Pension plan funding, risk sharing and technology choice

... the plan sponsor issues risky debt, then in the event of default, if the pension plan is not fully funded (or insured), this shortfall risk is borne by the plan members. We show that when capital market constraints on workers are binding, leveraging the risky technology, even with risky debt, raise ...

... the plan sponsor issues risky debt, then in the event of default, if the pension plan is not fully funded (or insured), this shortfall risk is borne by the plan members. We show that when capital market constraints on workers are binding, leveraging the risky technology, even with risky debt, raise ...

NBER WORKING PAPER SERIES INTERNATIONAL CONSUMPTION RISK IS SHARED AFTER ALL:

... How much welfare improvement can be generated by optimal international consumption risksharing? The obvious importance of this question has motivated a significant body of research.1 As this literature shows, international risk-sharing gains depend directly upon the value of consumption risk and the ...

... How much welfare improvement can be generated by optimal international consumption risksharing? The obvious importance of this question has motivated a significant body of research.1 As this literature shows, international risk-sharing gains depend directly upon the value of consumption risk and the ...

Comovement Among Stocks with Similar Book-to

... and French (1993), (1995)). While asset loadings on common factors in returns are frequently used to explain or understand differences in average returns, it is not well understood why assets load on common factors in the first place. According to the traditional view, common variation in returns is ...

... and French (1993), (1995)). While asset loadings on common factors in returns are frequently used to explain or understand differences in average returns, it is not well understood why assets load on common factors in the first place. According to the traditional view, common variation in returns is ...

Annual report 2013

... performances, as with the case of Boucheron and Van Cleef & Arpels, bolstered by their ultra high-end positioning as prestigious jewelers.” A word about Repetto’s particularly noteworthy performance for the year? “The Repetto fragrance represented Interparfums’ strongest launch in the French market ...

... performances, as with the case of Boucheron and Van Cleef & Arpels, bolstered by their ultra high-end positioning as prestigious jewelers.” A word about Repetto’s particularly noteworthy performance for the year? “The Repetto fragrance represented Interparfums’ strongest launch in the French market ...

1 Reflections about Brand Equity, Brand Value and their

... This construct of brand value is studied not only by marketing practitioners but also by professionals in finance and accounting. They see the brand as an intangible asset, possibly capitalized, giving brands considerable stature as equity during a brand purchase. The brand here represents an asset, ...

... This construct of brand value is studied not only by marketing practitioners but also by professionals in finance and accounting. They see the brand as an intangible asset, possibly capitalized, giving brands considerable stature as equity during a brand purchase. The brand here represents an asset, ...

Adopting Enterprise Risk Management (ERM) in high

... As risks become transparent, measurable and manageable, Trust Re’s performance profits from lower volatility and a greater resilience. At the same time, policyholders are set to benefit from more adequate, risk-based pricing and a lower counterparty risk, while rating agencies and regulators feel mo ...

... As risks become transparent, measurable and manageable, Trust Re’s performance profits from lower volatility and a greater resilience. At the same time, policyholders are set to benefit from more adequate, risk-based pricing and a lower counterparty risk, while rating agencies and regulators feel mo ...

Are Share Repurchases and Dividends Substitute

... the one used by Jagannathan, Stephens and Weisbach (2000). While we measure the repurchase activity only for common stocks, their measure uses the entire repurchase activity, which also includes preferred stocks. This difference, however, does not affect the results in this paper. ...

... the one used by Jagannathan, Stephens and Weisbach (2000). While we measure the repurchase activity only for common stocks, their measure uses the entire repurchase activity, which also includes preferred stocks. This difference, however, does not affect the results in this paper. ...

Derivatives and the Modern Prudent Investor Rule: Too Risky or Too Necessary?

... course, the cost of mistakes by fiduciaries, whether they take on too much risk or even not enough risk, can be tragic. This being said, legal scholarship by those in related disciplines, such as finance and economics, must seek to fill the void that still confounds those who are earnestly trying to ...

... course, the cost of mistakes by fiduciaries, whether they take on too much risk or even not enough risk, can be tragic. This being said, legal scholarship by those in related disciplines, such as finance and economics, must seek to fill the void that still confounds those who are earnestly trying to ...

Superperformance Stocks

... In recent years there have been hundreds of companies reporting expanding sales and increasing earnings, but declining stock prices. In numerous cases the combination of rising earnings but declining stock price is a long-term trend that has lasted a decade or longer, and indicates that investors ar ...

... In recent years there have been hundreds of companies reporting expanding sales and increasing earnings, but declining stock prices. In numerous cases the combination of rising earnings but declining stock price is a long-term trend that has lasted a decade or longer, and indicates that investors ar ...

Direct Investing in Private Equity

... skill—as their gross returns were higher than public equity benchmarks—the lack of superior return for the LPs implied that “rents” were earned by private equity managers. Recently, using more comprehensive data, Harris, et al. (2013), Robinson and Sensoy (2013), and Axelson, et al. (2013a) show tha ...

... skill—as their gross returns were higher than public equity benchmarks—the lack of superior return for the LPs implied that “rents” were earned by private equity managers. Recently, using more comprehensive data, Harris, et al. (2013), Robinson and Sensoy (2013), and Axelson, et al. (2013a) show tha ...

2013 CFA Level 1 - Book 5 - Apache

... exchange(pagerate37)risk an investor faces when a bond makes payments in a forei g n explaaiinn how inflatiyield on risk.volatil(pageity affects 37) the price of a bond with an embedded option m.n. expl and how(pagechanges in volatility affect the value of a callable bond and a purable bond. ...

... exchange(pagerate37)risk an investor faces when a bond makes payments in a forei g n explaaiinn how inflatiyield on risk.volatil(pageity affects 37) the price of a bond with an embedded option m.n. expl and how(pagechanges in volatility affect the value of a callable bond and a purable bond. ...

cash flow statement

... • A cash flow statement is needed because of the differences between profits and cash. It achieves the following: ---Provides additional information on business ...

... • A cash flow statement is needed because of the differences between profits and cash. It achieves the following: ---Provides additional information on business ...

Smart Beta - A referential guide for institutional investors

... Over the past decade, “smart beta,” a new suite of indexation strategies touting advantages over both active investment managers and traditional market-capitalizationweighted indexes, has erupted onto the financial scene and increasingly won the favor of institutional investors. However, the rise of ...

... Over the past decade, “smart beta,” a new suite of indexation strategies touting advantages over both active investment managers and traditional market-capitalizationweighted indexes, has erupted onto the financial scene and increasingly won the favor of institutional investors. However, the rise of ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... investment behavior of firms differs from the received wisdom taught in business schools. Observers of business practice find that the "hurdle rates" that firms require for expected returns on projects are typically three or four times the cost of capital.3 In other words, firms do not invest until ...

... investment behavior of firms differs from the received wisdom taught in business schools. Observers of business practice find that the "hurdle rates" that firms require for expected returns on projects are typically three or four times the cost of capital.3 In other words, firms do not invest until ...

Frequently Asked Questions about Exchange

... of the relevant underlying index.” Issuers and their affiliated purchasers rely on the noaction position regarding Rule 102 of Regulation M provided by the iPath Letter, which permits ETN issuers ...

... of the relevant underlying index.” Issuers and their affiliated purchasers rely on the noaction position regarding Rule 102 of Regulation M provided by the iPath Letter, which permits ETN issuers ...

Private Equity Investment in India: Efficiency vs Expansion

... My data confirm that PE firms select companies that are initially more productive, more profitable, and larger in terms of revenue, assets, and employee compensation. These firms have more people on the board of directors and hold more board meetings per year. Using data from the Indian survey of Bl ...

... My data confirm that PE firms select companies that are initially more productive, more profitable, and larger in terms of revenue, assets, and employee compensation. These firms have more people on the board of directors and hold more board meetings per year. Using data from the Indian survey of Bl ...

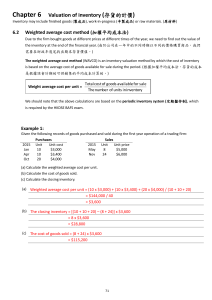

Chapter 6 Valuation of inventory (非流動資產折舊)

... During this period, goods at the invoiced price of $5,900 were returned by customers and there were no returns outwards. It is the company’s policy to sell all goods at a 25% mark-up on cost. (iii) Goods costing $350 was drawn by Mr Wong on 4 January 2008 for his personal use. In addition, goods wer ...

... During this period, goods at the invoiced price of $5,900 were returned by customers and there were no returns outwards. It is the company’s policy to sell all goods at a 25% mark-up on cost. (iii) Goods costing $350 was drawn by Mr Wong on 4 January 2008 for his personal use. In addition, goods wer ...