Wells Real Estate Investment Trust, Inc.

... (ii) that the proxy statement relating to the transaction violates Section 14(A), including Rule 14a-9 thereunder, and Section 20(A) of the Securities Exchange Act of 1934, based upon, allegations that the proxy statement contains false and misleading statements or omits to state material facts rela ...

... (ii) that the proxy statement relating to the transaction violates Section 14(A), including Rule 14a-9 thereunder, and Section 20(A) of the Securities Exchange Act of 1934, based upon, allegations that the proxy statement contains false and misleading statements or omits to state material facts rela ...

A Lost Art Is active management doomed?

... within the next 10 years, up from a quarter to a third of institutional investor assets in 2010. A number of large pension funds have already taken action. For example, the £10.5bn scheme sponsored by Royal Dutch Shell in the UK announced in March 2010 that it had placed an upper limit of 40% on the ...

... within the next 10 years, up from a quarter to a third of institutional investor assets in 2010. A number of large pension funds have already taken action. For example, the £10.5bn scheme sponsored by Royal Dutch Shell in the UK announced in March 2010 that it had placed an upper limit of 40% on the ...

Study on Financial Market Segmentation in China: Evidence from Stock Market

... usually get the information earlier, it's a disadvantage for H-shares investors. On the whole, domestic investors' ability to access the information is much stronger than foreign investors, to access the information of the same listed company, H-shares investors are at a disadvantaged position, and ...

... usually get the information earlier, it's a disadvantage for H-shares investors. On the whole, domestic investors' ability to access the information is much stronger than foreign investors, to access the information of the same listed company, H-shares investors are at a disadvantaged position, and ...

Diversification and Portfolio Management (Ch. 8)

... • The “risk-return tradeoff” - Risk averse investors require higher rates of return to induce them to invest in higher risk securities. ...

... • The “risk-return tradeoff” - Risk averse investors require higher rates of return to induce them to invest in higher risk securities. ...

Slide 1

... Venture Capital - A 2001 study by the National Venture Capital Association ranked Minnesota 11th in jobs created by companies originally backed by venture capital, and the second fastest-growing state for venture capital investment between 1996 and 2001. Quality of Life - Minnesota's cultural attrac ...

... Venture Capital - A 2001 study by the National Venture Capital Association ranked Minnesota 11th in jobs created by companies originally backed by venture capital, and the second fastest-growing state for venture capital investment between 1996 and 2001. Quality of Life - Minnesota's cultural attrac ...

Fluctuations of Equity Share Price of the Selected Banks in

... that in the long run influence the economy. The study says the stock markets avail long-term capital to the listed firms by pooling funds from diverse investors and permit them to expand in business and also offer investors elective speculation roads to put their surplus funds in. The paper also eva ...

... that in the long run influence the economy. The study says the stock markets avail long-term capital to the listed firms by pooling funds from diverse investors and permit them to expand in business and also offer investors elective speculation roads to put their surplus funds in. The paper also eva ...

Free Sample - Exam Test Bank Store

... because the shares are purchased for a lower price than they were sold. The investor makes a profit by buying low and selling high, but with a short sale the sale occurs first. e. The risk from a short position is the fact that the price could rise instead of falling, in which case the short seller ...

... because the shares are purchased for a lower price than they were sold. The investor makes a profit by buying low and selling high, but with a short sale the sale occurs first. e. The risk from a short position is the fact that the price could rise instead of falling, in which case the short seller ...

802.4R2 Capital Assests Management Systems Definitions

... Back trending/standard costing - an estimate of the historical original cost using a known average installed cost for like units as of the estimated addition/ acquisition date. This cost is only applied to the capital assets initially counted upon implementation of the capital assets management syst ...

... Back trending/standard costing - an estimate of the historical original cost using a known average installed cost for like units as of the estimated addition/ acquisition date. This cost is only applied to the capital assets initially counted upon implementation of the capital assets management syst ...

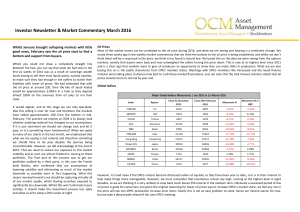

Market Commentary March 2016

... examination of corporates ability to repay their debt, and therefore we would expect credit default swaps (CDS) to widen as risks of defaults increase. Our preferred choice if we had to allocate would be to look for managers that are more focussed on both European or Asian markets where we expect li ...

... examination of corporates ability to repay their debt, and therefore we would expect credit default swaps (CDS) to widen as risks of defaults increase. Our preferred choice if we had to allocate would be to look for managers that are more focussed on both European or Asian markets where we expect li ...

synthetic zeros - SG Listed Products

... provide a way for you to assess the risk of a particular product Issuer such as Societe Generale becoming insolvent. Credit ratings are assigned by independent ratings agencies such as Standard & Poors and Moody’s. Standard & Poor’s rate companies from AAA (Most Secure/Best) to D (Most Risky/ Worst) ...

... provide a way for you to assess the risk of a particular product Issuer such as Societe Generale becoming insolvent. Credit ratings are assigned by independent ratings agencies such as Standard & Poors and Moody’s. Standard & Poor’s rate companies from AAA (Most Secure/Best) to D (Most Risky/ Worst) ...

Why SlOvAkIA - India-Central Europe Business Forum 2015

... from 1–185, with the first place being the best. Eurozone Member — One of a Few in CEE Slovakia adopted the Euro on 1 January 2009 and thus became the 16th member state of the Euro Area. The official exchange rate was 30.126 SKK/EUR. Membership in the Euro zone reduces the currency exchange risks an ...

... from 1–185, with the first place being the best. Eurozone Member — One of a Few in CEE Slovakia adopted the Euro on 1 January 2009 and thus became the 16th member state of the Euro Area. The official exchange rate was 30.126 SKK/EUR. Membership in the Euro zone reduces the currency exchange risks an ...

Introduction to Risk, Return and the Opportunity Cost of Capital

... an investment project as risky as the Standard and Poor’s Composite Index. We will suppose, to take things a bit loosely, it has the same degree of risk as the market portfolio. What rate should you use to discount this project’s forecasted cash flows? Clearly you should use the currently expected r ...

... an investment project as risky as the Standard and Poor’s Composite Index. We will suppose, to take things a bit loosely, it has the same degree of risk as the market portfolio. What rate should you use to discount this project’s forecasted cash flows? Clearly you should use the currently expected r ...

The Year Ahead in Healthcare Convertible Bonds

... Healthcare is represented through 96 convertible securities issues accounting for $40.3bn, or 19.5% of the BAML All Convertibles All Qualities Index (VXA0), making it the second largest sector in the asset class. All major healthcare industries are represented within this opportunity set (shown belo ...

... Healthcare is represented through 96 convertible securities issues accounting for $40.3bn, or 19.5% of the BAML All Convertibles All Qualities Index (VXA0), making it the second largest sector in the asset class. All major healthcare industries are represented within this opportunity set (shown belo ...

strong trading and a successful transition

... activities are overseen by a unitary Board of Directors. We have also promoted a number of talented individuals from the trading divisions to more senior positions and created two important management committees to oversee the trading business on the one hand and investments on the other. The Tradin ...

... activities are overseen by a unitary Board of Directors. We have also promoted a number of talented individuals from the trading divisions to more senior positions and created two important management committees to oversee the trading business on the one hand and investments on the other. The Tradin ...

Portfolio Theory - University of Toronto

... 3) Risk aversion 4) Assets jointly normally distributed ...

... 3) Risk aversion 4) Assets jointly normally distributed ...

1 - JustAnswer.de

... 41.) 41.) Sinking Fund Income is reported in the income statement as a.) A gain on sinking fund transaction b.) Extraordinary c.) income from operations d.) other income 42.) 42.) If bonds payable are not callable, the issuing corporation a.) must get special permission from SEC to repurchase them b ...

... 41.) 41.) Sinking Fund Income is reported in the income statement as a.) A gain on sinking fund transaction b.) Extraordinary c.) income from operations d.) other income 42.) 42.) If bonds payable are not callable, the issuing corporation a.) must get special permission from SEC to repurchase them b ...

高盛汉英词典 - 深圳市均达会计师事务所

... A monthly meeting, taking place in Paris, between the creditors of 19 countries for the purpose of discussing debt issues. Among other things, the Paris Club addresses the issue of coordinated debt relief for developing countries that cannot service their debt. ...

... A monthly meeting, taking place in Paris, between the creditors of 19 countries for the purpose of discussing debt issues. Among other things, the Paris Club addresses the issue of coordinated debt relief for developing countries that cannot service their debt. ...

model answers and marking scheme

... currency and pay in a currency or currencies that are trading at a discount to its base currency. However, in practice, government and other restrictions may not make this feasible including market-related factors and currency related issues. Forward contracts – very popular, a forward contract is a ...

... currency and pay in a currency or currencies that are trading at a discount to its base currency. However, in practice, government and other restrictions may not make this feasible including market-related factors and currency related issues. Forward contracts – very popular, a forward contract is a ...

Explaining investor preference for cash dividends

... (the way decisions are framed), affect the ultimate decision, even though the form is immaterial to the analysis. This is especially true for risky decisions. o Preferences will be defined on gains and losses rather than the final asset position o In situations with large capital gains or large capi ...

... (the way decisions are framed), affect the ultimate decision, even though the form is immaterial to the analysis. This is especially true for risky decisions. o Preferences will be defined on gains and losses rather than the final asset position o In situations with large capital gains or large capi ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.