7. Which of the following statements regarding money

... Which of the following statements is true regarding asset-backed securities (ASB)? ...

... Which of the following statements is true regarding asset-backed securities (ASB)? ...

Spillover effects among gold, stocks, and bonds

... indicating that the interdependence between markets is also time-varying, and that the pattern of spillovers differed depending on whether they looked at returns or volatilities. In particular, Diebold and Yilmaz found that returns appeared to exhibit a trend of increasing financial market integrati ...

... indicating that the interdependence between markets is also time-varying, and that the pattern of spillovers differed depending on whether they looked at returns or volatilities. In particular, Diebold and Yilmaz found that returns appeared to exhibit a trend of increasing financial market integrati ...

Indexes and benchmarks made clear

... Because an index is a hypothetical basket of stocks, it cannot be invested in directly. However, indexes are often licensed by fund managers to be used as the basis for passively invested products that track an index such as mutual funds, ETFs, separately managed accounts, swaps and structured produ ...

... Because an index is a hypothetical basket of stocks, it cannot be invested in directly. However, indexes are often licensed by fund managers to be used as the basis for passively invested products that track an index such as mutual funds, ETFs, separately managed accounts, swaps and structured produ ...

Notes on the Secrets of Economic Indicators

... Increasing unemployment claims are favorable for bonds especially if it jumps by 30,000 or more. A continuous drop in new claims is bad for bonds because it hints at more difficult conditions ahead. Bonds decline on increasing sales because it signals accelerating growth. Falling or weak sales are b ...

... Increasing unemployment claims are favorable for bonds especially if it jumps by 30,000 or more. A continuous drop in new claims is bad for bonds because it hints at more difficult conditions ahead. Bonds decline on increasing sales because it signals accelerating growth. Falling or weak sales are b ...

Risk parity - The Tel-Aviv Institutional Investment Conference

... any investment decisions. The information contained in this document can be changed any time and without prior notice. 1741 Asset Management Ltd., Wegelin Asset Management Funds SICAV and Wegelin Specialised Investment Funds SICAV accept no liability for any damages whatsoever arising from action ta ...

... any investment decisions. The information contained in this document can be changed any time and without prior notice. 1741 Asset Management Ltd., Wegelin Asset Management Funds SICAV and Wegelin Specialised Investment Funds SICAV accept no liability for any damages whatsoever arising from action ta ...

FREE Sample Here - Find the cheapest test bank for your

... a. Back before the SEC was created in the 1930s, companies would declare reverse splits in order to boost their stock prices. However, this was determined to be a deceptive practice, and it is illegal today. b. Stock splits create more administrative problems for investors than stock dividends, espe ...

... a. Back before the SEC was created in the 1930s, companies would declare reverse splits in order to boost their stock prices. However, this was determined to be a deceptive practice, and it is illegal today. b. Stock splits create more administrative problems for investors than stock dividends, espe ...

1 - Member and Committee Information

... The total Fund return for calendar year 2015 was 2.2%, against a benchmark return of 4.1% and the average fund return of 2.9%, placing the Fund in the 62nd percentile of funds in the WM All Funds Universe, a universe made up of public and private sector funds. (Note that 1st percentile ranking is hi ...

... The total Fund return for calendar year 2015 was 2.2%, against a benchmark return of 4.1% and the average fund return of 2.9%, placing the Fund in the 62nd percentile of funds in the WM All Funds Universe, a universe made up of public and private sector funds. (Note that 1st percentile ranking is hi ...

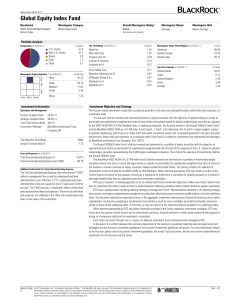

Global Equity Index Fund

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...

... by the MSCI ACWI IMI US $ Net Dividend Index. In seeking its objective, the Account invests in the Russell 3000[rt] Index Fund E and the BlackRock MSCI ACWI ex-U.S. IMI Index Fund E (each, a "Fund", and collectively, the "Funds") in target weights, subject to periodic rebalancing. Each Fund is an "i ...

Comovement and Predictability Relationships Between

... predict the returns on bond-like relative to speculative stocks also predicts the returns on government bonds. This cross-sectional focus complements Fama and French’s stock-index-level tests and delivers strong evidence that the expected returns of stocks and bonds are firmly linked. We offer a pre ...

... predict the returns on bond-like relative to speculative stocks also predicts the returns on government bonds. This cross-sectional focus complements Fama and French’s stock-index-level tests and delivers strong evidence that the expected returns of stocks and bonds are firmly linked. We offer a pre ...

Benchmarking a Transition Economy Capital Market

... regular updating of market prices [Boot and Thakor (1997)]. Therefore, this paper may also claim to be able to normatively place Poland at a certain stage of its economic development. Empirical analysis however, states that financial system architecture is also based on the progress of its financial ...

... regular updating of market prices [Boot and Thakor (1997)]. Therefore, this paper may also claim to be able to normatively place Poland at a certain stage of its economic development. Empirical analysis however, states that financial system architecture is also based on the progress of its financial ...

The impact of the Credit Crunch on the Sterling Corporate Bond

... invest proceeds, replace redeemed bonds, and pay out cash to the fund’s investors). While there is an element of speculative trading by these institutional investors, this does not represent their major investment objective. Generally bond markets remain as intermediated markets in contrast to equit ...

... invest proceeds, replace redeemed bonds, and pay out cash to the fund’s investors). While there is an element of speculative trading by these institutional investors, this does not represent their major investment objective. Generally bond markets remain as intermediated markets in contrast to equit ...

SUMMARY PROSPECTUS Tortoise North American Pipeline Fund

... As with all funds, a shareholder of the Fund is subject to the risk that his or her investment could lose money. The principal risks affecting shareholders’ investments in the Fund are set forth below. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or an ...

... As with all funds, a shareholder of the Fund is subject to the risk that his or her investment could lose money. The principal risks affecting shareholders’ investments in the Fund are set forth below. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the FDIC or an ...

SASB Press Kit: Best Hits of 2015

... to sell in terms of the expected financial and commercial performance of these assets over the long run. So while the UC decision may have been hailed as a divestment win by the media, the real victory here is for financial investors, as the UC move conforms entirely to commercial logics and, as suc ...

... to sell in terms of the expected financial and commercial performance of these assets over the long run. So while the UC decision may have been hailed as a divestment win by the media, the real victory here is for financial investors, as the UC move conforms entirely to commercial logics and, as suc ...

Impact of Foreign Institutional Investors

... institutions in India and the performance of the Indian stock markets and she concluded that Indian stock market is regarded at par with the developed markets Moreover, it had a very unique economic model and is based on strong economic growth with huge liquidity and it is not depended on the US eco ...

... institutions in India and the performance of the Indian stock markets and she concluded that Indian stock market is regarded at par with the developed markets Moreover, it had a very unique economic model and is based on strong economic growth with huge liquidity and it is not depended on the US eco ...

The New Economy Business Model and Sustainable

... economy over the past three decades. The resultant economic growth, however, has been unstable, while the distribution of income in the US economy has become significantly more unequal. In my forthcoming book, Sustainable Prosperity in the New Economy?, I show that the transition from OEBM to NEBM i ...

... economy over the past three decades. The resultant economic growth, however, has been unstable, while the distribution of income in the US economy has become significantly more unequal. In my forthcoming book, Sustainable Prosperity in the New Economy?, I show that the transition from OEBM to NEBM i ...

Forecasting stock market volatility with macroeconomic

... and can easily be applied by practitioners. The second criterion is the utility-based criterion developed by West et al. (1993) and recently applied by Fleming et al. (2001) to evaluate volatility forecasts. The utility-based criterion provides a microeconomic foundation for forecast evaluation. The ...

... and can easily be applied by practitioners. The second criterion is the utility-based criterion developed by West et al. (1993) and recently applied by Fleming et al. (2001) to evaluate volatility forecasts. The utility-based criterion provides a microeconomic foundation for forecast evaluation. The ...

19. Investments 3: Securities Market Basics

... Discount-service brokers perform only the trading portion of investment management, but their services usually cost 50 to 75 percent less than full-service brokers. Deep-discount brokers are even less expensive than discount-service brokers because they specialize in only one area. Like discount-ser ...

... Discount-service brokers perform only the trading portion of investment management, but their services usually cost 50 to 75 percent less than full-service brokers. Deep-discount brokers are even less expensive than discount-service brokers because they specialize in only one area. Like discount-ser ...

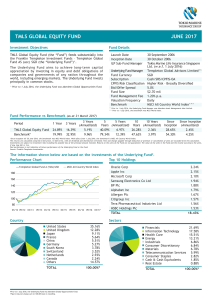

tmls global equity fund june 2017

... Past performance is not indicative of future performance. Investments are subject to investment risks including the possible loss of the principal amount invested. Returns on the units of the Fund are not guaranteed. The value of the units in the Fund and the income accruing to the units, if any, ma ...

... Past performance is not indicative of future performance. Investments are subject to investment risks including the possible loss of the principal amount invested. Returns on the units of the Fund are not guaranteed. The value of the units in the Fund and the income accruing to the units, if any, ma ...

The conceptual and empirical relationship between gambling

... Fortunately, there is reasonable consistency in the various definitions that have been proposed for “investing” with the following, capturing the sentiments of most: “purchasing or allocating money into an asset with the expectation of long term capital appreciation or profits deriving from that asset ...

... Fortunately, there is reasonable consistency in the various definitions that have been proposed for “investing” with the following, capturing the sentiments of most: “purchasing or allocating money into an asset with the expectation of long term capital appreciation or profits deriving from that asset ...

RIVERPARK INTRODUCES RIVERPARK LONG/SHORT

... performance to be repeated. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost, and current performance may be higher or lower than the performance quoted. For performance data curr ...

... performance to be repeated. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost, and current performance may be higher or lower than the performance quoted. For performance data curr ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... domestic distribution inventory if the Company lowers the prices of its products; exchanges up to 5% of certain purchases on a quarterly basis; and ship and debit transactions. Ship and debit transactions occur when the Company agrees to accept a lower selling price for a specific quantity of produc ...

... domestic distribution inventory if the Company lowers the prices of its products; exchanges up to 5% of certain purchases on a quarterly basis; and ship and debit transactions. Ship and debit transactions occur when the Company agrees to accept a lower selling price for a specific quantity of produc ...

The Predictability of Real Estate Returns and Market

... This study is also unique from previous finance literature on market timing in that previous studies have focused on testing for the existence of market timing ability within the sample. More specifically, the issue investigated is whether differential investment performance is due to stock selectio ...

... This study is also unique from previous finance literature on market timing in that previous studies have focused on testing for the existence of market timing ability within the sample. More specifically, the issue investigated is whether differential investment performance is due to stock selectio ...

The Effect of Corporate Governance on Stock Repurchases

... controlling owners constrained by a willingness to uphold a reputation for honesty, play a dominant role in board-level decision making in Swedish firms, such as in the decision to repurchase stock. The use of owner monitoring rather than performance-based pay to align managerial incentives with that ...

... controlling owners constrained by a willingness to uphold a reputation for honesty, play a dominant role in board-level decision making in Swedish firms, such as in the decision to repurchase stock. The use of owner monitoring rather than performance-based pay to align managerial incentives with that ...

Proceedings of 7th Annual American Business Research Conference

... expense of outside investors in the Japanese market. There have been a few empirical studies on delisting in the U.S. market, which document that the delisting decision has a significant negative effect on the stock price. However, depending on the sample and measurement methodology, conflicting res ...

... expense of outside investors in the Japanese market. There have been a few empirical studies on delisting in the U.S. market, which document that the delisting decision has a significant negative effect on the stock price. However, depending on the sample and measurement methodology, conflicting res ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.