Forms of Business - St Kevins College

... The syllabus states that students should be able to choose between alternatives and know about changing trends in ownership and structure. Choosing between alternatives. This would involve comparing advantages and disadvantages. The following headings could be used: 1. Formation. 2. Dissolution. 3. ...

... The syllabus states that students should be able to choose between alternatives and know about changing trends in ownership and structure. Choosing between alternatives. This would involve comparing advantages and disadvantages. The following headings could be used: 1. Formation. 2. Dissolution. 3. ...

Study Guide Questions for the Nova Video Mind Over Money

... behave, and how their individual behavior gets aggregated into market outcomes. The first view is consistent with the main premises of market efficiency – that the prices of stocks, bonds, real estate and other investments accurately reflect relevant information because these prices are determined b ...

... behave, and how their individual behavior gets aggregated into market outcomes. The first view is consistent with the main premises of market efficiency – that the prices of stocks, bonds, real estate and other investments accurately reflect relevant information because these prices are determined b ...

Exam 1 – Version 2 – Finance 3320 – Summer 2010

... Which one of the following Statements is True regarding market efficiency? a. Weak form market efficiency is plausible since we can observe the existence of futures and options markets. b. Strong form market efficiency is plausible because we see so many finance students and financial service profes ...

... Which one of the following Statements is True regarding market efficiency? a. Weak form market efficiency is plausible since we can observe the existence of futures and options markets. b. Strong form market efficiency is plausible because we see so many finance students and financial service profes ...

Minnesota 9-12 Personal Finance Standards

... borrowing and insuring decisions. 9.2.2.2.1 Establish financial goals; make a financial plan considering budgeting and asset building to meet those goals; and determine ways to track the success of the plan. For example: Goals—college education, start a business, buy a house, retire comfortably; cal ...

... borrowing and insuring decisions. 9.2.2.2.1 Establish financial goals; make a financial plan considering budgeting and asset building to meet those goals; and determine ways to track the success of the plan. For example: Goals—college education, start a business, buy a house, retire comfortably; cal ...

State of the Economy March 2017

... Federal Reserve raised rates, they did not point to major increases in productivity. In fact, most data projections show slow growth continuing. These projections seem to attribute much of the rise in stock prices to consumer confidence. Second, the recent slide in oil prices resulting from an incr ...

... Federal Reserve raised rates, they did not point to major increases in productivity. In fact, most data projections show slow growth continuing. These projections seem to attribute much of the rise in stock prices to consumer confidence. Second, the recent slide in oil prices resulting from an incr ...

Capital Market Development

... Capital markets/exchange Securities trading and fund management Exchanges Equities Fixed-income Government Municipal Private sector companies Commodities SRC Fire Code Lending Investors Act ...

... Capital markets/exchange Securities trading and fund management Exchanges Equities Fixed-income Government Municipal Private sector companies Commodities SRC Fire Code Lending Investors Act ...

Newsletter December 2014 - Danielson Financial Group

... High-yield bonds are subject to higher interest rates, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will dec ...

... High-yield bonds are subject to higher interest rates, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will dec ...

SocialStudiesHistorySS5H5 (SocialStudiesHistorySS5H5)

... C. Many farmers and their families lost their farms and moved west. D. The government built large dams in the West for irrigation. 8. In 1929, the United States entered an economic slowdown called the Great Depression. One of the early events was the stock market crash. What was a major cause of the ...

... C. Many farmers and their families lost their farms and moved west. D. The government built large dams in the West for irrigation. 8. In 1929, the United States entered an economic slowdown called the Great Depression. One of the early events was the stock market crash. What was a major cause of the ...

While technically an equity investment, shares of preferred stock pay

... Early callbacks -- Companies that issue preferred stock hold a call option, which allows them to redeem the securities at face value after a certain period, usually five years. Doing so can deprive investors holding those shares of additional years of guaranteed income they thought they had locked ...

... Early callbacks -- Companies that issue preferred stock hold a call option, which allows them to redeem the securities at face value after a certain period, usually five years. Doing so can deprive investors holding those shares of additional years of guaranteed income they thought they had locked ...

Market Update: 3rd Quarter (2015) On a global basis, stocks

... Asset prices are inflated, but not in “bubble” territory. Stocks have already retreated 12% from their highs. The U.S. economy continues to grow … albeit at a slow, consistent pace. The U.S. banking system is strong after being “recapitalized” on the backs of savers. U.S. banks have massive liquidit ...

... Asset prices are inflated, but not in “bubble” territory. Stocks have already retreated 12% from their highs. The U.S. economy continues to grow … albeit at a slow, consistent pace. The U.S. banking system is strong after being “recapitalized” on the backs of savers. U.S. banks have massive liquidit ...

Chapter 37 The Stock Market and Crashes

... 28. If stock prices are in-line with their fundamental determinants and profit expectations do not change, then a change in the interest rate by one percentage point from 10% to 11% a. Will change the stock price by exactly ten percent regardless of the expected distribution of the earnings over tim ...

... 28. If stock prices are in-line with their fundamental determinants and profit expectations do not change, then a change in the interest rate by one percentage point from 10% to 11% a. Will change the stock price by exactly ten percent regardless of the expected distribution of the earnings over tim ...

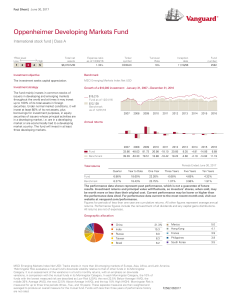

Oppenheimer Developing Markets Fund - Vanguard

... Loss of Money: Because the investment’s market value may fluctuate up and down, an investor may lose money, including part of the principal, when he or she buys or sells the investment. Growth Investing: Growth securities may be subject to increased volatility as the value of these securities is hig ...

... Loss of Money: Because the investment’s market value may fluctuate up and down, an investor may lose money, including part of the principal, when he or she buys or sells the investment. Growth Investing: Growth securities may be subject to increased volatility as the value of these securities is hig ...

Document

... efficient in processing new information that securities trade very close to or at their correct values at all times Efficient market advocates believe: Securities are rarely substantially mispriced in the marketplace No security analysis is capable of finding mispriced securities more frequent ...

... efficient in processing new information that securities trade very close to or at their correct values at all times Efficient market advocates believe: Securities are rarely substantially mispriced in the marketplace No security analysis is capable of finding mispriced securities more frequent ...

Buy Price higher than Sell Price on SSG or Portfolio/Stock

... Sales, profits and earnings will be uneven (or trending down) for the last few years. In section 2 on the back, it's likely that Pre-tax Profit, Return on Equity (or both) will be trending down, or Even at best. Section 3 may look normal, but you're likely to see a Reward/Risk figure of less than 1 ...

... Sales, profits and earnings will be uneven (or trending down) for the last few years. In section 2 on the back, it's likely that Pre-tax Profit, Return on Equity (or both) will be trending down, or Even at best. Section 3 may look normal, but you're likely to see a Reward/Risk figure of less than 1 ...

C. Mon. Sept. 30--STOCK MARKET GAME PACKET FALL 2013

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

... An exchange-traded fund (or ETF) is an investment vehicle traded on stock exchanges, much like stocks. An ETF holds assets such as stocks or bonds and trades at approximately the same price as the net asset value of its underlying assets over the course of the trading day. ETFs may be attractive as ...

Understanding the Economic and Stock Market Cycles

... Why sitting on the sidelines can mean missed opportunities After one of the longest running economic expansions in the modern era, we find ourselves in the midst of a recession. Headlines show rising unemployment, lower consumer sentiment and rising foreclosures. Yet despite the gloomy economic news ...

... Why sitting on the sidelines can mean missed opportunities After one of the longest running economic expansions in the modern era, we find ourselves in the midst of a recession. Headlines show rising unemployment, lower consumer sentiment and rising foreclosures. Yet despite the gloomy economic news ...

Key

... Note: Except possibly for questions in which you are required to provide a list, your answers to the following shortanswer questions should be no more than a sentence or two. If you write more, you will likely run out of time. 1. Assume that you previously purchased a call on Microsoft that you have ...

... Note: Except possibly for questions in which you are required to provide a list, your answers to the following shortanswer questions should be no more than a sentence or two. If you write more, you will likely run out of time. 1. Assume that you previously purchased a call on Microsoft that you have ...

The systematic analysts` forecast errors are predictable

... Analysts are too optimistic before recessions start and too pessimistic before recessions end From the fact that analysts’ forecast errors are predictable, analysts do not fully take into account of macro variables (market return, volatility, term spread, and default spread) in their prediction proc ...

... Analysts are too optimistic before recessions start and too pessimistic before recessions end From the fact that analysts’ forecast errors are predictable, analysts do not fully take into account of macro variables (market return, volatility, term spread, and default spread) in their prediction proc ...

Sole Proprietorships A sole proprietorship is a business owned by

... financial and nonfinancial, private and public, large and small, profit-seeking and not-forprofit. They perform such varied financial tasks as planning, extending credit to customers, evaluating proposed large expenditures, and raising money to fund the firm’s operations. ...

... financial and nonfinancial, private and public, large and small, profit-seeking and not-forprofit. They perform such varied financial tasks as planning, extending credit to customers, evaluating proposed large expenditures, and raising money to fund the firm’s operations. ...

Unit 7 Consumer Protection Notes

... (stocks/bonds etc) and strives to create a fair and orderly market environment. The SEC is a law enforcement agency What would be a violation or criminal activity that the SEC would investigate? Misrepresentation or omission of important information about stocks Manipulating the market price ...

... (stocks/bonds etc) and strives to create a fair and orderly market environment. The SEC is a law enforcement agency What would be a violation or criminal activity that the SEC would investigate? Misrepresentation or omission of important information about stocks Manipulating the market price ...

EMH Lecture2

... • “It might have been supposed that competition between expert professionals, possessing expert knowledge beyond that of the average private investor, would correct the vagaries of the ignorant individual left to himself. It happens, however, that the energies and skill of the professional investor ...

... • “It might have been supposed that competition between expert professionals, possessing expert knowledge beyond that of the average private investor, would correct the vagaries of the ignorant individual left to himself. It happens, however, that the energies and skill of the professional investor ...

impact of global financial crisis on investors` psychology : an analysis

... Disciplined growth style managers concentrate on companies that they believe can grow their earnings at a rate higher than the market average and that are selling for an appropriate price. Aggressive growth styles tend not to rely on traditional valuation methods or fundamental analysis. They rely o ...

... Disciplined growth style managers concentrate on companies that they believe can grow their earnings at a rate higher than the market average and that are selling for an appropriate price. Aggressive growth styles tend not to rely on traditional valuation methods or fundamental analysis. They rely o ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.