Seeing Value in Alternative Minimum Tax (AMT) Bonds

... Covered Call investing has attracted a great deal of attention from investors searching for lowervolatility equity strategies. The risk-reducing characteristics of the covered call strategy have produced superior risk-adjusted returns over time relative to a long only approach. This paper begins by ...

... Covered Call investing has attracted a great deal of attention from investors searching for lowervolatility equity strategies. The risk-reducing characteristics of the covered call strategy have produced superior risk-adjusted returns over time relative to a long only approach. This paper begins by ...

Chapter 6: The Measurement Perspective on Decision Usefulness

... The focus of the chapter is to analyze if accounting information can be made more useful in decision-making by taking a more measurement orientated approach in financial reporting. The measurement perspective differs from the information perspective that has been presented in previous chapters. The ...

... The focus of the chapter is to analyze if accounting information can be made more useful in decision-making by taking a more measurement orientated approach in financial reporting. The measurement perspective differs from the information perspective that has been presented in previous chapters. The ...

Third Quarter Results, 2010

... Investment instruments are classified in two categories: held-to-maturity investments and instruments available-for-sale. Held-to-maturity investments include only those instruments which the Bank has the capacity and intent to hold until maturity. We currently do not have held-to-maturity investmen ...

... Investment instruments are classified in two categories: held-to-maturity investments and instruments available-for-sale. Held-to-maturity investments include only those instruments which the Bank has the capacity and intent to hold until maturity. We currently do not have held-to-maturity investmen ...

Chapter 5 - Tamu.edu

... reports to shareholders and Forms 10Q (quarterly reports), 10K (annual reports), and 8-K (special events) reports to the SEC. Press releases include a summary of the quarterly report information and are the first announcement of quarterly financial information. The quarterly reports normally present ...

... reports to shareholders and Forms 10Q (quarterly reports), 10K (annual reports), and 8-K (special events) reports to the SEC. Press releases include a summary of the quarterly report information and are the first announcement of quarterly financial information. The quarterly reports normally present ...

Stock Price - Brooklyn Public Library

... The average volume over the past three months of a stock. Knowing the average volume can help you decide when the daily volume is active enough for you to take notice ...

... The average volume over the past three months of a stock. Knowing the average volume can help you decide when the daily volume is active enough for you to take notice ...

THE WORLD AT A CROSSROADS - KBL European Private Bankers

... our overall asset allocation strategy, we recognize that ...

... our overall asset allocation strategy, we recognize that ...

fa13-Weissman

... DISCLOSURE: Neither ISI nor its affiliates beneficially own 1% or more of any class of common equity securities of the subject companies referenced in the Report. No person(s) responsible for preparing this Report or a member of his/her household serve as an officer, director or advisory board membe ...

... DISCLOSURE: Neither ISI nor its affiliates beneficially own 1% or more of any class of common equity securities of the subject companies referenced in the Report. No person(s) responsible for preparing this Report or a member of his/her household serve as an officer, director or advisory board membe ...

Analysis of IDC EMEA Top 10 announcement (prelim)

... Some work off scale (Mass Merchandisers) lower margins but more volume and lower selling costs. Others work off scope by selling a broad range of offerings. Some work off efficient asset utilization (Airlines) – covering fixed costs with “bottoms” in seats. Revenue ...

... Some work off scale (Mass Merchandisers) lower margins but more volume and lower selling costs. Others work off scope by selling a broad range of offerings. Some work off efficient asset utilization (Airlines) – covering fixed costs with “bottoms” in seats. Revenue ...

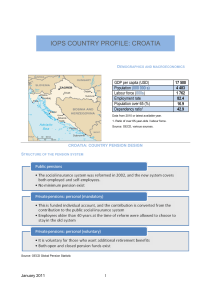

IOPS COUNTRY PROFILE: CROATIA

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

... (OMFs), which can only manage one mandatory fund each. By law, these funds must invest at least 50% of their assets in conservative government securities issued by the Republic of Croatia or the Croatian National Bank. In addition, no more than 45% of pension fund assets may be invested outside Croa ...

Permira Debt Managers appoints David Hirschmann as Head of

... Permira Debt Managers (“PDM”) is Permira’s independent debt management and advisory business. It is one of Europe’s leading specialist debt investors, advising investment funds and products which have provided more than €2.9bn of debt capital to over 100 European businesses. Wholly owned by Permira, ...

... Permira Debt Managers (“PDM”) is Permira’s independent debt management and advisory business. It is one of Europe’s leading specialist debt investors, advising investment funds and products which have provided more than €2.9bn of debt capital to over 100 European businesses. Wholly owned by Permira, ...

Nucleus Onshore Bond account

... Scottish Friendly reserves the right to defer for not more than six months the cancellation of units in a Fund which, directly or indirectly, holds assets in the form of real or heritable property, and not for more than one month in other cases. The unit prices applicable to the deferred transaction ...

... Scottish Friendly reserves the right to defer for not more than six months the cancellation of units in a Fund which, directly or indirectly, holds assets in the form of real or heritable property, and not for more than one month in other cases. The unit prices applicable to the deferred transaction ...

Financial instruments under the Connecting Europe Facility

... • Role of EU and EIB • EU determines general eligibility criteria (TEN-T Guidelines + CEF article 7) • EU helps develop project pipeline where appropriate • EIB selects specific projects using standard eligibility criteria and credit risk policies, select type of support • EU and EIB share risk, but ...

... • Role of EU and EIB • EU determines general eligibility criteria (TEN-T Guidelines + CEF article 7) • EU helps develop project pipeline where appropriate • EIB selects specific projects using standard eligibility criteria and credit risk policies, select type of support • EU and EIB share risk, but ...

B.A 5th Semester, Sub: Economics (M). Paper: 5.04 By : Surabi

... STOCK MARKET INDEX: A stock market index is a method of measuring assertion of the stock market. Many indices are cited by news or financial services firms and are used as benchmarks, to measure the performance of portfolios such as mutual funds .Alternatively, an index may also be considered as an ...

... STOCK MARKET INDEX: A stock market index is a method of measuring assertion of the stock market. Many indices are cited by news or financial services firms and are used as benchmarks, to measure the performance of portfolios such as mutual funds .Alternatively, an index may also be considered as an ...

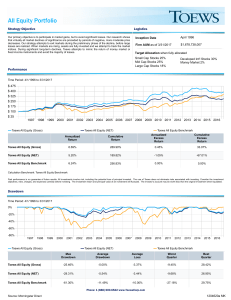

All Equity Portfolio

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

... Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal invested. The use of Toews does not eliminate risks associated with investing. Consider the investment objectives, risks, charges, and expenses carefully before investing. The ...

Important information regarding changes to the

... Deposits in the Merrill Lynch Bank Deposit Program moved from FIA to BANA, and when aggregated with other BANA deposits caused the excess over $250,000 to become uninsured. Deposits are now across two banks — BANA and BA-CA. Deposits of $300,000 are fully insured ($250,000 in BANA and $50,000 in BA- ...

... Deposits in the Merrill Lynch Bank Deposit Program moved from FIA to BANA, and when aggregated with other BANA deposits caused the excess over $250,000 to become uninsured. Deposits are now across two banks — BANA and BA-CA. Deposits of $300,000 are fully insured ($250,000 in BANA and $50,000 in BA- ...

Chapter 8 - Mississippi State University, College of Business

... Since equity earns a much higher return but with higher risk, it would be nice if we could invest and earn a high return but reduce the risk associated with such investments ...

... Since equity earns a much higher return but with higher risk, it would be nice if we could invest and earn a high return but reduce the risk associated with such investments ...

QFI CORE Model Solutions Fall 2014

... Calculate the change in σ 22 when σ 02 is decreased from 8% to 7%. Commentary on Question: A good number of candidates did well on this question. Other candidates who calculated the % change instead of arithmetic change were given full credit as long as they demonstrated clear understanding of the t ...

... Calculate the change in σ 22 when σ 02 is decreased from 8% to 7%. Commentary on Question: A good number of candidates did well on this question. Other candidates who calculated the % change instead of arithmetic change were given full credit as long as they demonstrated clear understanding of the t ...

Which Nations like BITs Best?

... two choices when determining the most profitable market to invest their capital in. Capital can be invested domestically or in a foreign market. If a domestic market is saturated then a flourishing foreign market may seem appealing. However, in an institutionally weak host country there is a high ri ...

... two choices when determining the most profitable market to invest their capital in. Capital can be invested domestically or in a foreign market. If a domestic market is saturated then a flourishing foreign market may seem appealing. However, in an institutionally weak host country there is a high ri ...

long-term portfolio guide - Responsible Investment Association

... A discussion of each action area follows in this paper. We address the management of institutional-investment portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of in ...

... A discussion of each action area follows in this paper. We address the management of institutional-investment portfolios and mutual funds, with particular focus on public equities. Investments in publicly-traded equities and bonds are the single biggest component in the collective portfolio of in ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.