ESG: How not to tick the box in 401(k)

... ESG return premium, is even more difficult. A recent study by MSCI4 into passive ESG tilted and momentum strategies showed that these had added value of 1.1% p.a. and 2.2% p.a. respectively, although this was over a fairly short time period. Similar conclusions are corroborated in a paper5 supported ...

... ESG return premium, is even more difficult. A recent study by MSCI4 into passive ESG tilted and momentum strategies showed that these had added value of 1.1% p.a. and 2.2% p.a. respectively, although this was over a fairly short time period. Similar conclusions are corroborated in a paper5 supported ...

Document

... KASE repo market is specially designed for domestic purposes – to satisfy the needs of local pension funds and banks in shortterm money borrowing and lending. KASE foreign currencies market – the basic trading site for the National Bank of the Republic of Kazakhstan to regulate the exchange rate of ...

... KASE repo market is specially designed for domestic purposes – to satisfy the needs of local pension funds and banks in shortterm money borrowing and lending. KASE foreign currencies market – the basic trading site for the National Bank of the Republic of Kazakhstan to regulate the exchange rate of ...

KASE Standard Presentation dated November 1, 2007

... KASE repo market is specially designed for domestic purposes – to satisfy the needs of local pension funds and banks in shortterm money borrowing and lending. KASE foreign currencies market – the basic trading site for the National Bank of the Republic of Kazakhstan to regulate the exchange rate of ...

... KASE repo market is specially designed for domestic purposes – to satisfy the needs of local pension funds and banks in shortterm money borrowing and lending. KASE foreign currencies market – the basic trading site for the National Bank of the Republic of Kazakhstan to regulate the exchange rate of ...

IN THE MATTER OF Yufeng Zhang – Settlement Accepted

... IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada. Created in 2008 through the consolidation of the Investment Dealers Association of Canada and Market Regulation Services Inc., IIROC sets high qual ...

... IIROC is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada. Created in 2008 through the consolidation of the Investment Dealers Association of Canada and Market Regulation Services Inc., IIROC sets high qual ...

The Role of ,,Business Angels“ in the Financial Market

... a) the founding entrepreneur can buy the investment share off each „business angel“; b) „business angel“ can offer his share in the company to some of the venture funds such as venture capital fund1; c) writing off their financial claims against the entrepreneur in case the investment has not result ...

... a) the founding entrepreneur can buy the investment share off each „business angel“; b) „business angel“ can offer his share in the company to some of the venture funds such as venture capital fund1; c) writing off their financial claims against the entrepreneur in case the investment has not result ...

A2 PRIVATE INVESTMENTS IN NEW INFRASTRUCTURES

... reliability standards. What is more, new infrastructures that compete with existing infrastructures constitute a redundancy that enhances overall reliability. For example, the chance of fixed and mobile telephony breaking down simultaneously is almost negligible. From the point of view of reliability ...

... reliability standards. What is more, new infrastructures that compete with existing infrastructures constitute a redundancy that enhances overall reliability. For example, the chance of fixed and mobile telephony breaking down simultaneously is almost negligible. From the point of view of reliability ...

Moore lcr08 7952932 en

... We …nd that in a monetary economy, the rate of return on money is very low, less than the return on equity. Nevertheless, a saving entrepreneur chooses to hold some money in his portfolio, because, in the event that he has an opportunity to invest in the future, he will be liquidity constrained, an ...

... We …nd that in a monetary economy, the rate of return on money is very low, less than the return on equity. Nevertheless, a saving entrepreneur chooses to hold some money in his portfolio, because, in the event that he has an opportunity to invest in the future, he will be liquidity constrained, an ...

The Great Escape? A Quantitative Evaluation of the Fed’s Non-Standard Policies ∗

... the model. A firm that faces an investment opportunity can only sell a certain fraction of its “illiquid” assets in each period. These illiquid assets correspond to equity in other firms. More generally, we interpret these illiquid assets as privately issued commercial paper, loans of banks, stocks, ...

... the model. A firm that faces an investment opportunity can only sell a certain fraction of its “illiquid” assets in each period. These illiquid assets correspond to equity in other firms. More generally, we interpret these illiquid assets as privately issued commercial paper, loans of banks, stocks, ...

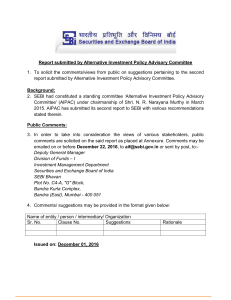

Report submitted by Alternative Investment Policy Advisory

... Since the first report of the Alternative Investment Policy Advisory Committee (AIPAC) was produced, the members of AIPAC have continued to work hard at the second report. The second report covers critical areas for the development of Alternative Investment Funds (AIFs) in India. The report includes ...

... Since the first report of the Alternative Investment Policy Advisory Committee (AIPAC) was produced, the members of AIPAC have continued to work hard at the second report. The second report covers critical areas for the development of Alternative Investment Funds (AIFs) in India. The report includes ...

grade 12 business studies learner notes

... SECTION B: ADDITIONAL CONTENT NOTES: TOPIC 1 Purpose of the Skills Development Act is to: ...

... SECTION B: ADDITIONAL CONTENT NOTES: TOPIC 1 Purpose of the Skills Development Act is to: ...

Sterling corporate bonds: an investor`s guide

... which is on average lower than EUR or USD as you have large proportions of buy and hold investors. Average issue size is also lower. The chart below outlines some similarities between the GBP and EUR markets, as both have a very high level of concentration risk: the top 100 issuers accounted for mor ...

... which is on average lower than EUR or USD as you have large proportions of buy and hold investors. Average issue size is also lower. The chart below outlines some similarities between the GBP and EUR markets, as both have a very high level of concentration risk: the top 100 issuers accounted for mor ...

Government Money Fund (formerly T. Rowe Price Prime Reserve

... securities they can hold. There have been a very small number of money funds in other fund complexes that have “broken the buck,” which means that those funds’ investors did not receive $1.00 per share for their investment in those funds. The potential for realizing a loss of principal in the fund c ...

... securities they can hold. There have been a very small number of money funds in other fund complexes that have “broken the buck,” which means that those funds’ investors did not receive $1.00 per share for their investment in those funds. The potential for realizing a loss of principal in the fund c ...

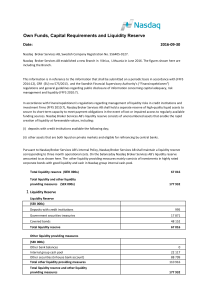

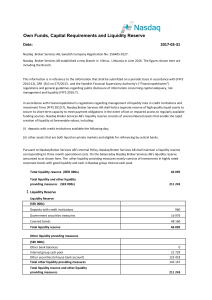

Own Funds, Capital Requirements and Liquidity Reserve

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

... Nasdaq Broker Services AB established a new Branch in Vilnius, Lithuania in June 2016. The figures shown here are including the Branch. ...

Disclaimer

... ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from the relevant jurisdiction’s stock exchange in the equity analysis. Accordingly, investors’ returns may be less than the origin ...

... ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from the relevant jurisdiction’s stock exchange in the equity analysis. Accordingly, investors’ returns may be less than the origin ...

5information about the company, its share capital and stock

... The Essilor stock is included in the following indices: CAC 40, SBF 120, SBF 250, Euronext 100, EURO STOXX 50, STOXX All Europe 100 and FTSEurofirst 300. In addition, Essilor has been included in the Low Carbon 100 Europe® Index since it was launched. This index launched by NYSE Euronext on October 2 ...

... The Essilor stock is included in the following indices: CAC 40, SBF 120, SBF 250, Euronext 100, EURO STOXX 50, STOXX All Europe 100 and FTSEurofirst 300. In addition, Essilor has been included in the Low Carbon 100 Europe® Index since it was launched. This index launched by NYSE Euronext on October 2 ...

http://www-935.ibm.com/services/us/imc/pdf/ge510-6270-trader.pdf

... On the other hand, those companies with defined benefit pension plans will separate Alpha from Beta to better match assets to liabilities. As such, these institutional investors are expected to increase their allocation to more volatile funds (such as certain types of hedge funds and private equity) ...

... On the other hand, those companies with defined benefit pension plans will separate Alpha from Beta to better match assets to liabilities. As such, these institutional investors are expected to increase their allocation to more volatile funds (such as certain types of hedge funds and private equity) ...

Fees Eat Diversification`s Lunch

... hereafter) Long-term Capital Market Return Assumptions. This is a publiclyavailable set of asset class risk, return, and correlation assumptions. It covers 45 asset classes and has been updated annually; see Shairp et al. (2012). Second, we have access to a biennial fee survey from a major instituti ...

... hereafter) Long-term Capital Market Return Assumptions. This is a publiclyavailable set of asset class risk, return, and correlation assumptions. It covers 45 asset classes and has been updated annually; see Shairp et al. (2012). Second, we have access to a biennial fee survey from a major instituti ...

Sectoral Accounts, Balance Sheets, and Flow of Funds

... The IAG, which includes all agencies represented in the Inter-Secretariat Working Group on National Accounts, to develop a strategy to promote the compilation and dissemination of the balance sheet approach (BSA), flow of funds, and sectoral data more generally, starting with the G-20 economies. Dat ...

... The IAG, which includes all agencies represented in the Inter-Secretariat Working Group on National Accounts, to develop a strategy to promote the compilation and dissemination of the balance sheet approach (BSA), flow of funds, and sectoral data more generally, starting with the G-20 economies. Dat ...

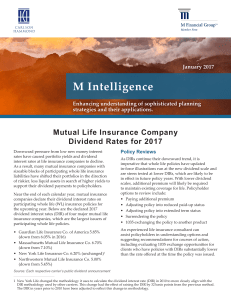

Mutual Life Dividend Rates – March 2017

... rates have caused portfolio yields and dividend interest rates at life insurance companies to decline. As a result, many mutual insurance companies with sizeable blocks of participating whole life insurance liabilities have shifted their portfolios in the direction of riskier, less liquid assets in ...

... rates have caused portfolio yields and dividend interest rates at life insurance companies to decline. As a result, many mutual insurance companies with sizeable blocks of participating whole life insurance liabilities have shifted their portfolios in the direction of riskier, less liquid assets in ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.