Tilburg University Stability of Monetary Unions

... asymmetric shocks, the countries can adjust the exchange rate to alter the relative prices and mitigate adverse effects of the shocks. However, if these two countries use the same currency, country-specific monetary policy measures are no longer possible, and thus adjustment is more costly than in t ...

... asymmetric shocks, the countries can adjust the exchange rate to alter the relative prices and mitigate adverse effects of the shocks. However, if these two countries use the same currency, country-specific monetary policy measures are no longer possible, and thus adjustment is more costly than in t ...

Identifying the Relationship Between Trade and Exchange Rate

... The empirical findings of this paper provide support for the view that trade depresses real exchange rate volatility. A trading relationship that is 1 percent of GDP greater than the median trade relationship implies that the volatility of the bilateral real exchange rate associated with the intens ...

... The empirical findings of this paper provide support for the view that trade depresses real exchange rate volatility. A trading relationship that is 1 percent of GDP greater than the median trade relationship implies that the volatility of the bilateral real exchange rate associated with the intens ...

KOM Chapter 13

... Changes in the exchange rate influence value of net foreign wealth (gross foreign assets minus gross foreign liabilities). – Appreciation of the value of foreign currencies makes foreign assets held by the U.S. more valuable, but does not change the dollar value of dollar-denominated debt for the U. ...

... Changes in the exchange rate influence value of net foreign wealth (gross foreign assets minus gross foreign liabilities). – Appreciation of the value of foreign currencies makes foreign assets held by the U.S. more valuable, but does not change the dollar value of dollar-denominated debt for the U. ...

NBER WORKING PAPER SERIES CAPITAL FLOWS, INVESTMENT, AND EXCHANGE RATES Alan C. Stockman

... investment, the magnitude and sign of the country's net international indebtedness, and the covariance between foreign output and the rate of foreign monetary growth. Productivity shocks that alter domestic output do not necessarily result in a current account surplus because, unlike much work ...

... investment, the magnitude and sign of the country's net international indebtedness, and the covariance between foreign output and the rate of foreign monetary growth. Productivity shocks that alter domestic output do not necessarily result in a current account surplus because, unlike much work ...

МИНИСТЕРСТВО ОБРАЗОВАНИЯ РОССИЙСКОЙ ФЕДЕРАЦИИ

... (a) For two goods X and Y, the opportunity cost of X in terms of Y is the number of units of Y that must be given up to get an extra unit of X. In a Ricardian model, the opportunity cost of X in terms of Y in a country with unit labour requirements a x, ay is - ay/ax. In a Ricardian model opportunit ...

... (a) For two goods X and Y, the opportunity cost of X in terms of Y is the number of units of Y that must be given up to get an extra unit of X. In a Ricardian model, the opportunity cost of X in terms of Y in a country with unit labour requirements a x, ay is - ay/ax. In a Ricardian model opportunit ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... uation of the real exchange rate is more necessary for a balance-ofpayments improvement when the conditions for a smooth working of the real balance effect are unfavorable. Can the process of price adjustment differ depending on the way the exchange rate is managed? The answer would be positive if o ...

... uation of the real exchange rate is more necessary for a balance-ofpayments improvement when the conditions for a smooth working of the real balance effect are unfavorable. Can the process of price adjustment differ depending on the way the exchange rate is managed? The answer would be positive if o ...

NBER WORKING PAPER SERIES LIQUIDITY TRAPS: HOW TO AVOID THEM AND

... two advantages. First, the exposition in simpler. Second, it is what central banks actually do. Changes in reserve requirements, open market operations etc. arebest viewed as ways of changing the interest rate. .In an open economy, the other institutionally relevant instrument of monetary policy is ...

... two advantages. First, the exposition in simpler. Second, it is what central banks actually do. Changes in reserve requirements, open market operations etc. arebest viewed as ways of changing the interest rate. .In an open economy, the other institutionally relevant instrument of monetary policy is ...

SUMMARY EXPLANATION FOR FEB

... decrease of 52.1% compared to the figure for the same month of last year, most of the decrease was in electronic products, iron & steel and articles thereof, mineral products, and etc. (b) U.S.A.:A total of US$0.86 billion, representing a decrease of 65.2% compared to the figure for the same month o ...

... decrease of 52.1% compared to the figure for the same month of last year, most of the decrease was in electronic products, iron & steel and articles thereof, mineral products, and etc. (b) U.S.A.:A total of US$0.86 billion, representing a decrease of 65.2% compared to the figure for the same month o ...

The revival of growth in the US when the rest... indifferently or poorly is a source of some surprise. From... THE MYTH OF A GLOBAL SAVINGS GLUT

... 1990s were not always productively used but absorbed for the wrong reasons. In some developing countries, governments borrowed to finance budgetary deficits and avoid necessary fiscal consolidation. In other countries, these funds were not allocated to projects promising the highest returns because ...

... 1990s were not always productively used but absorbed for the wrong reasons. In some developing countries, governments borrowed to finance budgetary deficits and avoid necessary fiscal consolidation. In other countries, these funds were not allocated to projects promising the highest returns because ...

NBER WORKING PAPER SERIES DEVALUATION CRISES AND THE MACROECONOMIC CONSEQUENCES

... Regarding real exchange rates, in 15 out of the 19 countries wsth relevant data the bilateral real exchange rate experienced a real apprecia tion in the three years prior to the devaluation; in 13 out of the 19 cases there also was a real appreciation of the multilateral RER during the period immedi ...

... Regarding real exchange rates, in 15 out of the 19 countries wsth relevant data the bilateral real exchange rate experienced a real apprecia tion in the three years prior to the devaluation; in 13 out of the 19 cases there also was a real appreciation of the multilateral RER during the period immedi ...

Consumption and real exchange rates with incomplete

... There are two key features that are important in accounting for our results. By assuming that international asset trade is limited to a risk-less bond we break the link between the real exchange rate and relative consumption that would arise under complete …nancial markets. While by introducing non- ...

... There are two key features that are important in accounting for our results. By assuming that international asset trade is limited to a risk-less bond we break the link between the real exchange rate and relative consumption that would arise under complete …nancial markets. While by introducing non- ...

International monetary policy transmission

... These significant regression results do not necessarily imply a loss of monetary policy independence in EMEs. In principle, EME central banks can choose their short-term policy rates. The question is why they seem to follow US monetary policy, an issue which is discussed in the accompanying paper by ...

... These significant regression results do not necessarily imply a loss of monetary policy independence in EMEs. In principle, EME central banks can choose their short-term policy rates. The question is why they seem to follow US monetary policy, an issue which is discussed in the accompanying paper by ...

Long-Horizon Forecasts of Asset Prices when the Discount Factor is

... rate models - the Monetary and Taylor Rule models. Both models include a risk premium, which is a stationary unobservable fundamental. For seven foreign currency-U.S. dollar exchange rates, we calculate the risk premium from Consensus Forecasts of exchange rates, assuming the survey data is an appro ...

... rate models - the Monetary and Taylor Rule models. Both models include a risk premium, which is a stationary unobservable fundamental. For seven foreign currency-U.S. dollar exchange rates, we calculate the risk premium from Consensus Forecasts of exchange rates, assuming the survey data is an appro ...

Monetary Policy and Real Estate Prices: A Disaggregated

... Central banks control their monetary policy instruments in efforts to reach their policy goals. While the primary goal of most central banks is price stability, many central banks also care about real activity (output, unemployment).1 Moreover, contributing or even guaranteeing domestic financial st ...

... Central banks control their monetary policy instruments in efforts to reach their policy goals. While the primary goal of most central banks is price stability, many central banks also care about real activity (output, unemployment).1 Moreover, contributing or even guaranteeing domestic financial st ...

PDF

... hypoth esis that the variables are not cointegrated must be rejected (Table 2) and that the variables presented one cointegrated vector. Therefore an error-correction procedure was applied to the VAR model (Enders, 2004). The criteria of AKAIKE and SCHUARZ had indicated that one lag would have to be ...

... hypoth esis that the variables are not cointegrated must be rejected (Table 2) and that the variables presented one cointegrated vector. Therefore an error-correction procedure was applied to the VAR model (Enders, 2004). The criteria of AKAIKE and SCHUARZ had indicated that one lag would have to be ...

Tesis de Maestría en Economía Internacional

... who used a partial equilibrium model to analyze fiscal sustainability with a balance sheet approach. They incorporate the correlation between different shocks by estimating their combined distribution and the dynamic responses to the relevant economic policy variables by estimating a VAR model. They ...

... who used a partial equilibrium model to analyze fiscal sustainability with a balance sheet approach. They incorporate the correlation between different shocks by estimating their combined distribution and the dynamic responses to the relevant economic policy variables by estimating a VAR model. They ...

Macroeconomic Stabilization and Capital Inflows in Transition

... The determinants of inflation could also traditionally be identified as various demandpull and cost-push factors that have successfully explained the temporal behavior of inflationary processes. Classic demand-pull factors include periodic episodes of money or credit growth expansion as well as the ...

... The determinants of inflation could also traditionally be identified as various demandpull and cost-push factors that have successfully explained the temporal behavior of inflationary processes. Classic demand-pull factors include periodic episodes of money or credit growth expansion as well as the ...

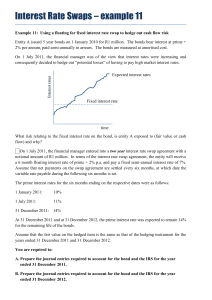

Interest Rate Swaps – example 11

... At 31 December 2011 and at 31 December 2012, the prime interest rate was expected to remain 14% for the remaining life of the bonds. Assume that the fair value on the hedged item is the same as that of the hedging instrument for the years ended 31 December 2011 and 31 December 2012. You are required ...

... At 31 December 2011 and at 31 December 2012, the prime interest rate was expected to remain 14% for the remaining life of the bonds. Assume that the fair value on the hedged item is the same as that of the hedging instrument for the years ended 31 December 2011 and 31 December 2012. You are required ...

Europe and Global Imbalances Philip R. Lane Department of Economics, TCD

... The much-debated topic of global current account imbalances is usefully summarized by Figure 1, which plots the current account balances of Europe and the United States together with those of countries/regions that are running significant current account surpluses. Current account balances are expre ...

... The much-debated topic of global current account imbalances is usefully summarized by Figure 1, which plots the current account balances of Europe and the United States together with those of countries/regions that are running significant current account surpluses. Current account balances are expre ...

Monetary Policy and Exchange Rate Volatility in a Small Open

... being the instrument of that policy.4 For this very reason our framework allows us to model alternative monetary regimes. Furthermore, we believe that our approach accords much better with the practice of modern central banks, and provides a more suitable framework for policy analysis than the tradi ...

... being the instrument of that policy.4 For this very reason our framework allows us to model alternative monetary regimes. Furthermore, we believe that our approach accords much better with the practice of modern central banks, and provides a more suitable framework for policy analysis than the tradi ...

2017 Yr 12 Econs ATAR Program and scheme of assessment

... Unit 4 – Economic policies and management This unit explores the economic objectives of the Australian Government and the actions and policies taken in the pursuit of these objectives. Changes in the level of economic activity influence the policy mix and the government’s capacity to achieve its obj ...

... Unit 4 – Economic policies and management This unit explores the economic objectives of the Australian Government and the actions and policies taken in the pursuit of these objectives. Changes in the level of economic activity influence the policy mix and the government’s capacity to achieve its obj ...

CHAPTER 14—EXCHANGE-RATE ADJUSTMENTS AND THE

... imports is 0.2 b. Elasticity of demand for French exports is 0.6 while the French elasticity of demand for imports is 0.4 c. Elasticity of demand for French exports is 0.5 while the French elasticity of demand for © 2011 Cengage Learning. All Rights Reserved. This edition is intended for use outside ...

... imports is 0.2 b. Elasticity of demand for French exports is 0.6 while the French elasticity of demand for imports is 0.4 c. Elasticity of demand for French exports is 0.5 while the French elasticity of demand for © 2011 Cengage Learning. All Rights Reserved. This edition is intended for use outside ...

Is the J-Curve Effect Observable for Small North European

... Slow exchange rate pass-through complicates the story further. Suppose that frictions to international trade are sufficient to allow deviations from purchasing power parity, at least in the short run. In reaction to exchange rate changes, producers may not immediately change the foreign currency pri ...

... Slow exchange rate pass-through complicates the story further. Suppose that frictions to international trade are sufficient to allow deviations from purchasing power parity, at least in the short run. In reaction to exchange rate changes, producers may not immediately change the foreign currency pri ...