Capital Markets Review

... Style box returns based on the GICS Classification model. All values are cumulative total return for stated period including reinvestment of dividends. The indices used from left to right, top to bottom are: Russell 1000 Value Index, Russell 1000 Index, Russell 1000 Growth Index, Russell Mid-Cap Val ...

... Style box returns based on the GICS Classification model. All values are cumulative total return for stated period including reinvestment of dividends. The indices used from left to right, top to bottom are: Russell 1000 Value Index, Russell 1000 Index, Russell 1000 Growth Index, Russell Mid-Cap Val ...

Document

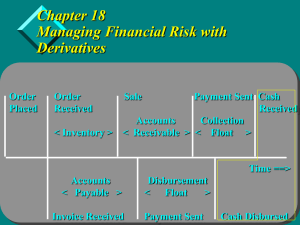

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...

... react to change more rapidly than others, because credit perceptions differ from market to market, and because receptivity to specific debt structures differs from market to market. If, for instance, a corporation wants term floating-rate funds but finds that the market for its fixed-rate debt is co ...

Principles Underlying Asset Liability Management

... The Task Force was comprised of members of the actuarial profession with experience in ALM in the United States and Canada. The ALM principles articulated in this document are applicable to a broad range of entities facing ALM-related issues. The applicability of these principles will depend on the ...

... The Task Force was comprised of members of the actuarial profession with experience in ALM in the United States and Canada. The ALM principles articulated in this document are applicable to a broad range of entities facing ALM-related issues. The applicability of these principles will depend on the ...

2-4 Financial Analysis-

... knowledge of financial statements: A. I am very comfortable with them B. I have a general understanding but lack details C. I saw much, but retained little ...

... knowledge of financial statements: A. I am very comfortable with them B. I have a general understanding but lack details C. I saw much, but retained little ...

NBER WORKING PAPER SERIES THE JAPANESE BUBBLE: A 'HETEROGENEOUS' APPROACH Robert B. Barsky

... underlying principle behind the possibility that prices might not have been out of line with fundamentals. When the required return is only slightly above the long-rate expected growth rate of an asset‟s earnings stream, asset prices can be both “nearly infinite” and “nearly indeterminate”. Merely r ...

... underlying principle behind the possibility that prices might not have been out of line with fundamentals. When the required return is only slightly above the long-rate expected growth rate of an asset‟s earnings stream, asset prices can be both “nearly infinite” and “nearly indeterminate”. Merely r ...

Lecture 16

... than in equally weighted portfolios. In crisis, equal weighted portfolios tend to have higher returns than value weighted portfolios. When value and momentum perform poorly, equal weighted portfolios tend to do poorly as well. A portfolio weight vector is an input to the mean-variance optimization. ...

... than in equally weighted portfolios. In crisis, equal weighted portfolios tend to have higher returns than value weighted portfolios. When value and momentum perform poorly, equal weighted portfolios tend to do poorly as well. A portfolio weight vector is an input to the mean-variance optimization. ...

Slide 1

... the benefits received are perceived to be low, too. • Different customer segments will have different value perceptions • A product which is adapted to the needs of a particular segment can be very valuable to that segment even if the overall “quality” is not seen as superior by most other consumers ...

... the benefits received are perceived to be low, too. • Different customer segments will have different value perceptions • A product which is adapted to the needs of a particular segment can be very valuable to that segment even if the overall “quality” is not seen as superior by most other consumers ...

relationship - University of St Andrews

... the relationship between stock prices, earnings and expected dividends. They find that a long term moving average of earnings predicts dividends and the ratio of this earnings variable to current stock price is powerful in predicting stock returns over several years. They conclude that these facts m ...

... the relationship between stock prices, earnings and expected dividends. They find that a long term moving average of earnings predicts dividends and the ratio of this earnings variable to current stock price is powerful in predicting stock returns over several years. They conclude that these facts m ...

IN-KIND DONATION FORM

... 1. Provide specific project information related to the event being planned including date, city and county. 2. Provide detailed information related to the description of the item or service being donated. For printing donations, include specific number of pages, packets or other items that are being ...

... 1. Provide specific project information related to the event being planned including date, city and county. 2. Provide detailed information related to the description of the item or service being donated. For printing donations, include specific number of pages, packets or other items that are being ...

STOCK Beta

... standard deviation of 42% per year and a beta of .10. Amalgamated Copper has a standard deviation of 31% a year and a beta of .66. Explain why Lonesome Gulch is the safer investment for a diversified investor? ...

... standard deviation of 42% per year and a beta of .10. Amalgamated Copper has a standard deviation of 31% a year and a beta of .66. Explain why Lonesome Gulch is the safer investment for a diversified investor? ...

Modern Strategic Mine Planning

... acting. Waiting may or may not end up being the best action after the fact – the game is at each point in time to probabilistically compute whether to immediately act and reap a guaranteed cash flow, or whether to wait an additional period and revisit this question as new economic information is rev ...

... acting. Waiting may or may not end up being the best action after the fact – the game is at each point in time to probabilistically compute whether to immediately act and reap a guaranteed cash flow, or whether to wait an additional period and revisit this question as new economic information is rev ...

asset

... page viii for list of features for each chapter of the text: Power Point lectures, quizzes, videos, ...

... page viii for list of features for each chapter of the text: Power Point lectures, quizzes, videos, ...

IM Chapter 14

... Although earlier chapters have touched on topics from financial statement analysis, we now present a comprehensive overview of the subject. The chapter is organized into three sections. We begin by introducing a number of analytical tools. Second, measures of liquidity, credit risk, and profitabilit ...

... Although earlier chapters have touched on topics from financial statement analysis, we now present a comprehensive overview of the subject. The chapter is organized into three sections. We begin by introducing a number of analytical tools. Second, measures of liquidity, credit risk, and profitabilit ...