16. Investing in Bonds

... 1) As interest rates rise, the market price of your bond is also likely to rise. Answer: FALSE Diff: 2 Question Status: Previous edition 2) If you buy a corporate bond for $970 and sell it six months later for $1,050, you will have A) interest income of $80. B) a short-term capital gain of $80. C) a ...

... 1) As interest rates rise, the market price of your bond is also likely to rise. Answer: FALSE Diff: 2 Question Status: Previous edition 2) If you buy a corporate bond for $970 and sell it six months later for $1,050, you will have A) interest income of $80. B) a short-term capital gain of $80. C) a ...

monetary transmission mechanism in albania

... rate. As the exchange rate indicates the value of domestic currency relative to foreign currencies, it can be influenced by foreign interest rates, as well as domestic interest ones. The size and the direction of the impact of a change in the policy rate on the exchange rate is difficult to predict, ...

... rate. As the exchange rate indicates the value of domestic currency relative to foreign currencies, it can be influenced by foreign interest rates, as well as domestic interest ones. The size and the direction of the impact of a change in the policy rate on the exchange rate is difficult to predict, ...

McGraw-Hill Global Education Intermediate Holdings

... Combined Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2014 (Successor), Periods March 23, 2013 to March 31, 2013 (Successor) and January 1, 2013 to March 22, ...

... Combined Consolidated Statements of Cash Flows for the Three Months Ended March 31, 2014 (Successor), Periods March 23, 2013 to March 31, 2013 (Successor) and January 1, 2013 to March 22, ...

BB SBA Financing Solution Sheet

... qualifying for other types of loans. The down payment requirement for an SBA loan is typically lower than for a conventional loan, and the extended repayment term makes the monthly payment smaller as well. Other advantages can include no balloon payments, no prepayment fees for terms less than 15 ye ...

... qualifying for other types of loans. The down payment requirement for an SBA loan is typically lower than for a conventional loan, and the extended repayment term makes the monthly payment smaller as well. Other advantages can include no balloon payments, no prepayment fees for terms less than 15 ye ...

Document

... Relative Valuation Techniques • Value can be determined by comparing to similar stocks based on relative ratios • Relevant variables include earnings, cash flow, book value, and sales • Multiply this variable by some “capitalization ...

... Relative Valuation Techniques • Value can be determined by comparing to similar stocks based on relative ratios • Relevant variables include earnings, cash flow, book value, and sales • Multiply this variable by some “capitalization ...

Chapter 10 The Bond Markets

... Bond pricing is, in theory, no different than pricing any set of known cash flows. Once the cash flows have been identified, they should be discounted to time zero at an appropriate discount rate. The table on the next slide outlines some of the terminology unique to debt, which may be necessary to ...

... Bond pricing is, in theory, no different than pricing any set of known cash flows. Once the cash flows have been identified, they should be discounted to time zero at an appropriate discount rate. The table on the next slide outlines some of the terminology unique to debt, which may be necessary to ...

role profile - ActionAid UK

... Lead on the development and implementation of an annual plan and budget for the Retention and Development team, monitor team activities and expenditure and adapt as necessary through the year Manage and develop the portfolio of ActionAid products in order to maximise supporter value including financ ...

... Lead on the development and implementation of an annual plan and budget for the Retention and Development team, monitor team activities and expenditure and adapt as necessary through the year Manage and develop the portfolio of ActionAid products in order to maximise supporter value including financ ...

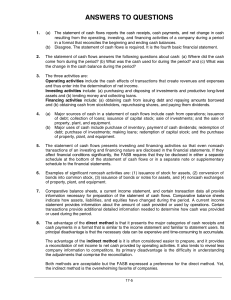

answers to questions - ORU Accounting Information

... cash provided by operating activities because depreciation is an expense but not a cash payment. 15. The statement of cash flows is useful because it provides information to the investors, creditors, and other users about: (1) the company’s ability to generate future cash flows, (2) the company’s ab ...

... cash provided by operating activities because depreciation is an expense but not a cash payment. 15. The statement of cash flows is useful because it provides information to the investors, creditors, and other users about: (1) the company’s ability to generate future cash flows, (2) the company’s ab ...

Modern Strategic Mine Planning

... In mine planning, decisions as to how and when to act include the extraction and routing of blocks of ore, the timing of lumpy decisions such as pushbacks or transitions from open pit to underground mining, and the placement of shafts. As with financial options, the goal is to take actions that opti ...

... In mine planning, decisions as to how and when to act include the extraction and routing of blocks of ore, the timing of lumpy decisions such as pushbacks or transitions from open pit to underground mining, and the placement of shafts. As with financial options, the goal is to take actions that opti ...

FBLA ACCOUNTING II

... 20. Both Accounts Payable and the vendor’s individual a. True account should be debited when a purchase is made on account. 21. Source documents should be discarded at the end of the a. True fiscal year to make room for next year's documents. 22. Subsidiary ledgers are used to maintain accounts a. T ...

... 20. Both Accounts Payable and the vendor’s individual a. True account should be debited when a purchase is made on account. 21. Source documents should be discarded at the end of the a. True fiscal year to make room for next year's documents. 22. Subsidiary ledgers are used to maintain accounts a. T ...

par value - McGraw Hill Higher Education

... • Usually refers to amounts of directly contributed equity capital in excess of the par value. – For example, suppose 1,000 shares of common stock having a par value of $1 each are sold to investors for $8 per share. The contributed surplus would be ...

... • Usually refers to amounts of directly contributed equity capital in excess of the par value. – For example, suppose 1,000 shares of common stock having a par value of $1 each are sold to investors for $8 per share. The contributed surplus would be ...

the influence of the financial factors on cash flow, as determining

... Also, another financial factor, which has an influence on investment decisions adopted by the firm, is the leverage; more clearly, the higher leverage firms’ investments can be more sensitive to the cash flow than lower leverage firms’ investments. The cash flow is the only source of financing for t ...

... Also, another financial factor, which has an influence on investment decisions adopted by the firm, is the leverage; more clearly, the higher leverage firms’ investments can be more sensitive to the cash flow than lower leverage firms’ investments. The cash flow is the only source of financing for t ...

2nd Semester Study Guide

... Carries to Next MonthRepeat process 3 times Semi-Annual Interest Rate (2 times a year) Principal x Rate = Interest Interest + Principal = Amount Owed New Amount Owed Carries to Next Semi Annual Term Repeat process 2 times Quarterly Interest Rate (4 times a year) Principal x Rate = Interest ...

... Carries to Next MonthRepeat process 3 times Semi-Annual Interest Rate (2 times a year) Principal x Rate = Interest Interest + Principal = Amount Owed New Amount Owed Carries to Next Semi Annual Term Repeat process 2 times Quarterly Interest Rate (4 times a year) Principal x Rate = Interest ...

Putnam Bond Index Fund

... in the financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Fund’s preparation an ...

... in the financial statements. The procedures selected depend on our judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, we consider internal control relevant to the Fund’s preparation an ...