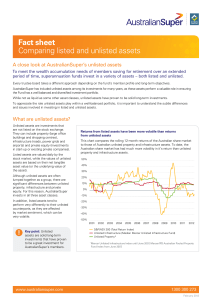

Fact sheet Comparing listed and unlisted assets

... allows a fund to have available cash flow after interest to meet ongoing capital requirements, pay down debt or distribute income to investors. This increased flexibility reduces a fund’s risk of not being able to refinance its existing debts. Many listed property assets had high debt levels, couple ...

... allows a fund to have available cash flow after interest to meet ongoing capital requirements, pay down debt or distribute income to investors. This increased flexibility reduces a fund’s risk of not being able to refinance its existing debts. Many listed property assets had high debt levels, couple ...

Savings, Investment Spending, and the Financial System

... savings available for investment spending in any given country is known as the net capital inflow into that country, equal to the total inflow of foreign funds minus the total outflow of domestic funds to other countries. Like the budget balance, a net capital inflow can be negative—that is, more ca ...

... savings available for investment spending in any given country is known as the net capital inflow into that country, equal to the total inflow of foreign funds minus the total outflow of domestic funds to other countries. Like the budget balance, a net capital inflow can be negative—that is, more ca ...

Gundlach: Trump Should be Commended

... fund] with prepayment and credit risk.” Indeed, he said DBL has triple the risk of DBLTX, although its performance has been two- to three-times that of DBLTX, giving the two roughly the same riskadjusted results. He said that DSL is approximately 10-times the size of DBL and has more credit risk and ...

... fund] with prepayment and credit risk.” Indeed, he said DBL has triple the risk of DBLTX, although its performance has been two- to three-times that of DBLTX, giving the two roughly the same riskadjusted results. He said that DSL is approximately 10-times the size of DBL and has more credit risk and ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... discouraged. The role of capital in the growth of an economy cannot be over emphasized. Most entrepreneurs recognize that a well organized money market is crucial for mobilizing domestic capital for short and mediumterm investments. Lending is one of the most important services that banks render to ...

... discouraged. The role of capital in the growth of an economy cannot be over emphasized. Most entrepreneurs recognize that a well organized money market is crucial for mobilizing domestic capital for short and mediumterm investments. Lending is one of the most important services that banks render to ...

SVP-SV and Rising Interest Rates.indd

... Stable value seeks to achieve its objectives by investing in short-to-intermediate duration fixed income securities paired with stable value investment contracts (also commonly known in the industry as “wrap” agreements). Given that market interest rates are near all time lows, many investors see a ...

... Stable value seeks to achieve its objectives by investing in short-to-intermediate duration fixed income securities paired with stable value investment contracts (also commonly known in the industry as “wrap” agreements). Given that market interest rates are near all time lows, many investors see a ...

CAPITAL MARKET MASTER PLAN - Securities and Exchange

... Current size limits relevance and role in the national economic development Average size of Only a fraction of the GDP – 27% the capital markets of peer Limited representation on the NSE of the key sectors in the broad economies relative to GDP economy – Telecommunications, Oil and Gas, Agricu ...

... Current size limits relevance and role in the national economic development Average size of Only a fraction of the GDP – 27% the capital markets of peer Limited representation on the NSE of the key sectors in the broad economies relative to GDP economy – Telecommunications, Oil and Gas, Agricu ...

Cash Reserves Fund

... Stable net asset value risk The fund may not be able to maintain a stable $1.00 share price at all times. If a money market fund fails to maintain a stable net asset value, or if there is a perceived threat that a money market fund is likely to fail to maintain a stable net asset value, money market ...

... Stable net asset value risk The fund may not be able to maintain a stable $1.00 share price at all times. If a money market fund fails to maintain a stable net asset value, or if there is a perceived threat that a money market fund is likely to fail to maintain a stable net asset value, money market ...

Solutions_ch2_ch3_2

... The company left its bills to suppliers outstanding for 77.25 days on average. A large value for this ratio could imply that either (1) the company is having liquidity problems, making it difficult to pay off its short-term obligations, or (2) that the company has successfully negotiated lenient cre ...

... The company left its bills to suppliers outstanding for 77.25 days on average. A large value for this ratio could imply that either (1) the company is having liquidity problems, making it difficult to pay off its short-term obligations, or (2) that the company has successfully negotiated lenient cre ...

Algorithms for VWAP and Limit Order Trading

... • Option 2: Sell it to a brokerage – What should be the price – The future VWAP over the next month [minus some commission cost] • Brokerage: Needs to sell the shares at the VWAP (more or less) – brokerage takes on risk ...

... • Option 2: Sell it to a brokerage – What should be the price – The future VWAP over the next month [minus some commission cost] • Brokerage: Needs to sell the shares at the VWAP (more or less) – brokerage takes on risk ...

NBER WORKING PAPER SERIES INCOMPLETE MARKET DYNAMICS IN NEOCLASSICAL PRODUCTION ECONOMY George-Marios Angeletos

... We next examine infinite horizon economies. Multiple steady states can then arise from idiosyncratic production risks and the endogeneity of interest rates. Under incomplete markets, individual risk-taking is encouraged by the ability to self-insure against future consumption shocks, and thus by the ...

... We next examine infinite horizon economies. Multiple steady states can then arise from idiosyncratic production risks and the endogeneity of interest rates. Under incomplete markets, individual risk-taking is encouraged by the ability to self-insure against future consumption shocks, and thus by the ...

04_CapStr_DebtLimit_Niu

... If the firm is overvalued, the stock price will fall in the future. Then ...

... If the firm is overvalued, the stock price will fall in the future. Then ...

The concept of investment efficiency and its application to

... assets. The process can be further refined to add more details. For example, it can be used to determine allocations to alternative asset classes such as real estate, private equity or hedge funds. The resulting asset mix forms the strategic asset allocation. For the avoidance of doubt, this stage i ...

... assets. The process can be further refined to add more details. For example, it can be used to determine allocations to alternative asset classes such as real estate, private equity or hedge funds. The resulting asset mix forms the strategic asset allocation. For the avoidance of doubt, this stage i ...

finalterm examination

... Chicago Mercantile Exchange and the Chicago Board of Trade and the 2008 acquisition of the New York Mercantile Exchange). According to BIS, the combined turnover in the world's derivatives exchanges totaled USD 344 trillion during Q4 2005. Some types of derivative instruments also may trade on tradi ...

... Chicago Mercantile Exchange and the Chicago Board of Trade and the 2008 acquisition of the New York Mercantile Exchange). According to BIS, the combined turnover in the world's derivatives exchanges totaled USD 344 trillion during Q4 2005. Some types of derivative instruments also may trade on tradi ...

120KB - ACT Department of Treasury

... and education. The remainder is expenditure on retail goods such as food, alcohol and tobacco, furnishings and other household equipment. Private consumption tends to be a relatively stable source of demand with households adjusting their savings and credit levels to adjust for short-term economic i ...

... and education. The remainder is expenditure on retail goods such as food, alcohol and tobacco, furnishings and other household equipment. Private consumption tends to be a relatively stable source of demand with households adjusting their savings and credit levels to adjust for short-term economic i ...

Dealing in Company Shares

... Directors and senior executives are, and are seen to be, in close relationship to Pental in that they have access to information before it becomes generally available. This may lead to a perception of advantage over other shareholders and the general public in deciding when to buy or sell shares. Fu ...

... Directors and senior executives are, and are seen to be, in close relationship to Pental in that they have access to information before it becomes generally available. This may lead to a perception of advantage over other shareholders and the general public in deciding when to buy or sell shares. Fu ...

Document

... • “What if” questions can help gauge sensitivity of revenues, costs, and earnings • Management may indicate appropriateness of earnings estimates • Discuss the industry’s major issues • Review the planning process • Talk to more than just the top managers ...

... • “What if” questions can help gauge sensitivity of revenues, costs, and earnings • Management may indicate appropriateness of earnings estimates • Discuss the industry’s major issues • Review the planning process • Talk to more than just the top managers ...

FREQUENTLY ASKED QUESTIONS BY SHAREHOLDERS ABOUT

... the symbol "CFN wi." On August 31, "When Issued" trading is scheduled to end for both "CAH wi" and "CFN wi" and "Regular Way" trading is scheduled to begin for CareFusion common stock on September 1 under the ticker symbol "CFN." Q6.) Do I need to sell my shares in the “When Issued” market? A6.) Th ...

... the symbol "CFN wi." On August 31, "When Issued" trading is scheduled to end for both "CAH wi" and "CFN wi" and "Regular Way" trading is scheduled to begin for CareFusion common stock on September 1 under the ticker symbol "CFN." Q6.) Do I need to sell my shares in the “When Issued” market? A6.) Th ...

View PDF - Dolphin Capital Investors

... Dolphin Capital Investors Limited, the leading investor in the residential resort sector in south-east Europe and the largest real estate investment company listed on AIM in terms of net asset value, is pleased to provide the following update in relation to Kea Resort: Management by Aman Resorts Dol ...

... Dolphin Capital Investors Limited, the leading investor in the residential resort sector in south-east Europe and the largest real estate investment company listed on AIM in terms of net asset value, is pleased to provide the following update in relation to Kea Resort: Management by Aman Resorts Dol ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.