iShares US Treasury Bond 7-10 Year JPY Hedged ETF

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

... - Because ETFs invest in securities whose prices fluctuate, the market price or base value may decrease due to shifts in the underling index or foreign exchange market, fluctuations in the price of constituent securities, bankruptcy or deterioration in the financial conditions of constituent securit ...

Contemporary-Financial-Management-11th-Edition

... 7. The New York Stock Exchange is a physical location where buyers and sellers of securities meet to exchange assets. The New York Stock Exchange works through a specialist system and complex computer linkages that match buyers and sellers and maintain an orderly market. In contrast, the over-the-co ...

... 7. The New York Stock Exchange is a physical location where buyers and sellers of securities meet to exchange assets. The New York Stock Exchange works through a specialist system and complex computer linkages that match buyers and sellers and maintain an orderly market. In contrast, the over-the-co ...

Volatility Spillovers and Asymmetry in Real Estate Stock Returns

... L lim P(U q V q) lim P(V q U q) lim q0 ...

... L lim P(U q V q) lim P(V q U q) lim q0 ...

Navellier - Weekly Marketmail

... watching their actions – i.e., their continued pump-priming to boost economic growth. I oftentimes view these occasional pullbacks as new buying opportunities, especially for some companies that aggressively buy back their existing shares. And now, after a brief Memorial Day pause, the market will l ...

... watching their actions – i.e., their continued pump-priming to boost economic growth. I oftentimes view these occasional pullbacks as new buying opportunities, especially for some companies that aggressively buy back their existing shares. And now, after a brief Memorial Day pause, the market will l ...

April 21st, 2017 Report

... Northeast Bancorp (NBN): We were unable to find any conclusive evidence regarding Northeast Bancorp’s stock value rise. ...

... Northeast Bancorp (NBN): We were unable to find any conclusive evidence regarding Northeast Bancorp’s stock value rise. ...

Looking to gain from small-cap inefficiencies with active management

... analysts dedicated to researching a large-cap company and 13 analysts dedicated to a mid-cap company.A Small-cap companies had an average of seven analysts. The high coverage large caps receive means these companies are priced by the market. And with such extensive research externally available on t ...

... analysts dedicated to researching a large-cap company and 13 analysts dedicated to a mid-cap company.A Small-cap companies had an average of seven analysts. The high coverage large caps receive means these companies are priced by the market. And with such extensive research externally available on t ...

Oil, Currencies, and the Fed

... Contradicting a continuous barrage of misinformation from consultants and pundits that kept many investors from participating in the run up, investors have finally come to realize that the last six years was not a secular bear market but its inverse; one of the longest secular bull markets in financ ...

... Contradicting a continuous barrage of misinformation from consultants and pundits that kept many investors from participating in the run up, investors have finally come to realize that the last six years was not a secular bear market but its inverse; one of the longest secular bull markets in financ ...

q1 2017 global market update

... Yes, it’s frustrating to think about missing the 10%+ move since the election, especially if you’ve been waiting for a correction. Should one sit on the sidelines and wait for the inevitable pullback, or will the market run up another 10% before that happens? By now, most of our readers know that we ...

... Yes, it’s frustrating to think about missing the 10%+ move since the election, especially if you’ve been waiting for a correction. Should one sit on the sidelines and wait for the inevitable pullback, or will the market run up another 10% before that happens? By now, most of our readers know that we ...

BM 418 Personal Finance

... It has been around for a while, with 6 million shares outstanding and a book value per share of $40. It has expected earnings per share next year of $2. You know that similar companies trade in the US at a prospective PE range of 14-16 times earnings. You also have estimated the assets in the compan ...

... It has been around for a while, with 6 million shares outstanding and a book value per share of $40. It has expected earnings per share next year of $2. You know that similar companies trade in the US at a prospective PE range of 14-16 times earnings. You also have estimated the assets in the compan ...

Investment Modeling with StockPointer

... presence of canadian economy in some sectors No stock should weight for more than 7.5% of the portfolio Objective of 10% cash should be kept in portfolio ...

... presence of canadian economy in some sectors No stock should weight for more than 7.5% of the portfolio Objective of 10% cash should be kept in portfolio ...

Turkish Capital Markets - Capital Markets Board of Turkey

... Foreign Investor Custody Ratio (Stock Market) ...

... Foreign Investor Custody Ratio (Stock Market) ...

Genesis and prospects of the Ukrainian stock market

... Ukrainian stock market contains elements which are typical for markets in many countries: availability of state control over the circulation of securities; regulation of their total list, licenses for professional participants of transactions; licenses for stock-exchange and non-stock-exchange turno ...

... Ukrainian stock market contains elements which are typical for markets in many countries: availability of state control over the circulation of securities; regulation of their total list, licenses for professional participants of transactions; licenses for stock-exchange and non-stock-exchange turno ...

Analysts foresee boost in market activities this week

... market indicators of the Nigerian Stock Exchange towards the end of last week will be sustained this week. The analysts said specifically that the increased momentum in the indices would likely be driven by the banking and financial sectors The analysts hinged their prediction on the expected full y ...

... market indicators of the Nigerian Stock Exchange towards the end of last week will be sustained this week. The analysts said specifically that the increased momentum in the indices would likely be driven by the banking and financial sectors The analysts hinged their prediction on the expected full y ...

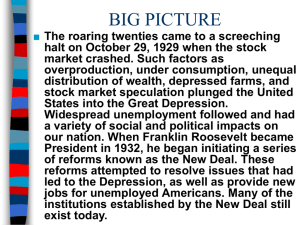

Great Depression

... stock market speculation plunged the United States into the Great Depression. Widespread unemployment followed and had a variety of social and political impacts on ...

... stock market speculation plunged the United States into the Great Depression. Widespread unemployment followed and had a variety of social and political impacts on ...

Introduction of Nan-Jae Lin`s Complimentary Stocks Investment

... Prepare your courage to buy more stocks when everyone has extreme fear about the market ...

... Prepare your courage to buy more stocks when everyone has extreme fear about the market ...

June 13th 2008 - Neil H. Gendreau, CFP

... the spread on junk bond yields over treasury yields have become quite enticing, especially as an income producing agent. While less than investment grade corporate credit has a higher chance of default than investment grade debt, default risk can be more effectively managed through a mutual fund rat ...

... the spread on junk bond yields over treasury yields have become quite enticing, especially as an income producing agent. While less than investment grade corporate credit has a higher chance of default than investment grade debt, default risk can be more effectively managed through a mutual fund rat ...

Savings and Investing

... average. They rarely pay dividends and investors buy them in the hope of capital appreciation. A start-up technology company is likely to be a growth stock. Income stocks pay dividends consistently. Investors buy them for the income they generate. An established utility company is likely to be an in ...

... average. They rarely pay dividends and investors buy them in the hope of capital appreciation. A start-up technology company is likely to be a growth stock. Income stocks pay dividends consistently. Investors buy them for the income they generate. An established utility company is likely to be an in ...

Chapter 8 - FIU Faculty Websites

... Banks make money on the difference in the interest rate they pay on deposits and collect on ...

... Banks make money on the difference in the interest rate they pay on deposits and collect on ...

chapter # 6 - how the markets work - supply

... The cost of trading has dropped dramatically -- it's easy to find commissions for less than $10 a trade. But there are other costs to trading -- including mark-ups by brokers and higher taxes for short-term trades -- that stack the odds against traders. What's more, active trading requires paying cl ...

... The cost of trading has dropped dramatically -- it's easy to find commissions for less than $10 a trade. But there are other costs to trading -- including mark-ups by brokers and higher taxes for short-term trades -- that stack the odds against traders. What's more, active trading requires paying cl ...

irrevocable stock or bond power form

... Signature Guarantee is a stamp you may get from an eligible Guarantor Institution such as a bank or a brokerage firm. To get the stamp, you will need to bring the form to the eligible Guarantor and complete this section in their presence. All current owners must sign their name and have their signat ...

... Signature Guarantee is a stamp you may get from an eligible Guarantor Institution such as a bank or a brokerage firm. To get the stamp, you will need to bring the form to the eligible Guarantor and complete this section in their presence. All current owners must sign their name and have their signat ...

Market Capitalisation– The overall market capitalisation remained

... Market Capitalisation– The overall market capitalisation remained stagnant this week as there was no price movement experienced in the market. STRI – the accumulation index witnessed an increase of 0.11% to conclude the week at 2904.39. Since STRI factors in dividend returns into its calculation, th ...

... Market Capitalisation– The overall market capitalisation remained stagnant this week as there was no price movement experienced in the market. STRI – the accumulation index witnessed an increase of 0.11% to conclude the week at 2904.39. Since STRI factors in dividend returns into its calculation, th ...

Investing in Stocks

... Chartists plot past price movements and other market averages to observe trends they use to predict a stock’s future value I think these folks are all wet. ...

... Chartists plot past price movements and other market averages to observe trends they use to predict a stock’s future value I think these folks are all wet. ...

The Investment Environment

... Managers could be given shares of stock or stock options to give them incentives to act like stockholders. Collateralization of loans reduces the incentive for borrowers to act in a risky fashion since they would lose their collateral. The existence of liquid markets for collateral then allows ...

... Managers could be given shares of stock or stock options to give them incentives to act like stockholders. Collateralization of loans reduces the incentive for borrowers to act in a risky fashion since they would lose their collateral. The existence of liquid markets for collateral then allows ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.