- Free Documents

... Obviously, these assets cannot be discussed in detail in this chapter however, instructors can provide additional details as they see fit. What is important here is for students to be exposed to the major types of financial assets early in the course in order for them to understand the basics of alt ...

... Obviously, these assets cannot be discussed in detail in this chapter however, instructors can provide additional details as they see fit. What is important here is for students to be exposed to the major types of financial assets early in the course in order for them to understand the basics of alt ...

The Adequacy of Investment Choices Offered By 401(k) Plans Edwin

... In order to determine if 401(k) plans offer their participants appropriate investment choices, we need to hypothesize an adequate set of alternative investment choices. There are two approaches that can be taken. The first approach draws on the field of financial economics, where extensive literatur ...

... In order to determine if 401(k) plans offer their participants appropriate investment choices, we need to hypothesize an adequate set of alternative investment choices. There are two approaches that can be taken. The first approach draws on the field of financial economics, where extensive literatur ...

Public Capital: Investment Stocks and Depreciation

... contribution to potential output, there is some debate over the merits of adopting a ‘Golden Rule’ which excludes public investment from the fiscal rules (see Portes and Wren-Lewis 2014, Mintz and Smart, 2006). Several modifications to the rules have been proposed in order to strike a balance betwee ...

... contribution to potential output, there is some debate over the merits of adopting a ‘Golden Rule’ which excludes public investment from the fiscal rules (see Portes and Wren-Lewis 2014, Mintz and Smart, 2006). Several modifications to the rules have been proposed in order to strike a balance betwee ...

Financial Leverage and the Leverage Effect

... the cash flows generated by a firm’s assets are specified exogenously, have a constant volatility, and are split into an exogenously specified riskless debt service and a dividend stream to equity holders. We derive the equilibrium prices and dynamics of all financial claims. We identify the economi ...

... the cash flows generated by a firm’s assets are specified exogenously, have a constant volatility, and are split into an exogenously specified riskless debt service and a dividend stream to equity holders. We derive the equilibrium prices and dynamics of all financial claims. We identify the economi ...

Why Firms Issue Targeted Stock

... to save U S West $200 million in potential taxes over a few years (Reingold (1995)). However, there is some doubt whether targeted stock issues will continue to be tax-free. The Treasury department has proposed legislation to tax companies on their gain if they sell targeted stock. Congress is sched ...

... to save U S West $200 million in potential taxes over a few years (Reingold (1995)). However, there is some doubt whether targeted stock issues will continue to be tax-free. The Treasury department has proposed legislation to tax companies on their gain if they sell targeted stock. Congress is sched ...

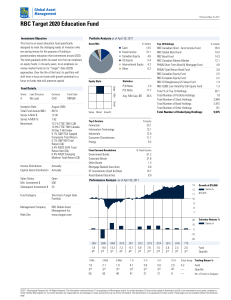

RBC Target 2020 Education Fund

... 2016. The Adjusted MER represents what the reported MER would have been had management fee changes been in effect throughout 2016. Series H and Series I are not available for purchase by new investors. Existing investors who hold Series H or Series I units can continue to make additional investments ...

... 2016. The Adjusted MER represents what the reported MER would have been had management fee changes been in effect throughout 2016. Series H and Series I are not available for purchase by new investors. Existing investors who hold Series H or Series I units can continue to make additional investments ...

Executive stock and option valuation in a two state

... and it is usually determined by utility-based models that ask what minimum dollar amount would make him give up the stock options or the restricted stock. Lambert, Larcker, and Verrecchia (1991), Huddart (1994), Kulatilaka and Marcus (1994), Carpenter (1998), and Hall and Murphy (2002) present versi ...

... and it is usually determined by utility-based models that ask what minimum dollar amount would make him give up the stock options or the restricted stock. Lambert, Larcker, and Verrecchia (1991), Huddart (1994), Kulatilaka and Marcus (1994), Carpenter (1998), and Hall and Murphy (2002) present versi ...

The Welfare Cost of Business Cycles with

... The assumption of heterogeneous trading technologies is critical to my results. The question thus arises: How realistic is the assumption of heterogeneous trading technologies? The answer can be found in empirical studies and data that have shown a high amount of heterogeneity in household portfolio ...

... The assumption of heterogeneous trading technologies is critical to my results. The question thus arises: How realistic is the assumption of heterogeneous trading technologies? The answer can be found in empirical studies and data that have shown a high amount of heterogeneity in household portfolio ...

Risk Arbitrage and the Prediction of Successful

... in a profit equal to the spread of SEK 2.50 or a return of 2.56% during the bidperiod2 of 49 days. The annual return on the investment would have been 18.8%. If the offer had failed, the arbitrageur would have closed the position, at prevailing market prices, at the date of termination. This would m ...

... in a profit equal to the spread of SEK 2.50 or a return of 2.56% during the bidperiod2 of 49 days. The annual return on the investment would have been 18.8%. If the offer had failed, the arbitrageur would have closed the position, at prevailing market prices, at the date of termination. This would m ...

Bonds

... Bonds Recommendations You will be making recommendations to two friends—one who is trying to help her parents save for retirement and another who is interested in launching his own business Download- Reading: Comparing Stocks and Bonds ...

... Bonds Recommendations You will be making recommendations to two friends—one who is trying to help her parents save for retirement and another who is interested in launching his own business Download- Reading: Comparing Stocks and Bonds ...

have Higher Stock Returns? - IC

... correlation could result from reverse causality. For example, an increase in productivity may not be related to job satisfaction but by other external factors, like payments and work conditions. On the other hand, studies above use job performance as a dependent variable. Three problems may result f ...

... correlation could result from reverse causality. For example, an increase in productivity may not be related to job satisfaction but by other external factors, like payments and work conditions. On the other hand, studies above use job performance as a dependent variable. Three problems may result f ...

FCA Consultation CP16/30: Transaction cost disclosure in

... As we have seen recently with either fair value adjustments or trading restrictions temporarily placed on property funds, asset valuations for illiquid assets such as property are subjective. A further issue for DC is that the values being traded are often small and so are met out of funds’ cash-flo ...

... As we have seen recently with either fair value adjustments or trading restrictions temporarily placed on property funds, asset valuations for illiquid assets such as property are subjective. A further issue for DC is that the values being traded are often small and so are met out of funds’ cash-flo ...

risks associated with financial instruments (glossary)

... Non-systematic risk refers to risks that can be mitigated through diversification. It is also called unique, diversifiable, firm-specific, or industryspecific risk. Investors can mitigate this type of risk by constructing portfolios in an intelligent way. The two examples below illustrate simple div ...

... Non-systematic risk refers to risks that can be mitigated through diversification. It is also called unique, diversifiable, firm-specific, or industryspecific risk. Investors can mitigate this type of risk by constructing portfolios in an intelligent way. The two examples below illustrate simple div ...

Rate of return = $2317.24 / $20000 = 11.59% per

... Asset allocation means choosing among broad categories such as stocks and bonds. Security selection means picking individual assets within a particular category, such as shares of stock in particular companies. ...

... Asset allocation means choosing among broad categories such as stocks and bonds. Security selection means picking individual assets within a particular category, such as shares of stock in particular companies. ...

Investor Sentiment and Beta Pricing

... extreme form of overconfidence is that agents’ trade on pure noise due to their belief that they are trading on fundamentals. Such trading by unsophisticated investors may also be more prevalent during optimistic periods than pessimistic ones, indicating that rational pricing would be more evident d ...

... extreme form of overconfidence is that agents’ trade on pure noise due to their belief that they are trading on fundamentals. Such trading by unsophisticated investors may also be more prevalent during optimistic periods than pessimistic ones, indicating that rational pricing would be more evident d ...

capital market and reserch unit

... This report is prepared by the Capital Market and Research Unit of Dynamic Portfolio Ltd as a guideline for clients that intend to invest in stocks on the basis of their own investment decision without completely relying on the information contained herein. The report has been carefully prepared, no ...

... This report is prepared by the Capital Market and Research Unit of Dynamic Portfolio Ltd as a guideline for clients that intend to invest in stocks on the basis of their own investment decision without completely relying on the information contained herein. The report has been carefully prepared, no ...

Time-Zone Arbitrage in Vanguard International

... performed the best. BSRW used two thresholds: 0.5% and 1% expected excess returns to signal a switch from the money market to the mutual fund. On days that the expected excess is less than zero the investor moves out of the international fund. They measured returns to the strategy against a benchmar ...

... performed the best. BSRW used two thresholds: 0.5% and 1% expected excess returns to signal a switch from the money market to the mutual fund. On days that the expected excess is less than zero the investor moves out of the international fund. They measured returns to the strategy against a benchmar ...

What Makes the Bonding Stick?

... hypothesis and, more broadly, to assess the value of U.S. legal enforcement institutions for crosslisted firms, we find evidence that calls the legal bonding hypothesis into question. Successful bonding depends crucially on enforcement. Conventional wisdom from Bentham (1789) to Becker (1968) and b ...

... hypothesis and, more broadly, to assess the value of U.S. legal enforcement institutions for crosslisted firms, we find evidence that calls the legal bonding hypothesis into question. Successful bonding depends crucially on enforcement. Conventional wisdom from Bentham (1789) to Becker (1968) and b ...

Working Paper Series Short Selling Regulation

... many years.7 Fourth, securities lending (be it for short selling purposes or not) also entails a substantial credit risk. Most recently, the investment company Olivant reported that it was not able to locate its equity stake of almost 2.8% of total UBS shares due to the collapse of Lehman Brothers, ...

... many years.7 Fourth, securities lending (be it for short selling purposes or not) also entails a substantial credit risk. Most recently, the investment company Olivant reported that it was not able to locate its equity stake of almost 2.8% of total UBS shares due to the collapse of Lehman Brothers, ...

Foreign Institutional Investors and Corporate Governance in

... launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particular in emerging markets, where funding needs are high and investor protection standards often stil ...

... launched to encourage and convince institutional investors to play a more active role. However, not enough is known about how institutional investors utilize CG in their investment decisions, in particular in emerging markets, where funding needs are high and investor protection standards often stil ...

EFFECT OF BEHAVIOURAL BIASES ON INVESTMENT DECISIONS

... For a long time everybody thought that traditional finance theory is accurate because it states that investors think rationally and make deliberate decisions, based on various estimations or using economic models. However after a number of investigations, it was noticed that human decisions often de ...

... For a long time everybody thought that traditional finance theory is accurate because it states that investors think rationally and make deliberate decisions, based on various estimations or using economic models. However after a number of investigations, it was noticed that human decisions often de ...

FIRM ELEMENT TRAINING - Securities Training Corporation

... STC has written training plans for more than 300 broker-dealers, including retail, institutional, and investment advisory firms, banks, and insurance companies Our plan writing-services begin with a comprehensive Needs Analysis. Using a combination of methods including interviews, questionnaires, an ...

... STC has written training plans for more than 300 broker-dealers, including retail, institutional, and investment advisory firms, banks, and insurance companies Our plan writing-services begin with a comprehensive Needs Analysis. Using a combination of methods including interviews, questionnaires, an ...

investment

... Security selection Risk-return trade-off Market efficiency Active vs. passive management ...

... Security selection Risk-return trade-off Market efficiency Active vs. passive management ...

BlackRock US Corporate Bond Index Fund

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

... The custodian of the Fund is J.P. Morgan Bank (Ireland) plc. Further information about the Fund can be obtained from the latest annual report and half-yearly reports of the BlackRock Fixed Income Dublin Funds plc (BFIDF). These documents are available free of charge in English and certain other lang ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.