Chapter 16 Market Efficiency

... the company’s investments in order to maximize the wealth of shareholders. 1.6.2 Managers need not worry, for example, about the effect on share prices of financial results in the published accounts because investors will make allowances for low profits or dividends in the current year if higher pro ...

... the company’s investments in order to maximize the wealth of shareholders. 1.6.2 Managers need not worry, for example, about the effect on share prices of financial results in the published accounts because investors will make allowances for low profits or dividends in the current year if higher pro ...

Stock Market Development and Economic Growth: An

... Americans owned 85% of all stock and 71% owned no stock. It follows that there would not be much changes in mass consumption items, but maybe luxury goods. If 71% owned no stocks in a developed nation where investment knowledge and stock trading is readily available, the figure is likely to be highe ...

... Americans owned 85% of all stock and 71% owned no stock. It follows that there would not be much changes in mass consumption items, but maybe luxury goods. If 71% owned no stocks in a developed nation where investment knowledge and stock trading is readily available, the figure is likely to be highe ...

Strategy Overview Schroder International Equity Alpha Summary

... the document when taking individual investment and/or strategic decisions. Schroders has expressed its own views and opinions in this document and these may change. Countries mentioned are shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. Diversification ...

... the document when taking individual investment and/or strategic decisions. Schroders has expressed its own views and opinions in this document and these may change. Countries mentioned are shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. Diversification ...

SKS Consulting - Company Rescue

... SKS offers a standalone assessment product to provide our clients an accurate understanding of an organization’s current operational and financial state by performing a thorough due diligence. Upon completion of our review, we provide our clients with an extensive analysis outlining the companies st ...

... SKS offers a standalone assessment product to provide our clients an accurate understanding of an organization’s current operational and financial state by performing a thorough due diligence. Upon completion of our review, we provide our clients with an extensive analysis outlining the companies st ...

letter - International Capital Market Association

... seems clear that the primary intended meaning of the term "investments" in this context is products which an investor purchases for the sole purpose of obtaining a return on the amount invested – that is, a term investment product in which investment is made at the beginning of an investment period, ...

... seems clear that the primary intended meaning of the term "investments" in this context is products which an investor purchases for the sole purpose of obtaining a return on the amount invested – that is, a term investment product in which investment is made at the beginning of an investment period, ...

LionGlobal Asia Bond Fund

... This publication is for information only. It is not an offer or solicitation for the purchase or sale of any securities/investments and does not have regard to your specific investment objectives, financial situation or particular needs. All applications for units in our funds must be made on applic ...

... This publication is for information only. It is not an offer or solicitation for the purchase or sale of any securities/investments and does not have regard to your specific investment objectives, financial situation or particular needs. All applications for units in our funds must be made on applic ...

Chapter 1, Answer to Questions

... Individuals invest because an investment has the potential to preserve or increase value and to earn income. It is important to stress that this does not imply that an investment will in fact preserve value or earn income. Bad investments do exist. 2. (a) Securities and property are simply two class ...

... Individuals invest because an investment has the potential to preserve or increase value and to earn income. It is important to stress that this does not imply that an investment will in fact preserve value or earn income. Bad investments do exist. 2. (a) Securities and property are simply two class ...

Chapter 10

... This would require perfect markets in which all information is cost-free and available to everyone at the same time (which is clearly not the case) Implication: Not even “insiders” would be able to “beat the market” on a consistent basis ...

... This would require perfect markets in which all information is cost-free and available to everyone at the same time (which is clearly not the case) Implication: Not even “insiders” would be able to “beat the market” on a consistent basis ...

Strategic Value Dividend (MA) Select UMA

... manager's results in managing Morgan Stanley program accounts, or the investment manager's results in managing accounts and investment products, in the same or a substantially similar investment discipline. (For periods through June 2012, the Fiduciary Services program operated through two channels ...

... manager's results in managing Morgan Stanley program accounts, or the investment manager's results in managing accounts and investment products, in the same or a substantially similar investment discipline. (For periods through June 2012, the Fiduciary Services program operated through two channels ...

Stock Market Simulation Debriefing

... theories as to why that is? Who lost the most money for you? Why do you think that was? Choose one of your stocks that you ended the game with and print its “live chart” for the last 3 months. Interpret the graph by analyzing the activity over time. What conclusions or assumptions can you make a ...

... theories as to why that is? Who lost the most money for you? Why do you think that was? Choose one of your stocks that you ended the game with and print its “live chart” for the last 3 months. Interpret the graph by analyzing the activity over time. What conclusions or assumptions can you make a ...

Practice set and Solutions 1

... deemed “accredited investors.” To be accredited, an investor must have a net worth of over $1 million or have an annual income of at least $200,000 ($300,000 if married). These stiff financial requirements allow hedge funds to avoid regulation under the theory that individuals with such wealth shoul ...

... deemed “accredited investors.” To be accredited, an investor must have a net worth of over $1 million or have an annual income of at least $200,000 ($300,000 if married). These stiff financial requirements allow hedge funds to avoid regulation under the theory that individuals with such wealth shoul ...

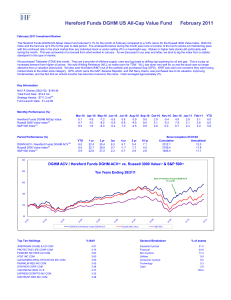

Click to download DGHM ACV FEBRUARY 2011

... (e) Share Class A is German tax registered from 27/5/10 and has applied for UK Reporting Fund Status for the year to September 2011. (f) Share Class D is German tax registered from 1/10/10. This document is for information purposes and internal use only. It is neither an advice nor a recommendation ...

... (e) Share Class A is German tax registered from 27/5/10 and has applied for UK Reporting Fund Status for the year to September 2011. (f) Share Class D is German tax registered from 1/10/10. This document is for information purposes and internal use only. It is neither an advice nor a recommendation ...

Impact of market changes on business

... WorldCom and Sprint are the No. 2 and No. 3 long-distance telephone companies in the country; the price tag of the merger was put at about $125 billion. Federal Communications Chairman William Kennard voiced his opposition immediately after the two companies made the announcement on Oct. 5, 1999. Ke ...

... WorldCom and Sprint are the No. 2 and No. 3 long-distance telephone companies in the country; the price tag of the merger was put at about $125 billion. Federal Communications Chairman William Kennard voiced his opposition immediately after the two companies made the announcement on Oct. 5, 1999. Ke ...

Weekly Economic Update

... leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisio ...

... leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisio ...

Microsoft Word - Money banking and Financial markets Assignment

... groups together funds from many investors and invests the money in a variety of stocks. Consequently, a mutual fund diversifies stocks, and it lowers investors’ risk. For example, youstart your own mutual fund and offer investors a chance to invest in this fund. You take themoney and buy 30 differen ...

... groups together funds from many investors and invests the money in a variety of stocks. Consequently, a mutual fund diversifies stocks, and it lowers investors’ risk. For example, youstart your own mutual fund and offer investors a chance to invest in this fund. You take themoney and buy 30 differen ...

East Asia and Global Imbalances: Saving, Investment, and

... capital inflows and the willingness of foreigners to invest there. … Thus, we probably have little choice except to be patient as we work to create the conditions in which a greater share of global saving can be redirected away from the United States and toward the rest of the world - particularly t ...

... capital inflows and the willingness of foreigners to invest there. … Thus, we probably have little choice except to be patient as we work to create the conditions in which a greater share of global saving can be redirected away from the United States and toward the rest of the world - particularly t ...

Testing the Strong-Form Efficiency of the Namibian Stock Market

... future spot rates. This can be interpreted as it usually has been that market expectations regarding exchange rate movements are rational and/or non-existence of time varying risk premium, i.e. no systematic forecast errors. Strong-Form Efficiency Market Hypothesis Jensen (1968) studied the performa ...

... future spot rates. This can be interpreted as it usually has been that market expectations regarding exchange rate movements are rational and/or non-existence of time varying risk premium, i.e. no systematic forecast errors. Strong-Form Efficiency Market Hypothesis Jensen (1968) studied the performa ...

Preparing for the Worst. Incorporating Downside Risk in Stock Market

... explaining how to incorporate it into investment decisions. Highlighting this asymmetry of the stock market, the authors describe how existing theories miss the downside and follow with explanations of how it can be included. Various techniques for calculating downside risk are demonstrated. This bo ...

... explaining how to incorporate it into investment decisions. Highlighting this asymmetry of the stock market, the authors describe how existing theories miss the downside and follow with explanations of how it can be included. Various techniques for calculating downside risk are demonstrated. This bo ...

UNIT V

... The first step in the preparation of final accounts is the preparation of trail balance. In the double entry system of book keeping, there will be credit for every debit and there will not be any debit without credit. When this principle is followed in writing journal entries, the total amount of al ...

... The first step in the preparation of final accounts is the preparation of trail balance. In the double entry system of book keeping, there will be credit for every debit and there will not be any debit without credit. When this principle is followed in writing journal entries, the total amount of al ...

Common Stocks_Ch06

... • Stock Split: when a company increases the number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a ...

... • Stock Split: when a company increases the number of shares outstanding by exchanging a specified number of new shares of stock for each outstanding share – Usually done to lower the stock price to make it more attractive to investors – Stockholders end up with more shares of stock that sells for a ...

Where`s The Exit? New Opportunities In China For PE

... We are aware that there are a number of similar transactions being pursued in the market at present, and further insights will no doubt be gained in due course. For now, private equity firms that have invested into Chinese companies can, at the very least, take comfort that an additional exit route ...

... We are aware that there are a number of similar transactions being pursued in the market at present, and further insights will no doubt be gained in due course. For now, private equity firms that have invested into Chinese companies can, at the very least, take comfort that an additional exit route ...

Investment Management Process p2ch1

... Risk is the chance that the actual outcome is different than the expected outcome ...

... Risk is the chance that the actual outcome is different than the expected outcome ...

310 Homework 4 (CH7 and 8): Shell Co., is a young start

... 1) Shell Co., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a $10 per share dividend 10 years from today and will increase the dividend by 5 percent per year thereafte ...

... 1) Shell Co., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a $10 per share dividend 10 years from today and will increase the dividend by 5 percent per year thereafte ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.