File - South Metro Denver Chamber

... federal law” view? • Congressional action not in near future despite majority of states permitting. • Consolidation in marijuana industry. • 10 people control nearly 20% of Denver’s 1,046 active medical and recreational licenses. ...

... federal law” view? • Congressional action not in near future despite majority of states permitting. • Consolidation in marijuana industry. • 10 people control nearly 20% of Denver’s 1,046 active medical and recreational licenses. ...

Q1 2017 Investor Fact Sheet

... Launched multi-currency registered brokerage accounts, enabling clients to hold U.S. dollars and six other major currencies in their registered accounts; and ...

... Launched multi-currency registered brokerage accounts, enabling clients to hold U.S. dollars and six other major currencies in their registered accounts; and ...

What can be learned from the banking crisis

... customers are not able to punish them by refusing to purchase or by demanding price discounts. Quality declines below the quality that would prevail in a market of informed customers. In order to prevent lemon markets, most countries have, for example, food regulators who set the lower limits for qu ...

... customers are not able to punish them by refusing to purchase or by demanding price discounts. Quality declines below the quality that would prevail in a market of informed customers. In order to prevent lemon markets, most countries have, for example, food regulators who set the lower limits for qu ...

To view this press release as a file

... Supervisor in charge of the Off-Site Evaluation Division, which he has fulfilled since 2011. In parallel, Mr. Tamam will be appointed as Head of the Business Sector in the project to set up a Credit Database, reporting to the Bank of Israel’s Director General. This project is of great importance to ...

... Supervisor in charge of the Off-Site Evaluation Division, which he has fulfilled since 2011. In parallel, Mr. Tamam will be appointed as Head of the Business Sector in the project to set up a Credit Database, reporting to the Bank of Israel’s Director General. This project is of great importance to ...

Henderson Global Equity Income Report

... industry’s most innovative and formative thinkers. Our expertise encompasses the major asset classes, we have investment teams situated around the world, and we serve individual and institutional investors globally. We have £264.6bn in assets under management, more than 2000 employees and offices in ...

... industry’s most innovative and formative thinkers. Our expertise encompasses the major asset classes, we have investment teams situated around the world, and we serve individual and institutional investors globally. We have £264.6bn in assets under management, more than 2000 employees and offices in ...

A Depositor Run in Securities Markets: The Korean Experience

... segments of the debt market evaporated and investors turned to the CDS market to hedge their exposures. In the face of such distress selling, financing conditions in Korea’s corporate bond market deteriorated to the point where the solvency of some financial institutions was threatened. Credit card ...

... segments of the debt market evaporated and investors turned to the CDS market to hedge their exposures. In the face of such distress selling, financing conditions in Korea’s corporate bond market deteriorated to the point where the solvency of some financial institutions was threatened. Credit card ...

PowerPoint-presentatie - EESC European Economic and Social

... • 6/9/2012: announcement that the ECB would do ‘whatever it takes to save the euro’: Outright Monetary Transactions to buy public bonds on the secondary market with no time- or size-limit • Juin 2014: TLTRO targeted longer term refinancing operation: auctioning of 4-year loans at ultra-low interes ...

... • 6/9/2012: announcement that the ECB would do ‘whatever it takes to save the euro’: Outright Monetary Transactions to buy public bonds on the secondary market with no time- or size-limit • Juin 2014: TLTRO targeted longer term refinancing operation: auctioning of 4-year loans at ultra-low interes ...

Real Estate Investment

... Short term funds to cover cost of completing development Must show commitment of permanent lender to pay out after developed ...

... Short term funds to cover cost of completing development Must show commitment of permanent lender to pay out after developed ...

Reporting Considerations

... Treasury. This opinion had left the agencies unable to pay dividends on their common and preferred stock. In past years, Fannie Mae and Freddie Mac preferred and common stock had been held (in many cases prior to their defaults as long-term holdings) by various entities, including hedge funds, banks ...

... Treasury. This opinion had left the agencies unable to pay dividends on their common and preferred stock. In past years, Fannie Mae and Freddie Mac preferred and common stock had been held (in many cases prior to their defaults as long-term holdings) by various entities, including hedge funds, banks ...

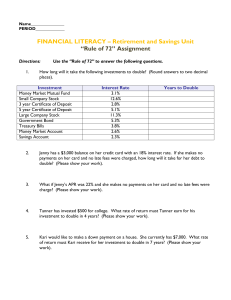

Rule of 72 Assignment

... Jackie’s parents invested $3,000 into a common stock earning 10% when she was born. How many times will Jackie’s investment double before age 36? What will her investment be worth? What would Jackie’s investment be worth if her parent’s had waited to invest until she was age 7? (Please show your wor ...

... Jackie’s parents invested $3,000 into a common stock earning 10% when she was born. How many times will Jackie’s investment double before age 36? What will her investment be worth? What would Jackie’s investment be worth if her parent’s had waited to invest until she was age 7? (Please show your wor ...

Chapter 9: Sources of Capital

... health of the economy. The SAVINGS RATE is the percentage of people’s disposable income that is not spent. Tells about wages Tells about economic slowdowns ...

... health of the economy. The SAVINGS RATE is the percentage of people’s disposable income that is not spent. Tells about wages Tells about economic slowdowns ...

What Is Diversification?

... Virtually every investment has some type of risk associated with it. The stock market rises and falls. An increase in interest rates can cause a decline in the bond market. No matter what you decide to invest in, risk is something you must consider. One key to successful investing is managing risk w ...

... Virtually every investment has some type of risk associated with it. The stock market rises and falls. An increase in interest rates can cause a decline in the bond market. No matter what you decide to invest in, risk is something you must consider. One key to successful investing is managing risk w ...

Strengthening the Financial System Establishing an International

... • This Decree - promulgated in 1978 - confers ownership of State land (in contrast to Federal or “parastatal” land) in the State Governor. • Not only has this Decree caused many social problems it continues to disrupt “normal” bank financings because the taking of land or property as security (a fun ...

... • This Decree - promulgated in 1978 - confers ownership of State land (in contrast to Federal or “parastatal” land) in the State Governor. • Not only has this Decree caused many social problems it continues to disrupt “normal” bank financings because the taking of land or property as security (a fun ...

Financial Times

... A loan to be paid by another loan, to be paid by another, etc. Each loan is an obligation that bank does not have ability to pay on time—“sale of what you don’t have” Highly risky—gharar “Two sales in one”: Fulfillment of one contract is conditioned on another ...

... A loan to be paid by another loan, to be paid by another, etc. Each loan is an obligation that bank does not have ability to pay on time—“sale of what you don’t have” Highly risky—gharar “Two sales in one”: Fulfillment of one contract is conditioned on another ...

Diapositiva 1 - European Parliament

... A BANK GOES INTO LIQUIDATION OR THE BANK IS TOTALLY BAILED OUT. ...

... A BANK GOES INTO LIQUIDATION OR THE BANK IS TOTALLY BAILED OUT. ...

Damascus looks to investment banks | Special Report | MEED

... of a market of 20 million people that has only recently moved to a free market economy is sufficiently high that it can attract the world’s leading investment banks. As evidence, it can point to the bid in March 2010 by EFG Hermes, the Middle East’s largest publicly traded investment bank, to open a ...

... of a market of 20 million people that has only recently moved to a free market economy is sufficiently high that it can attract the world’s leading investment banks. As evidence, it can point to the bid in March 2010 by EFG Hermes, the Middle East’s largest publicly traded investment bank, to open a ...

Presentation Chapter 4

... favors lending for investment by setting a differentiated discount rate that is lower for bank advances dedicated to financing investment in strategic sectors or activities. asset reserve requirement formula can be used whereby banks can choose to satisfy their reserve requirement by either lendin ...

... favors lending for investment by setting a differentiated discount rate that is lower for bank advances dedicated to financing investment in strategic sectors or activities. asset reserve requirement formula can be used whereby banks can choose to satisfy their reserve requirement by either lendin ...

smarterinsightTM - Donald Wealth Management

... Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, headline grabbing repor ...

... Equity markets have the ability to thrill and terrify investors in equal measure on a more or less daily basis - they always have and they always will. The present turmoil in the Eurozone and the lacklustre pace of recovery in the UK economy, combined with the sensationalist, headline grabbing repor ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.