Crisis Alpha and Risk in Alternative Investment

... in Alternative Investments can be divided into three main types of risk: price risk, credit risk, and liquidity risk. Strategies which take on price risk seem more likely to provide crisis alpha whereas those which take on credit risk and liquidity risk suffer losses during equity market crisis. Tab ...

... in Alternative Investments can be divided into three main types of risk: price risk, credit risk, and liquidity risk. Strategies which take on price risk seem more likely to provide crisis alpha whereas those which take on credit risk and liquidity risk suffer losses during equity market crisis. Tab ...

Thoughts on Rising Interest Rates

... by less than current expectations •• Rising interest rates are not a major threat to traditional bonds or real estate investments, though both areas require thoughtful strategies to manage through tightening monetary policy •• In contrast, we are less constructive on Real Estate Investment Trusts (R ...

... by less than current expectations •• Rising interest rates are not a major threat to traditional bonds or real estate investments, though both areas require thoughtful strategies to manage through tightening monetary policy •• In contrast, we are less constructive on Real Estate Investment Trusts (R ...

Job Type Description – Template

... determine the amount of Capital required to absorb the earnings impact from a severe and adverse change in market risk factors. • Risk management oversight includes economic and earnings at risk. Risk factor coverage includes broad definition of interest rate risk: yield curve risk, basis risk (teno ...

... determine the amount of Capital required to absorb the earnings impact from a severe and adverse change in market risk factors. • Risk management oversight includes economic and earnings at risk. Risk factor coverage includes broad definition of interest rate risk: yield curve risk, basis risk (teno ...

Risk

... variance. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. ...

... variance. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. ...

Law for Business - Matawan-Aberdeen Regional School District

... variance. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. ...

... variance. Standard deviation is also known as historical volatility and is used by investors as a gauge for the amount of expected volatility. ...

The Dynamics of Business Investment Following Banking Crises

... I start by estimating equation (1), which does not differentiate between normal recessions and banking crises, and find that there is evidence that growth in business investments in recoveries is moderately stronger the deeper the previous recession was. The parameter estima ...

... I start by estimating equation (1), which does not differentiate between normal recessions and banking crises, and find that there is evidence that growth in business investments in recoveries is moderately stronger the deeper the previous recession was. The parameter estima ...

Changes in the investor base for Emerging Market public debt: What

... driven by the search for yield in a world where interest rates are low and central banks in the major high-income countries follow expansionary monetary policies to stimulate growth. The emergence of EB debt as a viable asset class took place with the view that many EMs had seen significant improvem ...

... driven by the search for yield in a world where interest rates are low and central banks in the major high-income countries follow expansionary monetary policies to stimulate growth. The emergence of EB debt as a viable asset class took place with the view that many EMs had seen significant improvem ...

Competitive aspects of foreign markets appear attractive

... because you have seen a lot of that happen already in 2014. It’s interesting to look even a little bit deeper. China is the biggest emerging market. They have two stock exchanges in China. One is the Shenzhen Stock Market and the other is the Shanghai Stock Market. The Shanghai Stock Market was one ...

... because you have seen a lot of that happen already in 2014. It’s interesting to look even a little bit deeper. China is the biggest emerging market. They have two stock exchanges in China. One is the Shenzhen Stock Market and the other is the Shanghai Stock Market. The Shanghai Stock Market was one ...

Emerging Market Finance

... (esp. Taiwan and India (e.g. Infosys on NASDAQ often trades at a 30% premium to Mumbai SE)) ...

... (esp. Taiwan and India (e.g. Infosys on NASDAQ often trades at a 30% premium to Mumbai SE)) ...

Our investment process - Close Brothers Asset Management

... by fundamental analysis and bottom-up security selection. We focus on liquid, alternative investments such as property, infrastructure, commodities and absolute return funds. Investors with a higher risk tolerance tend to have a larger allocation to equities and alternatives and more international e ...

... by fundamental analysis and bottom-up security selection. We focus on liquid, alternative investments such as property, infrastructure, commodities and absolute return funds. Investors with a higher risk tolerance tend to have a larger allocation to equities and alternatives and more international e ...

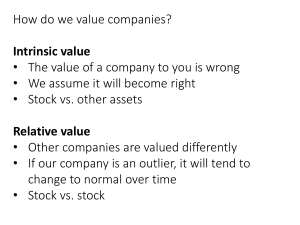

Relative value

... Issues in Using Enterprise Value Multiples EV = Market Value of Stock + Debt – Cash – Investments Justified EV/EBITDA • Positively related to FCFF growth • Positively related to ROIC • Negatively related to WACC ...

... Issues in Using Enterprise Value Multiples EV = Market Value of Stock + Debt – Cash – Investments Justified EV/EBITDA • Positively related to FCFF growth • Positively related to ROIC • Negatively related to WACC ...

PRESENTATION TO HE DARWISH ISMA`EEL ALI AL BALUSHI

... THE GOAL (10 yrs.) 1. Achieve profitability from year 2 2. Target 500,0001 students over 10 yrs. 3. Multiplier difficult to estimate - ‘goal’: ...

... THE GOAL (10 yrs.) 1. Achieve profitability from year 2 2. Target 500,0001 students over 10 yrs. 3. Multiplier difficult to estimate - ‘goal’: ...

schroders liquid alternatives br en

... While investment portfolios have traditionally been built around bonds and equities, there is a growing body of research that shows how the introduction of an allocation to liquid alternative investments can serve to improve returns and reduce risk over the long term. Since 2008, as Figure 1 illustr ...

... While investment portfolios have traditionally been built around bonds and equities, there is a growing body of research that shows how the introduction of an allocation to liquid alternative investments can serve to improve returns and reduce risk over the long term. Since 2008, as Figure 1 illustr ...

Changing Causes of the US Trade Deficit

... shortfall of U.S. saving in the 2000s was roughly the same as the 1990s even though the borrowing needs of the private sector were much diminished. It also meant that long-term interest rates did not fall as much as they otherwise would have.4 Investors choose where to invest based on the (risk-adju ...

... shortfall of U.S. saving in the 2000s was roughly the same as the 1990s even though the borrowing needs of the private sector were much diminished. It also meant that long-term interest rates did not fall as much as they otherwise would have.4 Investors choose where to invest based on the (risk-adju ...

Which of the following arguments about purchasing

... A. Net exports increase by the same amount as the amount of foreign direct investment made on Slovakian plants. B. Supply of US dollar in foreign exchange market will not be affected because US monetary policy has not changed. C. Net foreign portfolio investment will increase due to a rise in real i ...

... A. Net exports increase by the same amount as the amount of foreign direct investment made on Slovakian plants. B. Supply of US dollar in foreign exchange market will not be affected because US monetary policy has not changed. C. Net foreign portfolio investment will increase due to a rise in real i ...

Latest bill text (Draft #1)

... debt liability and related funds of state government, including all revenue bonds issued by or approved by the State Property and Buildings Commission. Accounts necessary to assure integrity of trust indentures shall be maintained. Funds appropriated for debt service shall be allotted to these accou ...

... debt liability and related funds of state government, including all revenue bonds issued by or approved by the State Property and Buildings Commission. Accounts necessary to assure integrity of trust indentures shall be maintained. Funds appropriated for debt service shall be allotted to these accou ...

Investment Promotion Manual

... The tourism-related investment laws and incentives are discussed in brief. Updating occurs together with the yearly revision of the Investment Priorities Plan (IPP) which lists the type of activities and areas extended incentives under Executive Order No. 226, otherwise known as the Omnibus Investme ...

... The tourism-related investment laws and incentives are discussed in brief. Updating occurs together with the yearly revision of the Investment Priorities Plan (IPP) which lists the type of activities and areas extended incentives under Executive Order No. 226, otherwise known as the Omnibus Investme ...

Constructing investment strategy portfolios by

... To solve a problem with genetic algorithms, an encoding mechanism must first be designed to represent each solution as a chromosome, e.g., a binary string. A fitness function is also required to measure the goodness of a chromosome. Genetic algorithms search the solution space using a population which ...

... To solve a problem with genetic algorithms, an encoding mechanism must first be designed to represent each solution as a chromosome, e.g., a binary string. A fitness function is also required to measure the goodness of a chromosome. Genetic algorithms search the solution space using a population which ...

F 385627 15 PaceUniversity FS

... estimation of the fair value of investments in investment companies for which the investment does not have a readily determinable fair value, using net asset value per share or its equivalent, as reported by the University’s external investment managers. The University invests in various investment ...

... estimation of the fair value of investments in investment companies for which the investment does not have a readily determinable fair value, using net asset value per share or its equivalent, as reported by the University’s external investment managers. The University invests in various investment ...

Preferred Securities: A Tax-Advantaged Alternative to Muni Bonds

... bonds, including credit risk and interest-rate risk. As nearly all preferred securities have issuer call options, call risk and reinvestment risk are also important considerations. In addition, investors face equity-like risks, such as deferral or omission of distributions, subordination to bonds an ...

... bonds, including credit risk and interest-rate risk. As nearly all preferred securities have issuer call options, call risk and reinvestment risk are also important considerations. In addition, investors face equity-like risks, such as deferral or omission of distributions, subordination to bonds an ...

Factsheet 2014 Annual

... focus on reform and innovation as two main themes Deputy General Manager in March 2002. Currently also within its businesses, and continue to drive human serves as Director at Shangsan Co., Development Co., and Vice Chairman at Zheshang Securities resource improvements going forward. ...

... focus on reform and innovation as two main themes Deputy General Manager in March 2002. Currently also within its businesses, and continue to drive human serves as Director at Shangsan Co., Development Co., and Vice Chairman at Zheshang Securities resource improvements going forward. ...

What should a well-designed and well

... 2. Is there an established process for screening of project proposals for basic consistency with government policy and strategic guidance? Is this process effective? What proportion of projects so screened are rejected? 3. Is there a formal appraisal process for more detailed evaluation of public in ...

... 2. Is there an established process for screening of project proposals for basic consistency with government policy and strategic guidance? Is this process effective? What proportion of projects so screened are rejected? 3. Is there a formal appraisal process for more detailed evaluation of public in ...

Foreign Direct Investment and Transnational Corporations in the

... agency seated in the capital city of Bratislava. In following years SARIO provided significant institutional support for foreign investors. Under the care of SARIO there were many investment projects in automotive sector, in electronics, in chemistry, rubber and plastics and in machinery implemented ...

... agency seated in the capital city of Bratislava. In following years SARIO provided significant institutional support for foreign investors. Under the care of SARIO there were many investment projects in automotive sector, in electronics, in chemistry, rubber and plastics and in machinery implemented ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.