NYSE National, Inc. Schedule of Fees and Rebates As Of

... MDR credit (in such percent as is specified above) of the market data revenue attributable to such ETP Holder’s executions and displayed quotes in securities priced at $1.00 or greater. b) Adjustments. To the extent market data revenue from Tape “A”, "B" or “C” securities transactions is subject to ...

... MDR credit (in such percent as is specified above) of the market data revenue attributable to such ETP Holder’s executions and displayed quotes in securities priced at $1.00 or greater. b) Adjustments. To the extent market data revenue from Tape “A”, "B" or “C” securities transactions is subject to ...

What is a Supported Residents September 2016

... Moving into aged care can be financially complex, with many families particularly concerned about their ability to fund their access to an aged care facility. Aged care is tightly legislated by the Commonwealth Government, with criteria in place for residents deemed to be of reduced financial means. ...

... Moving into aged care can be financially complex, with many families particularly concerned about their ability to fund their access to an aged care facility. Aged care is tightly legislated by the Commonwealth Government, with criteria in place for residents deemed to be of reduced financial means. ...

Buying with a margin of safety in fixed income

... safety is defined as the spread or yield above inflation. We always want to achieve a yield above inflation (a real yield), adjusted for the level of risk. Yield can be generated in many forms, but it is important to always ask at what level of risk this is being offered. Fixed income asset prices h ...

... safety is defined as the spread or yield above inflation. We always want to achieve a yield above inflation (a real yield), adjusted for the level of risk. Yield can be generated in many forms, but it is important to always ask at what level of risk this is being offered. Fixed income asset prices h ...

Savings and Investing Common Forms of Investments

... liquid—it can be bought or sold at any time on the open market. Preferred Stock Preferred stock has advantages over common stock due to the payment of fixed rate dividends. Shareholders have no voting privileges, and stock prices tend to be more stable. This type of stock is also liquid. Blue chip c ...

... liquid—it can be bought or sold at any time on the open market. Preferred Stock Preferred stock has advantages over common stock due to the payment of fixed rate dividends. Shareholders have no voting privileges, and stock prices tend to be more stable. This type of stock is also liquid. Blue chip c ...

9 BMO Guardian Global High Yield Bond Fund Advisor Series

... ®Registered trade-mark of Bank of Montreal, used under licence. For information only. The information contained herein is not, and should not be construed as investment advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice sho ...

... ®Registered trade-mark of Bank of Montreal, used under licence. For information only. The information contained herein is not, and should not be construed as investment advice to any party. Investments should be evaluated relative to the individual’s investment objectives and professional advice sho ...

Stepping In Where Larger Prime Brokers Step Back

... funds decline in recent quarters. Asset returns have been up, but I think this general trend of money flowing out of active investment into passive investment is going to continue for a little bit. So there are some headwinds for the hedge fund industry in general. The challenge for the smaller mana ...

... funds decline in recent quarters. Asset returns have been up, but I think this general trend of money flowing out of active investment into passive investment is going to continue for a little bit. So there are some headwinds for the hedge fund industry in general. The challenge for the smaller mana ...

Focusing on Long-Term Return Objectives in a Low Return World

... outstanding such that entities with the largest borrowing needs receive the largest index weights. As a result, the amount of U.S. Treasury debt in these indexes has steadily moved higher in recent years. At the same time, the duration (interest rate sensitivity) of these indexes has also increased ...

... outstanding such that entities with the largest borrowing needs receive the largest index weights. As a result, the amount of U.S. Treasury debt in these indexes has steadily moved higher in recent years. At the same time, the duration (interest rate sensitivity) of these indexes has also increased ...

The totalising market and the Marxist theory of the state NB: This is a

... disavowed the instrumentalist idea that the state works at the behest of the capitalist class, interpreting Marx and Engels’s ‘managing committee’ remarks as indicating precisely that the state could detach from these individual interests and act to bolster the class as a whole. For Miliband, there ...

... disavowed the instrumentalist idea that the state works at the behest of the capitalist class, interpreting Marx and Engels’s ‘managing committee’ remarks as indicating precisely that the state could detach from these individual interests and act to bolster the class as a whole. For Miliband, there ...

Enrollment - Retirement Plan Consultants

... – There are no age requirements for participation, and all full- and part-time employees are eligible. Auto-Enrollment • Full-time employees with [insert years] or more year of service must contribute [enter %] of their annual salary. ...

... – There are no age requirements for participation, and all full- and part-time employees are eligible. Auto-Enrollment • Full-time employees with [insert years] or more year of service must contribute [enter %] of their annual salary. ...

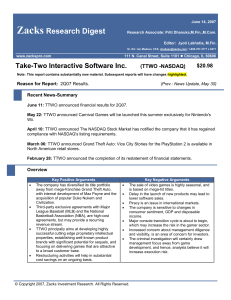

TTWO -NASDAQ

... On June 11, 2007, TTWO announced financial results for 2Q07. In 2Q07, revenue was $205.4 million, and reported loss per share was $0.71. The results continued to be adversely impacted by the video game industry's transition from current generation to next-generation platforms. On May 22, 2007, TTWO ...

... On June 11, 2007, TTWO announced financial results for 2Q07. In 2Q07, revenue was $205.4 million, and reported loss per share was $0.71. The results continued to be adversely impacted by the video game industry's transition from current generation to next-generation platforms. On May 22, 2007, TTWO ...

Financial Statements Dartmouth General Hospital Charitable

... financial instruments subsequently measured at cost or amortized cost, fair value is adjusted by the amount of the related financing fees and transaction costs. Transaction costs and financing fees relating to financial instruments that are measured subsequently at fair value are recognized in opera ...

... financial instruments subsequently measured at cost or amortized cost, fair value is adjusted by the amount of the related financing fees and transaction costs. Transaction costs and financing fees relating to financial instruments that are measured subsequently at fair value are recognized in opera ...

CHAPTER 6 Risk, Return, and the Capital Asset Pricing Model 1

... Market risk is that part of a security’s stand-alone risk that cannot be eliminated by diversification. Firm-specific, or diversifiable, risk is that part of a security’s stand-alone risk that can be eliminated by diversification. ...

... Market risk is that part of a security’s stand-alone risk that cannot be eliminated by diversification. Firm-specific, or diversifiable, risk is that part of a security’s stand-alone risk that can be eliminated by diversification. ...

Special_Economix_Zone_Lodz

... a total exemption from Corporate Income Tax (CIT) from the activity conducted within the Zone’s area. ...

... a total exemption from Corporate Income Tax (CIT) from the activity conducted within the Zone’s area. ...

McFall

... Gross Value Add (GVA) by EU copyright industry sectors as a % of total GDP, 2000 & 2008 estimate** ...

... Gross Value Add (GVA) by EU copyright industry sectors as a % of total GDP, 2000 & 2008 estimate** ...

Final Results - caledonian trust plc

... recognition. Thus the current level of subsidy from the Group is not necessary for the charity's purposes, and, indeed, a transition, carefully modulated to ensure possible deleterious effects are mitigated, will allow the charity to develop into an organisation that can support its causes amongst a ...

... recognition. Thus the current level of subsidy from the Group is not necessary for the charity's purposes, and, indeed, a transition, carefully modulated to ensure possible deleterious effects are mitigated, will allow the charity to develop into an organisation that can support its causes amongst a ...

Impact Investing: How does it make a difference?

... the 2014 World Economic Forum in Davos showed that 79 percent of money managers running impact funds believe they can deliver an at market return for investors. Having said this, financial returns from impact investments can vary just like any other investment: from return of principal to above-mark ...

... the 2014 World Economic Forum in Davos showed that 79 percent of money managers running impact funds believe they can deliver an at market return for investors. Having said this, financial returns from impact investments can vary just like any other investment: from return of principal to above-mark ...

FEDERAL BUDGET 2005-2005

... operated through a Life Insurance Company. • The Pension Fund so formed can invest in the ‘Capital Markets’. • Tax concessions have been provided for ‘Contributions’ (investments) and ‘Return’ on investment, whereas, ‘Benefits’ arising from investment are deemed to be taxable. • The system does not ...

... operated through a Life Insurance Company. • The Pension Fund so formed can invest in the ‘Capital Markets’. • Tax concessions have been provided for ‘Contributions’ (investments) and ‘Return’ on investment, whereas, ‘Benefits’ arising from investment are deemed to be taxable. • The system does not ...

small and medium-sized enterprises` access to finance

... Equity financing is essential for innovative firms that have the potential for rapid growth and are willing to accept outside equity investors. These firms are in a small minority, but have the potential to grow into large companies. Overall, equity financing is used by 3 % of European SMEs. Innovat ...

... Equity financing is essential for innovative firms that have the potential for rapid growth and are willing to accept outside equity investors. These firms are in a small minority, but have the potential to grow into large companies. Overall, equity financing is used by 3 % of European SMEs. Innovat ...

You Can See Where This is Going

... Life was abjectly miserable for almost everyone 300 years ago. And misery in your own life limits how much mental bandwidth you have for sympathy toward others. Animal welfare barely registered as relevant when the health of your own children was so tenuous, and famine and plague lurked around every ...

... Life was abjectly miserable for almost everyone 300 years ago. And misery in your own life limits how much mental bandwidth you have for sympathy toward others. Animal welfare barely registered as relevant when the health of your own children was so tenuous, and famine and plague lurked around every ...

How are infrastructure stocks affected by rising interest rates?

... Looking at interest-rate sensitivity in Exhibit 2, electric utilities are at the top end of the spectrum due to their relatively bond-like cash flows and high dividend yields. However, high yields do not automatically equate to high rate sensitivity. For example, while ...

... Looking at interest-rate sensitivity in Exhibit 2, electric utilities are at the top end of the spectrum due to their relatively bond-like cash flows and high dividend yields. However, high yields do not automatically equate to high rate sensitivity. For example, while ...

Factors behind Japan`s sluggish capital investment growth

... capital investment in nominal terms in the latest available FY2014 figures stood at 68.4 trillion yen, which was down over 10% from 76.8 trillion yen recorded in FY2007. Even though capital investment should reach the FY2015 70 trillion yen target in the Japan Revitalization Strategy, this would sti ...

... capital investment in nominal terms in the latest available FY2014 figures stood at 68.4 trillion yen, which was down over 10% from 76.8 trillion yen recorded in FY2007. Even though capital investment should reach the FY2015 70 trillion yen target in the Japan Revitalization Strategy, this would sti ...

Annex V-CD REITS - Uganda Securities Exchange

... ‟real estate investment trust” means a trust established for investment in real estate but does not include an exempted real estate investment trust; ‟real estate investment trust scheme” or ‟REIT scheme” means an arrangement made or established for the purposes of collective investment by persons i ...

... ‟real estate investment trust” means a trust established for investment in real estate but does not include an exempted real estate investment trust; ‟real estate investment trust scheme” or ‟REIT scheme” means an arrangement made or established for the purposes of collective investment by persons i ...

NBER WORKING PAPERS SERIES TRADE REFORMS, CREDIBILITY, AND DEVELOPMENT

... searching for the cheapest way to pull himself out of the mud by griping his own hair. The ...

... searching for the cheapest way to pull himself out of the mud by griping his own hair. The ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.