Staying Positive on Equity Market Neutral

... a change in the value of the fund’s market benchmark. Securities with betas higher than 1.0 have been, and are expected to be, more volatile than the benchmark; securities with betas lower than 1.0 have been, and are expected to be, less volatile than the benchmark. The Russell 1000® Index measures ...

... a change in the value of the fund’s market benchmark. Securities with betas higher than 1.0 have been, and are expected to be, more volatile than the benchmark; securities with betas lower than 1.0 have been, and are expected to be, less volatile than the benchmark. The Russell 1000® Index measures ...

Does Gender and Age Affect Investor Performance and the

... The paper provides detailed analysis of the account size, risk level and trading intensity of different age groups, concentrating on gender differences in an emerging market setup. There is currently no empirical work for a young emerging market in western cultural environment that can have clear im ...

... The paper provides detailed analysis of the account size, risk level and trading intensity of different age groups, concentrating on gender differences in an emerging market setup. There is currently no empirical work for a young emerging market in western cultural environment that can have clear im ...

Why Minimum Standards in Corporate Bonds Communications?

... predominantly conceptualised for equity investors. This means that information essential to bond investors is sometimes treated as less important in corporate reporting. Among other things, this affects the tools and topics such as risk reporting, refinancing plans, interest income and pension liabi ...

... predominantly conceptualised for equity investors. This means that information essential to bond investors is sometimes treated as less important in corporate reporting. Among other things, this affects the tools and topics such as risk reporting, refinancing plans, interest income and pension liabi ...

THE ASSET ALLOCATION INVESTMENT PROCESS

... both the upside potential and the downside risk. Dividends are not guaranteed and are subject to change or elimination. The prices of small company stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertis ...

... both the upside potential and the downside risk. Dividends are not guaranteed and are subject to change or elimination. The prices of small company stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertis ...

Instructions: Exercises for seminar no. 1, 7 Sept.

... seminars in order to get all the information, corrections, discussions, modifications, etc. However, if there are some parts which we do not get through because of limited time, solutions to those remaining parts (or extensive comments to the volunteers’ suggested solutions) will be made available. ...

... seminars in order to get all the information, corrections, discussions, modifications, etc. However, if there are some parts which we do not get through because of limited time, solutions to those remaining parts (or extensive comments to the volunteers’ suggested solutions) will be made available. ...

What is Risk?

... would face if he or she held only one asset. Portfolio risk: The risk an investor would face if he or she held more than one assets, an investment portfolio. ...

... would face if he or she held only one asset. Portfolio risk: The risk an investor would face if he or she held more than one assets, an investment portfolio. ...

UNITED PARCEL SERVICE

... oil and stove oil, petrochemicals, asphalt, lube base oils, sulfur, crude mineral spirits, bunker oils, petroleum coke, and Propane-Octene. As of July 31, 2007, Valero Energy owned and operated 17 refineries in the United States, Canada, and the Caribbean with a combined throughput capacity of appro ...

... oil and stove oil, petrochemicals, asphalt, lube base oils, sulfur, crude mineral spirits, bunker oils, petroleum coke, and Propane-Octene. As of July 31, 2007, Valero Energy owned and operated 17 refineries in the United States, Canada, and the Caribbean with a combined throughput capacity of appro ...

Wheeler Real Estate Investment Trust, Inc. (Form: 8-K

... The Company considers portions of this Current Report on Form 8-K relating to its business operations, benefits from the acquisition of properties, acquisition strategy and its target markets to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section ...

... The Company considers portions of this Current Report on Form 8-K relating to its business operations, benefits from the acquisition of properties, acquisition strategy and its target markets to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section ...

Stock Market Integration and the Determinants of Co

... A very few studies evidence on the determinants of stock market co-movement has been presented by Pretorius (2002), which examined ten emerging stock markets for the period 1995–2000 by employing a cross-section and a time-series model. The major findings showed that only bilateral trade and the in ...

... A very few studies evidence on the determinants of stock market co-movement has been presented by Pretorius (2002), which examined ten emerging stock markets for the period 1995–2000 by employing a cross-section and a time-series model. The major findings showed that only bilateral trade and the in ...

Royce Opportunity Fund

... This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. The Fund invests primarily in smallcap stocks, which may involve considerably more risk than investing in larger-cap stocks ...

... This material is not authorized for distribution unless preceded or accompanied by a current prospectus. Please read the prospectus carefully before investing or sending money. The Fund invests primarily in smallcap stocks, which may involve considerably more risk than investing in larger-cap stocks ...

Kalev_Kaarna - Eesti Majandusteaduse Selts

... loss of sales or customers the ROP is generally set higher than average demand. Commonly used value for reorder point is the mean plus two standard deviations. Depending on the distribution of demand during lead time, this will result in stock outs of somewhere between 2-10% of order cycles. Since m ...

... loss of sales or customers the ROP is generally set higher than average demand. Commonly used value for reorder point is the mean plus two standard deviations. Depending on the distribution of demand during lead time, this will result in stock outs of somewhere between 2-10% of order cycles. Since m ...

Limits of using distribution as a competitive edge. Implications for

... loss of sales or customers the ROP is generally set higher than average demand. Commonly used value for reorder point is the mean plus two standard deviations. Depending on the distribution of demand during lead time, this will result in stock outs of somewhere between 2-10% of order cycles. Since m ...

... loss of sales or customers the ROP is generally set higher than average demand. Commonly used value for reorder point is the mean plus two standard deviations. Depending on the distribution of demand during lead time, this will result in stock outs of somewhere between 2-10% of order cycles. Since m ...

Job Description Job title Senior Investment Manager, Northern

... Working with the MI Team to prepare reports and analysis of investments and fund activities and dealing with specific queries from within the team or from stakeholders and preparing analysis and findings; ...

... Working with the MI Team to prepare reports and analysis of investments and fund activities and dealing with specific queries from within the team or from stakeholders and preparing analysis and findings; ...

MEASURING INVESTMENT RETURNS AND RISKS

... Probabilityi x [Return1i - E(R1)][Return2i - E(R2)] In a portfolio, there is a covariance for each asset pairing – the many covariances account for most of a portfolio’s variance. All else equal, covariance is large when the data points fall along the regression line instead of away from it beca ...

... Probabilityi x [Return1i - E(R1)][Return2i - E(R2)] In a portfolio, there is a covariance for each asset pairing – the many covariances account for most of a portfolio’s variance. All else equal, covariance is large when the data points fall along the regression line instead of away from it beca ...

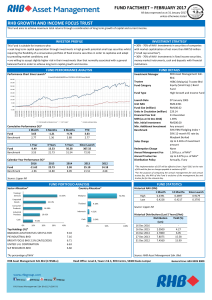

RHB Growth And Income Focus Trust

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

... A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the PHS and the contents of the Master Prospectus dated 3 August 2016 and its supplementary(ies) ...

Becoming a Millionaire - Frederick H. Willeboordse

... Note: All the comments are based on the assumption that we are average investors at best… ...

... Note: All the comments are based on the assumption that we are average investors at best… ...

FrontInvest Alternatives

... FrontInvest budgeting tools include the automatic creation of budgets based on assets information (through the Modeling module), the management of the internal budgeting process (initial budgets and reforecasts) within the client’s organization, and the monitoring of budgets. Actual figures can be a ...

... FrontInvest budgeting tools include the automatic creation of budgets based on assets information (through the Modeling module), the management of the internal budgeting process (initial budgets and reforecasts) within the client’s organization, and the monitoring of budgets. Actual figures can be a ...

Click to download DSM US LCG JUNE 2010

... investors must be pushed upward to compensate for the risks in today’s investment environment. The higher return required by investors drives down the current market price of risky assets, such as stocks. If returns and valuations are to be permanently re-set at lower levels, one must believe that w ...

... investors must be pushed upward to compensate for the risks in today’s investment environment. The higher return required by investors drives down the current market price of risky assets, such as stocks. If returns and valuations are to be permanently re-set at lower levels, one must believe that w ...

Intermediate Financial Management, 5th Ed.

... be used to reduce input price risk? The purchase of a commodity futures contract will allow a firm to make a future purchase of the input at today’s price, even if the market price on the item has risen substantially in the interim. ...

... be used to reduce input price risk? The purchase of a commodity futures contract will allow a firm to make a future purchase of the input at today’s price, even if the market price on the item has risen substantially in the interim. ...

Procedures For Investment From Overseas MCB PSM

... State Bank of Pakistan (SBP) has allowed investments in MCB Pakistan Stock Market Fund (MCB PSM Fund) from Overseas or Non-Resident Pakistanis and Individuals on repatriation basis. Units of MCB PSM Fund will be issued against Pak Rupee equivalent amount as shown in the “Proceeds Realisation Certifi ...

... State Bank of Pakistan (SBP) has allowed investments in MCB Pakistan Stock Market Fund (MCB PSM Fund) from Overseas or Non-Resident Pakistanis and Individuals on repatriation basis. Units of MCB PSM Fund will be issued against Pak Rupee equivalent amount as shown in the “Proceeds Realisation Certifi ...

What Are Financial Intermediaries Paid For?

... return, and risk by the standard deviation of return. So junk bonds looked like a ‘‘dominant’’ security with respect to Treasuries: more return with less risk. The logical extension of that idea is what we could call the Milken arbitrage: If junk dominates investment grade bonds, can we sell AAA bon ...

... return, and risk by the standard deviation of return. So junk bonds looked like a ‘‘dominant’’ security with respect to Treasuries: more return with less risk. The logical extension of that idea is what we could call the Milken arbitrage: If junk dominates investment grade bonds, can we sell AAA bon ...

Stock Insurance Companies Versus Mutual Insurance

... companies on their participating policies. REALITY: While stock companies have shareholders and mutual companies do not, this difference does not enable mutual companies to pay more policy dividends. Stock and mutual companies have the same competitive concerns when deciding to pay policy dividends. ...

... companies on their participating policies. REALITY: While stock companies have shareholders and mutual companies do not, this difference does not enable mutual companies to pay more policy dividends. Stock and mutual companies have the same competitive concerns when deciding to pay policy dividends. ...

PROGRAM ON HOUSING AND URBAN POLICY CONFERENCE PAPER SERIES

... hand, work by Brueckner (1997) and Flavin and Yamashita (1998) suggests that the vast majority of households are “overinvested” in housing from a portfolio standpoint, because their desired level of housing consumption dominates portfolio considerations. Poterba (2000) provides the first broad evid ...

... hand, work by Brueckner (1997) and Flavin and Yamashita (1998) suggests that the vast majority of households are “overinvested” in housing from a portfolio standpoint, because their desired level of housing consumption dominates portfolio considerations. Poterba (2000) provides the first broad evid ...

trading hours euronext amsterdam, brussels, lisbon and

... Markets”), referred to respectively as the Amsterdam, Brussels, Lisbon, London and Paris markets, as relevant. This Info-Flash is for information purposes only and does not constitute any investment advice or an offer, solicitation or recommendation to acquire or dispose of any investment or to enga ...

... Markets”), referred to respectively as the Amsterdam, Brussels, Lisbon, London and Paris markets, as relevant. This Info-Flash is for information purposes only and does not constitute any investment advice or an offer, solicitation or recommendation to acquire or dispose of any investment or to enga ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.