realestate

... • In the first half of 2005, two-thirds of homebuyers financed more than 80% of their purchase. • 17% of homeowners have a loan-to-value ratio (LTV) of 95% or more, versus only 3% one decade ago. (That means that 17% own less than 5% of their home's value free, and clear). • About 42% of first-time ...

... • In the first half of 2005, two-thirds of homebuyers financed more than 80% of their purchase. • 17% of homeowners have a loan-to-value ratio (LTV) of 95% or more, versus only 3% one decade ago. (That means that 17% own less than 5% of their home's value free, and clear). • About 42% of first-time ...

Sweden - Randal C. Picker

... required to have 25% of assets in bonds. • 1985: Regulations dropped. ...

... required to have 25% of assets in bonds. • 1985: Regulations dropped. ...

Stocks Are Not The New Bonds

... Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries. Issued in the United States by MFS Institutional Advisors, Inc. (“MFSI”) and MFS Investment Management. Issued in Canada by MFS Investment Management ...

... Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries. Issued in the United States by MFS Institutional Advisors, Inc. (“MFSI”) and MFS Investment Management. Issued in Canada by MFS Investment Management ...

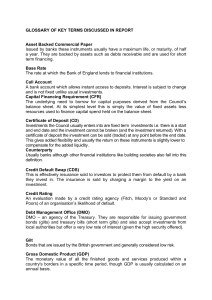

GLOSSARY OF KEY TERMS DISCUSSED IN

... of short term (less than one year) securities representing high-quality, liquid debt and monetary instruments. Monetary Policy Committee (MPC) Government body that sets the bank rate (commonly referred to as being base rate). Its primary target is to keep inflation within plus or minus 1% of a centr ...

... of short term (less than one year) securities representing high-quality, liquid debt and monetary instruments. Monetary Policy Committee (MPC) Government body that sets the bank rate (commonly referred to as being base rate). Its primary target is to keep inflation within plus or minus 1% of a centr ...

A Study on the Technical Analysis of Share Price Movements of

... This study is mainly carried out based on the secondary data taken from stock exchanges so there were a few variations in the data published by the major websites. Finding is restricted to five banks and cannot be generalized to the industry as a whole. The study is conducted based only on technical ...

... This study is mainly carried out based on the secondary data taken from stock exchanges so there were a few variations in the data published by the major websites. Finding is restricted to five banks and cannot be generalized to the industry as a whole. The study is conducted based only on technical ...

Key Dodd-Frank Act Implementation Issues for International Banks

... with US banking operations (including a US branch, agency, or commercial lending company) § Under Dodd-Frank, when considering whether to apply enhanced prudential standards to foreign banking organizations, the Board and the FSOC must consider: – (A) National treatment and equality of competitiv ...

... with US banking operations (including a US branch, agency, or commercial lending company) § Under Dodd-Frank, when considering whether to apply enhanced prudential standards to foreign banking organizations, the Board and the FSOC must consider: – (A) National treatment and equality of competitiv ...

Chapter 11

... What is a derivative security? A derivative security has its value determined by, or derived from, the value of another investment vehicle. They represent a contract on an underlying security or asset ...

... What is a derivative security? A derivative security has its value determined by, or derived from, the value of another investment vehicle. They represent a contract on an underlying security or asset ...

Mispriced Markets

... prices. After World War 2 Japan’s economy grew phenomenally to be the second largest economy in the world and at its peak in 1989 the market capitalisation of the stocks within the Nikkei index was one third of the total market capitalisation of all stock indices in the world. The industrial boom in ...

... prices. After World War 2 Japan’s economy grew phenomenally to be the second largest economy in the world and at its peak in 1989 the market capitalisation of the stocks within the Nikkei index was one third of the total market capitalisation of all stock indices in the world. The industrial boom in ...

What Sets Us Apart - Asia Pacific Fund

... United Kingdom this document is issued only to persons falling within a permitted category under (i) the FSA’s rules made under section 238(5) of the Financial Services and Markets Act 2000 and (ii) the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) ...

... United Kingdom this document is issued only to persons falling within a permitted category under (i) the FSA’s rules made under section 238(5) of the Financial Services and Markets Act 2000 and (ii) the Financial Services and Markets Act 2000 (Promotion of Collective Investment Schemes) (Exemptions) ...

press release ojk issues regulation on capital market investment

... Financial Services Authority, Jakarta, August 5, 2016: The Financial Services Authority (OJK) has issued the Financial Services Authority Regulation (POJK) No. 26/POJK.04/2016 on Investment Products within the Capital Market in order to Support the Law on Tax Amnesty. The POJK signifies the OJK’s co ...

... Financial Services Authority, Jakarta, August 5, 2016: The Financial Services Authority (OJK) has issued the Financial Services Authority Regulation (POJK) No. 26/POJK.04/2016 on Investment Products within the Capital Market in order to Support the Law on Tax Amnesty. The POJK signifies the OJK’s co ...

Lecture 10 Chapter 11 PPT

... investors to screen out bad credit from good credit risks • Also, the development of money market mutual funds in the 1970s contributed to growth by creating a market for commercial paper. ...

... investors to screen out bad credit from good credit risks • Also, the development of money market mutual funds in the 1970s contributed to growth by creating a market for commercial paper. ...

Mahesh Krishnamoorthy Chief Business Officer, Mahindra Integrated

... centre for ICICI Lombard GIC (2013-14), expansion of the captive contact centre for ICICI Bank (2005-06), Private Wealth, NBFC and SEBI regulated portfolio management business for Ambit Group (2009-10), NBFC and Institutional Equities desk for Angel Broking (2008-09), BFSI & REIT fundamental researc ...

... centre for ICICI Lombard GIC (2013-14), expansion of the captive contact centre for ICICI Bank (2005-06), Private Wealth, NBFC and SEBI regulated portfolio management business for Ambit Group (2009-10), NBFC and Institutional Equities desk for Angel Broking (2008-09), BFSI & REIT fundamental researc ...

Inflation Report May 2005

... Sources: Bank of England, BCC, CBI, CBI/Grant Thornton, CBI/PwC and ONS. (a) Measures weight together sectoral surveys using shares in real business investment. Disaggregated data on financial services investment are provided by the ONS but are not subject to the scrutiny applied to officially relea ...

... Sources: Bank of England, BCC, CBI, CBI/Grant Thornton, CBI/PwC and ONS. (a) Measures weight together sectoral surveys using shares in real business investment. Disaggregated data on financial services investment are provided by the ONS but are not subject to the scrutiny applied to officially relea ...

Sofia, Bulgaria, October 13, 2006 Milen Markov Chairman of

... 1. What should be the legal form of the mutlifunds: – one legal person with separate portfolios with different level of risk – each portfolio should be a separate legal person ...

... 1. What should be the legal form of the mutlifunds: – one legal person with separate portfolios with different level of risk – each portfolio should be a separate legal person ...

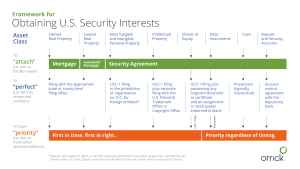

Obtaining US Security Interests

... Filing with the appropriate state or county level filing office ...

... Filing with the appropriate state or county level filing office ...

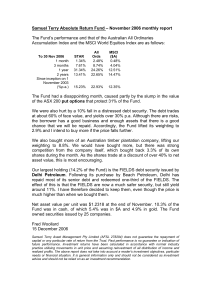

November 2006 - Samuel Terry

... The Fund had a disappointing month, caused partly by the slump in the value of the ASX 200 put options that protect 31% of the Fund. We were also hurt by a 10% fall in a distressed debt security. The debt trades at about 60% of face value, and yields over 30% p.a. Although there are risks, the borro ...

... The Fund had a disappointing month, caused partly by the slump in the value of the ASX 200 put options that protect 31% of the Fund. We were also hurt by a 10% fall in a distressed debt security. The debt trades at about 60% of face value, and yields over 30% p.a. Although there are risks, the borro ...

- Liontrust

... Your investment should provide a good and increasing level of income in real terms while also preserving the value of your capital over time. If a fund can consistently deliver these objectives over the long term, there is a good chance that it will be more rewarding than many other investments, and ...

... Your investment should provide a good and increasing level of income in real terms while also preserving the value of your capital over time. If a fund can consistently deliver these objectives over the long term, there is a good chance that it will be more rewarding than many other investments, and ...

Aberdeen Global – Select Euro High Yield Bond Fund

... • Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your investment. • Bonds are affected by changes in interest rates, inflation and any decline in creditworthiness of the bond is ...

... • Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of your investment. • Bonds are affected by changes in interest rates, inflation and any decline in creditworthiness of the bond is ...

What is the Financial Crisis?

... followed the collapse in the housing bubble. The price of oil nearly tripled from $50 to $147 from early 2007 to 2008, before plunging as the financial crisis began to take hold in late 2008. Experts debate the causes, with some attributing it to speculative flow of money from housing and other inve ...

... followed the collapse in the housing bubble. The price of oil nearly tripled from $50 to $147 from early 2007 to 2008, before plunging as the financial crisis began to take hold in late 2008. Experts debate the causes, with some attributing it to speculative flow of money from housing and other inve ...

File - Coach ANDERSON`S Classroom

... • Checkpoint: How did the rash of sub-prime mortgages endanger the U.S. economy? – Mortgage companies and banks began to loan people money who could not afford to pay these loans back. – When interest rates rose, many people couldn’t afford to pay their mortgages, which led to foreclosures. – The ri ...

... • Checkpoint: How did the rash of sub-prime mortgages endanger the U.S. economy? – Mortgage companies and banks began to loan people money who could not afford to pay these loans back. – When interest rates rose, many people couldn’t afford to pay their mortgages, which led to foreclosures. – The ri ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.