: Alternative to traditional reinsurance when insurance cycle hardens. – Diversification effects: Shedding risks to financial markets in areas where exposures are over-concentrated. – Counterparty risks: Solution via special purpose vehicles offers lower counter ...

... Protection buyers: – Capacity/Premiums: Alternative to traditional reinsurance when insurance cycle hardens. – Diversification effects: Shedding risks to financial markets in areas where exposures are over-concentrated. – Counterparty risks: Solution via special purpose vehicles offers lower counter ...

MainStay Cushing® Renaissance Advantage Fund

... participants. The lack of an active trading market may make it difficult to obtain an accurate price for a security. As a result, an investor could pay more than the market value when buying Fund shares or receive less than the market value when selling Fund shares. Small- and mid-cap stocks are oft ...

... participants. The lack of an active trading market may make it difficult to obtain an accurate price for a security. As a result, an investor could pay more than the market value when buying Fund shares or receive less than the market value when selling Fund shares. Small- and mid-cap stocks are oft ...

Experience - Berkshire Asset Management, LLC

... For illustrative purposes only. Holdings, sector weightings, market capitalization and portfolio characteristics are based on representative portfolio and are subject to change at any time. Holdings, sector weightings, market capitalization and portfolio characteristics of individual client portfoli ...

... For illustrative purposes only. Holdings, sector weightings, market capitalization and portfolio characteristics are based on representative portfolio and are subject to change at any time. Holdings, sector weightings, market capitalization and portfolio characteristics of individual client portfoli ...

Triloma EIG Global Energy Funds Participate in First Privately

... floating rate and secured by a first lien security interest in substantially all of the assets of Crown. Previously, the U.S. Securities and Exchange Commission granted the Funds an order for exemptive relief, allowing them to co-invest in portfolio companies with each other and with affiliated inve ...

... floating rate and secured by a first lien security interest in substantially all of the assets of Crown. Previously, the U.S. Securities and Exchange Commission granted the Funds an order for exemptive relief, allowing them to co-invest in portfolio companies with each other and with affiliated inve ...

Form of Press Releases to be issued via the primary

... CHARLOTTE, N.C.– (BUSINESS WIRE) – January 19, 2016 – Bank of America Company (the "Corporation") informed its securities holders that it has filed a Current Report on Form 8-K with the U.S. Securities and Exchange Commission ("SEC") on January 19, 2016, announcing financial results for the fourth q ...

... CHARLOTTE, N.C.– (BUSINESS WIRE) – January 19, 2016 – Bank of America Company (the "Corporation") informed its securities holders that it has filed a Current Report on Form 8-K with the U.S. Securities and Exchange Commission ("SEC") on January 19, 2016, announcing financial results for the fourth q ...

Rand Water Dialogue on Climate Change DBSA Presentation

... • Finances projects and programmes that demonstrate the maximum potential for a paradigm shift towards low-carbon and climate-resilient sustainable development • Provides minimum concessional funding (i.e. a grant-equivalent subsidy element) necessary to make a project or programme viable. • Financi ...

... • Finances projects and programmes that demonstrate the maximum potential for a paradigm shift towards low-carbon and climate-resilient sustainable development • Provides minimum concessional funding (i.e. a grant-equivalent subsidy element) necessary to make a project or programme viable. • Financi ...

Be Careful of What You Think You Know

... (or yen, or euro). For example, ECB rules state that they cannot buy bonds that trade at yields lower than their -0.40% deposit facility. That rules out much of the German yield curve, forcing the ECB to buy longer maturities. Additionally, national finance ministries are issuing longer dated securi ...

... (or yen, or euro). For example, ECB rules state that they cannot buy bonds that trade at yields lower than their -0.40% deposit facility. That rules out much of the German yield curve, forcing the ECB to buy longer maturities. Additionally, national finance ministries are issuing longer dated securi ...

RECESSIONS, DEPRESSIONS, DEFLATION, INFLATION

... been providing quality investment services since 1983, and currently manages over $170 million in assets. We specialize in providing disciplined investment strategies and comprehensive retirement planning solutions. Our goal is to provide the highest quality investment and planning services availabl ...

... been providing quality investment services since 1983, and currently manages over $170 million in assets. We specialize in providing disciplined investment strategies and comprehensive retirement planning solutions. Our goal is to provide the highest quality investment and planning services availabl ...

Asian Bonds Still Sitting Pretty - March 2013

... can be overweight on safer currencies such as the Hong Kong Dollar and the Singapore Dollar in times of market uncertainty, and be overweight on higher beta currencies such as the Korean Won and the Malaysian Ringgit when risk appetite is supportive. All said, the benefits of investing in bonds are ...

... can be overweight on safer currencies such as the Hong Kong Dollar and the Singapore Dollar in times of market uncertainty, and be overweight on higher beta currencies such as the Korean Won and the Malaysian Ringgit when risk appetite is supportive. All said, the benefits of investing in bonds are ...

Fossil fuel investments cost major funds billions

... TORONTO, CANADA -- Corporate Knights, together with 350.org and South Pole Group, has launched the Clean Capitalist Decarbonizer, an interactive tool that allows users to determine the financial impact of divesting from carbon heavy companies. Using this first-of-its kind tool, Corporate Knights a ...

... TORONTO, CANADA -- Corporate Knights, together with 350.org and South Pole Group, has launched the Clean Capitalist Decarbonizer, an interactive tool that allows users to determine the financial impact of divesting from carbon heavy companies. Using this first-of-its kind tool, Corporate Knights a ...

www.topproducerwebsite.com

... offer to buy or sell any security or investment product. This material is not to be construed as providing investment services in any jurisdiction where such offers or solicitation would be illegal. Opinions and estimates are as of a certain date and subject to change without notice. You should be a ...

... offer to buy or sell any security or investment product. This material is not to be construed as providing investment services in any jurisdiction where such offers or solicitation would be illegal. Opinions and estimates are as of a certain date and subject to change without notice. You should be a ...

Marble Harbor Investment Counsel, LLC Excerpt from Fourth

... valuations are fair, bond yields look more attractive compared to both inflation and equities. A migration from stocks into bonds could bring down markets from their Olympian heights. ...

... valuations are fair, bond yields look more attractive compared to both inflation and equities. A migration from stocks into bonds could bring down markets from their Olympian heights. ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.

![here [PDF 930KB]](http://s1.studyres.com/store/data/015583737_1-d7b211cd32cfe2b3ea9542c07b5cf992-300x300.png)