Threadneedle UK Select Fund

... * 4% defaults with a 40% assumed recovery rate ** 2% defaults with a 40% assumed recovery rate *** 1% defaults with a 40% assumed recovery rate ...

... * 4% defaults with a 40% assumed recovery rate ** 2% defaults with a 40% assumed recovery rate *** 1% defaults with a 40% assumed recovery rate ...

Blackstone Alternative Multi

... well as other investments. BXMIX’s investments involve special risks including, but not limited to, loss of all or a significant portion of the investment due to leveraging, short-selling, or other speculative practices, lack of liquidity and volatility of returns. The following is a summary descrip ...

... well as other investments. BXMIX’s investments involve special risks including, but not limited to, loss of all or a significant portion of the investment due to leveraging, short-selling, or other speculative practices, lack of liquidity and volatility of returns. The following is a summary descrip ...

MLM - Student Managed Fund

... Martin Marietta Materials is well positioned to benefit from the housing market recovery while more stable government projects provide steady growth. They are well protected from new entrants to the market since it is very hard to open new quarries due to zoning and environmental regulations. They a ...

... Martin Marietta Materials is well positioned to benefit from the housing market recovery while more stable government projects provide steady growth. They are well protected from new entrants to the market since it is very hard to open new quarries due to zoning and environmental regulations. They a ...

Stocks-Bonds - Model Capital Management LLC

... desired portfolio exposures primarily with low-cost index ETFs. We select ETFs that meet our criteria of large AUM size, high liquidity, and low fees. We are not limited to any particular ETF sponsor. Most ETFs currently approved have expense ratios below 0.2%. Our choice of ...

... desired portfolio exposures primarily with low-cost index ETFs. We select ETFs that meet our criteria of large AUM size, high liquidity, and low fees. We are not limited to any particular ETF sponsor. Most ETFs currently approved have expense ratios below 0.2%. Our choice of ...

Ontario District Commercial Banking Presentation to: Ontario North

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

... • We are still lending money for commercial real estate! • Bank debt syndication market and the securitization vehicles that became popular a few years back has dried up on larger mortgage deals Our lending policies for both owner occupied and investment properties have not changed due to current ec ...

Presentation title here in Arial 32pt

... – Your asset allocation is what matters most – so make it your main focus – Be obsessive about risk, and the returns will look after themselves – Risk and return objectives should be ‘real’, not ‘relative’ – Be capital efficient when matching your liabilities ...

... – Your asset allocation is what matters most – so make it your main focus – Be obsessive about risk, and the returns will look after themselves – Risk and return objectives should be ‘real’, not ‘relative’ – Be capital efficient when matching your liabilities ...

FSI Statement on Introduction of Senate Regulatory Reform

... “This provision is a reasonable compromise that will ensure that the interests of all stakeholders in this debate, but most importantly the interests of small investors, are carefully considered before final rules are implemented,” said Dale E. Brown, President & CEO of FSI. “As the delivery of fina ...

... “This provision is a reasonable compromise that will ensure that the interests of all stakeholders in this debate, but most importantly the interests of small investors, are carefully considered before final rules are implemented,” said Dale E. Brown, President & CEO of FSI. “As the delivery of fina ...

FINANCIAL REPORTING PERFORMANCE GOALS

... An independent public accounting firm will be employed to perform an annual audit of all Funds, Authorities, Agencies and Grant Programs, And the annual audited report will be made available to the general public, bond and financial consultants, and other interested citizens and organizations. The a ...

... An independent public accounting firm will be employed to perform an annual audit of all Funds, Authorities, Agencies and Grant Programs, And the annual audited report will be made available to the general public, bond and financial consultants, and other interested citizens and organizations. The a ...

Reasons Young Americans Won`t Be Ready For Retirement

... Adjust your risk level to fit your tolerance by varying your allocation between the risky (stocks and hard assets) and the more stable (bonds and cash) asset classes. Although it may make you uncomfortable, taking some risk may be essential. Historically the trade-off for fluctuations in portfolio v ...

... Adjust your risk level to fit your tolerance by varying your allocation between the risky (stocks and hard assets) and the more stable (bonds and cash) asset classes. Although it may make you uncomfortable, taking some risk may be essential. Historically the trade-off for fluctuations in portfolio v ...

U3A Horsley Money Matters Group

... • Your cash may not be lent straight away, and • There's no savings safety guarantee (no £85,000) • All trade body members are required to have insurance to cover a site going bust – but will it work in practice? Source: Moneysavingexpert website ...

... • Your cash may not be lent straight away, and • There's no savings safety guarantee (no £85,000) • All trade body members are required to have insurance to cover a site going bust – but will it work in practice? Source: Moneysavingexpert website ...

The Fed`s 405% problem

... The fact that investors still overreact to global events shows that Emerging Markets is still misunderstood in many quarters. The actual fall-out from three months of severe outflows, currency volatility, sovereign spread widening, rising domestic bond yields, monetary policy tightening and fiscal r ...

... The fact that investors still overreact to global events shows that Emerging Markets is still misunderstood in many quarters. The actual fall-out from three months of severe outflows, currency volatility, sovereign spread widening, rising domestic bond yields, monetary policy tightening and fiscal r ...

TVAM Fund Presentati..

... The devaluation of VND is currently considered as one of key concerns for Vietnam in coming years under intensive pressure of stronger USD and weaker CNY. The continuous decline of VND in future, if are not well controlled, will take a negative impact on Vietnam’s macro economy as it may affects for ...

... The devaluation of VND is currently considered as one of key concerns for Vietnam in coming years under intensive pressure of stronger USD and weaker CNY. The continuous decline of VND in future, if are not well controlled, will take a negative impact on Vietnam’s macro economy as it may affects for ...

Broken Promises Insolvency in Defined Benefit Funds

... Yes, a defined benefit fund has a number of risks which could create a deficit • poor investment returns • higher than expected salary increases • pensioners living too long • more people choosing pensions • higher then expected inflation (indexed pensions) • large number of people resigning when th ...

... Yes, a defined benefit fund has a number of risks which could create a deficit • poor investment returns • higher than expected salary increases • pensioners living too long • more people choosing pensions • higher then expected inflation (indexed pensions) • large number of people resigning when th ...

B. Quantitative Criteria

... Commitments must be represented by a signed letter of intent by each investor whose commitment may only be subject to legal due diligence, Fond-ICO Global’s commitment in the new fund or the first closing taking place. Portfolio contributions, as well as any other non-monetary contribution, will not ...

... Commitments must be represented by a signed letter of intent by each investor whose commitment may only be subject to legal due diligence, Fond-ICO Global’s commitment in the new fund or the first closing taking place. Portfolio contributions, as well as any other non-monetary contribution, will not ...

Seminar in Financial Management

... The main reason for employing real option approach instead of traditional models of capital budgeting under uncertainty are the introduction of managerial flexibility in light of irreversibility and the possibility to abstract ...

... The main reason for employing real option approach instead of traditional models of capital budgeting under uncertainty are the introduction of managerial flexibility in light of irreversibility and the possibility to abstract ...

Presentation to a conference celebrating Professor Rachel McCulloch: “Is... Optimal in the 21

... these funds fully understand the complexities of the investment strategies pursued by fund managers and the risks to which they are exposed. In foreign markets, investor demand for emerging market assets has continued to expand, with inflows into dedicated bond and equity funds in those countries, i ...

... these funds fully understand the complexities of the investment strategies pursued by fund managers and the risks to which they are exposed. In foreign markets, investor demand for emerging market assets has continued to expand, with inflows into dedicated bond and equity funds in those countries, i ...

Existe-t-il une relation entre l*information sectorielle et le tableau

... primarily in the real estate business should adopt the cost model to measure their investment property in order to avoid the procyclical effect of fair value. Hypothesis 2: Fair Value may have a pro-cyclical effect, allowing better KPIs (Key Performance Indicators) through profitability, rentabili ...

... primarily in the real estate business should adopt the cost model to measure their investment property in order to avoid the procyclical effect of fair value. Hypothesis 2: Fair Value may have a pro-cyclical effect, allowing better KPIs (Key Performance Indicators) through profitability, rentabili ...

Financial Market Infrastructures The Asia Pacific Financial Forum

... The Asia Pacific Financial Forum (APFF) Seattle Symposium, 7 July 2014 ...

... The Asia Pacific Financial Forum (APFF) Seattle Symposium, 7 July 2014 ...

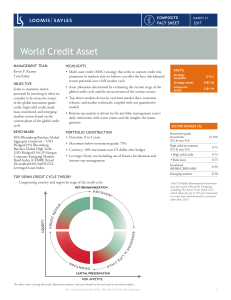

World Credit Asset

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

... The World Credit Asset Composite includes all discretionary accounts with market values greater than $75 million managed by Loomis Sayles that seek to maximize risk-adjusted returns by allocating across the credit spectrum based on macro analysis of economic regimes and the global credit cycle. Acce ...

Will shares produce highest returns long-term?

... because of the interconnections and uncertainty. It will however, always “try” to be in “balance”. From time to time, the allocation of economic activity will get out of balance; interest rates will rise too high, or wages will go up too fast. In each case, the immediate result is lower residual pro ...

... because of the interconnections and uncertainty. It will however, always “try” to be in “balance”. From time to time, the allocation of economic activity will get out of balance; interest rates will rise too high, or wages will go up too fast. In each case, the immediate result is lower residual pro ...

in GDP

... Total inflow of foreign investment was reduced by 31.7% Highest value of FDI is in amount of KM 117 million which is investment capital from Austria. Investors which invested more in 2005 compared to 2004 are: Slovenia, Turky and USA. Regarding the sectorial structure the highest investment were rec ...

... Total inflow of foreign investment was reduced by 31.7% Highest value of FDI is in amount of KM 117 million which is investment capital from Austria. Investors which invested more in 2005 compared to 2004 are: Slovenia, Turky and USA. Regarding the sectorial structure the highest investment were rec ...

IB SL WORD PROBLEMS Population of animals, people and

... Find how long, to the nearest second, it takes for half of the initial amount of liquid to flow out of the tank. ...

... Find how long, to the nearest second, it takes for half of the initial amount of liquid to flow out of the tank. ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.