Rate of return = $2317.24 / $20000 = 11.59% per

... Purchasing on margin means borrowing some of the money used to buy securities. You do it because you desire a larger position than you can afford to pay for, recognizing that using margin is a form of financial leverage. As such, your gains and losses will be magnified. Of course, you hope you only ...

... Purchasing on margin means borrowing some of the money used to buy securities. You do it because you desire a larger position than you can afford to pay for, recognizing that using margin is a form of financial leverage. As such, your gains and losses will be magnified. Of course, you hope you only ...

Financial Regulation, Behavioural Finance, and the Global Credit

... the findings of behavioural finance that are most pertinent to the present discussion. The largest segment of the secondary market for structured credit securities is not highly liquid rendering the EMH approach inapplicable. However, the contrast is still useful for methodological reasons and by re ...

... the findings of behavioural finance that are most pertinent to the present discussion. The largest segment of the secondary market for structured credit securities is not highly liquid rendering the EMH approach inapplicable. However, the contrast is still useful for methodological reasons and by re ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... of inflation with such policies results to adverse economic performance. An example is nominal ceilings on interest rate with high rate of inflation often lead to negative real interest rate. Another common distortion is the maintenance of fixed nominal exchange rate which becomes increasing over va ...

... of inflation with such policies results to adverse economic performance. An example is nominal ceilings on interest rate with high rate of inflation often lead to negative real interest rate. Another common distortion is the maintenance of fixed nominal exchange rate which becomes increasing over va ...

chapter 26: managing client portfolios

... necessary in order to achieve the return requirements specified by Fairfax; however, greater diversification of these assets among other equity classes is needed to produce a more efficient, potentially less volatile portfolio that would meet both her risk tolerance parameters and her return require ...

... necessary in order to achieve the return requirements specified by Fairfax; however, greater diversification of these assets among other equity classes is needed to produce a more efficient, potentially less volatile portfolio that would meet both her risk tolerance parameters and her return require ...

AER Better Regulation Rate of Return Factsheet

... estimate is 6.5, chosen from within a range of 5 to 7.5 per cent. The MRP compensates an investor for the systematic risk of investing in a broad market portfolio. Analysis of historical estimates of the MRP show a long term average of about 6 per cent. We also have regard to another financial model ...

... estimate is 6.5, chosen from within a range of 5 to 7.5 per cent. The MRP compensates an investor for the systematic risk of investing in a broad market portfolio. Analysis of historical estimates of the MRP show a long term average of about 6 per cent. We also have regard to another financial model ...

Open - Burberry Group Plc

... progress against the Company’s core strategies. Financial measures The Board believes it is important to ensure alignment between executive management’s strategic focus and the long-term interests of shareholders. Certain elements of executive remuneration are based on performance against the follow ...

... progress against the Company’s core strategies. Financial measures The Board believes it is important to ensure alignment between executive management’s strategic focus and the long-term interests of shareholders. Certain elements of executive remuneration are based on performance against the follow ...

How FIRPTA Reform Would Benefit the U.S. Economy

... years with financial products related to residential real estate, the deteriorating assets and debt of commercial real estate are widely held throughout the country. In particular, many of the stressed and distressed loans in commercial real estate are not held by large national and global banks, bu ...

... years with financial products related to residential real estate, the deteriorating assets and debt of commercial real estate are widely held throughout the country. In particular, many of the stressed and distressed loans in commercial real estate are not held by large national and global banks, bu ...

Minnesota Secure Choice Retirement Savings Act

... select their own financial advisor or manage an investment portfolio in order to participate in a plan that specifically minimizes barriers to participation by requiring no minimum opening balances and, depending on the outcomes of the study, can choose to adopt industry best practices of payroll de ...

... select their own financial advisor or manage an investment portfolio in order to participate in a plan that specifically minimizes barriers to participation by requiring no minimum opening balances and, depending on the outcomes of the study, can choose to adopt industry best practices of payroll de ...

міністерство освіти і науки україни державний економіко

... counted in the marketplace until it becomes a demand – the willingness and ability to purchase a desired object. Since an individual has limited resources, only some wants will end up as measurable demands. The terms goods and services are used to describe many things people desire. Consumer goods a ...

... counted in the marketplace until it becomes a demand – the willingness and ability to purchase a desired object. Since an individual has limited resources, only some wants will end up as measurable demands. The terms goods and services are used to describe many things people desire. Consumer goods a ...

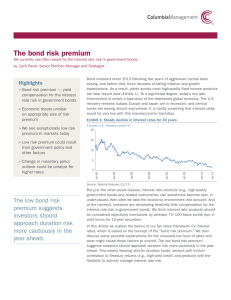

The bond risk premium

... Bond risk premium — yield compensation for the interest rate risk in government bonds On average, the U.S. Treasury yield curve slopes upward, with long-term interest rates above short-term interest rates. One reason for this shape could be investor expectations that short-term interest rates will t ...

... Bond risk premium — yield compensation for the interest rate risk in government bonds On average, the U.S. Treasury yield curve slopes upward, with long-term interest rates above short-term interest rates. One reason for this shape could be investor expectations that short-term interest rates will t ...

CAPITAL MARKET DEVELOPMENT AND FOREIGN PORTFOLIO INVESTMENT IN THE BAHAMAS May, 2000

... was driven by the failure of past non-market based strategies and the realization of the potential role that private imitative and capital markets can play. The ensuing development of local equity markets created conditions conducive to attract foreign portfolio investments (FPIs). As a result, many ...

... was driven by the failure of past non-market based strategies and the realization of the potential role that private imitative and capital markets can play. The ensuing development of local equity markets created conditions conducive to attract foreign portfolio investments (FPIs). As a result, many ...

Balance of payments, net foreign assets and foreign exchange

... in the latter part of their working life, experience shows. But large cohorts are retiring these years ...

... in the latter part of their working life, experience shows. But large cohorts are retiring these years ...

PSX Investor Guide

... sum of money at a specified maturity date and fixed return at regular intervals until then. At Stock Exchange, most of the trades are made in equity instruments, i.e. stocks or shares issued by various companies. ...

... sum of money at a specified maturity date and fixed return at regular intervals until then. At Stock Exchange, most of the trades are made in equity instruments, i.e. stocks or shares issued by various companies. ...

Slide 1

... Personal funds of project owner(s). Selling of stocks. The stockholder shares in management, profit, and loss of the business. ...

... Personal funds of project owner(s). Selling of stocks. The stockholder shares in management, profit, and loss of the business. ...

02-1619 Commercial Paper.qxd

... Commercial paper is short-term promissory notes issued by corporations and finance companies to raise funds for current expenses, working capital and other corporate purposes. When investors buy commercial paper, they are lending money to the issuing corporation. In return for this loan, the issuer ...

... Commercial paper is short-term promissory notes issued by corporations and finance companies to raise funds for current expenses, working capital and other corporate purposes. When investors buy commercial paper, they are lending money to the issuing corporation. In return for this loan, the issuer ...

Portfolio Performance, Discount Dynamics, and the Turnover of Closed-End Fund Mangers

... director stock ownership. They also find that the NAV performance increases and the expense ratio decreases subsequent to manager replacement. Our paper adds substantially to these findings by investigating the role of NAV performance and discount returns in predicting manager replacement. Several p ...

... director stock ownership. They also find that the NAV performance increases and the expense ratio decreases subsequent to manager replacement. Our paper adds substantially to these findings by investigating the role of NAV performance and discount returns in predicting manager replacement. Several p ...

Returns to Venture Capital - University of Colorado Boulder

... financing stage determines the risk premium, as the required rate of return is an arbitrary IRR to the proposal, not calculated through theoretical pricing models. Mean scores, Standard Venture capitalists make greater use of Deviation, and discounted cash flow approaches and less use Mann-Whitney U ...

... financing stage determines the risk premium, as the required rate of return is an arbitrary IRR to the proposal, not calculated through theoretical pricing models. Mean scores, Standard Venture capitalists make greater use of Deviation, and discounted cash flow approaches and less use Mann-Whitney U ...

View/Open

... capital investments are much harder to use as collateral than physical or financial assets, it is likely that the impact of capital market failure is much more intense for investments in human assets than in physical or financial ones. This reinforces the importance of public interventions in financ ...

... capital investments are much harder to use as collateral than physical or financial assets, it is likely that the impact of capital market failure is much more intense for investments in human assets than in physical or financial ones. This reinforces the importance of public interventions in financ ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.