The Argentine Experience - Federal Reserve Bank of Kansas City

... political uncertainty, given the presidential election in May 1995. However, there was no change in the fundamentals between December 19 and December 21, and I would maintain that there was never really a fundamental problem. This is obviously borne out by the rapid recovery of both the financial se ...

... political uncertainty, given the presidential election in May 1995. However, there was no change in the fundamentals between December 19 and December 21, and I would maintain that there was never really a fundamental problem. This is obviously borne out by the rapid recovery of both the financial se ...

Topic 1 : Saving and Investment

... More complex and realistic models of investment expenditure will recognize that investors make decisions based on their expectations of the future conditions of the economy. If national income is expected to increase, this would suggest that investment to expand firm’s output capacity will increase ...

... More complex and realistic models of investment expenditure will recognize that investors make decisions based on their expectations of the future conditions of the economy. If national income is expected to increase, this would suggest that investment to expand firm’s output capacity will increase ...

Dynamics Of The Merger Of Emirates Bank International (EBI) And

... In their continued effort to diversify domestic economies away from oil dependence, GCC countries have been investing in the growth of infrastructure including real estate, tourism, and industrial development. Leading in these efforts are UAE where there is now shortage of infrastructure like power ...

... In their continued effort to diversify domestic economies away from oil dependence, GCC countries have been investing in the growth of infrastructure including real estate, tourism, and industrial development. Leading in these efforts are UAE where there is now shortage of infrastructure like power ...

SIS Performance versus Benchmark to 31 March 2016

... NB: All the above investment strategies are exercised through investment in one, or a combination of, the Public Trustee Common Funds. The investment returns presented in this quarterly report relate to past performances and must not be taken to imply that this predicts future returns of the funds. ...

... NB: All the above investment strategies are exercised through investment in one, or a combination of, the Public Trustee Common Funds. The investment returns presented in this quarterly report relate to past performances and must not be taken to imply that this predicts future returns of the funds. ...

banking customer perception about interest rate spread

... Figure 9 is showing that Mostly respondents believes that current discount rate is below 10 %, due to recent news in print and electronic media regarding monetary policies announced by the State bank of Pakistan (SBP) so the people aware that banks gets funds from other banks and State Bank of Pakis ...

... Figure 9 is showing that Mostly respondents believes that current discount rate is below 10 %, due to recent news in print and electronic media regarding monetary policies announced by the State bank of Pakistan (SBP) so the people aware that banks gets funds from other banks and State Bank of Pakis ...

Market Comment - Emerging Market Corporate Bonds

... is the company behind the issue. If the fundamentals are strong and expected return = versus risk = balanced, we will invest! This explains how we can get yields of 10-13% in a very strong company with a pledge on assets whilst the benchmark is only paying between 6-8%. So investors need to be aware ...

... is the company behind the issue. If the fundamentals are strong and expected return = versus risk = balanced, we will invest! This explains how we can get yields of 10-13% in a very strong company with a pledge on assets whilst the benchmark is only paying between 6-8%. So investors need to be aware ...

BMO Asset Management Global Equity Fund

... returns through asset turnover and net profit margin. For those companies where the initial analysis has suggested a potentially attractive investment, the second part of the process is pursued. Before a decision is made to invest in a company, an in-depth interview with management is conducted to d ...

... returns through asset turnover and net profit margin. For those companies where the initial analysis has suggested a potentially attractive investment, the second part of the process is pursued. Before a decision is made to invest in a company, an in-depth interview with management is conducted to d ...

SECTOR REPORT Islamic Asset Management — Asia vs Arabia

... and invest it in a broad array of securities that are widely diversified, from the safest to the most risky investments. A portfolio’s composition would reflect the client’s investment objectives: a younger client would naturally prefer higher risk and higher return, while an older client the opposi ...

... and invest it in a broad array of securities that are widely diversified, from the safest to the most risky investments. A portfolio’s composition would reflect the client’s investment objectives: a younger client would naturally prefer higher risk and higher return, while an older client the opposi ...

BsBDH1edchap013WebDisplay

... Best Efforts Underwriting Underwriter must make their “best effort” to sell the securities at an agreed-upon offering price The company bears the risk of the issue not being sold The offer may be pulled if there is not enough interest at the offer price and the company does not get the capital a ...

... Best Efforts Underwriting Underwriter must make their “best effort” to sell the securities at an agreed-upon offering price The company bears the risk of the issue not being sold The offer may be pulled if there is not enough interest at the offer price and the company does not get the capital a ...

Opening Statement - Department of Finance ( 4 June 2014)

... We will also be pointing to continuing developments in the United States where the Securities and Exchange Commission is advanced in its deliberations on how best to approach the regulation of Money Market Funds. It is looking at several different approaches but has already made clear that it sees c ...

... We will also be pointing to continuing developments in the United States where the Securities and Exchange Commission is advanced in its deliberations on how best to approach the regulation of Money Market Funds. It is looking at several different approaches but has already made clear that it sees c ...

Closed-End Fund GGM Guggenheim Credit Allocation Fund

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

Market Insights - Quarterly outlook

... that sequencing to be respected, but the very fact that it ...

... that sequencing to be respected, but the very fact that it ...

Commentary by Skylands Capital LLC, Sub-Investment

... Franck Act, combined with a hostile regulatory atmosphere, has stifled new hiring and investment. When visiting management teams, regulatory overreach is often cited as an impediment to growth. However, the news is not all bad in Washington for the economy and investors. The Federal Reserve has take ...

... Franck Act, combined with a hostile regulatory atmosphere, has stifled new hiring and investment. When visiting management teams, regulatory overreach is often cited as an impediment to growth. However, the news is not all bad in Washington for the economy and investors. The Federal Reserve has take ...

on the structural weaknesses of the post-1999 turkish dis

... investors’ perceptions adversely. The Turkish government requested, in turn, a new threeyear stand-by arrangement for offsetting the detrimental effects of the external shock. The Fund accepted the new letter of intent dated January 18, 2002 with a considerable amount of financial support. The last ...

... investors’ perceptions adversely. The Turkish government requested, in turn, a new threeyear stand-by arrangement for offsetting the detrimental effects of the external shock. The Fund accepted the new letter of intent dated January 18, 2002 with a considerable amount of financial support. The last ...

WHy INTERNATIONAL BANkING GROUpS cHOOSE LUXEMBOURG

... both from the “Old Continent” as well as from non-EU countries. The Grand Duchy today counts 143 banks from 27 different countries. While certain doomsayers predicted that the introduction of the automatic exchange of information would spell the end of Luxembourg as a banking centre, reality has pro ...

... both from the “Old Continent” as well as from non-EU countries. The Grand Duchy today counts 143 banks from 27 different countries. While certain doomsayers predicted that the introduction of the automatic exchange of information would spell the end of Luxembourg as a banking centre, reality has pro ...

Slide 1

... * Includes structured products, hedge funds, managed fund, foreign currency, commodities (including precious metals), private equity and investments of passion (fine art and collactables). ** Includes direct real estate investments and REITs, which are not common instruments outside the United State ...

... * Includes structured products, hedge funds, managed fund, foreign currency, commodities (including precious metals), private equity and investments of passion (fine art and collactables). ** Includes direct real estate investments and REITs, which are not common instruments outside the United State ...

Navellier - Weekly Marketmail

... The S&P 500 rose for the fourth straight week, reaching a new record high of 1692 on Friday. The S&P has risen 5.3% so far in July, despite several weeks of downbeat growth statistics, which point to slower (1.0% to 1.5%) second quarter GDP growth rates. On the positive side, however, this return to ...

... The S&P 500 rose for the fourth straight week, reaching a new record high of 1692 on Friday. The S&P has risen 5.3% so far in July, despite several weeks of downbeat growth statistics, which point to slower (1.0% to 1.5%) second quarter GDP growth rates. On the positive side, however, this return to ...

Prudent Practices for Investment Managers

... accordance with applicable laws, trust documents, and written investment policy statements Practice No. 1.2 Fiduciaries are aware of their duties and responsibilities Practice No. 1.3 Fiduciaries and parties in interest are not involved in self-dealing Practice No. 1.4 Service agreements and contrac ...

... accordance with applicable laws, trust documents, and written investment policy statements Practice No. 1.2 Fiduciaries are aware of their duties and responsibilities Practice No. 1.3 Fiduciaries and parties in interest are not involved in self-dealing Practice No. 1.4 Service agreements and contrac ...

Investing in Bond Funds

... way they measure return. Mutual funds normally look at return relative to the market. For example, you hear that fund X has beaten the market by 4.3% in 2012. Hedge funds tend to look at absolute, as opposed to relative, return: they strive to earn a certain return each year (let’s say, 20%), regard ...

... way they measure return. Mutual funds normally look at return relative to the market. For example, you hear that fund X has beaten the market by 4.3% in 2012. Hedge funds tend to look at absolute, as opposed to relative, return: they strive to earn a certain return each year (let’s say, 20%), regard ...

Russian Banking System – the Current State and Prospects for the

... recovery. The growth of the national banking system was predetermined by the demand for the banking services in the transition period to the market economy. The Russian banking system developed in 1992-1998 under the unfavorable macroeconomic conditions, including social and political instability, c ...

... recovery. The growth of the national banking system was predetermined by the demand for the banking services in the transition period to the market economy. The Russian banking system developed in 1992-1998 under the unfavorable macroeconomic conditions, including social and political instability, c ...

Economic and market prospects

... Any opinions expressed in this presentation constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this presentation is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time o ...

... Any opinions expressed in this presentation constitute our judgement at the time of issue and are subject to change. We believe that the information contained in this presentation is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time o ...

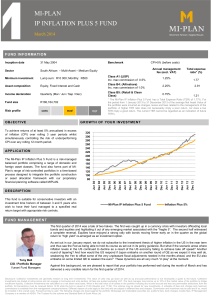

mi-plan ip inflation plus 5 fund

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

... Disclosure: Collective investments are generally medium to long term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Collective investments are traded at ruling prices and can engage in borrowing and scrip lending. All fees are ...

Assets Liabilities Management In Islamic Banking

... determining credit risk measure are considered by ALCO. The standard measure for allowances for bad debts (sum of public and specific reserves) to net loans should be at an acceptable level (the standard measure is 2% of net financing and advances). One of the advantages of Islamic banking in compar ...

... determining credit risk measure are considered by ALCO. The standard measure for allowances for bad debts (sum of public and specific reserves) to net loans should be at an acceptable level (the standard measure is 2% of net financing and advances). One of the advantages of Islamic banking in compar ...

The Koszyki Hall Will Emerge with Support of Bank Gospodarstwa

... bank offers preferential loans to investors executing urban projects that combine a commercial aspect (ensuring repayment of a loan) with social components desirable from the perspective of the local society (e.g. execution of a project enhances the attractiveness of a particular area, attracts inve ...

... bank offers preferential loans to investors executing urban projects that combine a commercial aspect (ensuring repayment of a loan) with social components desirable from the perspective of the local society (e.g. execution of a project enhances the attractiveness of a particular area, attracts inve ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.