FM11 Ch 04 Mini

... between stocks generally range from +0.5 to +0.7. A single stock selected at random would on average have a standard deviation of about 35 percent. As additional stocks are added to the portfolio, the portfolio’s standard deviation decreases because the added stocks are not perfectly positively corr ...

... between stocks generally range from +0.5 to +0.7. A single stock selected at random would on average have a standard deviation of about 35 percent. As additional stocks are added to the portfolio, the portfolio’s standard deviation decreases because the added stocks are not perfectly positively corr ...

Chapter 14

... determined by the retention rate and the return on equity – Earnings retention rate of industry compared to the overall market – Return on equity is a function of • the net profit margin ...

... determined by the retention rate and the return on equity – Earnings retention rate of industry compared to the overall market – Return on equity is a function of • the net profit margin ...

Document

... determined by the retention rate and the return on equity – Earnings retention rate of industry compared to the overall market – Return on equity is a function of • the net profit margin ...

... determined by the retention rate and the return on equity – Earnings retention rate of industry compared to the overall market – Return on equity is a function of • the net profit margin ...

introduction to the financial statements

... embedded into rental and other contracts denominated in foreign currencies. Upon acquisition of such financial instruments the Company assesses whether the economic characteristics of the embedded derivative instrument are clearly and closely related to the economic characteristics of the financial ...

... embedded into rental and other contracts denominated in foreign currencies. Upon acquisition of such financial instruments the Company assesses whether the economic characteristics of the embedded derivative instrument are clearly and closely related to the economic characteristics of the financial ...

OUTER LIMITS As Funds Leverage Up, Fears of Reckoning Rise

... interview that the torrent of money flowing into hedge funds has coincided with a troubling erosion in lending practices. The Fed, the Securities and Exchange Commission and European regulators have spent months trying to gauge the risk by gathering information from hedge funds and Wall Street firms ...

... interview that the torrent of money flowing into hedge funds has coincided with a troubling erosion in lending practices. The Fed, the Securities and Exchange Commission and European regulators have spent months trying to gauge the risk by gathering information from hedge funds and Wall Street firms ...

The Value Relevance of Financial Institutions` Fair Value

... Unrealized Gains and Losses to Equity Values This article provides a residual-income valuation framework for assessing whether fair value disclosures required by SFAS 119, Disclosures About Derivative Financial Instruments and Fair Values of Financial Instruments, are value-relevant. The primary the ...

... Unrealized Gains and Losses to Equity Values This article provides a residual-income valuation framework for assessing whether fair value disclosures required by SFAS 119, Disclosures About Derivative Financial Instruments and Fair Values of Financial Instruments, are value-relevant. The primary the ...

Research on the Stock Market Response to Earnings - PUC-SP

... The obvious difference between the yield/income rate before the publishing date and that after the publishing date means the accounting reports have passed new information to the market, and the market can make response to the accounting reports. That is, Rit in different RC / NI groups varies signi ...

... The obvious difference between the yield/income rate before the publishing date and that after the publishing date means the accounting reports have passed new information to the market, and the market can make response to the accounting reports. That is, Rit in different RC / NI groups varies signi ...

CapStrStu

... – Corporate deduction reduces ____ of _______ – ________ earnings from corporate level tax ...

... – Corporate deduction reduces ____ of _______ – ________ earnings from corporate level tax ...

Two Ways to Calculate the Rate of Return on a Portfolio

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

... same amounts. Their TIME-weighted rates of return were exactly the same. But one had a gain and the other a loss. How then does an investor evaluate the different rates of return? Which rate of turn is right? Which is best? Actually there is no right or wrong or best – they just have different meani ...

Market Discipline and why Risk Management is so Important

... What about the Models? The reliance on historical data models was flawed: the quant quake in 2007 was somehow a 1-in-10000 year event for many trading strategies! Multiple correlation: liquidity risk caused an unprecedented collapse across all asset classes and trading styles…when the sea dries ...

... What about the Models? The reliance on historical data models was flawed: the quant quake in 2007 was somehow a 1-in-10000 year event for many trading strategies! Multiple correlation: liquidity risk caused an unprecedented collapse across all asset classes and trading styles…when the sea dries ...

CHAPTER SIXTEEN

... Chapter 17 makes the point that a valuation has integrity if the relevant information is reflected in forecasts within the forecast horizon, such that periods beyond the horizon can be summarized in a steady-state continuing value calculation. Accounting methods determine how quickly information is ...

... Chapter 17 makes the point that a valuation has integrity if the relevant information is reflected in forecasts within the forecast horizon, such that periods beyond the horizon can be summarized in a steady-state continuing value calculation. Accounting methods determine how quickly information is ...

Market Segmentation Theory

... Marketability - The costs and rapidity with which investors can resell a security. ...

... Marketability - The costs and rapidity with which investors can resell a security. ...

PPT4

... Typically used by family-business owners to facilitate an orderly exchange of stock in the corporation for cash Often the primary vehicle through which family shareholders can realize value from their highly illiquid and unmarketable wealth— company stock The most obvious benefit of a buy–sell agree ...

... Typically used by family-business owners to facilitate an orderly exchange of stock in the corporation for cash Often the primary vehicle through which family shareholders can realize value from their highly illiquid and unmarketable wealth— company stock The most obvious benefit of a buy–sell agree ...

an alternative approach for teaching the interest

... Debit Bond Discount Credit Bonds Payable or Debit Cash Credit Bond Premium Credit Bonds Payable AMORTIZATION METHODS The bond discount or premium is amortized over the life of the bond. Accounting Principles Board Opinion Number 21 stated that this amortization should be determined "in such a way as ...

... Debit Bond Discount Credit Bonds Payable or Debit Cash Credit Bond Premium Credit Bonds Payable AMORTIZATION METHODS The bond discount or premium is amortized over the life of the bond. Accounting Principles Board Opinion Number 21 stated that this amortization should be determined "in such a way as ...

Sappi Limited

... Do you believe that more decision-useful information about investments in equity instruments (and derivatives on those equity instruments) results if all such investments are measured at fair value? If not, why? We believe that fair value provides decision useful information in most circumstances fo ...

... Do you believe that more decision-useful information about investments in equity instruments (and derivatives on those equity instruments) results if all such investments are measured at fair value? If not, why? We believe that fair value provides decision useful information in most circumstances fo ...

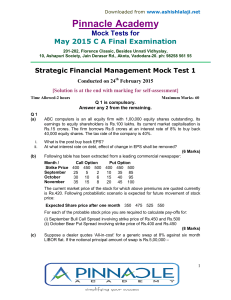

Pinnacle Academ y

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

... LIBOR for first reset period is 5.75%. A 3-year interest rate cap with a face value of $250 million and a strike price of 7% is available for a premium of 3.75%. Calculate effective cost of the capped loan for the following LIBOR on the next 5 rollover dates: 5.5%, 6%, 6.25%, 6.5% and 6.75%. Fixed i ...

Are investment certificates too complex?

... instruments, both in terms of the product itself and in terms of the market. They even do better than many established financial products. ...

... instruments, both in terms of the product itself and in terms of the market. They even do better than many established financial products. ...

CEO ownership, stock market performance, and managerial discretion

... According to this explanation, abnormal returns for high CEO-ownership firms are high because CEOs have better information about the prospects of the firm. At the same time, the market does not correctly anticipate this. The second explanation is based on the interplay of value increasing effort of ...

... According to this explanation, abnormal returns for high CEO-ownership firms are high because CEOs have better information about the prospects of the firm. At the same time, the market does not correctly anticipate this. The second explanation is based on the interplay of value increasing effort of ...