Green Paper on Long-Term Financing of the European - EUR-Lex

... These features include the characteristics of the investor, the nature of the asset, the type of financial intermediation, and the valuation and pricing of the asset. For further details, see the Staff Working Paper accompanying this Green Paper. ...

... These features include the characteristics of the investor, the nature of the asset, the type of financial intermediation, and the valuation and pricing of the asset. For further details, see the Staff Working Paper accompanying this Green Paper. ...

Green Paper on Long-Term Financing of the European Economy

... These features include the characteristics of the investor, the nature of the asset, the type of financial intermediation, and the valuation and pricing of the asset. For further details, see the Staff Working Paper accompanying this Green Paper. ...

... These features include the characteristics of the investor, the nature of the asset, the type of financial intermediation, and the valuation and pricing of the asset. For further details, see the Staff Working Paper accompanying this Green Paper. ...

Chapters 1 and 2

... 3. Which goal a NFP manager selects affects the types of decisions made. A manager of a food shelter may decide to maximize the utility of contributors or donors by selecting only "healthy foods" to give to clients; or may decide that the objective is to give out the greatest volume of food possible ...

... 3. Which goal a NFP manager selects affects the types of decisions made. A manager of a food shelter may decide to maximize the utility of contributors or donors by selecting only "healthy foods" to give to clients; or may decide that the objective is to give out the greatest volume of food possible ...

University and College Union

... No comments have been made about how the current cost sharing arrangement would work within this new framework. Currently, any increase in the costs of the scheme above 23.5% triggers rules 61.10 and 73.4 on cost sharing which state that “if the JNC does not agree…how that cost…is to be addressed…th ...

... No comments have been made about how the current cost sharing arrangement would work within this new framework. Currently, any increase in the costs of the scheme above 23.5% triggers rules 61.10 and 73.4 on cost sharing which state that “if the JNC does not agree…how that cost…is to be addressed…th ...

View

... gains or losses representing governments’ ability to finance its activities are either increased or decreased. Equity method of accounting, accounts for equity and income regardless of whether income is distributed to shareholders, which in not incompliant with basic accounting principles. ...

... gains or losses representing governments’ ability to finance its activities are either increased or decreased. Equity method of accounting, accounts for equity and income regardless of whether income is distributed to shareholders, which in not incompliant with basic accounting principles. ...

Emerging Market Volatility - Columbia Threadneedle ETF

... These funds are non-diversified and, as a result, may have greater volatility than diversified funds. These funds will concentrate their investments in issuers of one or more particular industries to the same extent as the underlying index. Concentration risk results from maintaining exposure to iss ...

... These funds are non-diversified and, as a result, may have greater volatility than diversified funds. These funds will concentrate their investments in issuers of one or more particular industries to the same extent as the underlying index. Concentration risk results from maintaining exposure to iss ...

Do Dividends Still Matter? Yes—And Here`s Why

... cautious stance. Yet we are all welleducated to the need for owning equities rather than bonds alone as a hedge against inflation while we seek income for our retirement years. Dividends, if acquired from successful companies with proven staying power, tend to grow over time, whereas bond interest r ...

... cautious stance. Yet we are all welleducated to the need for owning equities rather than bonds alone as a hedge against inflation while we seek income for our retirement years. Dividends, if acquired from successful companies with proven staying power, tend to grow over time, whereas bond interest r ...

the benefits of small capitalization investing

... mutualfunds. These prospectuses outline investment objectives, risks, fees, charges and expenses, and other information that you should read and consider carefully before investing. Principal Risks Investing in mutual funds involves risk, including the possible loss of principal. Investors’ shares, ...

... mutualfunds. These prospectuses outline investment objectives, risks, fees, charges and expenses, and other information that you should read and consider carefully before investing. Principal Risks Investing in mutual funds involves risk, including the possible loss of principal. Investors’ shares, ...

Investment Account Tracking

... Perhaps you’ve had a brokerage account or a retirement fund as a benefit from an offfarm job, but haven’t used Quicken for any records associated with your investments. Maybe you have had some experience with mutual funds and decided now that you want to add individual stocks to your investment port ...

... Perhaps you’ve had a brokerage account or a retirement fund as a benefit from an offfarm job, but haven’t used Quicken for any records associated with your investments. Maybe you have had some experience with mutual funds and decided now that you want to add individual stocks to your investment port ...

Presentation

... These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

... These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

Long-Term Insurance Act: Prescribed

... "group undertaking", in relation to an insurer, means a juristic person in which the insurer alone, or with its subsidiaries or holding company, directly holds 20% or more of the shares, if the juristic person is a company, or 20% or more of any other ownership interest, if the juristic person is no ...

... "group undertaking", in relation to an insurer, means a juristic person in which the insurer alone, or with its subsidiaries or holding company, directly holds 20% or more of the shares, if the juristic person is a company, or 20% or more of any other ownership interest, if the juristic person is no ...

Chapter 8 The Money Markets

... B) of regulations that limited what banks could pay for deposits. C) of both (A) and (B) of the above. D) of neither (A) nor (B) of the above. Answer: C 2) Money market securities are A) short-term. B) low risk. C) very liquid. D) all of the above. E) only (A) and (B) of the above. Answer: D 3) Mone ...

... B) of regulations that limited what banks could pay for deposits. C) of both (A) and (B) of the above. D) of neither (A) nor (B) of the above. Answer: C 2) Money market securities are A) short-term. B) low risk. C) very liquid. D) all of the above. E) only (A) and (B) of the above. Answer: D 3) Mone ...

press release

... approximately 10% offered partial pay-downs in an average amount of 16% of the loan outstanding.(16) Finally, due to among other factors, the continued rally in secondary loan prices and increased corporate borrower access to high yield bond take-outs, the pace of below-par loan buybacks slowed noti ...

... approximately 10% offered partial pay-downs in an average amount of 16% of the loan outstanding.(16) Finally, due to among other factors, the continued rally in secondary loan prices and increased corporate borrower access to high yield bond take-outs, the pace of below-par loan buybacks slowed noti ...

Annual Financial Report as at December 31, 2010

... decline in dollar terms, with investments totalling $391 million. The average amount invested per company was $2.2 million, down from the average of $2.7 million in 2009. The number of companies receiving financial assistance rose to 174, a 10% increase over the 158 companies financed in 2009. Despi ...

... decline in dollar terms, with investments totalling $391 million. The average amount invested per company was $2.2 million, down from the average of $2.7 million in 2009. The number of companies receiving financial assistance rose to 174, a 10% increase over the 158 companies financed in 2009. Despi ...

Growth Strategies to Expand Role of Capital Market

... growth companies which have been promoted into the Main Market of Bursa Malaysia. In total, 23 companies have transferred to the Main Market; of which 15 companies had a market capitalisation in excess of RM100 million as at the end of 2010. The ability of the investment management industry to parti ...

... growth companies which have been promoted into the Main Market of Bursa Malaysia. In total, 23 companies have transferred to the Main Market; of which 15 companies had a market capitalisation in excess of RM100 million as at the end of 2010. The ability of the investment management industry to parti ...

View Article (PDF)

... Acquisition Makes Situs the Leading Multinational, Independent Servicer in Europe NEW YORK AND LONDON – November 2nd, 2016 – Situs, the premier global provider of strategic business solutions for the finance and commercial real estate industries, today announced the completion of its acquisition of ...

... Acquisition Makes Situs the Leading Multinational, Independent Servicer in Europe NEW YORK AND LONDON – November 2nd, 2016 – Situs, the premier global provider of strategic business solutions for the finance and commercial real estate industries, today announced the completion of its acquisition of ...

Sustaining US Financialization with Global Value Chains

... countries, and thus has permitted companies to return a greater share of net revenues to shareholders rather than reinvesting these revenues in new productive capacity. In the financialization literature this is attributed to the “shareholder value revolution” that began in the 1980s. In the global ...

... countries, and thus has permitted companies to return a greater share of net revenues to shareholders rather than reinvesting these revenues in new productive capacity. In the financialization literature this is attributed to the “shareholder value revolution” that began in the 1980s. In the global ...

Investment banking

... makers for quotes. Investment banks provide these trading services to a range of clients in the financial sector, which are often described as ‘institutional investors’. These are asset managers such as pension funds or hedge funds, which manage savings on behalf of individuals, as well as insurance ...

... makers for quotes. Investment banks provide these trading services to a range of clients in the financial sector, which are often described as ‘institutional investors’. These are asset managers such as pension funds or hedge funds, which manage savings on behalf of individuals, as well as insurance ...

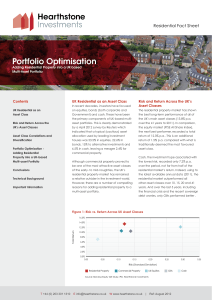

Portfolio Optimisation - Hearthstone Investments

... provided both a higher average total return and a lower level of risk than most other asset types. This in itself is counter-intuitive as it would be expected that in order to achieve a higher level of return, an investor must take additional risk. As shown in figure 1, however, this does not prove ...

... provided both a higher average total return and a lower level of risk than most other asset types. This in itself is counter-intuitive as it would be expected that in order to achieve a higher level of return, an investor must take additional risk. As shown in figure 1, however, this does not prove ...

Annual Report - Putnam Investments

... United Kingdom. Our analysts realized that the consensus negative view of Ashtead was based in part on a competitor’s poorly positioned business. Ashtead exceeded the market’s expectations during the period, and the stock performed accordingly. We maintained this position at period-end. What was the ...

... United Kingdom. Our analysts realized that the consensus negative view of Ashtead was based in part on a competitor’s poorly positioned business. Ashtead exceeded the market’s expectations during the period, and the stock performed accordingly. We maintained this position at period-end. What was the ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.