Thomson Reuters LPC Middle Market Loans Conference The

... Apr-15 B Riley Financial, KKR form middle market lending venture ...

... Apr-15 B Riley Financial, KKR form middle market lending venture ...

Core Real Estate Performance

... attempts to explain why economic decision making often differs from what the neo-classical theory suggests “rational actors” should do. One of the key take-aways of behavioral finance concerns how investors perceive and manage risk. The prior theory of “rational expectations” claimed that investors ...

... attempts to explain why economic decision making often differs from what the neo-classical theory suggests “rational actors” should do. One of the key take-aways of behavioral finance concerns how investors perceive and manage risk. The prior theory of “rational expectations” claimed that investors ...

Bubbles, Banks and Financial Stability

... on the empirical regularities around financial crises. Our focus on rational bubbles that can only occur in a low interest rate environment is supported by Jorda et al. (2012) who report that growth adjusted real interest rates are very low for several years in the run up to global crises. Our findi ...

... on the empirical regularities around financial crises. Our focus on rational bubbles that can only occur in a low interest rate environment is supported by Jorda et al. (2012) who report that growth adjusted real interest rates are very low for several years in the run up to global crises. Our findi ...

Overview prepared by

... 2015 was marked by escalation of risks associated with the situation around Greece, reaching an agreement on Iran and more significant and rapid slowdown in China’s growth. Increasing the Federal Reserve System Rate in 2015 will cause capital inflows into the United States. But the appreciation of t ...

... 2015 was marked by escalation of risks associated with the situation around Greece, reaching an agreement on Iran and more significant and rapid slowdown in China’s growth. Increasing the Federal Reserve System Rate in 2015 will cause capital inflows into the United States. But the appreciation of t ...

Download attachment

... A second aspect of competition in financial markets has received more attention from policy-makers than academics. It is well known that financial intermediaries can extract rents by exploiting monopoly power through some combination of market share, collusion and barriers to entry. For example trad ...

... A second aspect of competition in financial markets has received more attention from policy-makers than academics. It is well known that financial intermediaries can extract rents by exploiting monopoly power through some combination of market share, collusion and barriers to entry. For example trad ...

PML_Paper3_Financial Risk

... to increase their margin (money deposited as collateral) in order to protect their open trading positions. If the investor cannot provide the required amount of money immediately, the stock broker will close all positions automatically to avoid having to cover the client’s losses. Such situations, ...

... to increase their margin (money deposited as collateral) in order to protect their open trading positions. If the investor cannot provide the required amount of money immediately, the stock broker will close all positions automatically to avoid having to cover the client’s losses. Such situations, ...

time-varying effects of housing and stock prices

... households (Poterba, 2000). Furthermore, during economic expansions with consumer confidence rising, Aoki et al. (2004) argue that homeowners probably borrow to finance consumption and housing investment, since housing represents secured collateral. For the US, Wilkerson and Williams (2011) note tha ...

... households (Poterba, 2000). Furthermore, during economic expansions with consumer confidence rising, Aoki et al. (2004) argue that homeowners probably borrow to finance consumption and housing investment, since housing represents secured collateral. For the US, Wilkerson and Williams (2011) note tha ...

Switching Bubbles: From Outside to Inside

... when they are old, instead of lending money to old investors. Section 4 studies what happens when the economy switches between the Outside and the Inside Bubble. I show that investment and debt of entrepreneurs are lower. In particular, the investment of both middle-aged and young entrepreneurs are ...

... when they are old, instead of lending money to old investors. Section 4 studies what happens when the economy switches between the Outside and the Inside Bubble. I show that investment and debt of entrepreneurs are lower. In particular, the investment of both middle-aged and young entrepreneurs are ...

P a p e r 1 . 2 ... f i n a n c i a l ... 1 8 F e b r u a...

... US 10-year interest rates seem too low compared to current US growth and inflation rates - Greenspan's 'Conundrum ' ...

... US 10-year interest rates seem too low compared to current US growth and inflation rates - Greenspan's 'Conundrum ' ...

Housing, Mortgage Bailout Guarantees and the

... The United States displays one of the highest home ownership rates in the world at close to 70%, and owner-occupied houses constitute the most important asset for most U.S. households. Part of the attractiveness of owner-occupied housing stems from a variety of subsidies the government provides to h ...

... The United States displays one of the highest home ownership rates in the world at close to 70%, and owner-occupied houses constitute the most important asset for most U.S. households. Part of the attractiveness of owner-occupied housing stems from a variety of subsidies the government provides to h ...

Focus on Risk Adjusted Returns

... Given the option to add hedge funds to your portfolio, investors should be aware of the particular risk and return benefits to assess when analysing them. “Hedge funds are less constrained than long only investment products and incorporate additional investment strategies such as gearing, scrip borr ...

... Given the option to add hedge funds to your portfolio, investors should be aware of the particular risk and return benefits to assess when analysing them. “Hedge funds are less constrained than long only investment products and incorporate additional investment strategies such as gearing, scrip borr ...

word

... sector held steady with a 35% allocation and the effective duration extended slightly from 2.2 to 2.3??. The Bank continues to review all holdings in the MBS portfolio and will continue to evaluate the benefits of liquidating securities negatively impacted by current or potential future Government r ...

... sector held steady with a 35% allocation and the effective duration extended slightly from 2.2 to 2.3??. The Bank continues to review all holdings in the MBS portfolio and will continue to evaluate the benefits of liquidating securities negatively impacted by current or potential future Government r ...

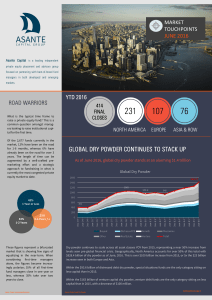

global dry powder continues to stack up

... alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

... alone, the figures become increasingly polarize; 35% of all first-time fund managers close in one year or less, whereas 35% take over two years to close. ...

Systemic Risk and the Financial System

... in the sense that efforts to liquidate them prior to maturity will yield a reduced value relative to their intrinsic worth if held to maturity. However, the bank is obligated to pay back demand deposits at any time the depositor requests. Thus, banks are seen as providing a fundamental maturity and ...

... in the sense that efforts to liquidate them prior to maturity will yield a reduced value relative to their intrinsic worth if held to maturity. However, the bank is obligated to pay back demand deposits at any time the depositor requests. Thus, banks are seen as providing a fundamental maturity and ...

Digital Loan Marketplace

... to individual participants grows as the total number of participants grows. A market with five hundred lenders is more valuable to an investor than a market with fifty because it provides greater opportunity for investors to expand their origination network. Similarly, a market with large numbers of ...

... to individual participants grows as the total number of participants grows. A market with five hundred lenders is more valuable to an investor than a market with fifty because it provides greater opportunity for investors to expand their origination network. Similarly, a market with large numbers of ...

Are Banks Still Important for Financing Large Businesses?

... secure a commercial paper backup line of credit with a bank. This line of credit provides a firm with the right to borrow any amount of money up to a specified level at any time. When commercial paper grows too costly, the firm can borrow from its line of credit, paying the bank interest at a predet ...

... secure a commercial paper backup line of credit with a bank. This line of credit provides a firm with the right to borrow any amount of money up to a specified level at any time. When commercial paper grows too costly, the firm can borrow from its line of credit, paying the bank interest at a predet ...

Higher rates after Trump win mean good things for bank loan yields

... had not seen much of a change in CRE pricing during the summer, when rates remained near historical lows, they told a different story during third-quarter earnings season, noting that pricing is beginning to inch up. ...

... had not seen much of a change in CRE pricing during the summer, when rates remained near historical lows, they told a different story during third-quarter earnings season, noting that pricing is beginning to inch up. ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.